Contents

Market Condition

Company Dynamics

Interesting & Noteworthy New Products

Regulatory Updates

Market Condition

1. Based on the Chinese Dairy Industry Quality Report 2022, the annual production of Chinese dairy industry reached 37.78 million tons in 2021, with a 7% year-on-year growth rate. The average raw milk purchase price was 4.29 yuan per kilogram, which peaked at a historic high. Meanwhile, the total revenue of the scaled dairy company (whose annal income is over 20 million yuan) reached 468.7 billion yuan, with a year-on-year growth rate of 11.7%.

2. Thirteen food companies were listed in the "2022 Top 500 Chinese Enterprises" released on September 6. Among them, eight food companies reached over 100 billion operating income. China Resources Group firmly ranked the first in the food industry with a revenue of 777.77 billion yuan. China National Cereals, Oils and Foodstuffs Corporation (COFCO) and New Hope Group ranked the second and the third, with 664.94 billion yuan and 252.65 billion yuan, respectively.

3. This month, the Certification and Accreditation Administration of the P.R.C (CNCA) disclosed the recent data on China's organic food market. The total sales value of organic products in 2021 was 95.16 billion yuan, 9% of the total sales value (8.86 billion yuan) is from imported products, with 6.56 billion yuan organic infant formula, 0.52 billion yuan skimmed milk powder, and 0.48 billion yuan sterilized milk.

4. In 2021, the top 5 countries with the highest organic product sales in China were Ireland (3.5 billion yuan), the Netherlands (1.9 billion yuan), Denmark (0.7 billion yuan), Finland (0.5 billion yuan) and New Zealand (0.3 billion yuan).

5. According to 2022H1 financial reports of 95 companies listed in China, 69 companies reported positive growth of operating income. The over-300-billion-yuan market was divided by 14 multi-billion companies. Among them, Yili, Master Kong and Menniu are the top three in the food industry, whose operation income reached 63.4 billion yuan, 47.7 billion yuan and 38.2 billion yuan, respectively. From the perspective of net profit, only 50% of food companies reported positive growth. Yili became the most profitable company in the food industry by virtue of 6.14 billion yuan net profit, with a 15.23% year-on-year growth. Besides, NongFu Spring and Mengniu Dairy reached 4.61 billion yuan and 37.51 billion yuan, ranking the second and the third.

6. During the "2022 China Cheese Development Summit Forum", China Dairy Association released the "Three-year Plan for Cheese Innovation and Development (2023-2025)". The plan indicated that China's cheese market was keeping a rapid growth trend, and cheese was becoming a new focus of the dairy industry. In addition, the plan set forth the overall goal of the nationwide cheese production of 500,000 tons and the cheese retail market size of over 30 billion yuan by 2025.

Company Dynamics

1. Ausnutria disclosed three framework agreements with Yili Industrial, whose major concerns were providing processing services in the production of milk powder (excluding infant formula) for Yili, and purchasing milk base powder and related ingredients from Yili. Yili agreed to buy goat milk powder from Ausnutria. The statement claimed three agreements came into force on September 23, 2022.

2. McDonald's opened its first "zero carbon" restaurant in Beijing. The restaurant is designed and constructed in line with Leadership in Energy and Environmental Design (LEED)’s net zero carbon and net zero energy certification standards.

3. %Arabica, a well-known Japanese chain operation coffee company, started its online e-commerce via Tmall on September 2, 2022. Multiple flavours of coffee beans and peripheral merchandise are available online.

%Arabica Peripheral Merchandise

%Arabica Peripheral Merchandise

4. PanTheryx announced its three major nutrition brands, Trubiotics, Life's First Naturals and DiaResQ, entering the Chinese nutritional supplement market through Tmall Global. Cross-Border E-Commerce (CBEC) can help PanTheryx avoid the time-consuming registration process.

5. Chobani, the first seller of Greek yoghurt in the U.S., launched "FlavorSome Exquisite Store" on Little Red Book. The limited edition of Chobani’s Greek fermented yoghurt pots was available online with four flavours. The manufacturer suggested retail price (MSRP) for four-cups of 170 grams was 144 yuan due to the high cost of air transportation. Notes: Little Red Book is a popular content-creating social media platform in China with more than 200 million active users posting their reviews. Red also provide online shopping service.

Chobani Limited Edition

Chobani Limited Edition

6. According to the prospectus officially pre-disclosed by China Securities Regulatory Commission, Mixue Ice City was trying to get listed on China's A-share market. The statement indicated Mixue Ice City has 22,276 stores, with 10.3 billion yuan in revenue in 2021. The yearly net profit was 1.91 billion yuan, with 203.09% year-on-year growth. In comparison, Nayuki, another listed tea beverage company, reported revenue and adjusted net profit of 2.045 billion yuan and -249 million yuan in 2022H1, respectively.

Interesting & Noteworthy New Products

1. Oatly has recently launched raw-coconut-flavoured oat milk with imported coconut milk. The MSRP is 95 yuan per 200ml 12-pack.

Oatly Raw Coconut Flavoured Milk

Oatly Raw Coconut Flavoured Milk

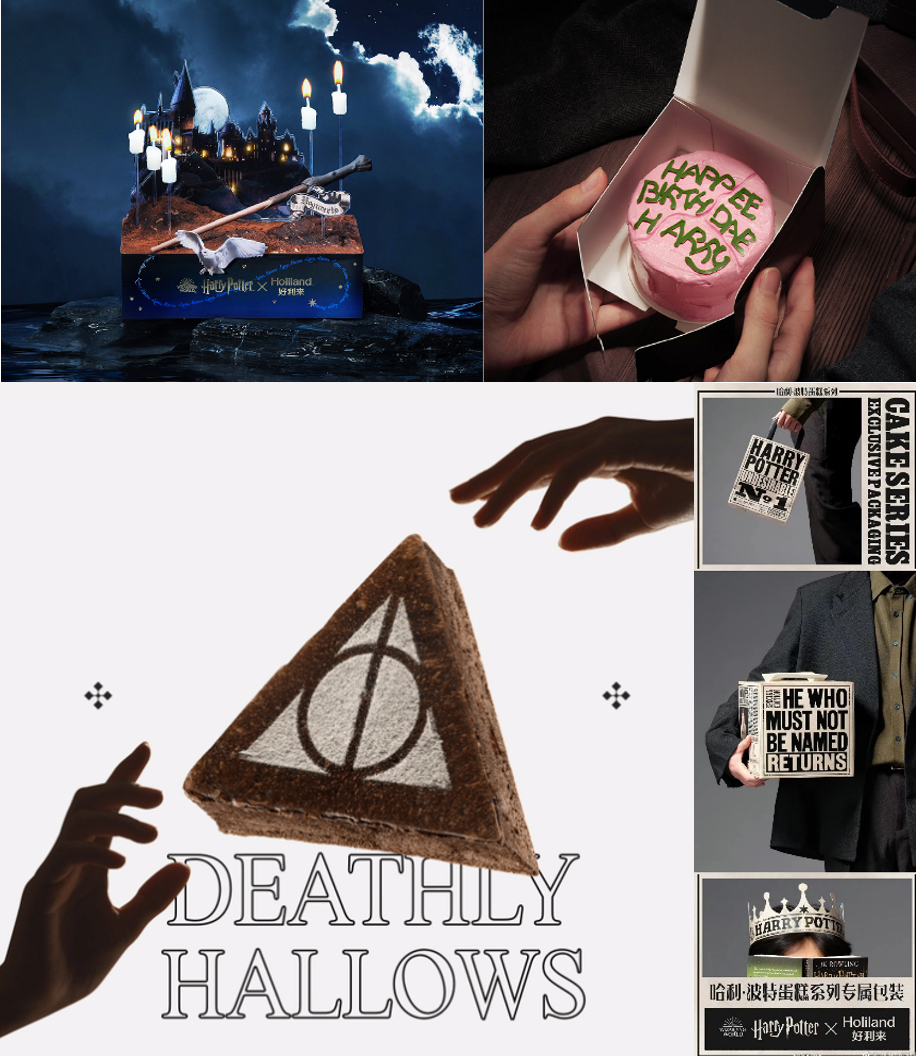

2. Chinese bakery brand Holiland and Harry Potter franchise released the new AW22 series, which contains Daily Prophet, Hogwarts Castle, Hagrid's Cake and the Deathly Hallows. Previously, Holiland and Harry Potter had launched two kinds of mooncake sets in July.

Holiland X Harry Potter AW22 Series

3. Blueglass Yogurt launched a new low G.I. oat yoghurt for meal replacement. As more and more people focus on health, food with low G.I. attracts lots of attention.

Blueglass Low G.I Yoghurt

4. On September 6, Wplus+, a subsidiary of Bloomage Biotechnology Corporation, launched a sodium hyaluronic acid collagen peptide composite drink. The drink is another “high-technology” drink after the launch of Wplus+’s sodium hyaluronate solid coffee drink. Bloomage is currently the world's largest supplier of hyaluronic acid, with its hyaluronic acid beauty brands rapidly rising in the Chinese skincare market in recent years.

Wplus+ Composite Drink

Wplus+ Composite Drink

5. After Sam's Clubs released the "mini lime" lemonade beverage on September 2021, it became a new market trend chased by younger generations. Recently, Yonghui Superstores' leisure snacks brand Chandashi released a mini lime-like beverage, whose sales exceeded 100,000 bottles within the first week.

Chandashi Mini Lime-like Beverage

Chandashi Mini Lime-like Beverage

6. McCafe's latte series was no longer available in China, whose successor is milk latte. The new milk latte became the successor, which offers four combinations: milk, oat milk, thick coconut milk and thick milk. Because of the oat milk trend on the market, the new series took its niche position. In addition, different from traditional latte products, the new series changed the selection of coffee beans, the extraction method and the milk ratio.

McCafe Milk Latte

McCafe Milk Latte

7. Danone has launched three healthy ageing nutritional products in China via online channels Tmall and Douyin the Chinese version of TikTok. Sold under the name "Ganmai" (敢迈), which means daring to take a step out, the product line "advocates the spirit of taking challenge and accepting new things", according to Danone. The new products were designed to address the most prevalent ageing-related problems among Chinese consumers aged 40 and above.

Ganmai Series Milk Powder For Aged People

Ganmai Series Milk Powder For Aged People

8. Recently, Coca-Cola's high-end pure water Smartwater entered the Chinese market and was the first to land in Sam's Clubs. The product was named "Simant packaged drinking water", with the same blue packaging style and straight bottle design. The MSRP is 80 yuan for 24 packs.

Coce-Cola's Smartwater

Coce-Cola's Smartwater

Regulatory Compliance

1. On September 2, 2022, the Standing Committee of the National People's Congress officially promulgated the new version of the Quality and Safety Law of Agricultural Products, which will come into effect on January 1, 2023. As the cardinal law of agricultural products in China, the Quality and Safety Law of Agricultural Products was developed to regulate the risk management and standard development of the quality and safety of agricultural products, the place of origin, production and sale of agricultural products, as well as stakeholder's legal responsibilities. More details on ChemLinked.

2. On September 7, 2022, China National Health Commission (NHC) approved the use of three new food additives, four new food-related products. Two colorants, namely, Tomato red and Carmine cochineal, were permitted to be used in more food categories now. More details on ChemLinked.

3. On September 8, 2022, China's State Council released a notice, announcing to further strengthen the governance of excessive packages for commodities. The notice pointed out that departments shall clarify and detail the requirements to manage excessive packaging through the whole supply chain, covering production, sales, delivery and recycling stages. Commodities like health food, edible agricultural foods, takeaway food, and express parcels are underlined. More details on ChemLinked.

4. On September 8, 2022, the latest G.B. standard drafts of food additives were opened for public comments. Six newly established standards, nine newly revised standards, and three amendment sheets were involved. More details on ChemLined.

5. On September 8, 2022, NHC opened the proposed draft of GB 2760-2014 Standard for Uses of Food Additives for public comments, along with the drafts of other 17 G.B. standards regarding food additives. Any comments can be submitted until October 10, 2022 via the National Food Safety Standards Information System. More details on ChemLinked.

6. NHC started to respond to proposals of great concern in food industry raised in the “Two Sessions”. The proposals covered new food raw materials, raw materials catalogue of health food, China's probiotics industry, and the health function of camellia oil. More details on ChemLinked.