1. Market overview

1.1 Market size

Against the social background of increasing number of people living alone and aging population in China, the demand for pet companionship is continuously growing. According to Deloitte, the penetration rate of pet-raising households in China increased from 12% in 2012 to 25% in 2021. Nevertheless, compared to the United States (70%), Australia (62%), and the United Kingdom (45%), there is still significant space for improvement.

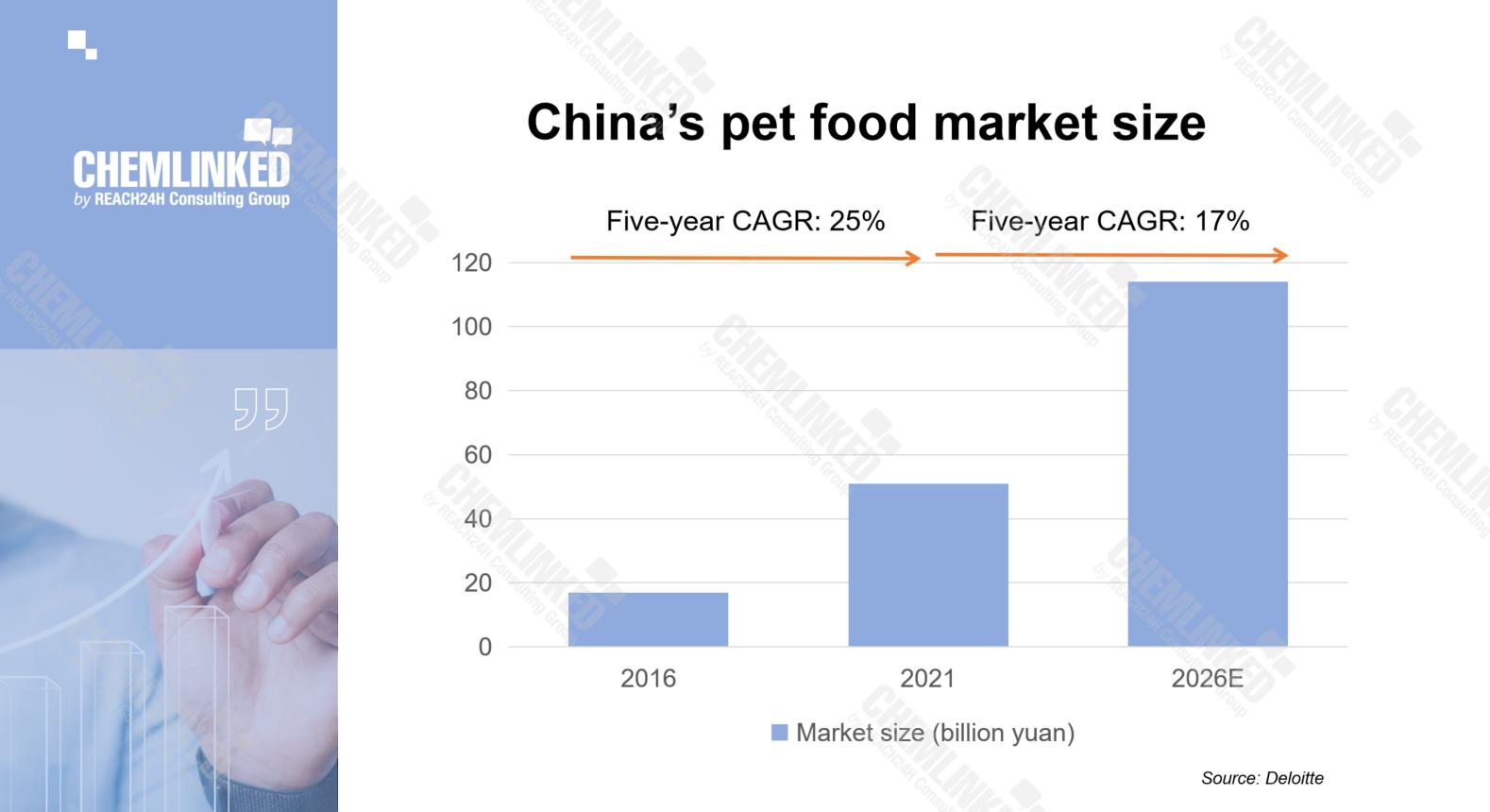

Additionally, post-80s and post-90s have become the main consumers in the pet market. With higher income and greater receptiveness to scientific pet-raising ideas, they are more willing to pay more for their pets. As a high-demand product in the pet industry, pet food foresees a fast-growing market. China's pet food market size was 51 billion yuan in 2021 and is expected to reach 114 billion yuan in 2026, with a five-year compound annual growth rate (CAGR) of 17%.

1.2 Market segments

By category, pet food for daily feeding holds the largest market share of 86%. To be specific to the subcategory level, baked, air-dried, and freeze-dried pet food have multiplied in sales and gradually replaced puffed pet food. However, the wet pet food sector in is not yet mature. Due to higher standards of raw material, manufacturing, and storage, there are relatively fewer players that focus on wet pet food. But there is great potential for growth in this segment as a result of rising advanced demand on pet food. In addition to daily feeding pet food, pet treats perform noticeably well with a CAGR of 35% from 2016 to 2021, as they function as helpful entertaining and training tools. Pet treats with specific nutritional and health benefits are expected to become increasingly popular.

2. Competitive landscape

2.1 Brand landscape

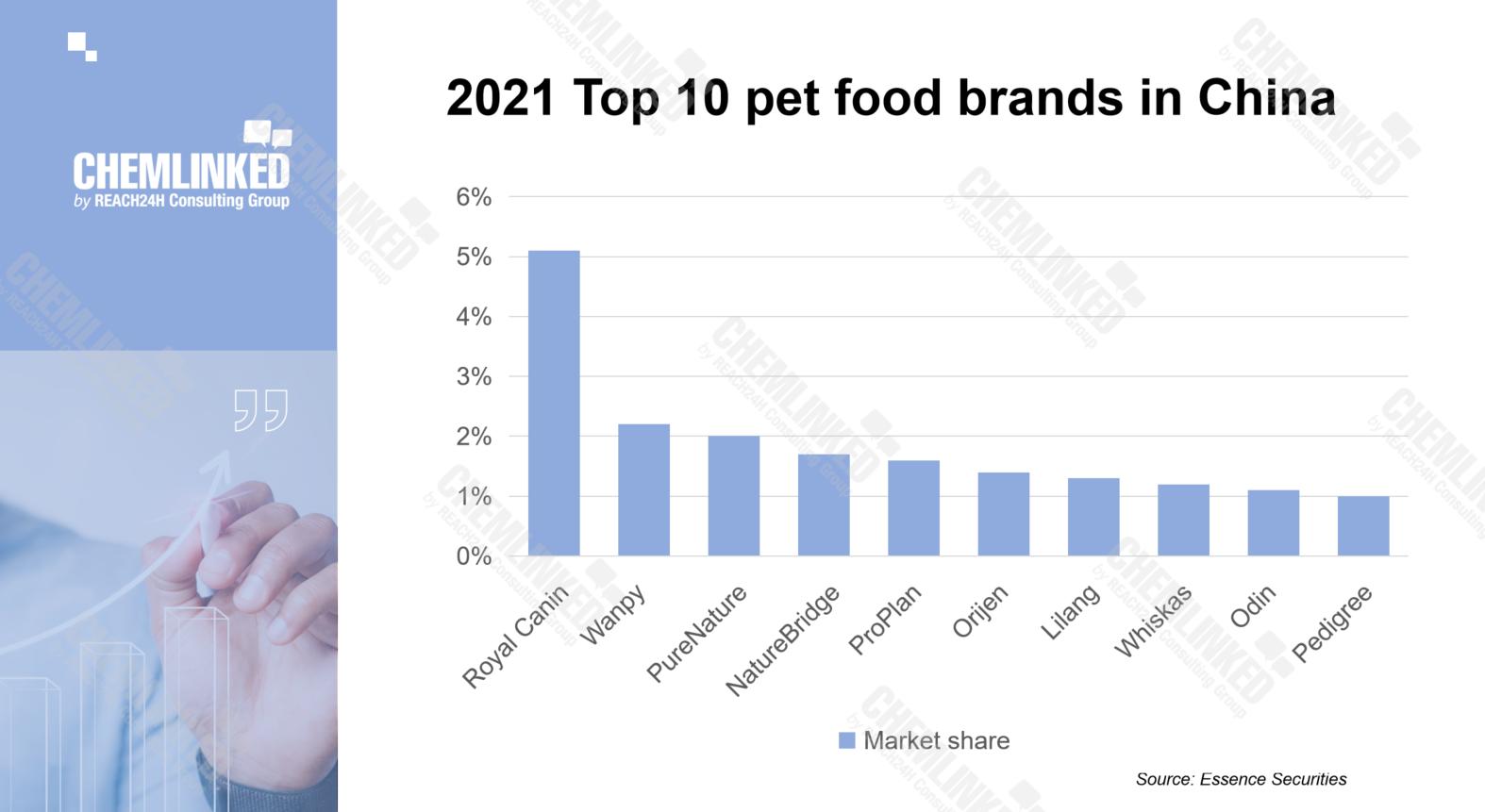

The competition in China's pet food market is not highly concentrated. The top 10 pet food brands only had a market share of 18.6%. International brands such as Royal Canin, Whiskas, Pedigree from Mars, and ProPlan and Friskies from Nestle have long held the leading positions. These brands have first-mover advantages and have occupied Chinese consumers' minds since entering the Chinese pet food market. Yet, with the gradual rise of Chinese domestic pet food brands, the market share of international brands has been diluted. In 2021, Chinese brand Wanpy occupied the second largest market share following Royal, while other Chinese brands such as NatureBridge and PureNature also gained a noticeable ranking.

2.2 Brand positioning

International pet food enterprises often adopt multi-brand strategies to cover different varieties, categories, and price ranges. International pet food brands have dominated the high-end and super-high-end sectors. In contrast, Chinese domestic brands focus on single-brand strategy to open the market by launching blockbuster products and then expanding product categories. Taking advantage of localized supply chains, Chinese domestic brands offer highly cost-effective products to win recognition and loyalty from consumers.

3. Sales channels

3.1 E-commerce

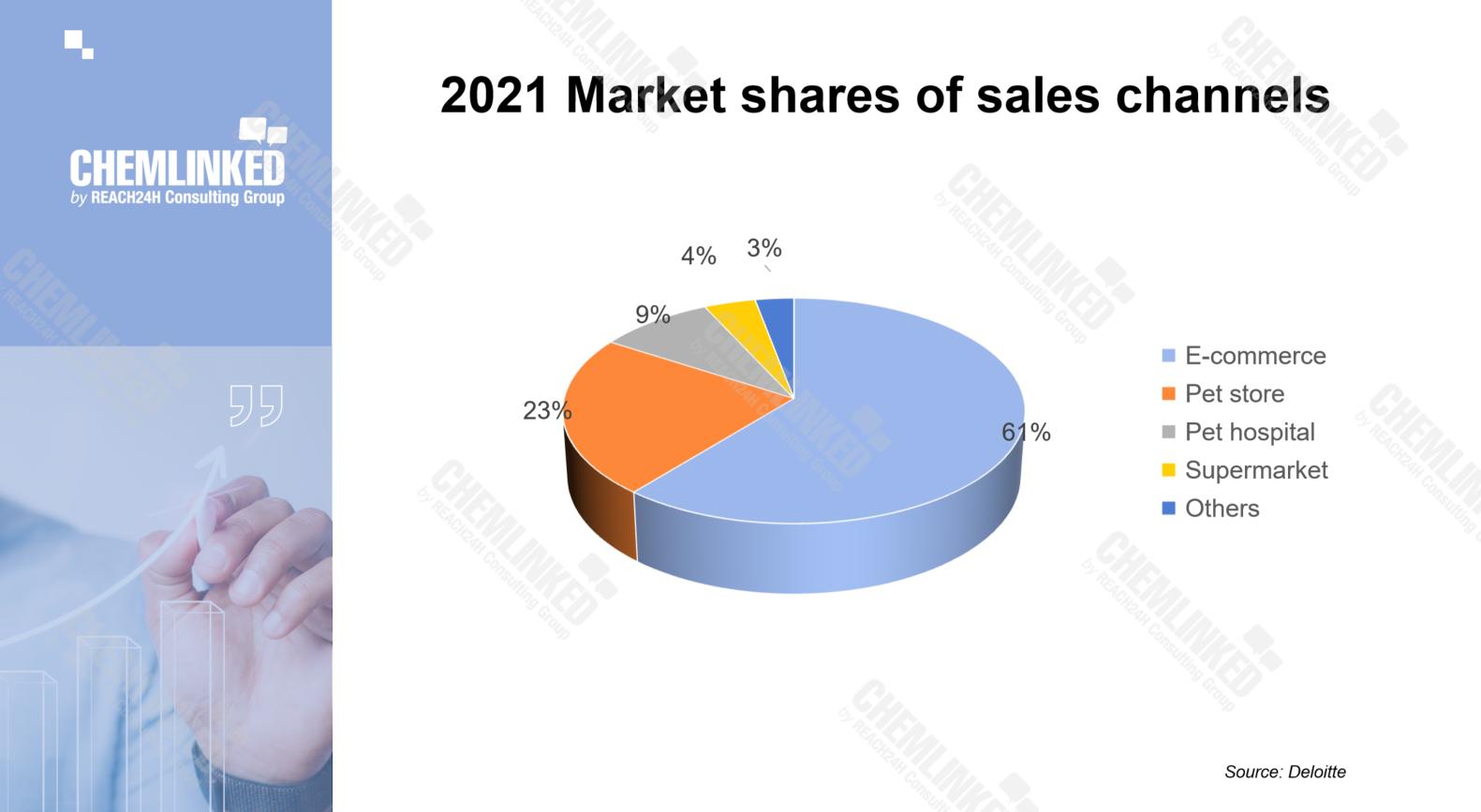

Thanks to the booming e-commerce industry, pet food sales through e-commerce channels have been constantly increasing, reaching a proportion of 61% in overall market sales in 2021.

Looking at different platforms, Tmall is the most significant e-commerce channel, emphasizing product differentiation and brand building. JD.com relies on its logistics system, prioritizing timely delivery and user experience. Emerging social media e-commerce platforms like Douyin attract traffic through pet-related short videos and KOL’s live streaming, reaching a wider range of consumers including those in low-tier cities with high traffic conversion efficiency.

3.2 Offline channels

Pet stores and pet hospitals are essential consumption scenarios for pet owners. High-quality chain pet stores create immersive consumption scenes that integrate products, services, and entertainment. For example, the Favor Pets chain pet stores provide comprehensive pet supplies–pet food, pet services, and other pet products with both private brand and cooperative brands. Such consumption scenes leverage satisfying experiences to bridge the gap between brands and consumers and enhance brand recognition. With expertise in pet diagnosis and treatment, pet hospitals deeply impact consumers' purchasing decisions and help brands accumulate loyal consumers.

4. Trends

4.1 Upgraded and diversified demand

With enhanced awareness of raising pets scientifically, pet owners pay more attention to scientific formula for balanced nutrition. Protein, calcium, and fat are the most concerned nutritional elements. In addition, customers have more segmented demands, such as gastrointestinal health, immunity enhancement, tear stain removal, and healthy hair color, conducing to the popularity of some functional ingredients, e.g., probiotics.

4.2 Growing pet food customization

Pet food customization is growing as a way of addressing specific health concerns. Nowadays pet owners tend to seek products that are more customized based on breeds, ages, and health conditions of pets, to meet pets' individual needs.

4.3 Pursuit of natural and additive-free product

Many pet owners pay attention to pet food with "natural" highlights, including fresh ingredients, high protein and meat content, natural processing, and no additives. Therefore, in today's Chinese pet food market, one of the key concerns is to meet consumers' functional demands for pet food on the premise of being natural and additive-free.