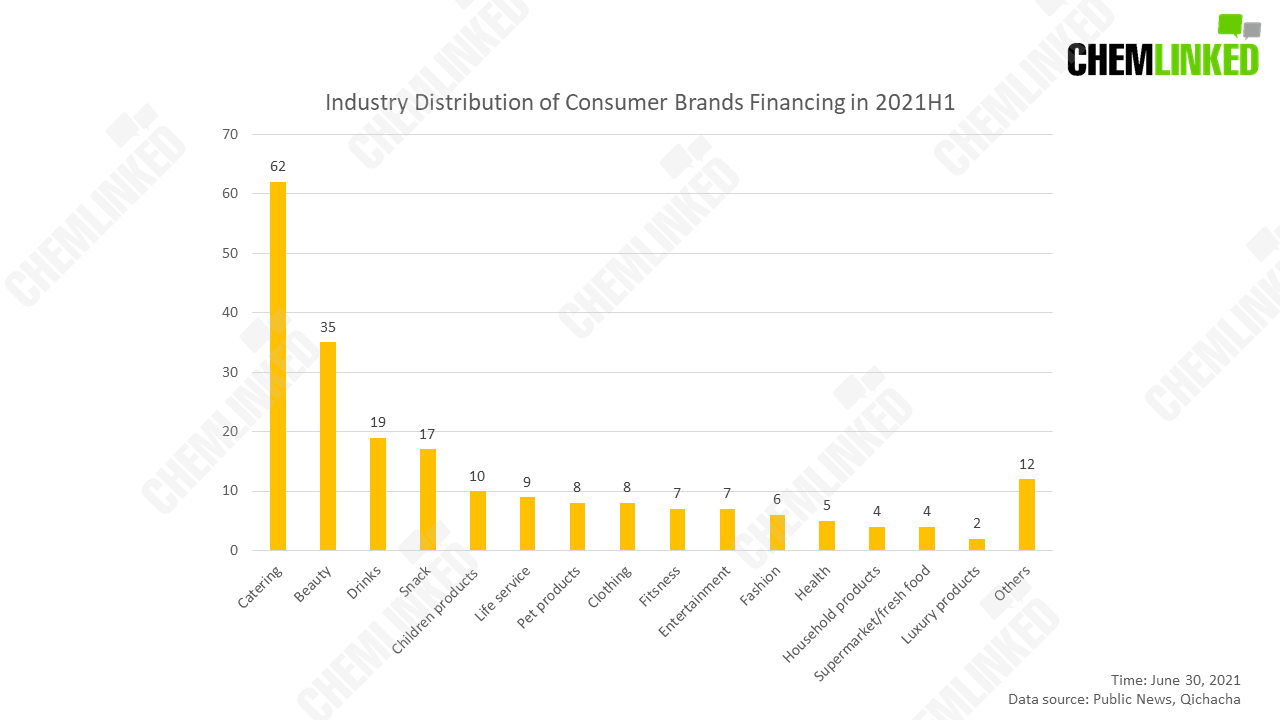

In the first half of 2021, a total of 197 consumer brands completed 215 rounds of financing, among which there were 124 brands founded after 2017, accounting for over 60%. Most financing events secured tens of millions yuan. As for industries, the catering industry was the most popular one among investors, followed by the beauty industry. The following graph shows the distribution of investment in different industries. 1

Catering Industry

In 2021H1, the catering industry was undoubtedly the shining star among investors. Sectors such as bubble tea, coffee, noodle, refreshment, etc., all got large investments. Brands receiving investments showed competitive advantages.

Because of the increasing competition in the bubble tea market, some new bubble tea brands distinguished themselves by specific selling points. Auntea Jenny focuses on selling healthy tea against people’s recognition that bubble tea is unhealthy for containing high sugar.

AUNTEA JENNY

After Luckin’s scandal, high-end coffee brands start to gain traction. The most famous one must be Manner coffee, receiving investment from many famous investors, such as Temasek, Meituan, and ByteDance.

MANNER COFFEE

As one of the Chinese favorite staple food, noodles also caught investors’ eyes. The leading brand in this sector, Hefu Noodle, even secured 800 million yuan recently.

The most eye-catching investment happened in the Chinese refreshment sector. Chinese refreshment, regarded as old-fashioned in the past, now has upgraded as a fashion icon among consumers with the rise of Chinese fashion. Chinese refreshment brands, thus, became one of the most potential investment projects among investors. DIM SUM BUREAU OF MOMO, a new Chinese refreshment brand founded in August 2020, completed four rounds of financing within one year with a brand valuation of 5 billion yuan. 2

DIM SUM BUREAU OF MOMO

Beauty Industry

The beauty industry continued its popularity, but investors’ attitude to different subcategories changed.

Although the makeup sector still had five financial events in 2021H1, it had lost investors’ interest compared to the same period in 2020 because of the overcrowded market and unpleasant capital market performance of Yatsen Global, Perfect Diary’s parent company. Although officially listed on the New York Stock Exchange, in the past seven months, the market value of Yatsen Global has been halved. As the parent company of a leading domestic color cosmetic brand, Yatsen Global’s performance in the secondary market implied the actual business data of the whole industry, changing the investment logic of capital for similar companies.

As for the skincare sector, functional skincare brands were the shining star. Concepts such as clean beauty, plant-base, and skintellectual, are popular, contributing to the rapid rise of functional skincare brands such as Winona. In March 2021, Winona’s parent company Botanee successfully launched an IPO, whose market value kept increasing and now has exceeded 90 billion yuan.

Investors’ interest in male cosmetics remained unabated. In 2021H1, there were five domestic financing events of emerging men's care brands, including two new brands founded in 2020, UP and Tabula Rasa. However, there is no dominant brand in this market, so investors hope to find a similar successful brand like “Perfect Diary” in the male cosmetic sector.

Tabula Rasa

Many personal care brands also have gained investors’ attention, such as Zebra Too Angry, CEEMCOME, Rocking Zoo, KUGG, BOP, NYSCPS, etc. Similar to the male cosmetic sector, the personal care sector also didn’t witness the rise of a dominant brand, so investors have high expectation for emerging brands in this sector.

Another worth-noting sector is cosmetic contact lenses. As a small niche sector, it completed five rounds of financing in 2021H1. This industry has the dual attributes of "medical devices + consumer products", so it shares a similar consumer group with the beauty industry. According to statistics from Tsingshan Capital, in the past five years, the consistent average annual growth value of cosmetic contact lenses is as high as 41%. It shows that the cosmetic contact lenses market is still a blue ocean. With investors’ support, the cosmetic contact lenses industry is expected to usher in rapid development. 3

MOODY: Cosmetic Contact Lenses Brand

Drink and Snacks

The concept health plays an important role in the drink and snack sectors. Low-alcohol wine became more popular than before. Planted-based is still a popular concept. However, investors’ interest moved from planted-based meat to planted-based milk. Oat milk brand Plantag and coconut milk COCO100 both completed 2-3 rounds of financing in half a year. Investors were also interested in the functional food sector. In 2021H1, the oral beauty brand UNOMI, the probiotic brand Yuanbenziran, and the anti-aging oral beauty brand NMN all received early financing.