Market Size

China's oral care market is on an upward trajectory. In 2021, the market reached an impressive size of 52.2 billion yuan, with a compound annual growth rate (CAGR) of 7.7% from 2017 to 2021, surpassing the global market average. Projections for 2026 suggest that the Chinese oral care market has the potential to reach 67.8 billion yuan. Comparing it to mature markets like the United States, South Korea, and Japan, the per capita spending on oral care in China is significantly lower, indicating ample room for future growth.

Toothpaste is the dominant segment within the oral care sector. As an essential product with consistent demand, despite an overall consumption slowdown from 2019 to 2021, the toothpaste market size continued to grow steadily. It is anticipated that by 2023, the Chinese toothpaste market will reach approximately 34.7 billion yuan.

Competitive Landscape

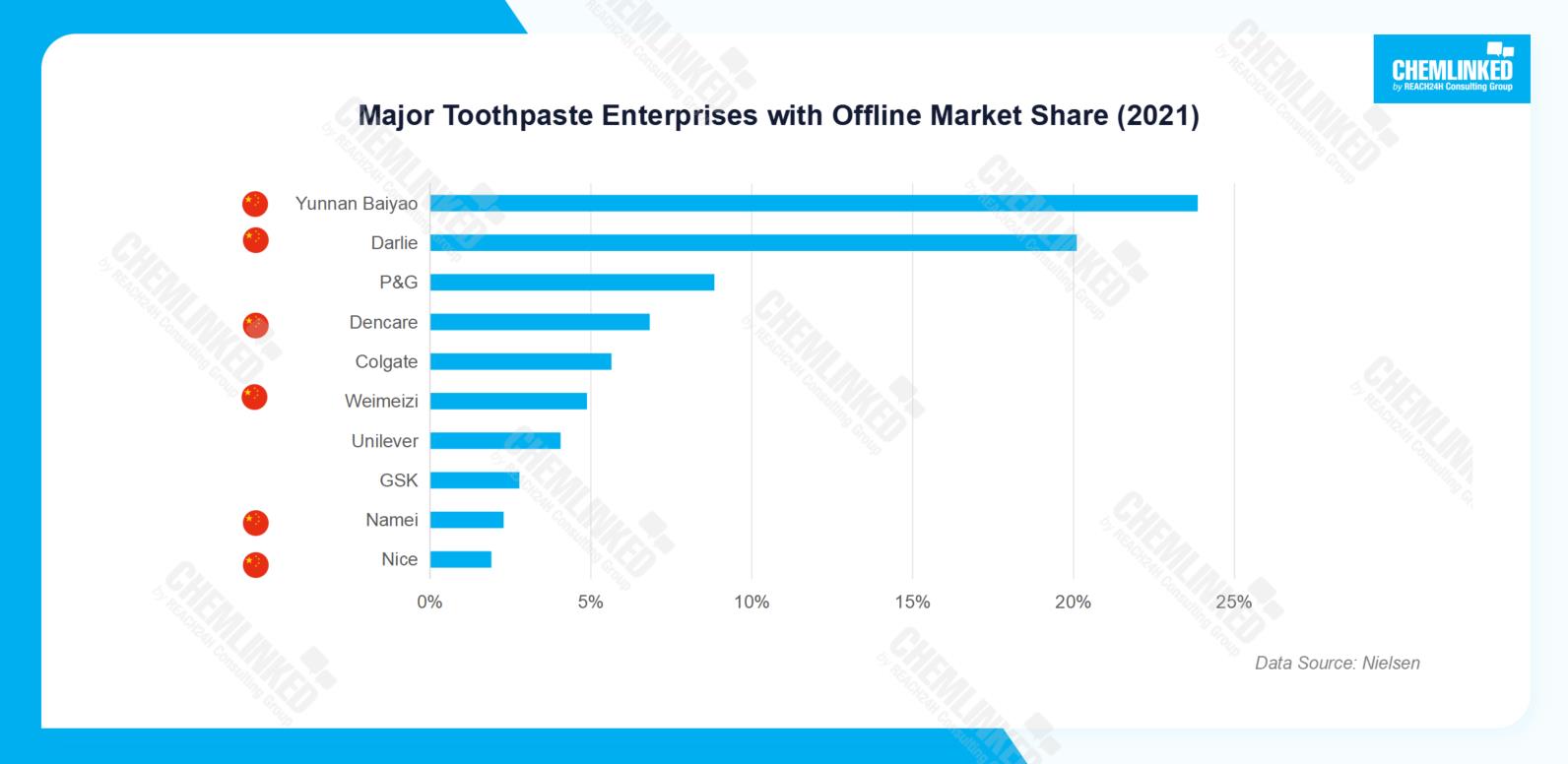

The toothpaste market in China exhibits a concentrated landscape. According to Nielsen, in 2021, the top ten toothpaste enterprises altogether held a share of 81% in the offline market, with the top five players, including Yunnan Baiyao, Darlie, P&G, Dencare, and Colgate, accounting for 65% of the market share. Yunnan Baiyao, in particular, has maintained its leadership position in the market, with its market share increasing from 22.2% in 2020 to 25% in the first half of 2023.

Chinese domestic toothpaste brands are gaining more consumers, with their market influence on the rise. According to the China Oral Care Industry Association, for the first eight months of 2023, the top five brands in the online toothpaste market were Yunnan Baiyao, Darlie, Crest, Colgate, and Saky, with their retail sales accounting for 11.2%, 7.8%, 6.5%, 6.0%, and 5.3%, respectively. Brands ranking from six to ten included Sensodyne, ORALSHARK, Lesening, Jingxiutang, and Lion. Notably, among the top ten brands, six are Chinese brands, with Yunnan Baiyao firmly holding the top position.

Notable Trends

Growing Efficacy-Driven Demand

Toothpaste has entered the era of efficacy, with consumers now expecting a wider range of product benefits. Currently, gum care, teeth whitening, and sensitivity relief toothpaste are the primary categories in demand. In the first half of 2023, their respective offline market shares were 28.9%, 23.9%, and 11.4%. It is worth noting that the market for traditional teeth whitening toothpaste is steadily declining, while categories focused on strong efficacy such as gum care and sensitivity relief are on the rise.

Upgrading Toothpaste Consumption

The increasing awareness of oral health is driving an upgrade in the oral care industry. Some consumers are showing a growing preference for mid-to-high-end products, with a reduced sensitivity to price. According to government data, the average price of a standard 120g toothpaste increased from 8.38 yuan in June 2015, to 10.61 yuan in February 2021. Furthermore, on Tmall, from 2019 to 2022, the average prices of toothpaste brands, including Yunnan Baiyao, Darlie, Saky, Colgate, and Crest, all experienced price increases, with Colgate's prices rising the most significantly, from 32.9 yuan in 2019 to 51 yuan in 2022, an increase of 52%.

Thriving Online Channels

E-commerce has evolved into a crucial sales channel for toothpaste, and simultaneously, new retail channels like community group buying, home delivery, and interest-based e-commerce are rapidly emerging. According to the China Oral Care Industry Association, Douyin and Kuaishou are the fastest-growing channels in the oral care industry, with growth rates exceeding 60% and 40%, respectively. Notably, Douyin has become the channel with the highest market share in the toothpaste market, accounting for over 30%. Moreover, online channels are creating opportunities for new brands. Some emerging Chinese toothpaste brands, such as Usmile and Canban, are successfully gaining ground through niche market segmentation and differentiated positioning.

Exploring New Growth Avenues

Consumer demand for a diverse range of oral care products is driving toothpaste brands to venture into additional categories, including dental floss, water flossers, mouthwash, and toothbrushes. According to Euromonitor, the mouthwash market has consistently grown with a CAGR of 45.69% from 2017 to 2021, and the electric toothbrush market has also witnessed significant expansion, with a CAGR of 27.27% from 2017 to 2021. Therefore, leading toothpaste brands are actively pursuing opportunities in these categories to find new growth avenues in the increasingly competitive and ever-evolving oral care industry.

Regulatory Compliance

On March 23, 2023, China State Administration for Market Regulation issued the finalized Administrative Measures on Toothpaste (Measures) that will come into effect on December 1, 2023. According to the Measures, starting from December 1, 2023, Chinese domestically produced toothpaste must be notified with the provincial-level drug supervision and administration department before being marketed. Imported toothpaste must be notified with the National Medical Products Administration before importation. The Measures has clarified regulations for toothpaste raw material management, product filing, production permits, safety assessment, and efficacy claims, leading to an increase in industry entry standards. Notably, the Measures stipulates that the efficacy claims of toothpaste should have a sufficient scientific basis. This implies that toothpaste products making efficacy claims will undergo a stringent and time-consuming efficacy assessment process.

On September 25, 2023, China National Medical Products Administration issued an announcement regarding the implementation of toothpastes supervision regulations and the simplification of notification document requirements for toothpastes already available in the market. According to the announcement, toothpaste manufacturers whose products have no incidents related to quality and safety, and are with comprehensive evidence of their history of safe usage can undergo simplified notification from October 1, 2023, to November 30, 2023. Products that have completed the simplified notification can continue to be imported and sold after December 1.

For more detailed compliance procedures, please contact us at contact@chemlinked.com