1. China’s sensitive skincare market size

1. China’s sensitive skincare market size

1.1 Enlarged consumer numbers

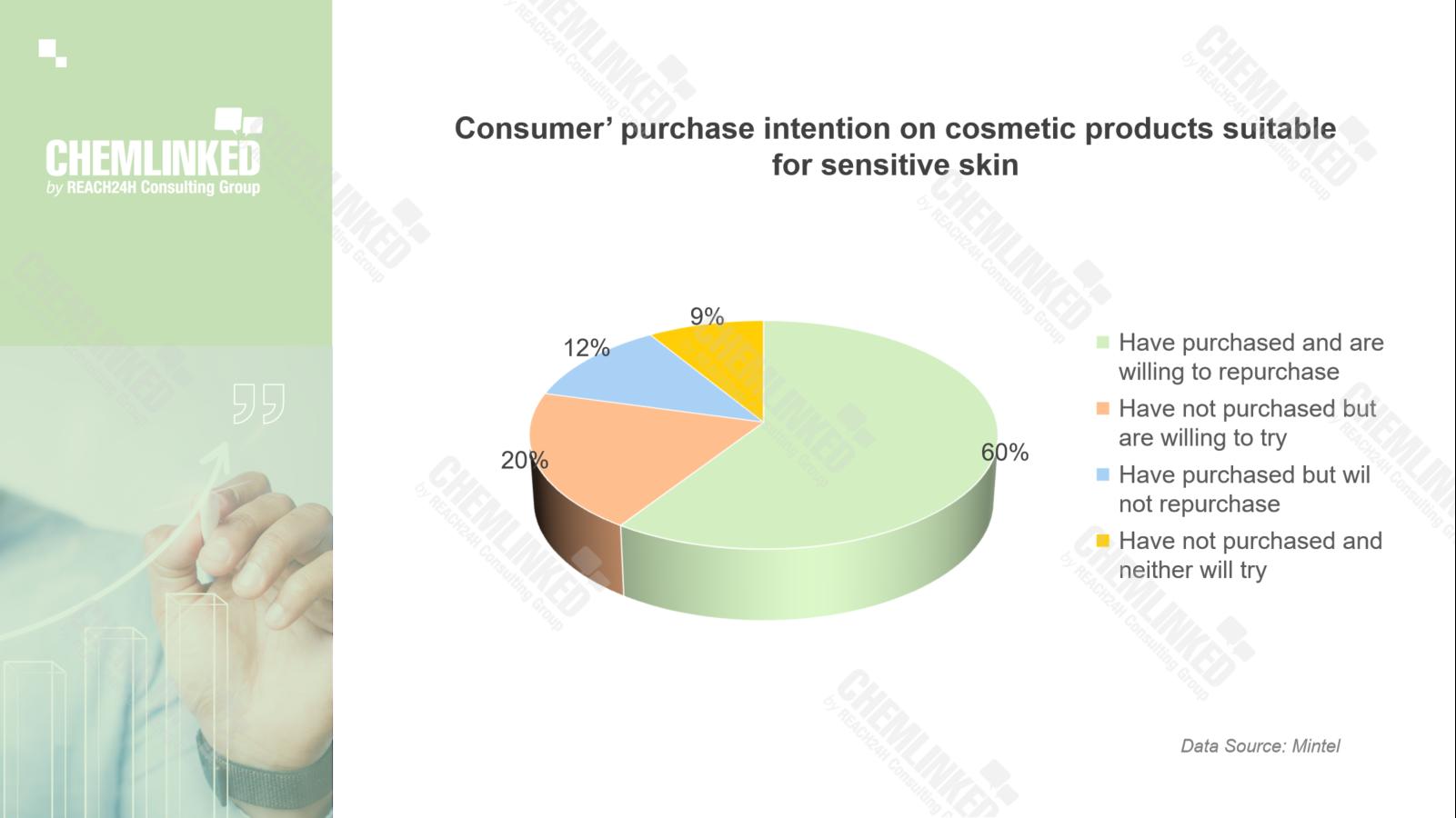

Consensus of Chinese Experts on the Diagnosis and Treatment of Sensitive Skin, jointly released by Chinese dermatology authorities, reveals that approximately 36.1% of Chinese female have sensitive skin. On Red, a popular lifestyle-sharing social media in China, there are over 620,000 notes related to "sensitive skin repair", and over 810,000 notes related to "sensitive skincare products”. Mintel data also shows that 60% Chinese cosmetic consumers have purchased and are willing to repurchase cosmetic products that are suitable for sensitive skin. Moreover, according to Guolian Securities, by 2030, the proportion of sensitive skin female in China is projected to reach 48% of the same group in Asia. Therefore, it is evident that skin sensitivity has become an important concern in China’s beauty industry.

1.2 Great market potential

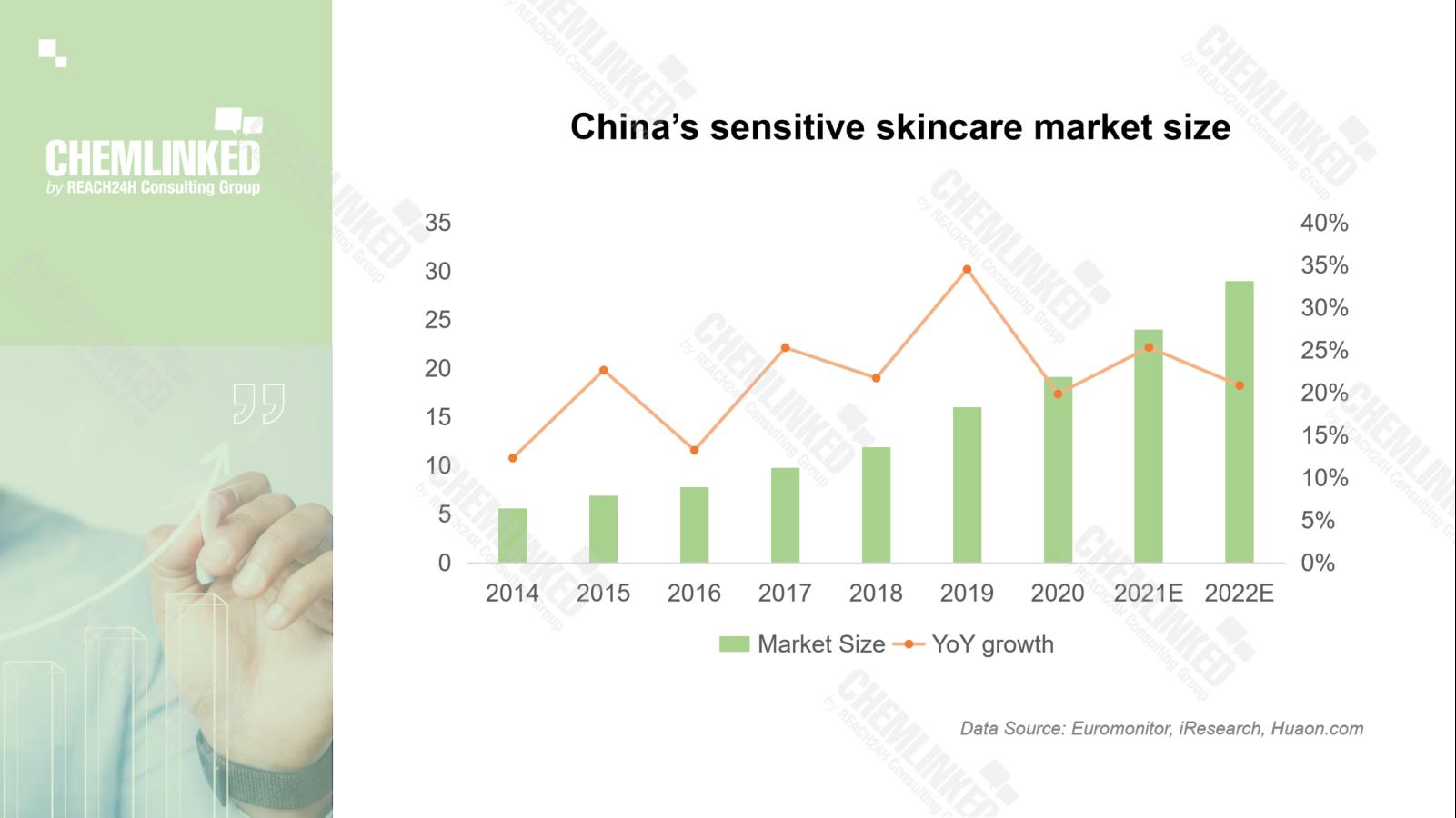

As consumers become increasingly aware of the importance of sensitive skin care, the market capacity of sensitive skincare products has been expanding. In 2022, the retail sales of sensitive skincare products on Ali platforms totalled around 13 billion yuan, with a modest increase of 2.13% year-on-year. According to Euromonitor, the size of Chinese sensitive skincare market was expected to reach 29 billion yuan in 2022, with a compound annual growth rate of 27% over the past three years.

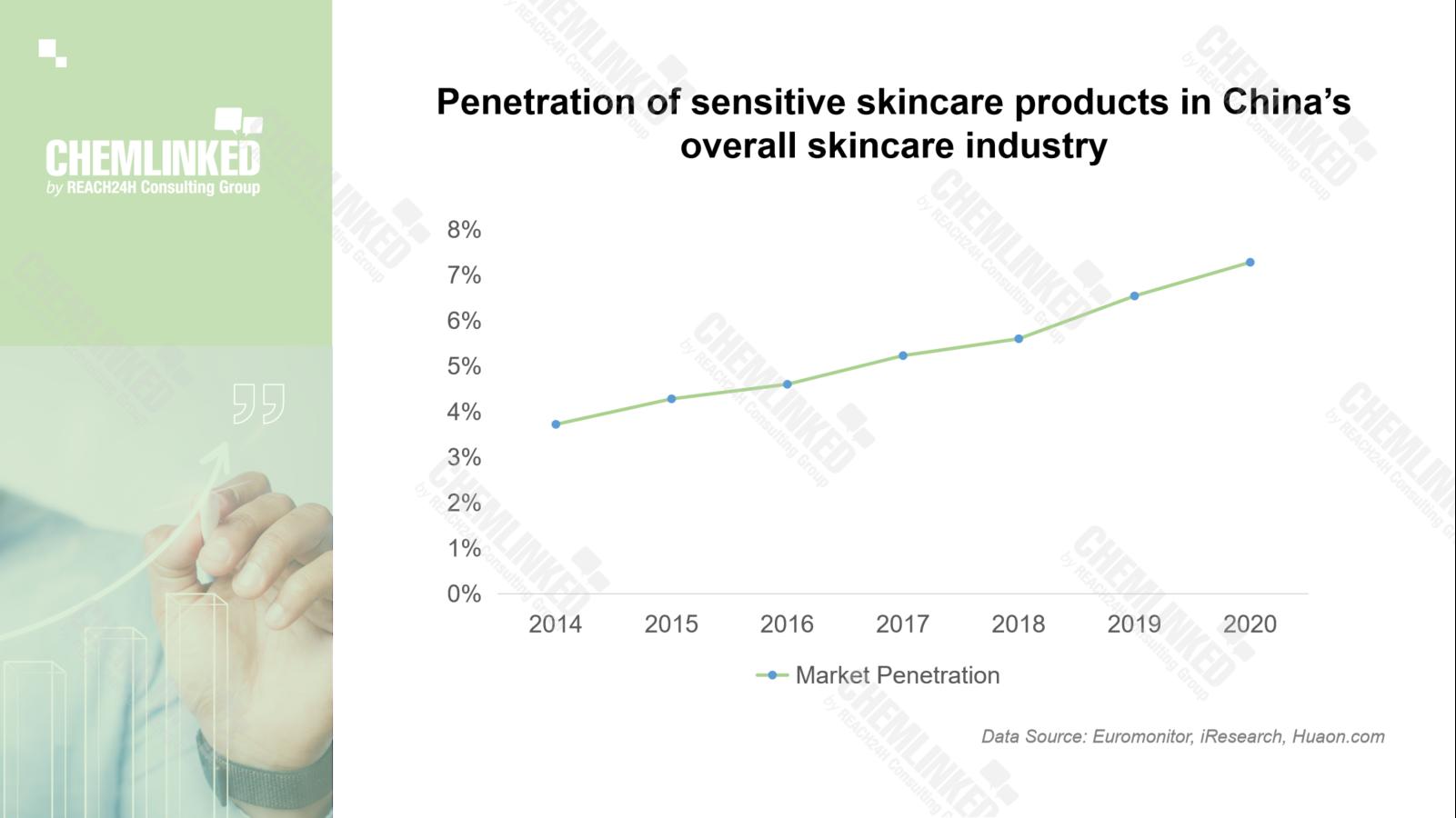

Although China’s sensitive skincare market has witnessed continuous expansion, its penetration in China’s overall skincare industry is relatively low. In 2020, it constituted merely 7.28% of China’s total skincare market, far behind the figure in France and the United States. Latest data reveals that the penetration of sensitive skincare products in online skincare market was 8% in 2022. In light of temporarily low penetration but constantly growing consumer demand, the sensitive skincare market foresees substantial growth.

2. Competitive Landscape

2.1 Market concentration rate (CR)

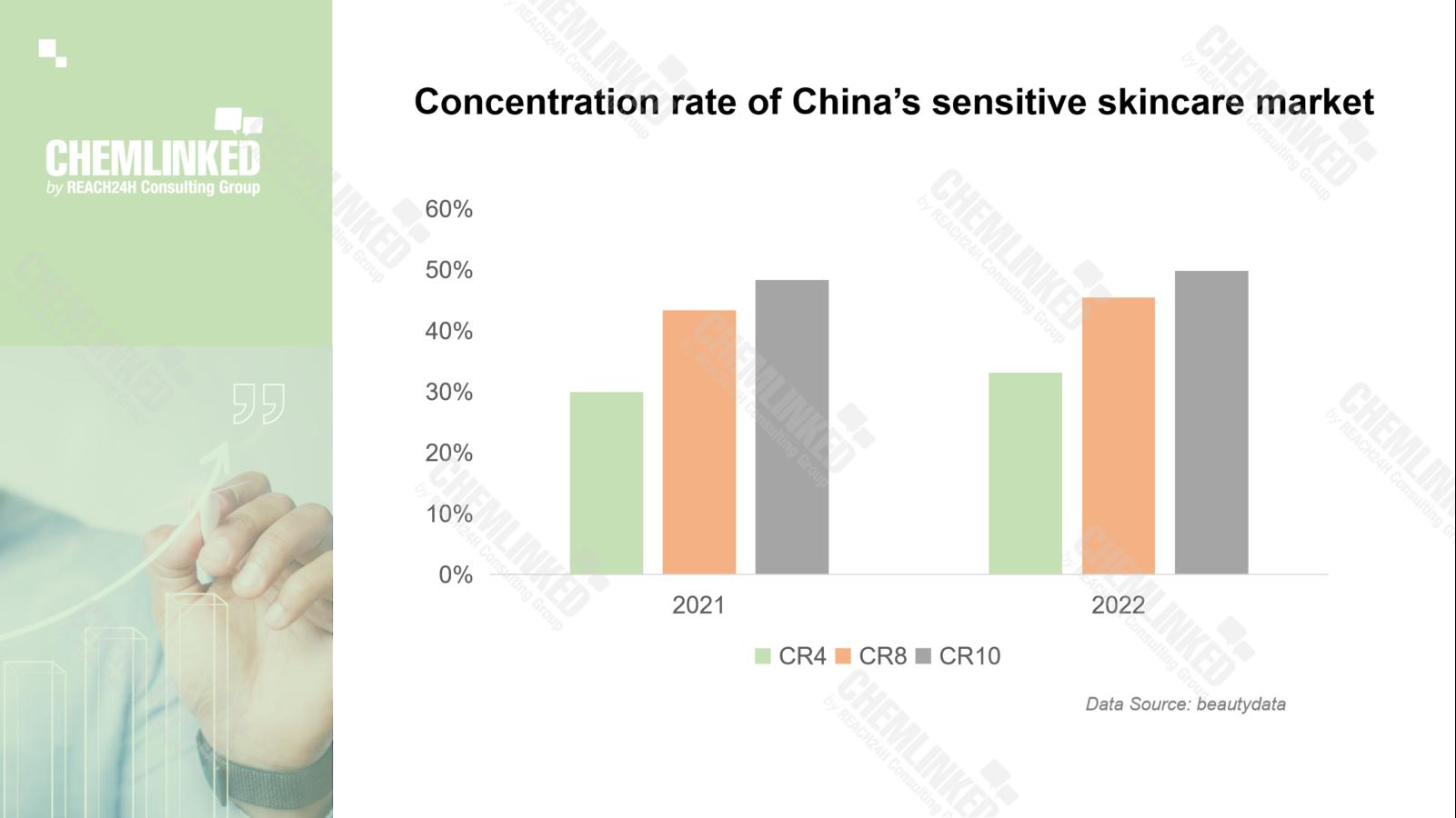

Competition in the sensitive skincare market is noticeably more concentrated than the overall skincare market. In 2022, the CR4, CR8, and CR10 indicators in the online market had a slight increase, reaching 33.1%, 45.43%, and 49.89%, respectively, which means the top-tier brands have established a strong market position that is difficult for others to challenge.

2.2 Brands landscape

Concerning the competitive landscape of brands, Chinese brands are gaining ground, especially emerging brands. In recent years, local brands specializing in sensitive skincare have significantly increased their research and development expenditure, deepened collaborations with medical research institutions, and continuously pursued technological innovations based on market demand. With advantages of medical research collaborations and keen insight into local market demand, high-quality Chinese brands such as Winona, Biohyalux, Medrepair, Dr.Yu, Dr.Alva, etc., have established themselves as the preferred choice of sensitive skin consumers in China.

By different market levels, the mid-range sensitive skin sector holds the largest share of 52%, and the proportion is steadily growing. In this sector, aforementioned Chinese brands have established a favorable competitive landscape. Meanwhile, the high-end sensitive skin sector holds a lower proportion and is mostly dominated by international brands such as SkinCeuticals and Kiehl's.

3. Trends in China’s sensitive skincare market

3.1 Precise sensitive skincare

As skin sensitivity issues become increasingly diverse, sensitive skin care products are also becoming more refined. On the one hand, based on individual differences in skin types, such as dry-sensitive skin, oily-sensitive skin, acne-prone sensitive skin, and combination-type sensitive skin, as well as different age groups, there are significant differences in care and repair strategies. On the other hand, consumer demand has become more diversified in different scenarios. For example, seasonal changes are an important cause of skin sensitivity. In addition, as consumer lifestyles change constantly, there is emerging demand for sensitive skincare in scenarios such as staying up late, traveling, post cosmetology, pregnancy, etc.

3.2 Sensitive skincare with advanced functions

Sensitive skin consumers become sophisticated in skincare with demand for more advanced functions. In addition to the basic needs of moisturizing, soothing sensitivity, and repairing the skin barrier, they pay increasing attention to functions of anti-acne, anti-aging, whitening, etc. Taking the popular sensitive skin anti-aging sector as an example, as sensitive skin is more susceptible to external stimuli leading to skin aging, 72% of sensitive skin consumers believe that anti-aging skincare should begin before the age of 24, earlier than those without sensitive skin. Furthermore, they are aware that inappropriate anti-aging steps and ingredients further exacerbate skin sensitivity. Therefore, sensitive skin anti-aging consumers seek the efficacy of anti-glycation, anti-oxidation, skin firmness, while are highly attentive to the feeling on the skin, ingredient mildness, and whether the product is specifically formulated for sensitive skin. Brands in this segment have been leveraging formula innovation to address potential drawbacks of high-efficacy ingredients and meet the demand for gentle yet effective anti-aging solutions.