With the development of China's maternal and infant product market and the diversification of consumer needs, maternal and infant products categories have gradually enriched, covering food (infant formula, complementary food, snacks, etc.), consumables (diapers, baby wipes, etc.), baby toys, feeding supplies, etc.

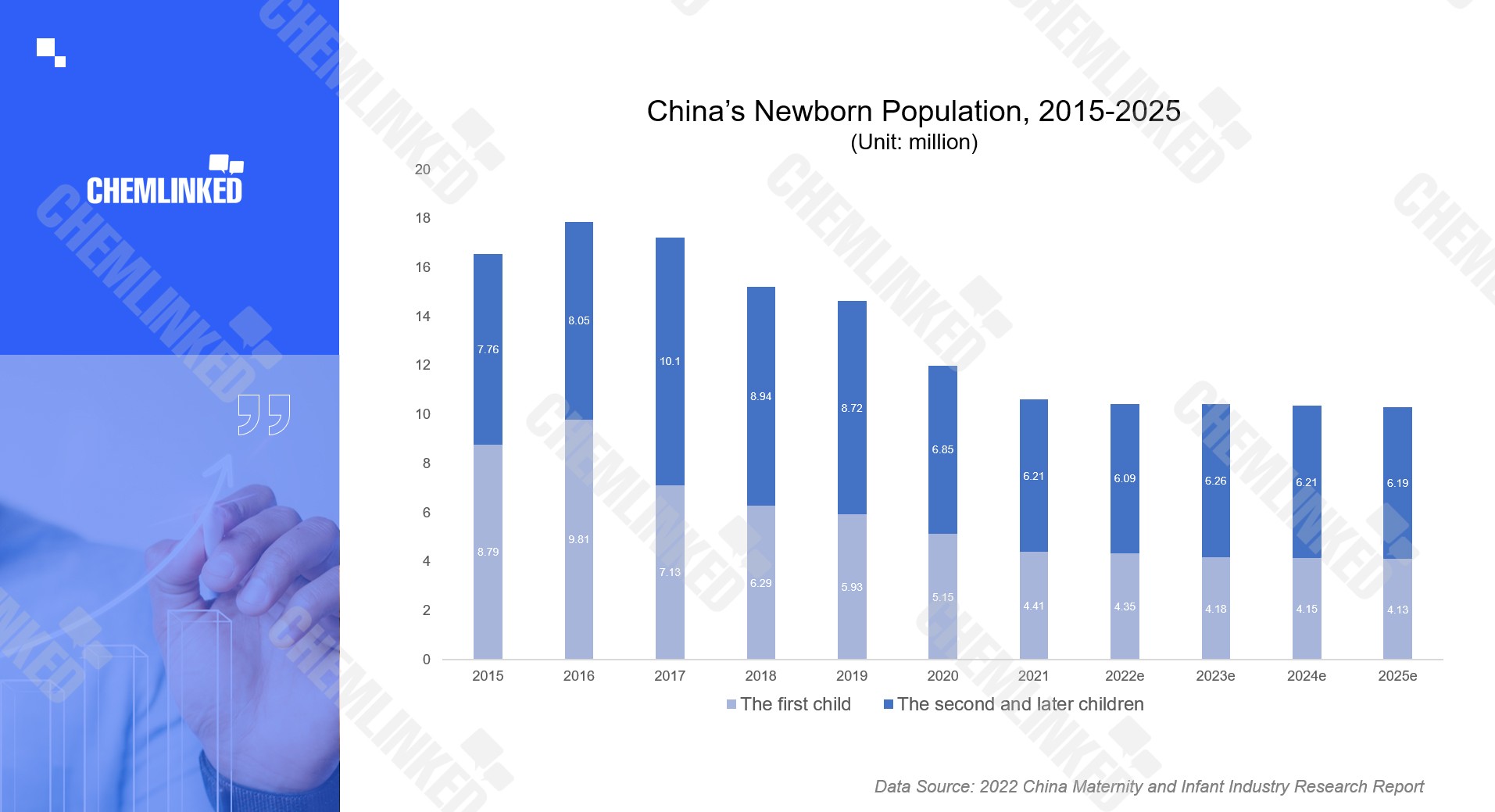

Although the birth rate in China continues to decline due to social changes, increasing costs of childcare and education, and the aging population, China faces an increasing trend in the maternal and infant market. In 2021, China's maternal and infant consumption scale was 3,459.1 billion yuan. iResearch predicts that the market will maintain a stable growth trend in the future, reaching 4,679.7 billion yuan by 2025.

From the perspective of the market share by categories, clothing, shoes and hats, and infant formula accounted for 26% and 22.7% respectively in 2021, which were the two largest maternal and infant categories, followed by diapers accounted for 12.1%. In recent years, complementary baby food are growing rapidly, ranking No. 4 with a market share of 9.3%.

The offline channels such as maternal and infant stores, supermarkets, etc. are the main sales channels in the market. In 2021, the offline consumption accounted for a market share of 66.2%. But with the development of mobile internet and changes in consumer consumption habits, coupled with the impact of the new crown epidemic, the online maternal and infant consumption has continued to grow. It is estimated that the proportion of online consumption will reach 39.0% by 2025.