The following paragraphs are just a glimpse of the formal report. Please contact us at contact@chemlinked.com to learn more about the complete report.

Market size

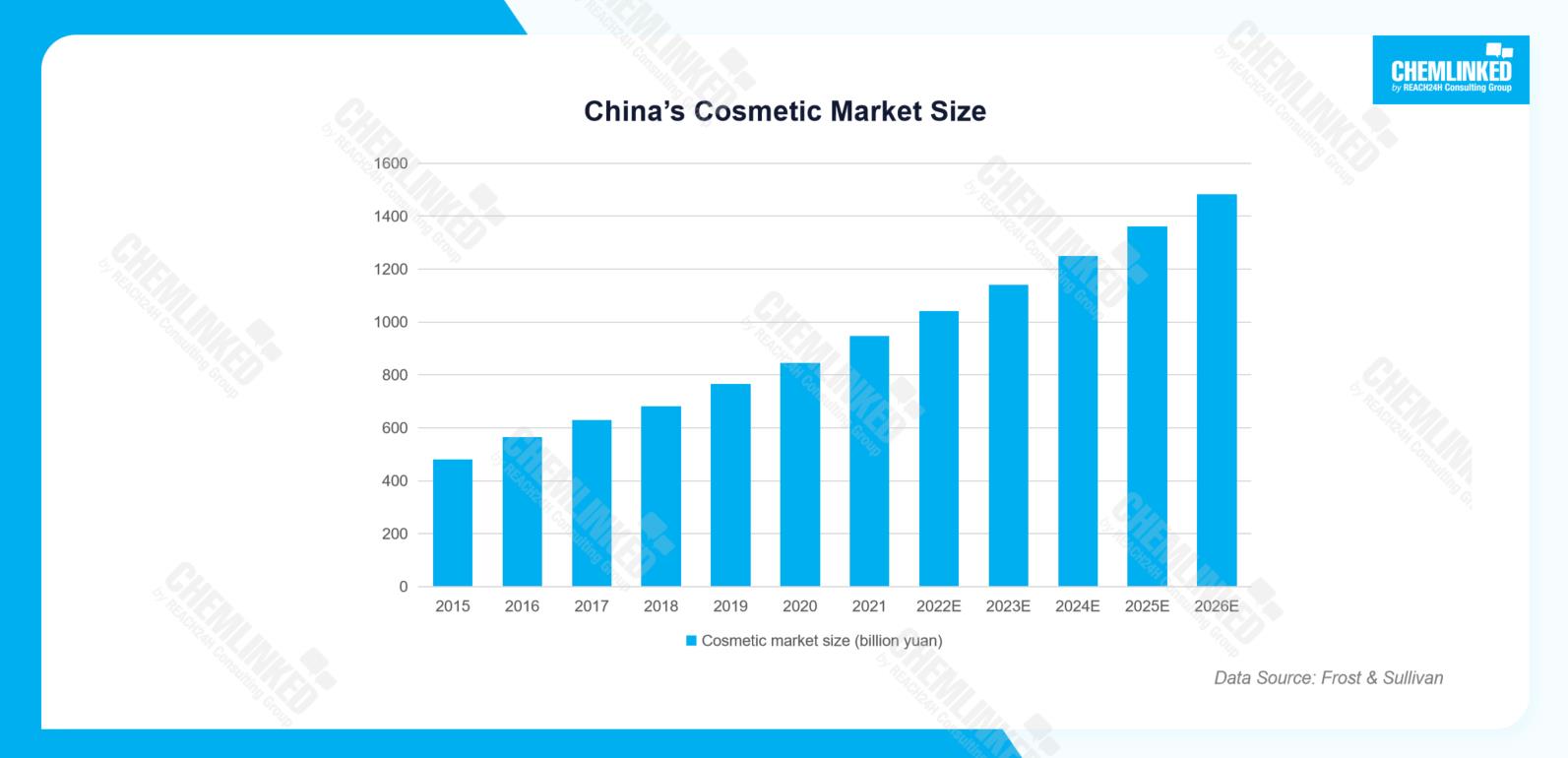

According to Frost & Sullivan, China's cosmetics market size reached 946.8 billion yuan in 2021, with a compound annual growth rate (CAGR) of 12.0% from 2015 to 2021, far exceeding the global cosmetics market's CAGR of 2.2% during the same period. Looking ahead, Frost & Sullivan forecasts that China's cosmetics market will maintain its robust growth, with a projected CAGR of 9.4% from 2021 to 2026, reaching 1,482.2 billion yuan by 2026.

From the perspective of retail sales, data from the National Bureau of Statistics revealed that China's total retail sales of cosmetics witnessed impressive growth from 261.9 billion yuan in 2018 to 402.6 billion yuan in 2021 with a CAGR of 15.4%. However, in 2022, the cosmetics retail sales experienced a slight decline to 393.6 billion yuan due to regional epidemic prevention measures in China, including lockdown. As the pandemic gradually recedes, consumer confidence in the Chinese market is rebounding, igniting a renewed market dynamism. In the first half of 2023, China's cosmetic retail sales reached a record high of 207.1 billion yuan, marking impressive growth compared to the same periods in the preceding years. Specifically, it experienced a significant increase of 41.70% compared to the first half of 2019, 40.20% compared to 2020, 8.05% compared to 2021, and 8.74% compared to 2022. This remarkable surge in retail sales highlights the strong and consistent growth momentum of the Chinese cosmetic market during that period. This impressive recovery underscores the resilience and untapped potential of the Chinese beauty industry.

Category

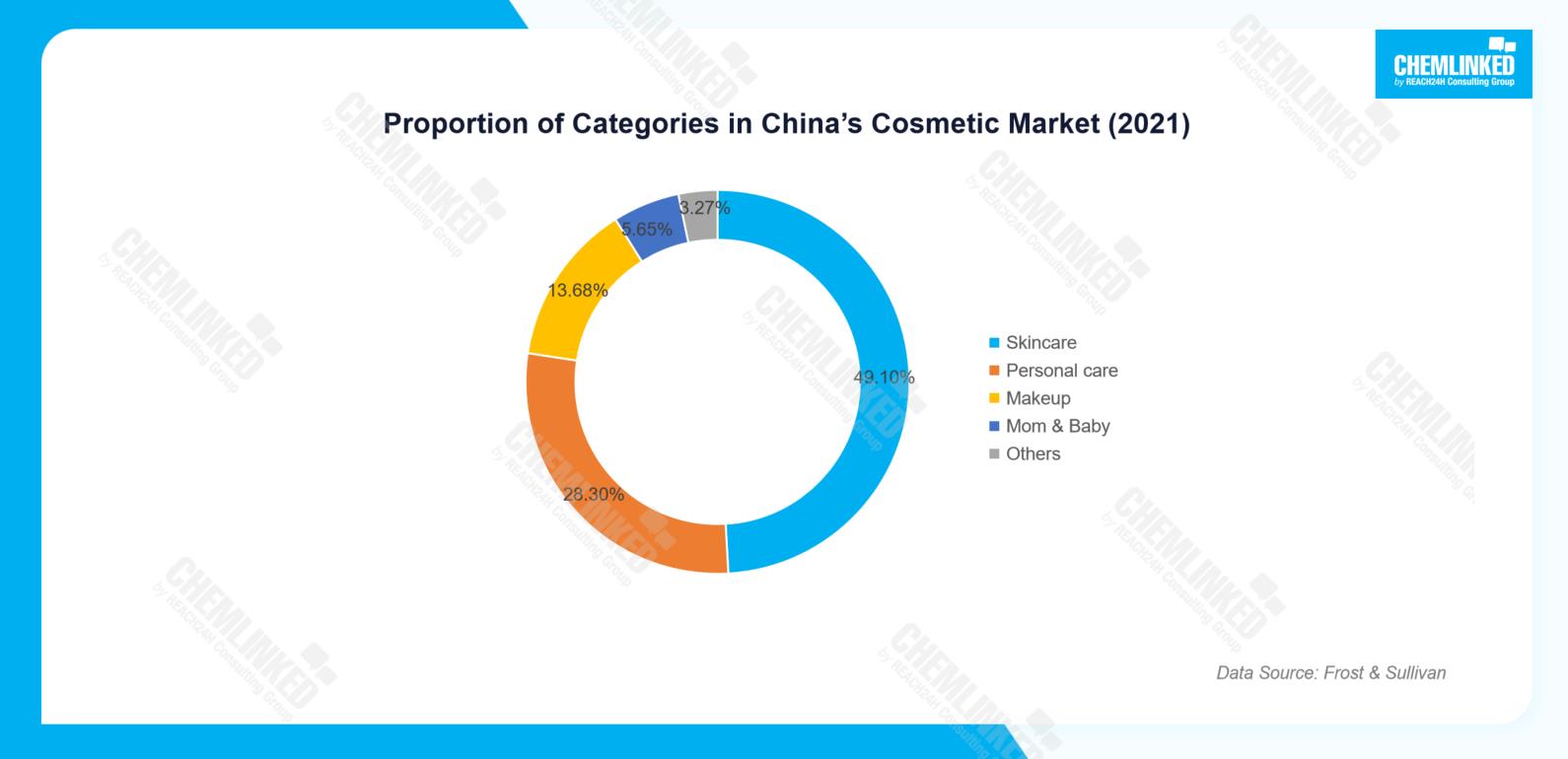

Cosmetics can be classified into five primary categories: skincare products, personal care products, makeup products, mom & baby care products, and other miscellaneous items. Notably, skincare products stand out as the largest segment within the cosmetics industry, accounting for an impressive 49.1% of the total market in 2021. According to Frost & Sullivan, by 2026, the market size of skincare, personal care, makeup, and mom & baby care products will reach 752.7, 387.8, 208.7, and 95.9 billion yuan respectively.

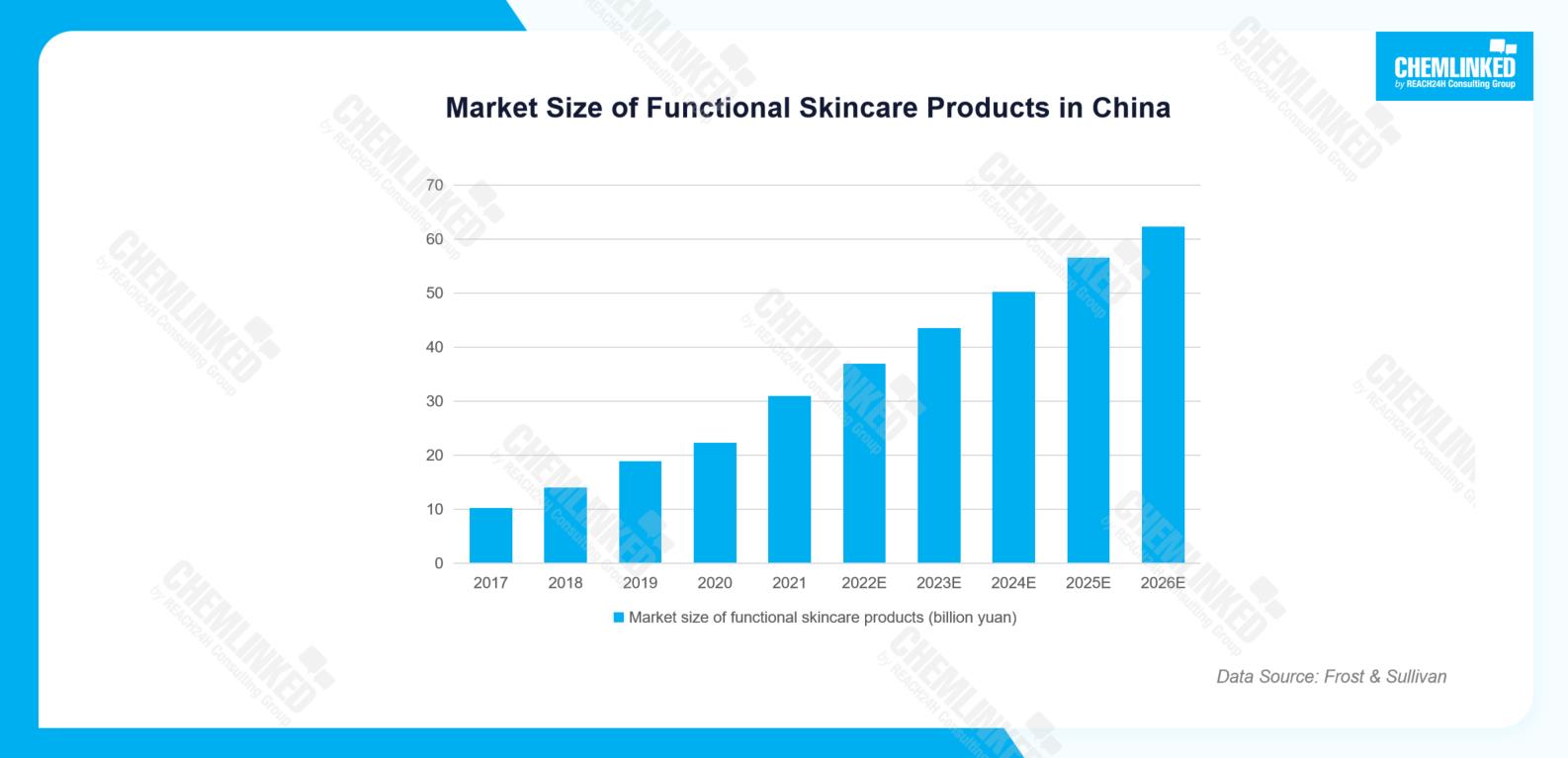

To further subdivide the categories, the performance of functional skincare products is particularly noteworthy. Despite their relatively small market share, these products have exhibited an impressive growth rate. The market size of functional skincare products surged from 10.25 billion yuan in 2017 to 30.96 billion yuan in 2021, with a remarkable CAGR of 31.8%. By 2026, the market size of functional skincare products is expected to further expand to 62.30 billion yuan. As the growth trajectory shows, the functional skincare segment does align perfectly with the evolving preferences of today's skincare-savvy consumers with more or less specific skin concerns, which also indicates the substantial growth of this segment in the Chinese market.

Sales Channels

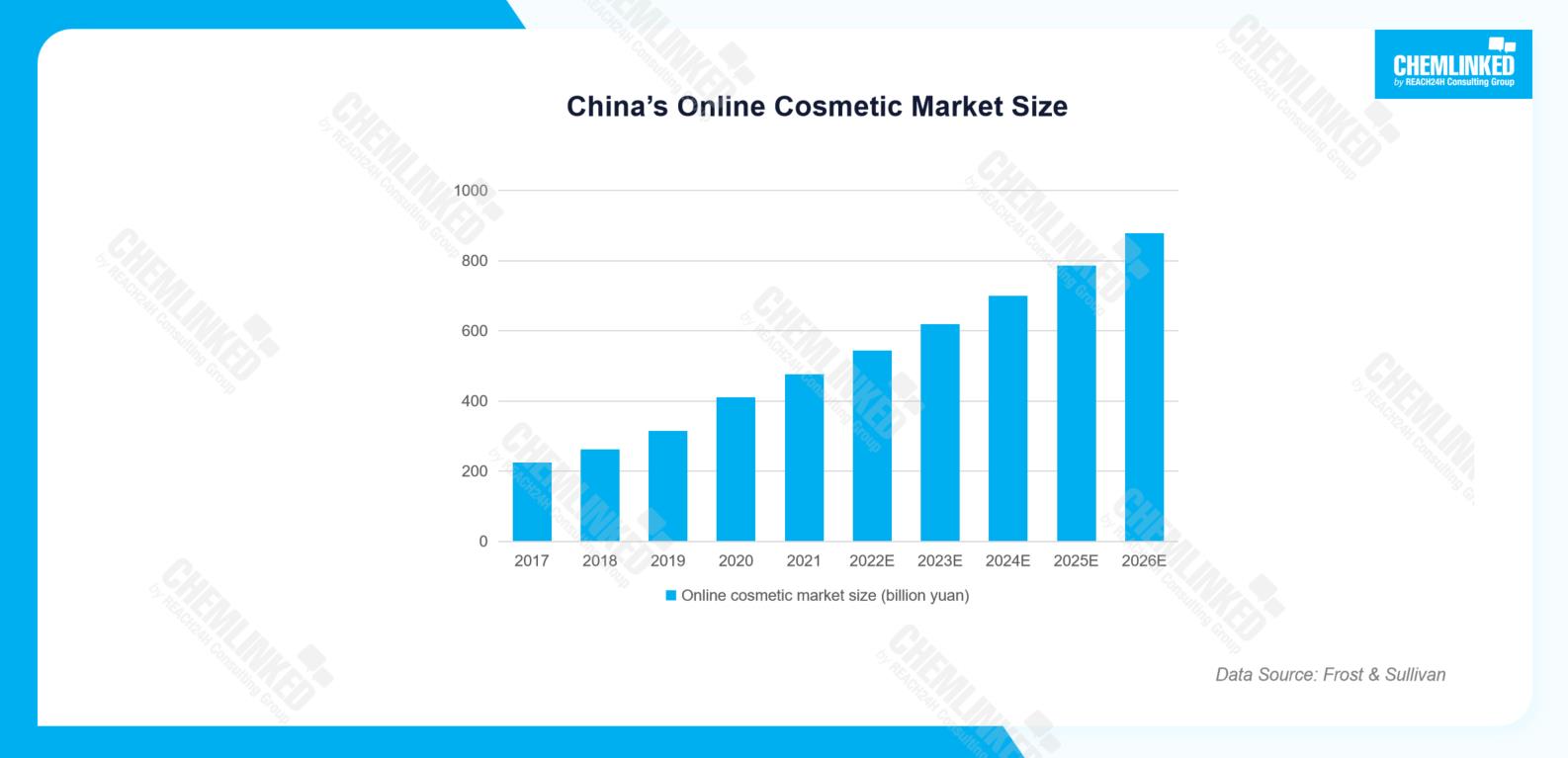

Benefiting from the development of China's e-commerce platforms, the online cosmetics market has experienced rapid growth. Data reveals that in 2021, the online cosmetics market reached 476.3 billion yuan, accounting for 50.31% of the total. It is projected to further reach 879.0 billion yuan by 2026, with a CAGR of 13%.

Competitive landscape

In the Chinese cosmetic market, international beauty giants hold a dominant position, particularly in the high-end sector. Companies such as L'Oréal, Estée Lauder, Shiseido, LVMH, P&G, etc. have established a strong presence in China, with their brands enjoying a high reputation among consumers. In 2021, the top five enterprises in the Chinese beauty industry were all international beauty enterprises, altogether holding a market share of 21.9%.

It is worth noting that Chinese domestic beauty enterprises are catching up, steadily expanding their presence in the overall Chinese cosmetics market. In 2021, local players accounted for an impressive 47% of the total market share. Chinese beauty enterprises like Proya, Botanee, and Bloomage Biotech have achieved impressive growth, driven by their strong research and development capabilities and highly effective local marketing campaigns.

Market Trends

Research and development have become more important

With the popularity of functional skincare and the implementation of new cosmetic regulations, the importance of R&D has become a consensus in China's cosmetic industry. Beauty enterprises are placing greater emphasis on enhancing R&D competitiveness to develop cutting-edge products tailored to consumer needs.

Premiumization remains on-trend

Chinese consumers are inclined toward high-end cosmetic products due to the upgraded consumption concept. As consumers prioritize their self-care lifestyle, they become more discerning in their choices. To be specific, they tend to seek safe ingredients with proven efficacy, and are willing to invest more on high-quality products that offer enhanced beauty experience and contribute to their overall well being.

Precise beauty solutions gain momentum

Consumers are increasingly seeking precise beauty solutions tailored to different skin concerns. Additionally, their preferences have become more diverse to adapt to various situations. This evolving trend opens up new opportunities for brands to explore and tap into the potential within more beauty segments.

More to be explored……

Regulatory Requirements

On Jan. 1, 2021, China's overarching cosmetic regulation Cosmetic Supervision and Administration Regulation (CSAR) entered into force. After this, a series of subsidiary regulations were released to consolidate the new cosmetic regulatory framework.

Before being marketed or imported into China, cosmetic products must get approval from National Medical Products Administration (NMPA) or medical products administration departments of provinces, autonomous regions, or municipalities directly under the Central Government according to the product category. Specifically, for special cosmetics, including hair dyes, hair perming products, freckle-removing and whitening products, sunscreens, anti-hair loss products, and cosmetics with new efficacy, they are subject to registration with NMPA to obtain approval for market access. For general cosmetics, it is necessary for brands to complete the notification process by submitting all the necessary dossiers before entering the market.

For more detailed compliance procedures, please contact us at contact@chemlinked.com.