Contents

Market Condition

Impressive Events

Company Dynamics

E-commerce & Social Commerce News

Regulatory Compliance

Market Condition

Market Condition

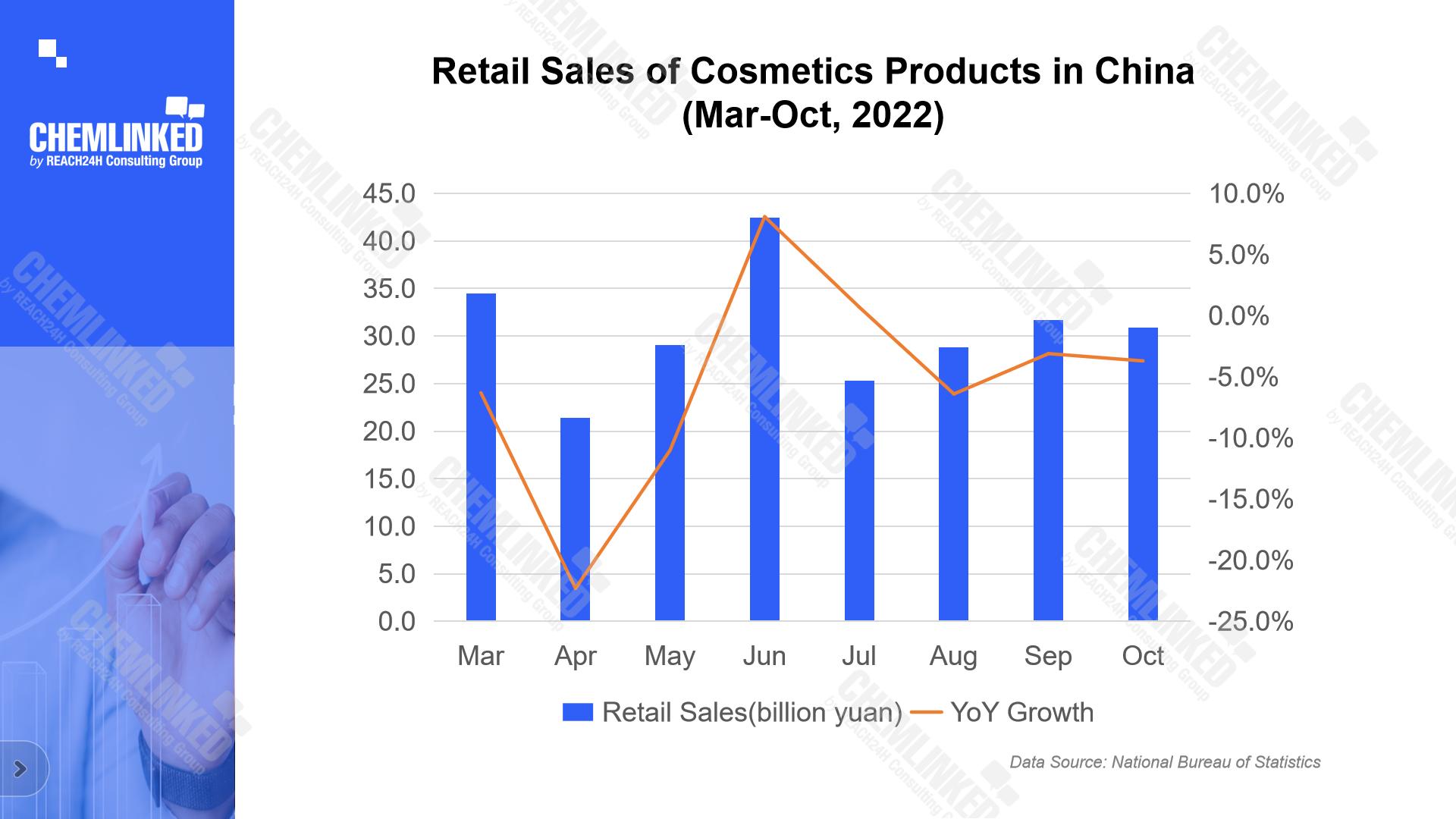

1. According to the National Bureau of Statistics, in October, China's retail sales of cosmetics reached 30.9 billion yuan, declining by 3.7% on a year-on-year (YoY) basis. The total retail sales of cosmetics from January to October 2022 dropped by 2.8% YoY to 308.4 billion yuan.

2. According to the General Administration of Customs of China, in October, China's import value of cosmetics and toiletries was 15.04 billion yuan, a YoY growth of 1.42%. The total import value of cosmetics and toiletries from January to October was 126.08 billion yuan, down 5.2 % YoY.

3. As per incomplete statistics of IPO in China's beauty industry, enterprises most preferred by capital all have functional skincare related business. Leading enterprises with medical cosmetology, such as Giant Biogene and Imeik, are the most sought after by the capital because their functional skincare products with high technological barriers cannot be substituted easily. In addition to beauty brand enterprises, upstream suppliers, such as OEM company Bawei Co. (supplier of Unilever, Marubi, Lafang Jahwa, etc.) and packaging materials company Zhongrong Co. (supplier of P&G, etc.), are also developing rapidly and have received recognition.

4. During this year's Double 11 Shopping Festival, instant retail platforms represented by Meituan Shangou became a new growth opportunity for offline beauty merchants. In fact, after the COVID-19 outbreak, offline retail stores such as Watsons, Sephora, and Colorist, as well as some brand stores, have entered Meituan Shangou and achieved significant results. Based on transactions and consumer experience, instant retail platforms have become a highly potential retail channel that should be noticed.

5. The "2022 Oriental Beauty Valley Blue Book" shows that the beauty consumption of the silver-haired group has seen an upward trend, with skincare sets and makeup sales increasing significantly. According to the National Bureau of Statistics, the number of elderly people aged 60 and above will exceed 300 million during the period of "14th Five-Year Plan", accounting for more than 20% of the total population. As the beauty awareness of the new generation of elderly has been greatly raised, the silver economy foresees great prospects in China's beauty market.

6. Twelve well-known German enterprises, including BASF, Wacker Chemie Group, Bayer, and Merck, accompanied German Chancellor Olaf Scholz on his official visit to China. The visit will positively impact China's chemical, pharmaceutical and cosmetic industries.

Impressive Events

From Nov 5th to 10th, the Fifth China International Import Expo was held at Shanghai National Convention Center with exhibitors from 145 countries, regions and international organizations. Among all exhibitors, 284 were Fortune 500 enterprises. Global beauty giants, including L'Oréal, Estée Lauder, Coty, Shiseido, P&G, Kose, Unilever, Amorepacific, Kao, Albion, etc., brought their brand matrices and new products to this exhibition.

This exhibition reveals some trends in the Chinese beauty market:

Technological innovation empowers the future of beauty. L'Oréal, Estée Lauder, and Shiseido exhibited their high-tech outcomes, including YSL SCENT-SATION, Lancôme Skin Screen device, and AI-based "digital skin", reflecting the deep integration of technology and beauty.

Customized cosmetics is catching more attention from beauty giants such as Shiseido and Amorepacific.

The Chinese male personal care market is highly anticipated. For example, Shiseido's SIDEKICK and Unilever's PROUDMEN are highlighted this year.

Company Dynamics

1. Shiseido announced a new growth plan for the Chinese market in the group's 150th-anniversary celebration in Shanghai. China CEO Kentaro Fujiwara (who will be promoted to the group's president and CEO on Jan 1st, 2023) said that Shiseido Group would continue to build the world's second-largest R&D center in China, deepen its skin research on Chinese consumers, and incubate local innovations on medical beauty and beauty supplements. In addition, Kentaro Fujiwara indicated that the Shiseido Beauty Innovations Fund was set at one billion yuan with focuses on China's emerging cosmetics, wellness, and related technology enterprises. Shiseido would combine the values of itself and emerging companies to enhance its business portfolio in China to meet the diversifying consumer needs.

2. Atelier Cologne, the niche French fragrance brand, revamped its positioning with a focus on the Asia-Pacific region in the short to medium term. Atelier Cologne first withdrew from the North American market at the beginning of 2022 and has been doing the same in Europe for a few months. With a fast-growing fragrance market, China has become a strategic choice for Atelier Cologne. Philippine Lesieur, marketing director of Atelier Cologne, indicated that in recent years Atelier Cologne grew considerably in Asia, mainly in China.

3. Amorepacific has reached a cooperation with Tmall Global to introduce new beauty and personal care products through cross-border e-commerce, including the scalp care brand LABO-H, anti-hair loss shampoo brand ROOT: GEN, etc. According to An Shihong, president of Amorepacific, more than 30 brands under Amorepacific are currently sold in the Chinese market through Tmall. More brands will be introduced to better cater to Chinese consumers' needs.

4. The Laundress, a famous luxury laundry detergent and cleaning product brand under Unilever, issued two voluntary recalls of about 6 million units of products in China due to potential bacterial contamination. Although Unilever released the Chinese market solution, consumers encountered obstacles in the refund process, including inability to get in touch with after-sales service, inability to get refunds without returning product packages while transaction orders were sufficient for reimbursements in overseas market. Consumers expressed disappointment on both The Laundress products and service.

5. Luxury skincare tool brand Dr. Arrivo was fined 1.5 million yuan in the Chinese market due to quality problems of its product Dr. Arrivo24K (concerning three inspection items: logo and description, structure, heat resistance and flame resistance). Previously, Dr. Arrivo was questioned because of its unqualified heat and flame resistance.

6. Giant Biogene Holdings Co., Ltd., a Chinese enterprise focusing on the R&D of recombinant collagen and other bioactive ingredient-based professional skin treatment product, was listed on the main board of the Hong Kong Stock Exchange under the ticker symbol 2367. HK. As the first listed Chinese recombinant collagen enterprise, Giant Biogene is one of the leaders in the booming collagen skincare industry, with flagship brands including Kefumei, and Collgene.

7. Cheermore, the parent company of ZHIBEN—an emerging Chinese skincare brand, launched a new makeup brand YIFINITE. YIFINITE's flagship store on Tmall was opened on Dec 1st, and has attracted attracted over 40 thousand followers during the warm-up stage. According to YIFINITE, four product categories, including cushion foundation, lip clay, lip gloss, and eyeshadow will be put on sale on Jan 1st, 2023.

8. HARMAY, a trendy specialty beauty retail store in China, launched "The Black Market"—a room-escaping-themed sales event in Shanghai. The dark and slightly scary design style and room escaping scenes made "The Black Market" a photogenic place. A large number of consumers were attracted to the store on the launching day, and posted their pictures and videos on social platforms such as Douyin and Xiaohongshu. Through scene innovation which greatly improves consumers' shopping experience, HARMAY creatively empowers offline sales.

E-commerce and Social Commerce News

1. Double 11 Shopping Festival

This year, for the first time, China's E-commerce platforms didn't officially release their GMVs during the Double 11 Shopping Festival. According to third-party data sources, the total GMV of all e-commerce platforms was 1,115.4 billion yuan, including 934 billion yuan on comprehensive e-commerce platforms, 181.4 billion yuan on live streaming e-commerce platforms, and the rest on new retail platforms and community group buying Platforms. By category, the total GMV of beauty & care reached 82.2 billion, ranking 4th in the TOP 10 category list.

According to Tmall Beauty, 75 brands achieved more than 100 million turnovers, among which 9 exceeded 1 billion and 3 exceeded 2 billion.

Top 5 Beauty & Care Brands: L'Oréal, Estée Lauder, Lancôme, Olay, Proya

Top 5 Fragrance Brands: Jo Malone, BEAST, Tom Ford, YSL, Armani

Top 5 Male Care Brands: L'Oréal Men, Gillette, Biotherm Homme, Lab Series, Kiehl's

(Download the complete Double 11 report for free)

2. Oct 2022 MAT Online Beauty Sales (Nov 2021-Oct 2022)

According to Nint, from Nov 2021 to Oct 2022, the total sales of beauty products on Tmall and JD.com was 212.2 billion yuan and 43.9 billion yuan, respectively. Although the total sales declined, top brands still performed noticeably well.

In Tmall's TOP20 beauty brands list, sales of OLAY, Shiseido, Helena Rubinstein (HR), Clarins, La Roche-Posay, and Guerlain grew by 19.97%, 15.42%, 31.17%, 20.19%, 23.9%, and 37.47% respectively. Chinese brands Proya and Winona achieved sales growth of 63.54% and 38.51%, respectively.

In JD's TOP20 beauty brands list, sales of SK-II, Lancôme, La Mer, HR, Clarins, and Cetaphil increased by 11.16%, 43.39%, 54.83%, 100.29%, 21.48%, and 42.76%, respectively. Chinese brands Proya and Winona achieved sales growth of 40.15% and 39.38%, respectively.

3. Douyin has become a new growth channel for P&G. The GMV of Olay, a brand under P&G, on Douyin increased by 460% YoY during the Double 11 Shopping Festival. This remarkable growth was attributed to Olay's marketing strategy of winning consumer trust through popularization of cosmetic ingredients and efficacy as well as concepts of scientific skincare.

Regulation Compliance

1. On Nov 10th, China National Medical Products Administration (NMPA) issued an announcement deciding to carry out a one-year pilot project of personalized cosmetic service in Beijing, Shanghai, Zhejiang, Shandong and Guangdong. The pilot project aims to explore feasible models and effective regulatory measures for cosmetics personalized services and to form replicable experiences and practices. More details on ChemLinked.

2. On Nov 14th, NMPA announced the Administrative Classifications of Medical Sodium Hyaluronate Products with immediate effect. In accordance with the new classification rules, cosmetics containing Sodium Hyaluronate should not be administered as drugs or medical devices. Besides, such cosmetics shall not claim medical effects. More details on ChemLinked.

3. On Nov 23rd, NMPA released a new cosmetics supplementary testing method, BJH 202203 Determination of 16alpha-hydroxyprednisolone in Cosmetics, which specifies the qualitative and quantitative determination method of the prohibited ingredient 16alpha-hydroxyprednisolone. It is applicable for determining 16alpha-hydroxyprednisolone in cream, lotion, and liquid (water) cosmetics. More details on ChemLinked.

4. On Nov 24th, the State Council issued an official reply which approved the establishment of 33 new cross-border e-commerce (CBEC) comprehensive pilot zones. The provincial-level governments are responsible for rolling out detailed plans. This is the 7th expansion since the establishment of the first pilot zone in Hangzhou in 2015. With this expansion, there will be a total of 165 CBEC comprehensive pilot zones in China.