Health Food

Graph 1

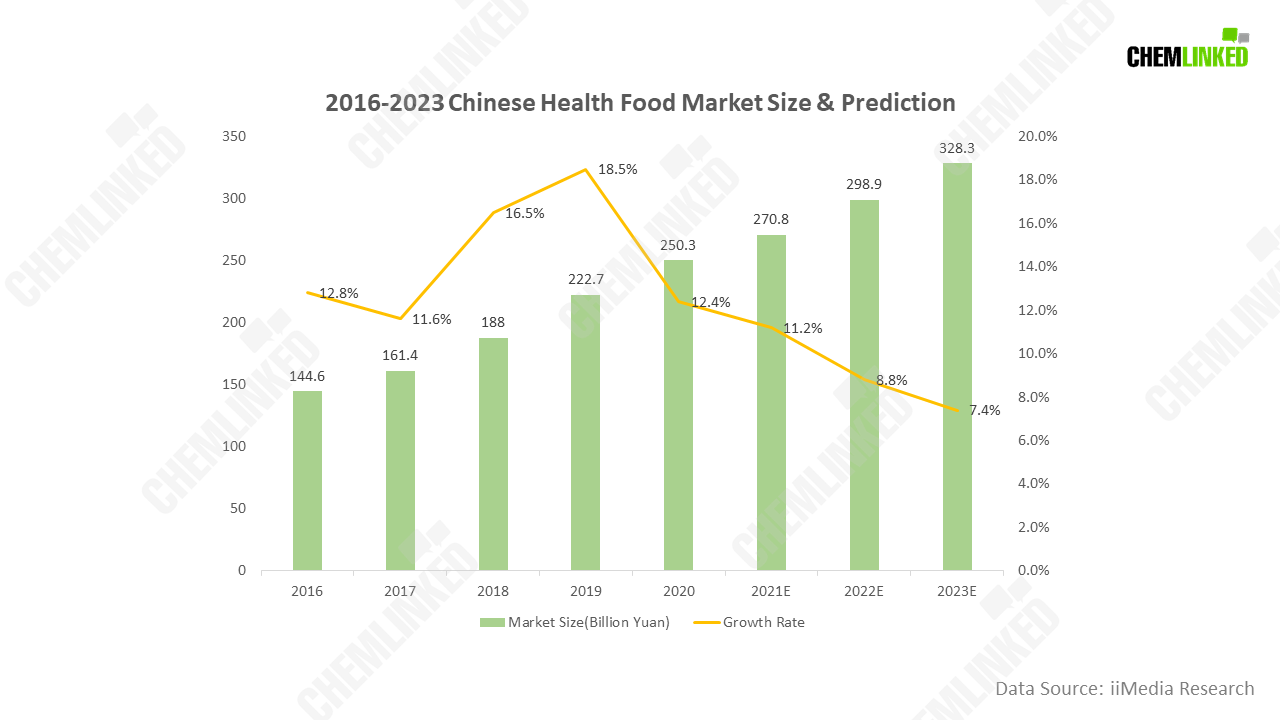

Chinese health food market size reached 250.3 billion yuan in 2020 and is expected to reach 328.3 billion yuan in 2023. However, its growth rate is predicted to be slowing down, implying that the competition is becoming more severe.

Graph 2

Overseas players still have their competitive advantages in this market. Graph2 shows that China is importing more health food from overseas as the imported amount of health food has rapidly increased in recent years. In 2020, China imported a total of 4.81 billion U.S. dollars of nutritional and health food, an increase of 23.9% year-on-year, while exports reaching 2.18 billion U.S. dollars, an increase of 11% year-on-year. Most imported products are from the U.S., Australia, and Canada.

The Chinese health food market now mainly have three kinds of products worthy of attention:

Products based on traditional Chinese medicine theory and using Chinese herbs as ingredients;

Nutritional supplements based on nutritional theory and using various nutrients as ingredients;

Biotransformed products.

Infant Formula

Graph 3

With a large population, China always has a high demand for infant formula. From 2016, the Chinese infant formula market size kept increasing, reaching 295.5 billion yuan in 2020. In the meantime, the whole market kept a high growth rate, about 15% every year.

Because of domestic infant formula security problems in the past, Chinese consumers prefer overseas infant formula brands. In 2018-2019, the most highly recognized brands in the Chinese infant formula market were imported brands, of which Abbott, Nestlé, and Mead Johnson ranked in the top three, respectively. The domestic milk powder brand Feihe ranked the fourth.

Graph 4

As for countries, Netherlands, New Zealand, Ireland, France, and Denmark are the top5 countries in the imported infant formula market.

However, there are still challenges for international players. First, though Chinese domestic infant formula brands have a bad reputation in the past, now they have been making efforts on quality to win consumers back. Some of them have achieved great results, proven by the rising market share of domestic brands has been rising since 2016. (See below).

Graph 5

In the meantime, the Chinese government also showed its support to local brands. In 2019, the Chinese government proposed that the self-sufficiency level of infant formula should maintain over 60%.

The pandemic also affected international infant formula’s import volume. From 2012 to 2019, the infant formula imported from overseas rose from 91,500 tons to 345,500 tons, with a CAGR of 15%. In 2020, the volume dropped to 335,800 tons, recording the first drop in the past nine years. The figure in 2021 didn’t rebound. The average monthly imported volume in the first eight months of 2021 is approximately equivalent to the figure of 2017, a decrease of 20.3% from 2019.

The situation seems murky, but there are still some growth points worthy of attention. First, as Chinese people’s living standards improve, the high-end market is witnessing explosive growth. The ultra-high-end market growth rate reached 57.1%, the high-end market growth rate was 27.7%, and the milk powder market priced below 290 yuan/kg continued to shrink. Second, after the further relaxation of the birth control policy, the birth rate of second-child in the first- and second-tier cities are lower than those in third- and fourth-tier cities, which means the low tier market has higher potential in the near future. This phenomenon is definitely worthy of brands’ attention.

Food for Special Medical Purposes

The recent data shows that the global market of food for special medical purposes was about 56-64 billion yuan, with a 6% growth rate. However, the Chinese market only accounts for 1%, about 600 million yuan. It is now a newborn market, which means that there is plenty of room to grow. After the pandemic, more and more consumers start to pay attention to this category. For example, products that can improve immunity become a new growth point. There is a bright future to expect.

Challenges for Chinese Special Food Market

With people’s disposable income and living standards increasing, consumers’ demand for special food also grows. However, the current special food market cannot satisfy the new demands, especially the market of food for special medical purposes. In the meantime, consumers still hold a cautious attitude to products from these two categories because of the past scandal in the infant formula and health food market. Gaining trust from consumers still requires time and cooperation between the market and law enforcement departments. In conclusion, Chinese consumers are hungry for special food, but the industry needs to keep pace with their increasing demand.