General Data

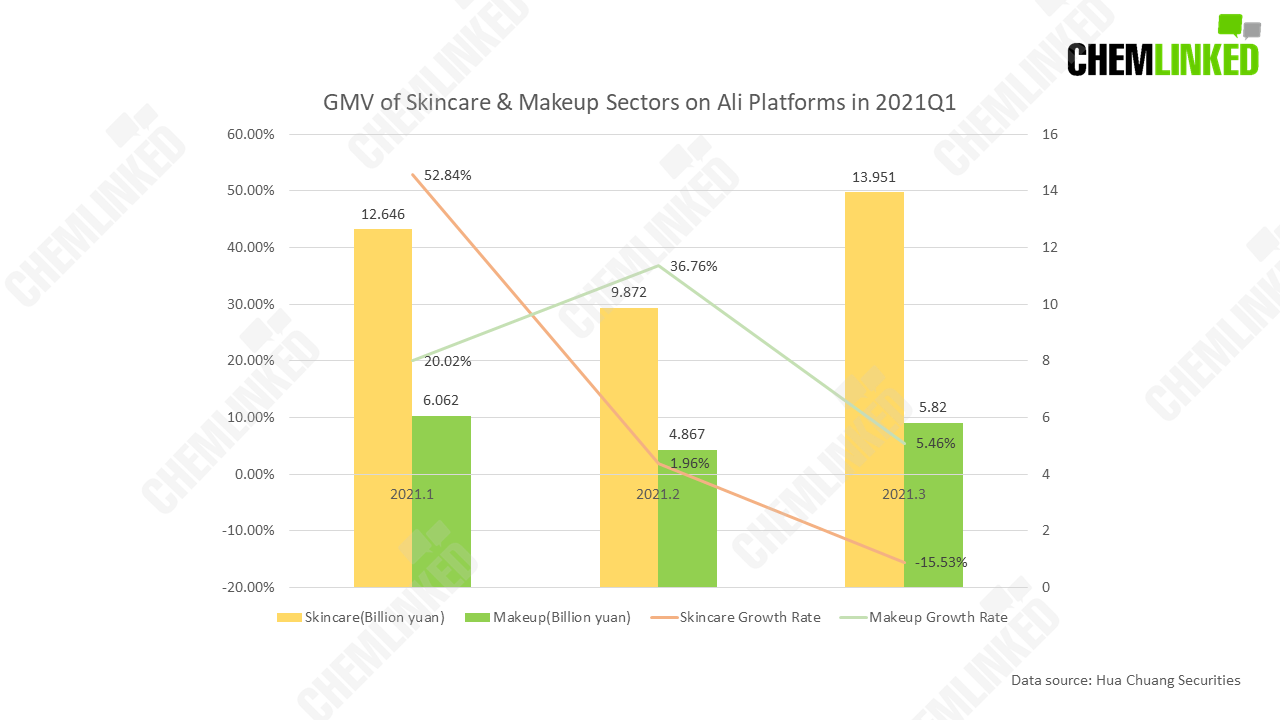

In 2021Q1, the online sales of the skincare and makeup sectors recorded an increasing trend. The skincare sector’s gross merchandise value (normally abbreviated as GMV) was about twice of the makeup sector’s GMV.

The skincare sector ‘s YoY growth rate in January was pretty high, reaching 52.84%, but dropped in the next following two months mainly because of the outstanding sales performance this sector achieved last year. In 2020, affected by the quarantine, many consumers turn to online channels to buy skincare products, making the online sales of the skincare sector higher than usual. The big promotion for international women’s day in March was the first promotion season after the pandemic, which again propelled consumers’ enthusiasm.

The makeup sector showed similar growth rates in January and March to the skincare sector for similar reasons. However, unlike the skincare sector, it had a good growth rate in February because the consumption for makeup products was depressed in 2020. During the nationwide home quarantine, people only needed skincare products but not makeup products.

Brand Performance

Among domestic brands, new brands performed well. Florasis ranked the first for three consecutive months, with a GMV of 285 million yuan, 288 million yuan, and 277 million yuan, respectively. The monthly growth rates were almost all over 50%, with a peak in February at 89.33%. Perfect Diary’s monthly GMV also maintained at 200+ million yuan, but its growth rates dropped in this period. The growth rate fell by 33.93% in March, mainly because its new products’ performance this year was inferior to that of last year.

As for traditional domestic brands, only Proya caught up with other brands. Its GMV maintained at 100 million yuan, and its growth rates were about 100%. Although the GMVs of other traditional brands, such as Pechoin and MARUBI, weren’t low, their low growth rates implied their potential risks.

Functional skincare brands continued their popularity, and their performance was outstanding in the first quarter of this year. BIOHYALUX and BioMESO from Bloomage Biotech, the hyaluronic acid giant in China, achieved substantial year-on-year growth from January to March. BIOHYALUX's GMV from January to March was 42 million yuan, 28 million yuan, and 80 million yuan, respectively, representing a year-on-year increase of 368.31%, 228.60%, and 134.56%, far ahead of other brands’ growth rate. The year-on-year growth rate of BioMESO's GMV in January was as high as 1256.88%, another surprising figure. Winona and Dr. Yu also performed well. In January, Winona’s GMV was 77 million yuan, a year-on-year increase of 103.9%, and Dr. Yu’s GMV was 76 million yuan, a year-on-year increase of 144.53%. In contrast, Home Facial Pro (normally abbreviated as HFP), the former superstar in the field, showed an obvious decline in Q1.

Big international brands were still powerful players in Q1. The monthly average GMV of brands such as Estee Lauder, L'Oreal, and Lancome, are all at 200+ million yuan level. Among them, L'Oréal's GMV even reached 315 million yuan in March.

Reasons for Growth

Relying on top live streamers

For top beauty brands, live-streaming is still one of the most effective methods to improve sales, especially with the help of top live streamers.

In the first quarter of this year, both domestic brands such as Dr. Yu and Winona, and international brands such as OLAY, Estee Lauder, and L'Oreal, have frequently appeared in the Austin Li’s and Viya’ (both are top live-streamers on Taobao) live-streaming.

For example, Florasis and BioMESO entered Austin Li’s and Viya’s live-streaming respectively on February 24. As a result, Florasis's GMV reached 19.67 million on that day. BioMESO’s accumulated GMV reached 9.77 million from 24th to 26th.

Taking advantage of the marketing season

In the first quarter, many brands seized the "38 Queen's Day" (marketing name of International Women’s Day) promotion season to achieve a surge in GMV.

For example, during the big promotion, the GMV of OLAY, Winona, and L’Oreal all reached a small peak by providing promotion discounts on International Women’s Day. Also, this year's Tmall Queen's Day was divided into three time periods. The first started from February, so some brands started their marketing campaigns at the end of February. Therefore, some brands such as BIOHYALUX, Estee Lauder, and L'Oreal showed great growth rates in February.