The following paragraphs are just a glimpse of the formal report. Please contact us at contact@chemlinked.com to learn more about the complete report.

Market Size

The demand for anti-aging products in China has experienced a rise in recent years, driven by consumers’ growing knowledge about skin aging and awareness of anti-aging prevention. Not only the seniors, but also the younger generations exhibited great interest in anti-aging cosmetics. To cater to consumer needs, a wide range of anti-aging cosmetic products targeting different aging conditions emerged in the Chinese market.

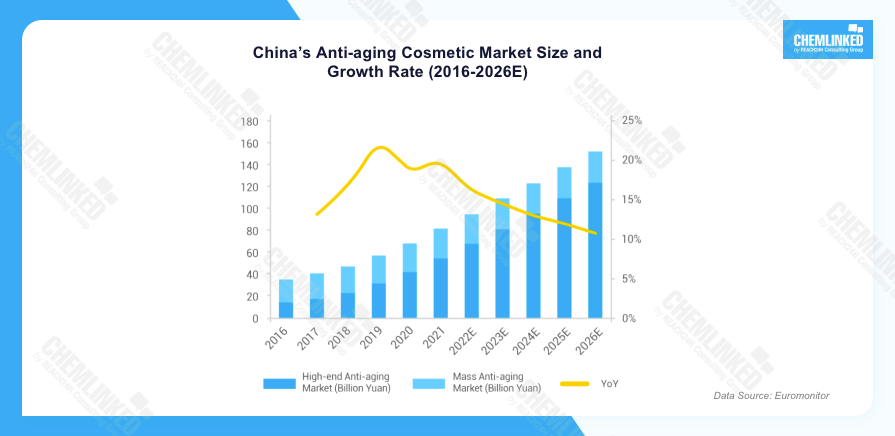

Fueled by this trend, the market size of anti-aging cosmetics in China witnessed steady growth. According to Euromonitor, China’s anti-aging cosmetic market reached CNY 82 billion in 2021 and was projected to rise to CNY 153.2 billion in 2026, with a compound annual growth rate (CAGR) of 13.3%.

Among these various anti-aging products, high-end anti-aging cosmetics hold a larger market share than mass anti-aging products, accounting for 67% in 2021. [1] This may be attributed to consumers’ inherent perception that high-end brands can offer superior quality, advanced formulas, and innovative ingredients for anti-aging cosmetics.

Competitive Landscape

In the long term, international brands have a dominant presence in China’s anti-aging cosmetics market. In 2021, overseas brands took up 9 seats out of China’s top 10 anti-aging cosmetics brands, collectively holding a market share of 42.2%. This dominance is primarily due to the robust competitiveness of international bands benefiting from their R&D and technological advancements. These brands have more investment in the R&D of anti-aging cosmetics, which endows them with competitive edges on the product ingredients and formulas. Whereas, Chinese domestic brands have actively developed anti-aging products in recent years and captured a certain market share. In 2021, Chando, Marubi, Pechoin and Inoherb ranked 4/12/18/19 among China’s top 20 anti-aging brands, accounting for 4.1%/1.4%/1.1%/1.1% of the market.

Consumer Analysis

With the further development of anti-aging industry and the widespread of anti-aging knowledge, more younger consumers begin to pay attention to anti-aging cosmetics. According to iiMedia Research, Chinese consumers aged 26 to 35 attached the most importance to information related to anti-aging skincare products in 2022, and the post-00s also displayed a strong anti-aging awareness.

Meanwhile, consumers tend to allocate more budgets to purchasing anti-aging cosmetics. In 2022, over 46% of consumers spent more than CNY 1,000 annually on anti-aging skincare products, indicating their acceptance of anti-aging products with higher prices and willingness to make the considerable financial commitment to maintaining a youthful appearance.

In terms of product types, consumers showed a preference for essence, lotion and cream. There has been a growing inclination towards essential oil-based anti-aging products, aligning with the concept of “skin care with oil” newly emerged in China in recent years. [2]

Trends Analysis

1. Rising Market Share of Chinese Domestic Brands

After noticing the potential of anti-aging market, Chinese domestic brands have increased their R&D expenditure on anti-aging cosmetics to improve brand competitiveness. Currently, domestic anti-aging products are increasingly favoured by Chinese consumers due to the improved qualities. In this condition, the market share of Chinese domestic brands is expected to increase in the future.

2. More Segmented Anti-aging Demands Based on Diverse Skin Sectors and Types

As the different parts of the skin age differently, the use of anti-aging cosmetics ranges according to different skin sectors. Currently, consumers are paying more attention to anti-aging products for eyes and face. Additionally, the focus of anti-aging varies among different skin types. The provision of customised anti-aging cosmetics for specific skin types has garnered consumer interest due to its ability to provide more targeted and effective solutions. For example, the key concern for mixed skin is anti-oxidation, while for sensitive skin, it is repairing.

3. Preference of Anti-aging Cosmetics with Multiple Efficacies

Compared with products with a single anti-aging efficacy, consumers prefer anti-aging cosmetics that offer multiple efficacies, such as skin brightening, spot removal and oil control. In the future, anti-aging cosmetics that cater to consumers' multifunctional needs by coordinating various ingredient formulas are expected to gain popularity.

Regulatory Requirements

Under China’s current regulatory framework, cosmetics are categorized as special cosmetics and general cosmetics, which are subject to registration and notification respectively. Special cosmetics refer to hair dyes, hair perming products, freckle-removing (whitening) products, sunscreens and anti-hair loss products and cosmetics with new efficacy. Other cosmetics are general cosmetics. The determination of whether anti-aging cosmetics should undergo registration or notification mainly depends on the classification of the products as either special or general cosmetics.

When applying for cosmetics registration or notification, the registrant or notifier shall fill in the product classification code in accordance with Cosmetic Classification Rules and Catalogs (Catalogs). The Catalogs divides cosmetic efficacies into 26 categories and new efficacies, while the claim of “anti-aging” is not listed in it. Among the 26 efficacy categories, the efficacies closely related to skin anti-aging are "anti-wrinkle" and "firming." To take prudent measures and minimize the possibility of penalties, companies are recommended to use these two relevant efficacies rather than directly claiming anti-aging, provided that the claims are fully supported by evaluation reports.

For more detailed compliance procedures, please contact us at contact@chemlinked.com.