The following paragraphs are just a glimpse of the formal report. Please contact us at contact@chemlinked.com to learn more about the complete report.

Market Overview

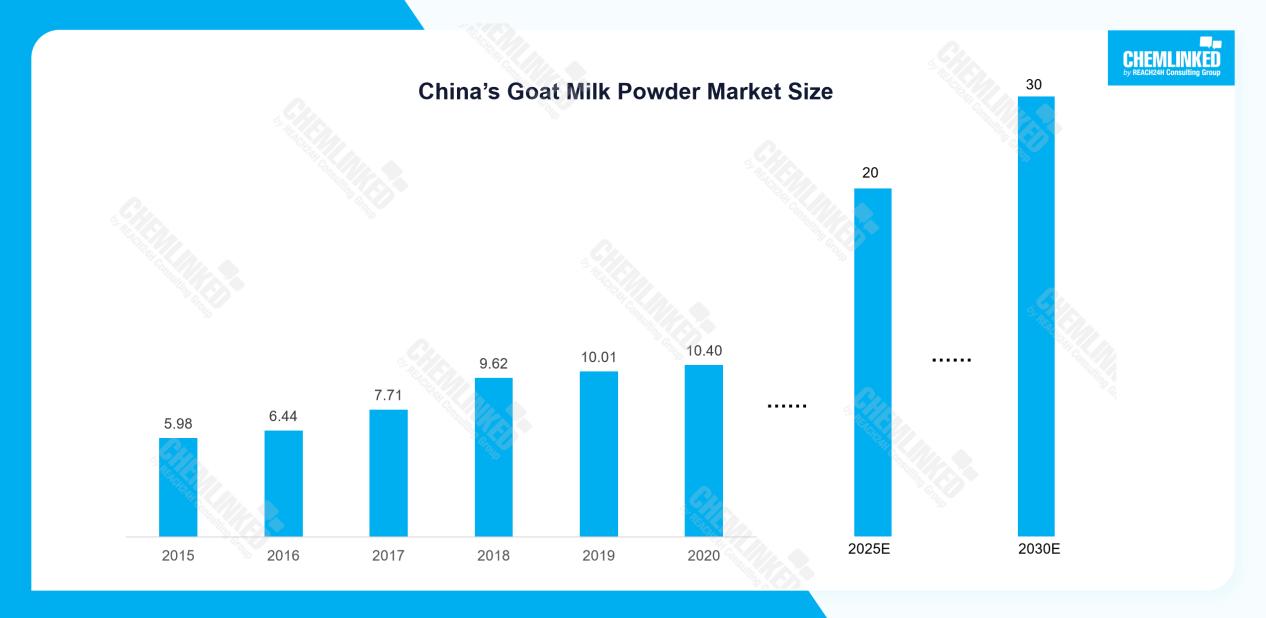

According to the 2022 Report on China's Goat Milk Powder Industry Development, the market size of China's goat milk powder experienced significant growth from 300 million yuan in 2008 to over 10 billion yuan in 2020, and is expected to reach 20 billion yuan by 2025 with goat milk infant formula accounting for 15 billion yuan. Moreover, as goat milk powder consumers gradually extend to children, elderly people, and other special populations, the market size can reach 30 billion yuan by 2030, according to estimation.

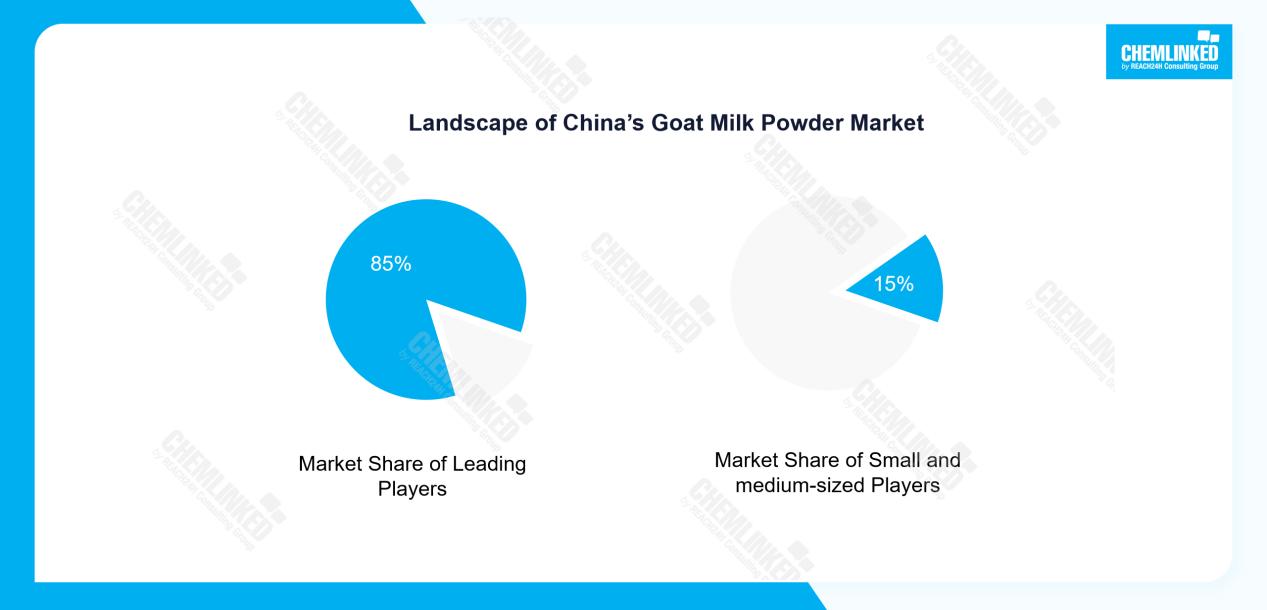

The market concentration is also on the rise. Currently, the leading brand in China’s goat milk powder market is Kabrita, a subsidiary of Ausnutria. As of April 2023, Kabrita held a significant share of 29.2% in the market. Furthermore, according to Nielsen IQ, Kabrita maintained a share of over 60% in China's imported infant and child goat milk powder market for five consecutive years from 2018 to 2022. As dairy giants like Yili are moving strategic moves into the Chinese goat milk powder market, the competition is intensifying. Industry insiders predict that large dairy enterprises will capture approximately 85% of the market share, leaving the remaining 15% to be divided among small and medium-sized enterprises.

Goat Milk Infant Formula Under New National Standards

By the end of May 2023, 634 recipes from 218 brands under 54 dairy enterprises have successfully passed the registration under the new national standards for infant formula. Among these, there are 154 recipes for goat milk infant formula, making up 24.29% of the total. It is noteworthy that the registration process for imported goat milk powder is slower compared to Chinese domestic counterparts. Out of the 154 goat milk infant formula recipes, only 5 of them are imported.

Sales Channels

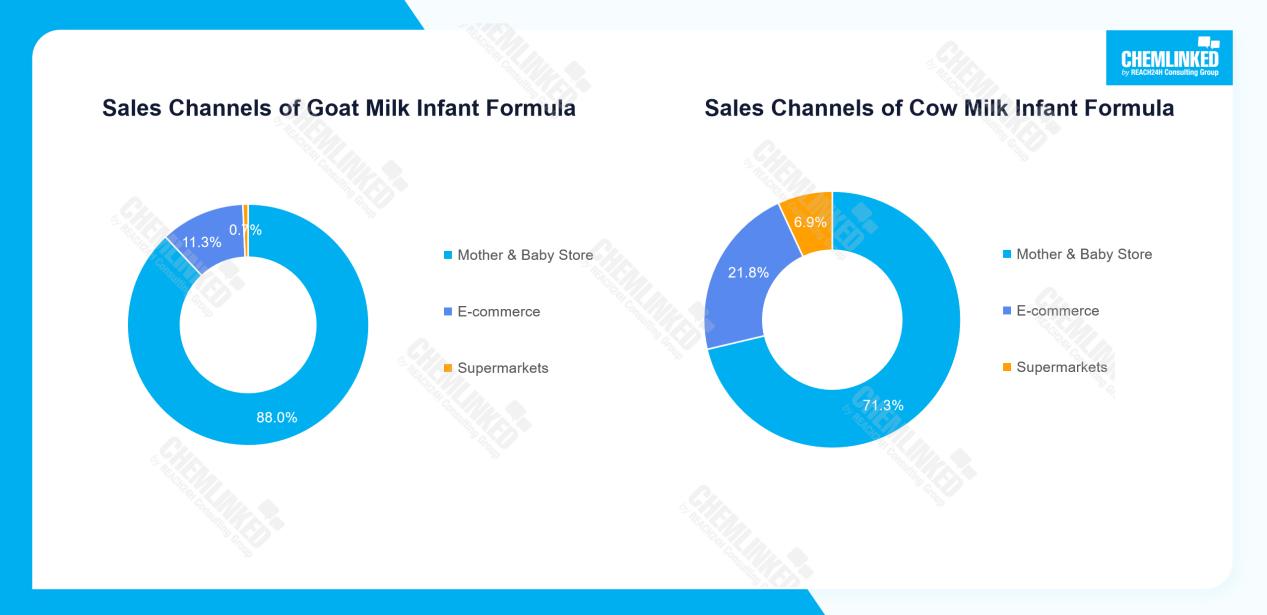

The sales of goat milk infant formula heavily rely on the mother & baby channel. According to Nielsen IQ, in 2022, mother & baby stores accounted for a substantial 88% of the sales, while e-commerce channels contributed only 11.3% and supermarkets a mere 0.7%. Notably, approximately 80% of mother and baby stores that offer goat milk infant formula are located in lower-tier cities. In the current and foreseeable future, the mother & baby channel remain a crucial role in the sales of goat milk infant formula.

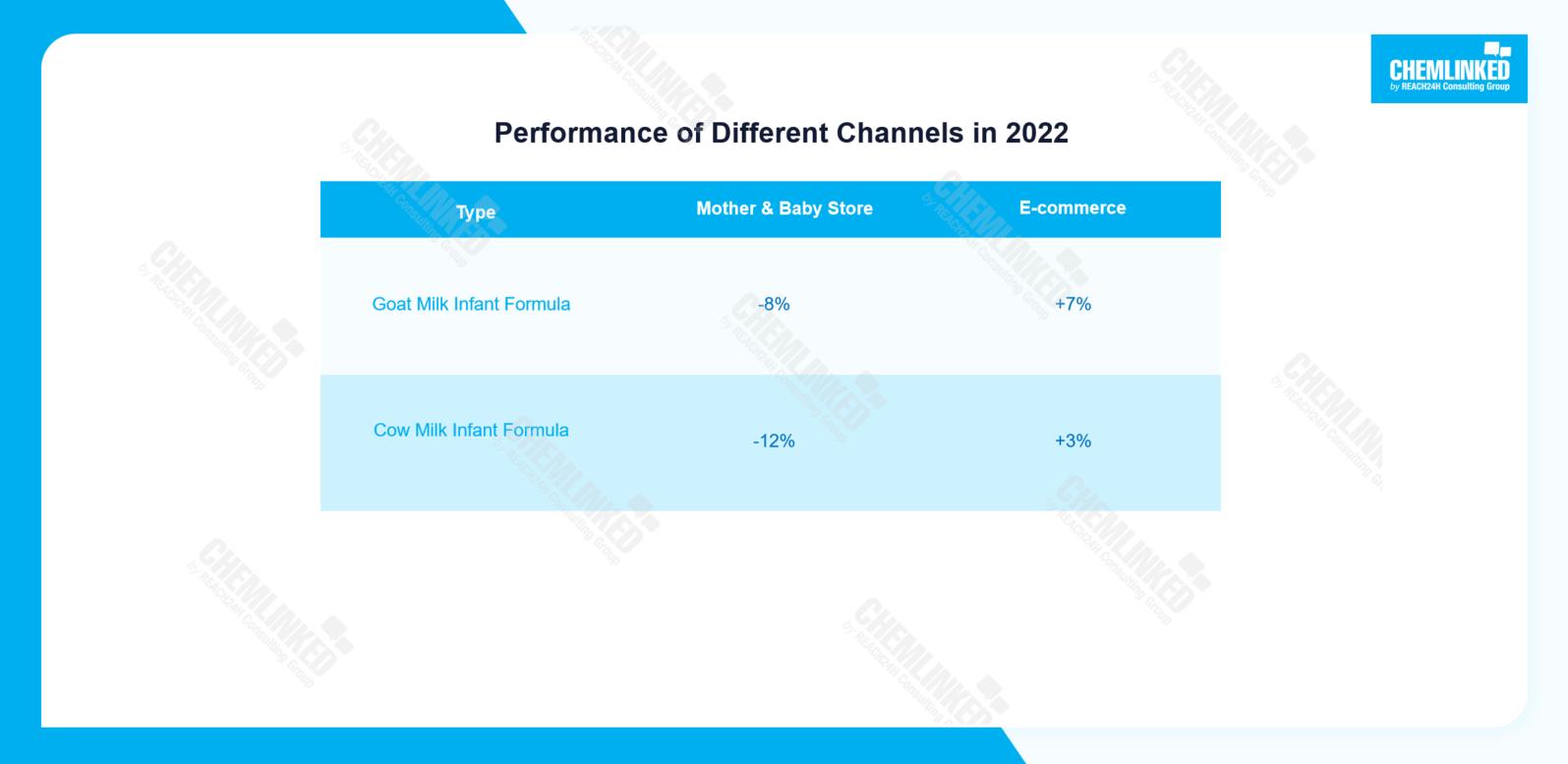

However, in 2022, both goat milk infant formula and cow milk infant formula experienced a decline within the mother & baby channel. Cow milk saw a decrease of 8%, while goat milk experienced a decline of 12%. Therefore, it is crucial for both goat and cow milk powder brands to maximize their presence in and foster a mutually beneficial partnership with mother & baby stores, thus to achieve growth and overcome challenges they face in 2023.

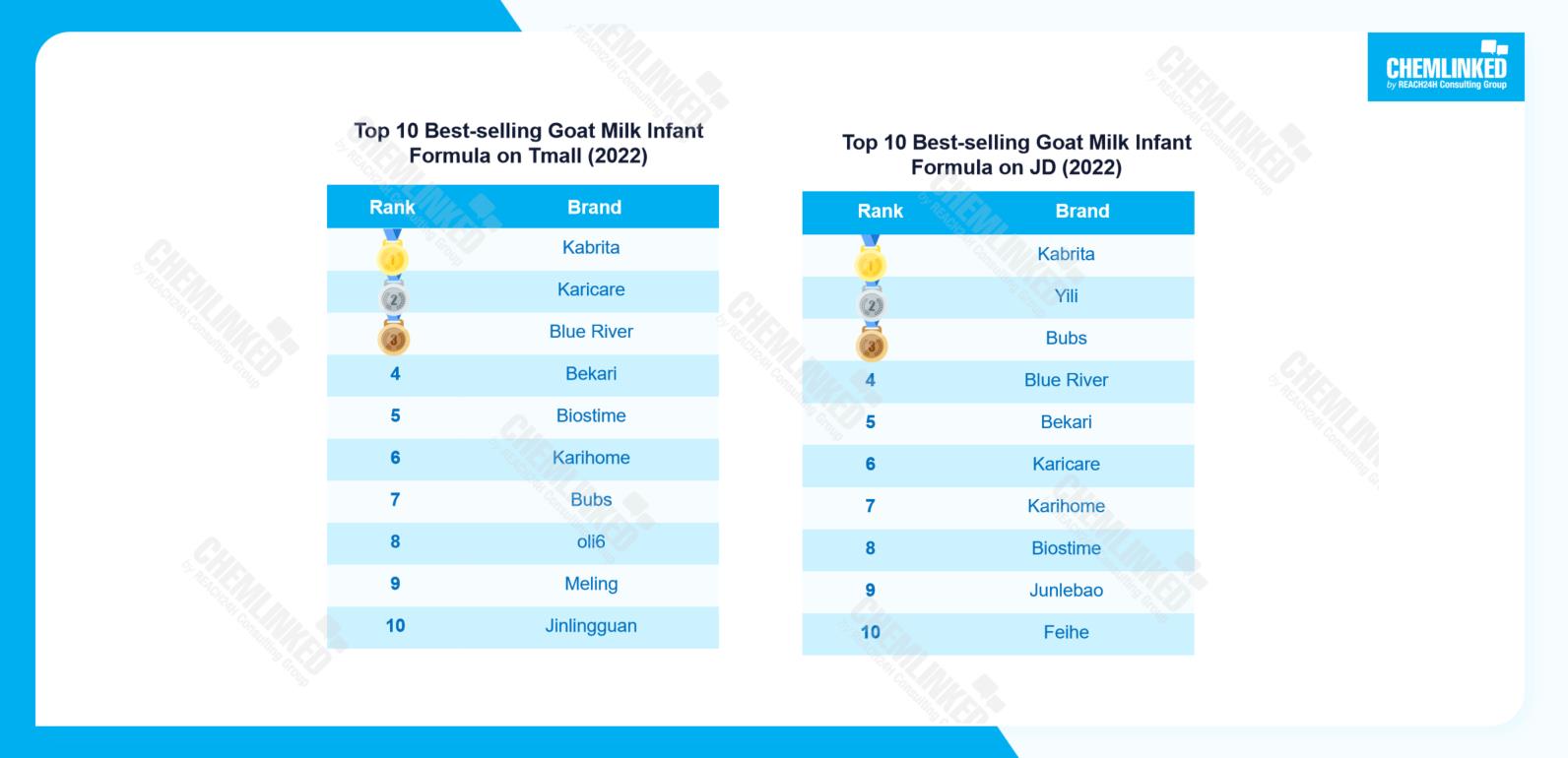

Goat milk infant formula experienced a slight growth of 3% in the E-commerce channel. On prominent E-commerce platforms Tmall and JD.com, the total sales of goat milk infant formula reached 2.33 billion yuan in 2022, representing a modest YoY increase of 2.83%. The top three best-selling brands on Tmall were Kabrita, Karicare, and Blue River, while on JD.com, the top three were Kabrita, Yili, and Bubs. Notably, brands such as Junlebao, Feihe, Jinlingguan, and Biostime, which have expanded from cow milk powder to goat milk powder, have also witnessed significant online growth.

Consumer Analysis

When selecting goat milk infant formula, consumers prioritize the nutritional composition as their primary concern, followed by factors such as brand reputation, milk source, safety, price, production techniques, origin, etc. With the implementation of new national standards, goat milk infant formula brands are undergoing substantial upgrades in nutritional formulas to enhance product competitiveness.

Delving into the nutritional composition, consumers pay the most attention to lactoferrin as a key nutrient in goat milk infant formula, followed by probiotics, as well as DHA & ARA, with all three nutrient groups garnering over 70% of attention. Additionally, prebiotics, OPO, and lutein are also of significant interest to consumers. Overall, as the younger generation of consumers becomes more knowledgeable about infant formula composition, there is a growing demand for formulas that offer comprehensive and balanced nutrition.

Regulatory Requirements

Different from most regular prepackaged foods, goat infant formula products sold to China shall get their recipe registered with China's State Administration for Market Regulation (SAMR) according to Administrative Measures for Registration of Infant and Young Children Milk Powder Formula Recipes. In July 2023, the authority issued the 2023 version of Administrative Measures for Registration of Infant and Young Children Milk Powder Formula Recipes, which will come into effect on October 1, 2023.

If these products are imported to China, their overseas manufacturers shall register with the General Administration of Customs of China (GACC) prior to recipe registration. The registration of infant formula manufacturers should be recommended by competent authorities in exporting countries.

Want to learn more about the detailed compliance procedures? Please contact us contact@chemlinked.com.