Price Spike of Coconut Water Raw Material

This summer, coconut water has emerged as a "dark horse" in China's beverage market. The recent hashtag #Price of Coconut Water Raw Material up 4000%# has sparked widespread attention on the social media. This phenomenon is a result of the significant surge in consumer demand for coconut water products, leading to a tight supply of raw materials and a subsequent price spike, especially of brown coconut water.

hashtag #Price of Coconut Water Raw Material up 4000%# ranked top 1 on Weibo

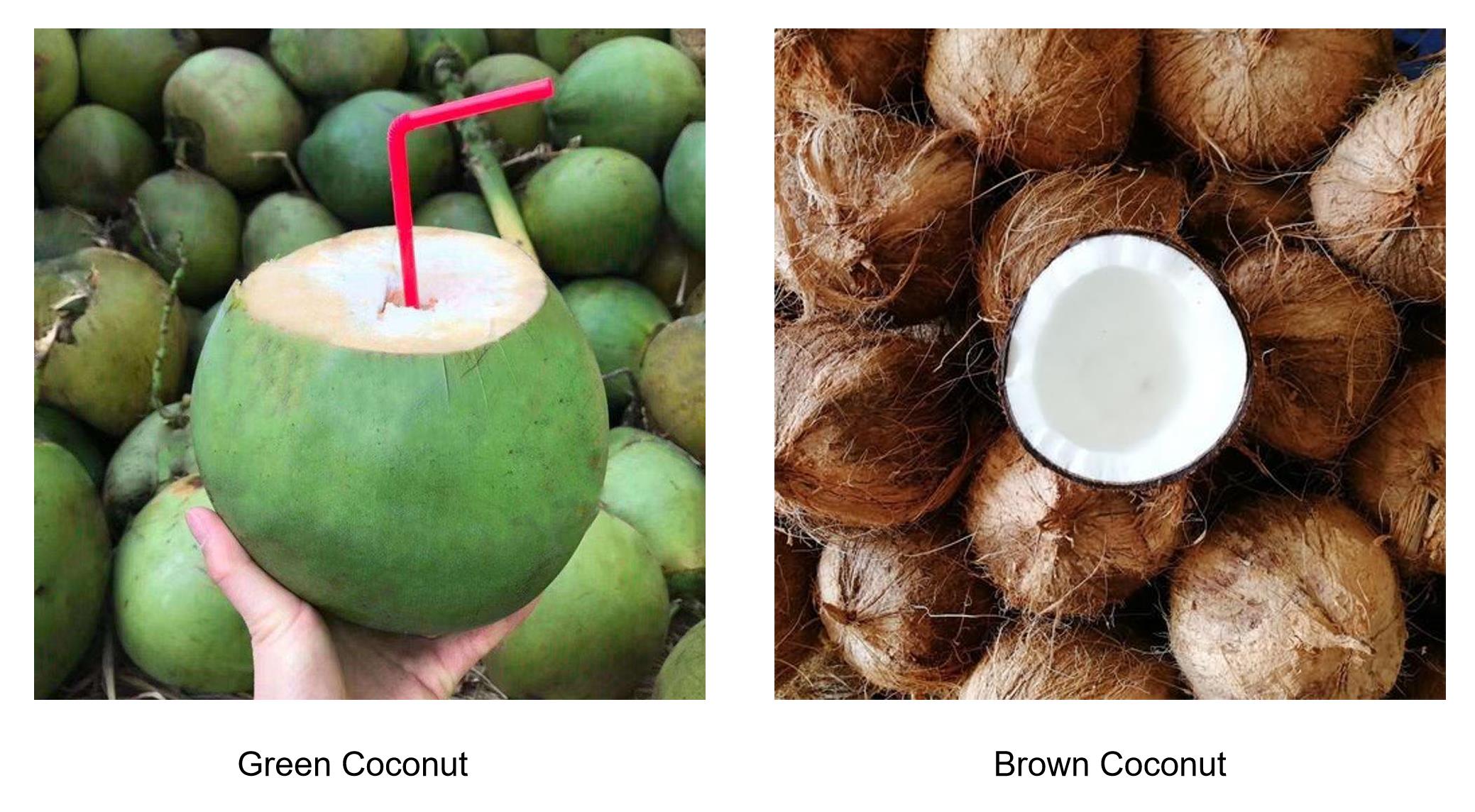

In fact, brown coconuts are traditionally used for coconut meat production, while their water are considered as a byproduct with a price of around a hundred yuan per ton. However, due to the insufficient supply of green coconuts, the main raw material for coconut water production, manufacturing companies have expanded their focus to cover brown coconuts. This has led to a significant price increase of brown coconut water, approaching nearly 4,000 yuan per ton. It's also worth noting that the majority of brown coconuts in the Chinese market are imported from Southeast Asian countries. According to the General Administration of Customs of China, from January to July this year, imports of coconuts through the Hainan port reached 330,000 tons, marking a 13.6% year-on-year (YoY) increase, with a total value of approximately 550 million yuan.

Surging Market Demand for Coconut Water Products

In the Chinese market, coconut water beverages mainly include packaged coconut water and freshly prepared coconut water. As fresh coconut water has a relatively short shelf life, packaged coconut water products typically undergo UHT (Ultra High Temperature) sterilization and filtration before being packaged. This processing method maximizes the retention of the coconut water's fresh and sweet flavor while also facilitating storage and transportation at room temperature, which is crucial for the expansion of coconut water market. At present, major brands of packaged coconut water in the Chinese market include VitaCoco, if, INNOCOCO, SANLIN, KaraCoCo, JaccoJuice, Coco100, FreeNow, Coconut Palm, etc. Furthermore, some retail outlets such as Walmart, Metro, Freshippo have also launched their own brands of coconut water. According to Tmall Mart, the sales of packaged coconut water products has shown a double-digit growth over the past year. Notably, in the most recent three months, sales has surged by an impressive 65% YoY.

packaged coconut water brands in the Chinese market

Freshly prepared coconut water primarily relies on coconut beverage shops that offer a variety of coconut-based drinks, including coconut water, coconut milk coffee, coconut milk tea. In recent years, brands specializing in freshly prepared coconut beverages have been rapidly expanding. According to Canyandata, brands like KoKoYeah, YesNoTwo, and BeileYe have opened 331, 315, and 153 stores, with a significant majority of these stores opened within the past year. The popularity of freshly prepared coconut beverages has also captured the attention of investors. Allcoconut, a fresh coconut water brand established in 2020, has successfully secured two rounds of financing, each amounting to tens of millions of yuan. LuckHaHa, founded in 2021, has completed three financing rounds, securing a cumulative amount of tens of millions of yuan.

YesNoTwo store and fresh prepared coconut water products

The soaring popularity of coconut water products can be attributed to two key factors. Firstly, there is a notable increase in consumers' health awareness. Consumers have placed growing emphasis on food products with clean ingredients that cater to their health-conscious preferences. Coconut water, with low sugar, low calorie and rich natural electrolyte attributes, is regarded as a natural and healthy beverage, making it well received. Secondly, the rise of freshly prepared tea beverages has fueled the craze for coconut-based beverages. Prominent freshly prepared coffee and tea brands like Luckin and HEYTEA have launched a series of coconut-based drinks, which has not only boosted the popularity of coconut milk but also paved the way for the burgeoning trend of coconut water. This summer, products such as Luckin's "Fresh Coconut Americano" and Ningji"s "Refreshing BUFF Coconut Series" have ignited substantial interest in coconut water.

freshly prepared coffee and tea brands launch coconut-based drinks

How to Ride the Wave

The market size of coconut water products in China has grown from 513 million yuan in 2018 to 780 million yuan in 2022, and is expected to reach 1 billion yuan by 2025. However, when compared to other beverage categories, the coconut water market is still in its early stage with huge room for development. Typical challenges facing coconut water brands include: 1) consumer awareness of coconut water is relatively low among the entire consumer group; 2) unstable supply of raw materials has a direct impact on both the quantity and quality of coconut water; 3) high production and preservation technique costs have led to high prices of coconut water products.

In response, coconut water brands need to strengthen their supply chain management and promote standardized production, to ensure a stable supply of raw materials, maintain product quality control, and optimize production costs. This will help them establish a competitive edge in both quality and price. Additionally, brands need to actively engage in marketing efforts, creating appealing consumption scenarios of coconut water products, emphasizing the health benefits of coconut water, as well as building unique brand identity to differentiate from other brands and win over consumers.

**Disclaimer: All pictures used in the article are from the Internet.