No one could predict that the electrolyte drinks would suddenly become a hit in the China at the end of 2022. This unexpected popularity is mainly attributed to the national-level cancellation of COVID-19 restrictions in December last year. (Read more at A Record of China’s Optimization of COVID-19 Measures, by Xinhuanet)

Electrolyte Drinks Being Snapped up for Alleviating COVID-19 Symptoms

Along with the easing of policies, COVID-19 spread out rapidly from city to city with a great many infections. Taking a glimpse of this situation from the online COVID-19 infection investigation result by Sichuan Center for Disease Control and Prevention, up until Dec 25, 2022, 63.52% of participants (158.5 thousand people) in Sichuan province had tested positive. As another 28% of participants were without testing results but had have COVID-19 symptoms, hence, the infection rate shall be higher than 63.52%. Common clinical symptoms include cough, fever, fatigue, body ache, etc.

The rapid infection and widely-appeared symptoms soon resulted in a shopping rush of medicines and finger pulse oximeters. Those who got infected in the first wave shared their experience on the Internet, recommending the food which can help relieve symptoms from the perspective of diet therapy. In this context, stockpiles like electrolyte drinks—replenishing water and electrolyte during fever, diarrhea, and/or vomiting—are highly sought after across China, catalyzed by posts on social media like Weibo and the Little Red Book. For example, up till today, there are over 90 thousand “notes” (posts generated by users) related to electrolyte drinks on the Little Red Book. More significantly, the popularity of electrolyte drinks is different from other popular foods, for “Pay attention to the balance of water and electrolyte to maintain homeostasis” is recommended as an approach for general treatment in China’s Diagnosis and Treatment Protocol for COVID-19 Patients (Trial Version 9). It is believed this protocol is the direct and major cause propelling the sudden popularity of electrolyte drinks.

The rapid infection and widely-appeared symptoms soon resulted in a shopping rush of medicines and finger pulse oximeters. Those who got infected in the first wave shared their experience on the Internet, recommending the food which can help relieve symptoms from the perspective of diet therapy. In this context, stockpiles like electrolyte drinks—replenishing water and electrolyte during fever, diarrhea, and/or vomiting—are highly sought after across China, catalyzed by posts on social media like Weibo and the Little Red Book. For example, up till today, there are over 90 thousand “notes” (posts generated by users) related to electrolyte drinks on the Little Red Book. More significantly, the popularity of electrolyte drinks is different from other popular foods, for “Pay attention to the balance of water and electrolyte to maintain homeostasis” is recommended as an approach for general treatment in China’s Diagnosis and Treatment Protocol for COVID-19 Patients (Trial Version 9). It is believed this protocol is the direct and major cause propelling the sudden popularity of electrolyte drinks.

How popular are electrolyte drinks? As revealed by data from Baidu (the biggest search engine in China), the search index of electrolyte drinks increased by 3,065% from Dec 4 to 13, 2022. JD.com, one of the e-commerce platform giants, also disclosed that from Dec 1 to 12, 2022, the transaction value of such products increased by over 10 times. Among all electrolyte drink products, Pocari Sweat from Japanese company Otsuka Pharmaceutical and Alienergy from Chi Forest (previously called Genki Forest, a local brand in China) achieved the top sales. According to a ranking list from JD.com in the middle of Dec 2022, the popularity of Pocari Sweat increased by 458% within 24 hours. The transaction value of products from both brands increased by 10 times within 15 days. On Jan 14, 2023, Chi Forest announced that the sales value of Alienergy in 2022 reached 1.27 billion yuan, and the highest sales in a single month exceeded 190 million yuan.

Seeing this opportunity, in Jan 2023, energy drink giant Eastroc Beverage moved the launch date of its electrolyte drink three months ahead.

Electrolyte drink by Eastroc Beverage

Jumping out of the Pandemic Context, Will Electrolyte Drinks still Be a Good Deal?

Little data is sketching the contours of the overall market size of electrolyte drinks in China, as corresponding market data is often calculated into the category level of sports drinks. Taking the data on sports drinks as a reference, as disclosed by iiMedia Research, China’s sports drink market expanded from 5.8 billion in 2014 to 12 billion in 2019 and is expected to increase to 21 billion in 2024.

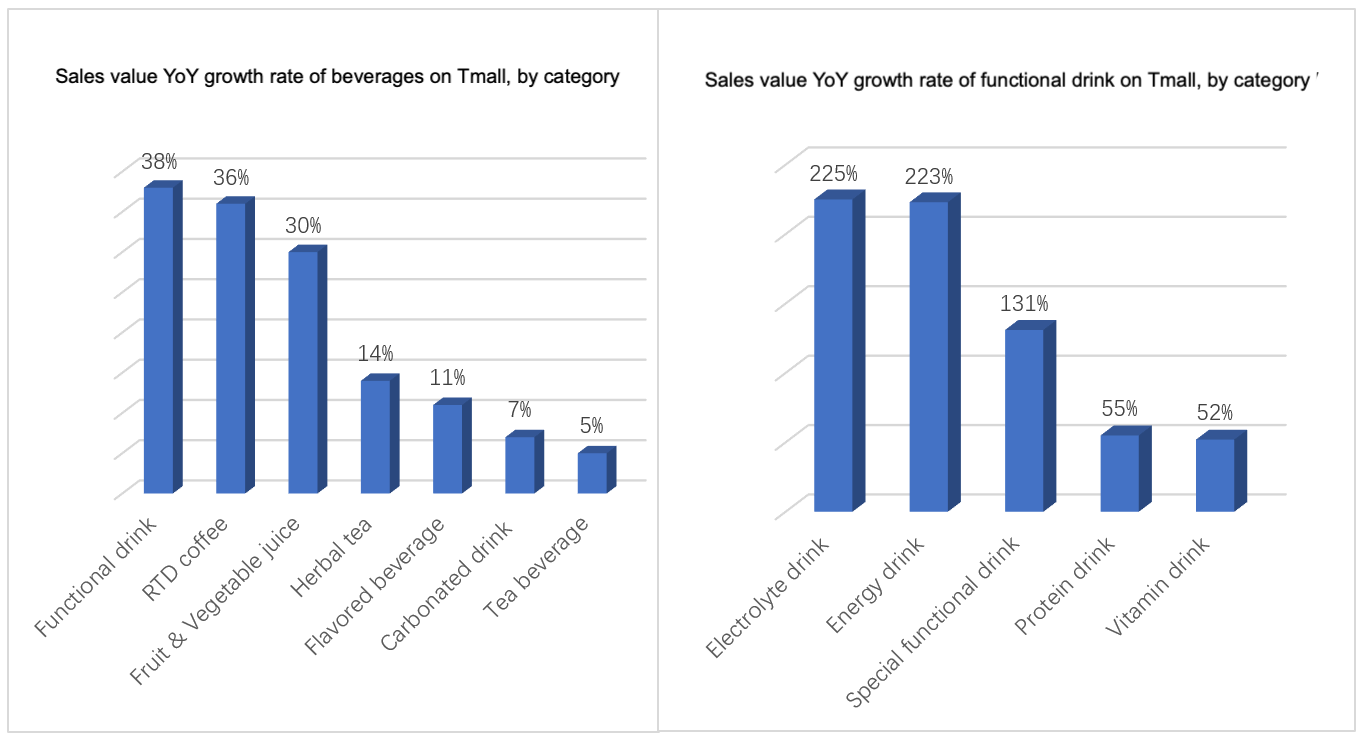

Although without specific market data, a report by Tmall Innovation Center (data collected from April 2021 to Mar 2022) revealed that the sales of electrolyte drinks are growing rapidly. Functional drinks had the fastest increasing rate among all beverage categories in the analysis period. Regarding the performance of functional drinks, the subcategory of electrolyte drinks played an important role with the fastest increasing rate. As per the report, the sales value of electrolyte drinks sold on Tmall in Q1 2022 posted a YoY growth rate of 225%. New consumers of electrolyte drinks surged 292% year-on-year. In addition, Alienergy and Scream from Nongfu Spring are the top 2 Chinese brands, while Pocari Sweat and Gatorade are the top 2 imported brands.

After analyzing the data above collected before the loosening of COVID-19 policy, ChemLinked predicts that the electrolyte drink market in China is promising and will keep expanding stably in the future. Firstly, before China’s lifting of COVID-19 policies, the business of electrolyte drinks has already taken on an upward trend because it fits the health trend, including people's interest in the workout, the demand for healthy or functional foods, etc.

Secondly, the new consumption groups will bring more consumption potential. In past years, most electrolyte drinks mainly targeted at people who love sports, a relevant “niche” business in the beverage industry. In recent years, new consumption brands like Chi Forest (launched in 2021) have been expanding the consumption scenes from the sports field to people’s daily life, like working, studying, playing e-sports, and bathing. Such a strategy will attract new consumption groups. Besides, the sudden change in pandemic policy brings lots of exposure to electrolyte drinks and is expected to accelerate the development of the electrolyte drinks sector. Although the stockpiling of electrolyte drinks spurred by the loosened measures is a short-time benefit, it indeed greatly speeds up people's positive perception on electrolyte drinks from a long-term perspective.

Regulations to Know Before Selling Electrolyte Drinks to China

Not only traditional food enterprises like Wahaha but also pharmaceutical companies like Huaren Pharmaceutical are entering the electrolyte drinks sector. For stakeholders who are interested in this sector, they shall do food classification first. Generally speaking, products containing electrolytes or want to claim "replenishing electrolyte" can fall into one of the following categories:

Electrolyte beverage: the product added with minerals and other nutrients that the body needs and can replenish electrolytes and water which has been consumed due to the metabolism of the body.

Solid beverages: solid products which are processed by using raw and auxiliary food materials and food additives, in the form of powder, granule or block, etc., and served by dissolving or brewing.

Sports beverage: beverages whose nutrients and their content can fit the physiological characteristics of people doing sports or physical activities; can replenish water, electrolytes, and energy for the body; and can be absorbed quickly.

Sports nutrition food: specially processed food that fits the physiological metabolic states, sports performance, and special needs for certain nutrients of the sports population (who participate in physical exercise with medium intensity or above for 30 min or above each time and three times or above per week).

Foods for special medical purposes (FSMP)—electrolyte formula: specially processed and prepared products to meet special needs for nutrients or diet of those suffering from food intake restriction, the disorder of digestive absorption, the disorder of metabolic or certain diseases. Such foods shall be used alone or together with other foods under the guidance of doctor or clinical nutritionist. Because the product specialty is far away from the common perception of electrolyte water, the analysis of its compliance is not discussed in this article.

The different food classification leads to different product compliance requirements. In the market, most electrolyte drinks fall in the electrolyte beverage category (e.g., popular products of Pocari Sweat and Alienergy) and sports beverage category (e.g., Gatorade and Scream). In addition, Pocari Sweat has launched solid beverage products. Corresponding product standards and special requirements for different product categories are briefly summarized below. Enterprises can check the standards and corresponding requirements first to see which category suits their products the most. For the compliance of food ingredients, ChemLinked recommends stakeholders to use the Combox tool for ingredient checks or reviews, including the compliance of food additives.

Table 1: Product compliance of different electrolyte products

SN | Food category | Type | Product standard | Special requirements |

1 | Electrolyte beverage | Regular Food | / | |

2 | a) Sports solid beverage, or b) Electrolyte solid beverage | Regular Food | Special requirements for labeling and the content of water | |

3 | Sports beverage | Regular Food |

| |

4 | Sports nutrition food | Foods for special dietary uses | GB 24154 National Food Safety Standard General Standard for Sports Nutrition Food |

|

Regarding product claims, all the products above can bear content claim and function claim following GB 28050 National Food Safety Standard General Rules for Nutrition Labeling of Prepackaged Foods. Moreover, products can emphasize the addition of certain ingredients based on GB 7718 National Food Safety Standard General Standard for the Labeling of Prepackaged Foods. E.g., it is allowed to label “replenishing electrolyte” or “Content of electrolyte≥200mg/bottle” on the principle display panel of the product.

Table 2: Claims for different electrolyte products

SN | Food category | Claims |

1 | Electrolyte beverage |

|

2 | a) Sports solid beverage or b) Electrolyte solid beverage | |

3 | Sports beverage | |

4 | Sports nutrition food (Foods for special dietary uses) |

|

In addition to product compliance, stakeholders shall also get overseas facilities, which manufactured such products, registered with China's Customs. (Recommended online course: The Ultimate Guide to China's GACC Overseas Food Manufacturer Registration)

Facing difficulties in selling food to China? ChemLinked provides one-stop compliance solution. For more info or inquiries, please email contact@chemlinked.com.