Contents

Market Condition

Company Dynamics

E-commerce & Social Commerce

Financial Results

Regulatory Compliance

Market Condition

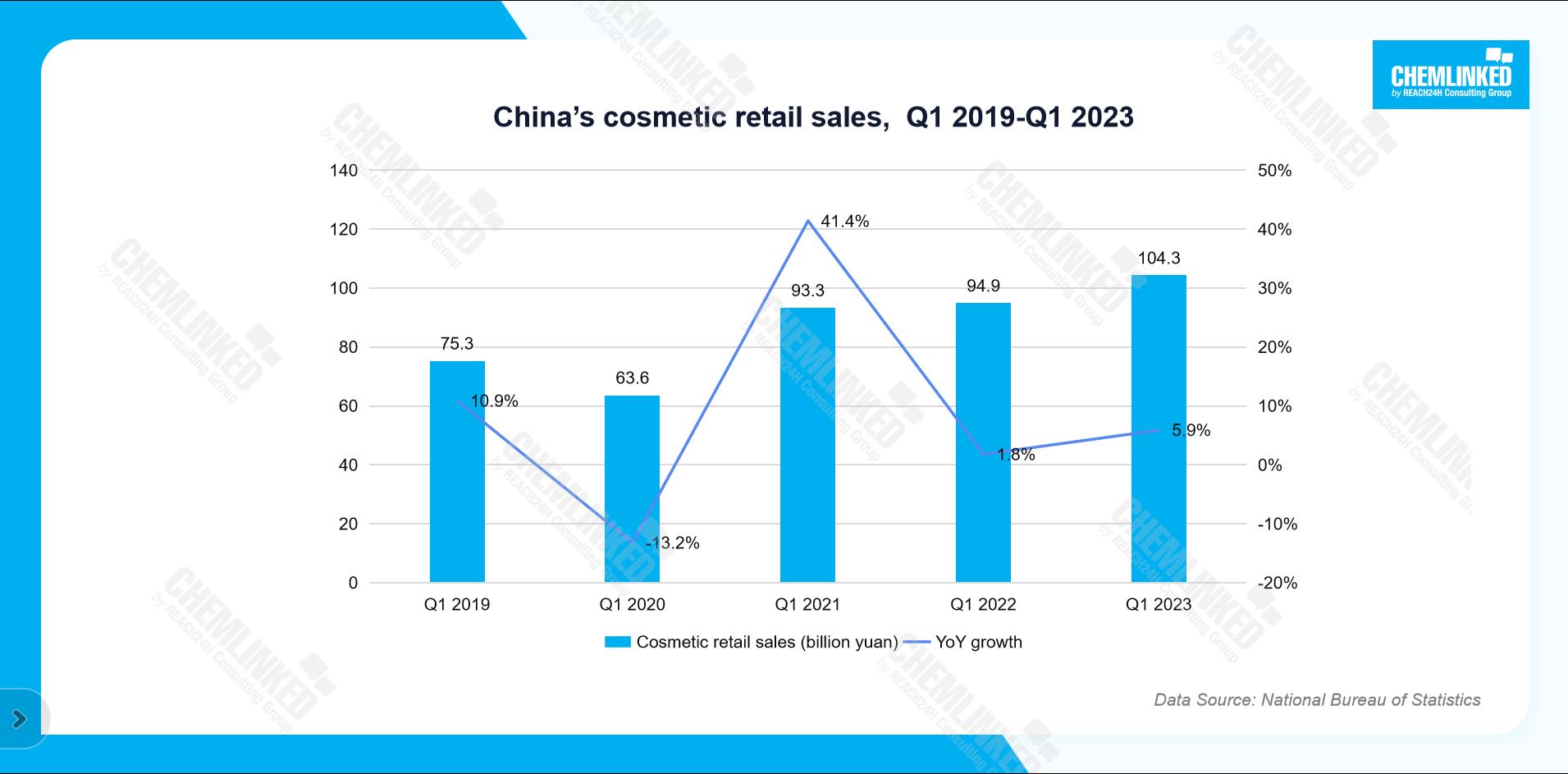

1. According to the National Bureau of Statistics, China's retail sales of cosmetics in March 2023 reached 39.3 billion yuan, representing a YoY increase of 9.6%. In the first quarter of 2023, the total retail sales of cosmetics amounted to 104.3 billion yuan, a YoY increase of 5.9%. This is the first time in the recent five years that Q1 cosmetic retail sales has exceeded 100 billion yuan. The Q1 performance indicates that the Chinese beauty industry is steadily recovering.

2. Initiated during French President Emmanuel Macron's state visit to China from April 5th to 7th, the joint statement between China and France has garnered significant industry attention. Notably, Article 17, which focuses on promoting economic exchange, prioritizes cosmetics as a key industry for both countries. In the past five years, France has consistently ranked among China's top 3 origins of cosmetic imports; in 2022, France claimed the top spot as China's largest source of cosmetic imports, valued at 30.43 billion yuan. With the positive impact of the Sino-French joint statement, French cosmetics are poised to seize new growth opportunities in China.

3. According to China's National Medical Products Administration (NMPA), the number of filed and registered imported cosmetics in 2022 decreased by approximately 2.88% YoY to 62,297, marking the third consecutive year of decline. The decline is partly due to the rise of Chinese domestic brands that diversify consumers' choices. Additionally, new regulations have set more stringent requirements for cosmetic registration, which poses more challenges to cosmetic brands.

4. In Q1 2023, Hainan Province welcomed 26.8 million tourists, an increase of 20.2% YoY, and achieved a total tourism revenue of 53 billion yuan, up 25% YoY. Additionally, the total sales of offshore duty-free shops in Hainan grew by 29% YoY to 20.3 billion yuan. The popularity of travel retail in Hainan is not only due to the recovery of the tourism industry but also the improved shopping experience brought by new pick-up methods, i.e. "Guaranteed Pick-up" for goods priced over RMB 50,000 yuan and "Immediate Purchase and Pickup" for goods priced below RMB 20,000 yuan. Under the "Guaranteed Pick-up" method, customers provide a deposit equivalent to the tax payable for the purchased goods, and the deposit will be refunded upon the presentation of the goods when leaving the island. Under the "Immediate Purchase and Pickup" methods, customers can purchase 15 product categories within the limit of each category per person and collect the goods immediately after paying. It is also worth noting that Hainan is preparing for the island-wide customs closure, which is expected to further promote travel retail.

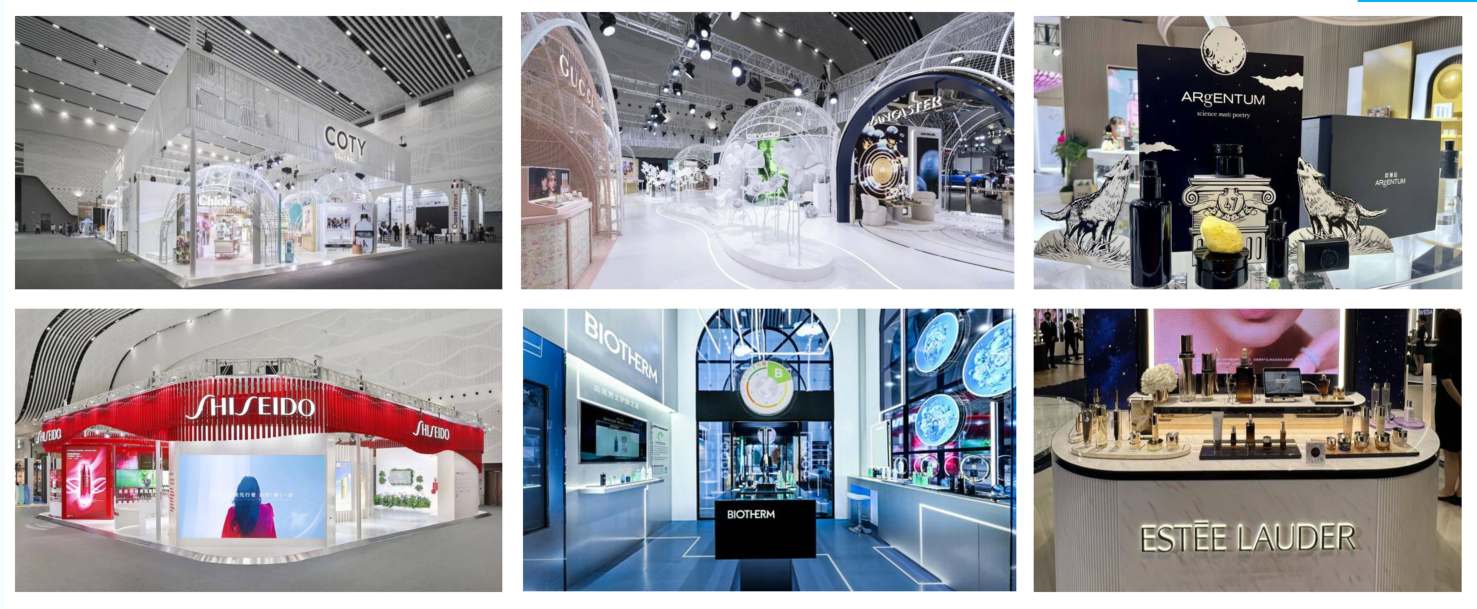

5. The 3rd China International Consumer Products Expo (CICPE) was held in Haikou, Hainan from April 10th to 15th, attracting over 3,100 consumer brands from 65 countries and regions. International beauty giants such as L'Oréal, Estée Lauder, Coty, and Shiseido participated in the expo. The combined effect of CICPE and the Hainan Free Trade Port policy have benefited various multinational beauty groups, which makes the growth of travel retail in 2023 become highly possible.

6. Tmall Global unveiled the first import consumption trend in 2023—Clean Beauty. Since 2021, nearly 200 overseas clean beauty brands have entered the Chinese market through Tmall Global. In 2022, the business of new clean beauty brands increased by 236% YoY. Furthermore, Tmall Global has updated its definition of clean beauty from version 1.0, which emphasized "safe ingredients, animal-friendly, eco-friendly, and sustainable development", to version 2.0, which newly includes "professional and effective" to better meet the needs of the Chinese market.

Company Dynamics

1. The Estée Lauder Group's niche fragrance brand, Le Labo, has announced that its first store in China will soon open in Shanghai. Chinese consumers have expressed their excitement about the news on social media platforms. In August of 2022, Estée Lauder Group initiated the official filing process for Le Labo under the Chinese name"勒莱柏” with China NMPA.

2. L'Oréal China introduced its new development strategy at the 2023 Annual General Meeting themed "Beauty Beyond @ the Dawn of New Era" in Shanghai. The so-called "5 dimensions" strategy, encompasses Innovation, Diversity & Inclusion, Multipolarity, Glocalization, and Sustainability, with the aim of exploring new growth opportunities. In 2022, L'Oréal China's sales increased by 5.5% YoY, which was 11% higher than the global cosmetics market average. In addition, during the 2022 "Double Eleven" shopping festival, L'Oréal ranked as the top-selling beauty group on multiple e-commerce platforms, including Tmall, JD.com, and Douyin.

3. Japanese Kao Corp. has announced that its cosmetic brands, Curel and Freeplus, will be manufactured in China. Kao's strengths in China lie in its medium-priced sensitive skincare brands, especially Curel and Freeplus. As the Chinese market is crucial to Kao's cosmetics business, this move will enable Kao to stay closer to Chinese consumers and keep up with the market trends.

4. La Mer has opened its largest global duty-free store in CDF Haikou International Duty-Free Shopping Complex, featuring a Spa de La Mer facial care room. The store also unveiled the latest Moisturizing Soft Cream.

5. Lancaster, a high-end skincare brand under Coty Group, has opened its first global store in Hangzhou Wulin Intime Department Store, offering offline luxury skincare experiences. In recent years, the brand has been expanding its presence in China, with four duty-free stores opened in Hainan since 2021 and pop-up stores conducted in many cities. Lancaster has also launched official flagship stores on Tmall and Douyin. Yuqing Mi, Coty China's general manager of skincare, said that after the successful launch in Hangzhou, Lancaster would further extend its footprint in other cities such as Nanjing, Chongqing, Beijing, etc.

6. LVMH Beauty has opened its Asian Research & Development center in the Pudong New Area of Shanghai, making it the first high-end beauty R&D center in Pudong’s Group Open Innovation plan ( this plan aims to establish over 100 open innovation centers of leading enterprises within three years). The center will conduct extensive research on Chinese consumers' skin characteristics, and also pay close attention to the latest developments in the digital and AI field. Leveraging multidisciplinary expertise, it aims to develop targeted skincare and beauty products that cater to the needs of Chinese consumers.

7. Bloomage Biotech launched the "Refresh Male Functional Skincare Lab" in Shanghai, making it the first professional male skincare research lab established by a Chinese beauty enterprise. According to Euromonitor, the size of China’s male skincare market was 14 billion yuan in 2022, only 5.7% of the female skincare market. Refresh, the male skincare brand under Bloomage Biotech, highlighted the distinctive features of this market and emphasized that marketing and product strategies of female products cannot be identically applied to male skincare products.

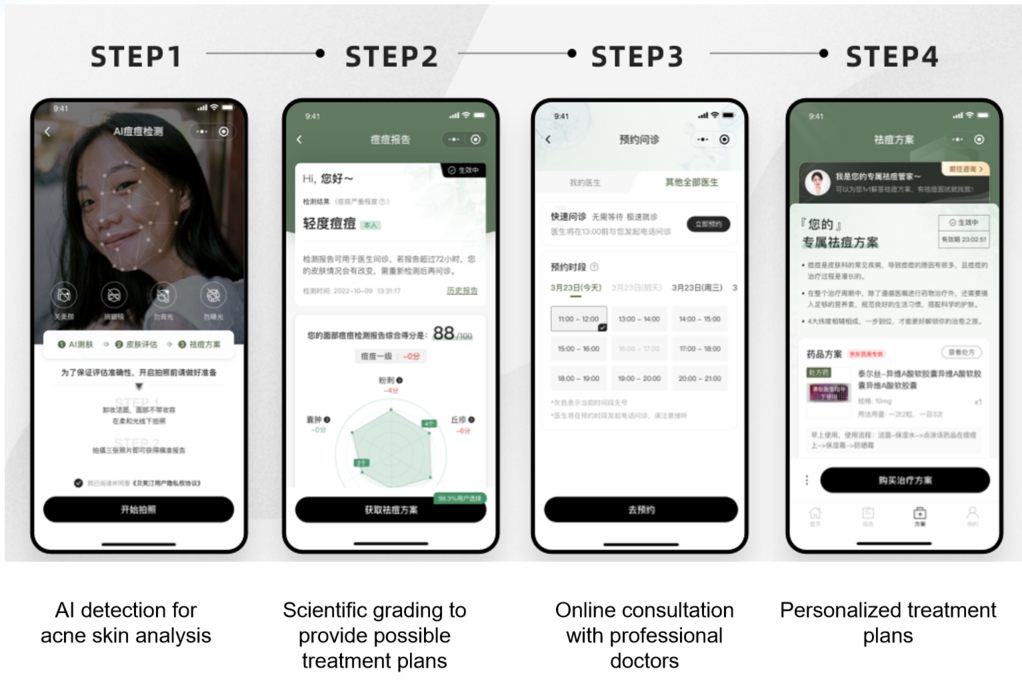

8. In its 2022 financial result, Botanee unveiled its brand Beifuting, a personalized acne treatment brand focusing on top medical research and AI-based precision diagnosis. Beifuting has collaborated with authoritative medical experts and an AI team to develop an AI skin diagnostic model tailored for Chinese acne-prone skin based on skin images and text data from 14 top-tier hospitals in nine provinces.

9. Skigin, another flagship brand beyond Confime and Collgene under Giant Biogene, held its 2023 brand launch in Shanghai. Thanks to Giant Biogene's breakthrough in the entire industry chain of rare ginsenosides, Skigin has entered the cosmetics, food, and health product markets with its exclusive material group "Bio-Gins," which contains a variety of highly active rare ginsenosides such as Rk3, Rh4, CK, etc., offering anti-aging solutions with both internal and external nourishment.

10. Dencare Co., Ltd., the parent company of the toothpaste brand Lengsuanling, has made its debut on the Shanghai Stock Exchange. According to Nelson, in 2021, Dencare's toothpaste products held a share of 6.83% in the offline toothpaste market, ranking fourth in the industry. From 2019 to 2021, its flagship brand Lengsuanling dominated the anti-tooth-sensitivity segment with a remarkable share of 60%.

E-Commerce & Social commerce

1. According to MKTIndex, in Q1 2023, the sales and volume of skincare products on Ali platforms dropped by 10.41% and 7.37% YoY, respectively. The makeup category saw an even more significant decrease, with sales and volume down by 18.05% and 13.42% YoY, respectively. However, Douyin presented a contrasting picture. Skincare product sales on Douyin skyrocketed by 67.2% YoY, with volume up by 85.9%. The makeup category also performed exceptionally well, with sales and volume surging by 87.1% and 86.1%, respectively.

2. At the 2023 Tmall Beauty Awards Summit, Tmall Beauty updated three key strategies for the year:

(1) Boosting the Super New Product Strategy to provide brands with predictable growth. Tmall Beauty plans to collaborate with brands to develop 30 products with over 1 billion yuan in sales, 500 products with over 10 million yuan in sales, and nurture 15,000 high-quality new products with a clear growth trajectory.

(2) Pioneering a technology-driven beauty trend, working with brands to encourage consumers to develop a more realistic understanding of the industry instead of only focusing on ingredients.

(3) Enhancing the content ecosystem to assist merchants in improving their retention and conversion rates in private domains.

3. JD Worldwide has unveiled its new strategy for 2023, aiming to assist foreign businesses in efficiently entering the Chinese market through a full-service approach, especially by its leveraging its expertise in smart supply chain management. Moreover, the platform is continuously lowering the entry threshold to reduce the cost of opening a store. A case in point is the "Spring Dawn Plan," which aims to facilitate quick entry and lower the entry barrier, thereby alleviating the cost burden for merchants.

4. In 2022, WeChat Channels saw significant growth with a 400% increase in views, a 308% YoY rise in creators with over 10,000 followers, and an 800% surge in GMV. Integrated with other WeChat ecosystems like Official Accounts, Mini Programs, WeChat Work, and WeChat Pay, the WeChat Channels has become a valuable traffic source for brands, enabling them to build a closed-loop traffic system. Its three operational strategies—live streaming, short videos, and content—are effectively driving traffic and engagement in public and private domains, presenting a new growth opportunity for beauty brands.

Financial Results

Beauty Enterprises' Financial Results in Q1 2023 | |||

International Enterprises | |||

Enterprise (division) | Revenue | YoY Growth | Notes |

L'Oréal | 78.30 billion yuan | 13.00% | 1. The consumer products division overtook the luxe division with a revenue of 28.83 billion, a YoY growth of 14.7%. All global brands under the division achieved double-digit growth. |

Unilever (beauty & wellbeing / personal care) | 23.68 / 25.98 billion yuan | 13.30%/12.60% | The basic sales growth in the Chinese market has rebounded to 1.8% thanks to the lifting of pandemic control policies. |

P&G (beauty/grooming) | 24.07/10.30 billion yuan | 3.00%/1.00% | 1. The sales growth driven by price increases and innovation was partly offset by the sales decline of SK-II in the travel retail channel. |

Beiersdorf (consumer) | 16.02 billion yuan | 14.80% | 1. Nivea's Q1 sales saw organic growth of 18% YoY, with products in China gradually becoming more high-end. |

LVMH (perfume & cosmetics) | 16.02 billion yuan | 11.00% | 1. Perfume & cosmetics business growth was driven by brands like Christian Dior, Guerlain, and Fenty Beauty.

|

Chinese Enterprises | |||

Shanghai Jahwa | 1.98 billion yuan | -6.49% | Q1 net profit reached 230 million yuan, a YoY increase of 15.59%, marking the highest value in 16 quarters. This was mainly due to reduced marketing expenses in the first quarter. |

Proya | 1.62 billion yuan | 29.27% | In 2022, the enterprise's revenue reached 6.39 billion yuan, a YoY increase of 37.82%. The revenue of the signature brand Proya was 5.26 billion yuan. |

Bloomage Biotech | 1.31 billion yuan | 4.01% | In 2022, the company's revenue was 6.36 billion yuan, a YoY increase of 28.53%. Its signature brands BIOHYALUX and QUADHA had revenues of 1.39 and 1.37 billion yuan, respectively. |

Botanee | 0.86 billion yuan | 6.78% | In 2022, the enterprise's revenue reached 5.01 billion yuan, a YoY increase of 24.65%. The revenue of its signature brand Winona was 4.89 billion yuan. |

Regulatory Compliance

1. On April 4, China National Medical Products Administration (NMPA) issued the finalized Supervision and Administration Measures on Online Operation of Cosmetics (Measures) and would implement it on September 1, 2023. The Measures clarifies the regulatory objects and authorities of cosmetics online operation, the management responsibilities of cosmetics e-commerce platforms, and the obligations of cosmetic operators on the e-commerce platforms. More details on Chemlinked.

2. On April 12, China NMPA issued Guidelines for Review of Registration of Radio Frequency Beauty Devices to assist relevant enterprises in preparing registration application documents, and the technical review department under the supervision authority in reviewing documents. More details on Chemlinked.