Market Overview

In recent years, the consumer market in Southeast Asia has seen rapid development, with beauty, personal care, and health products emerging as hot-selling items in the region. As a result, Southeast Asia is now considered a pivotal "market of the future" for the global cosmetics industry. According to Statista, the revenue in Southeast Asia's beauty and personal care market is projected to reach USD 33.1 billion in 2023, with an expected compound annual growth rate (CAGR) of 3.31% from 2023 to 2028.

Within the region, Singapore and Malaysia markets have reached a relatively mature stage. Meanwhile, markets in Indonesia, the Philippines, Thailand, and Vietnam have shown rapid development, with Indonesia and Vietnam experiencing remarkable growth exceeding 100% since 2019. Indonesia, in particular, with its large population, presents enormous potential in the beauty and personal care market, creating a highly favorable environment for businesses offering a diverse range of products.

The primary driver behind this growth is the generational shift, with a new wave of young consumers entering the market. These consumers bring a fresh perspective, emphasizing fashion, trends, and personalization. This shift is further fueled by social media, globalization, and eCommerce, which disseminate trends from around the world, profoundly impacting consumer behavior when it comes to beauty products.

According to Global Web Index, Southeast Asian beauty consumers exhibit three typical characteristics: firstly, a strong emphasis on physical appearance, with 62% of consumers experiencing beauty-related anxiety. Second, a habit of buying beauty and personal care products, with 96% of consumers having made such purchases in the past 3-6 months. Third, a willingness to explore diverse shopping experiences, with 54% expressing a keen interest in trying new products. Meanwhile, due to variations in geographical location, economic development, ethnicity, religious beliefs, culture, as well as various other factors, each country in the region presents its unique characteristics and consumer preferences. Therefore, brands looking to enter these Southeast Asian markets should conduct thorough market research and tailor their product offerings to align with the specific needs of each market.

Market Landscape

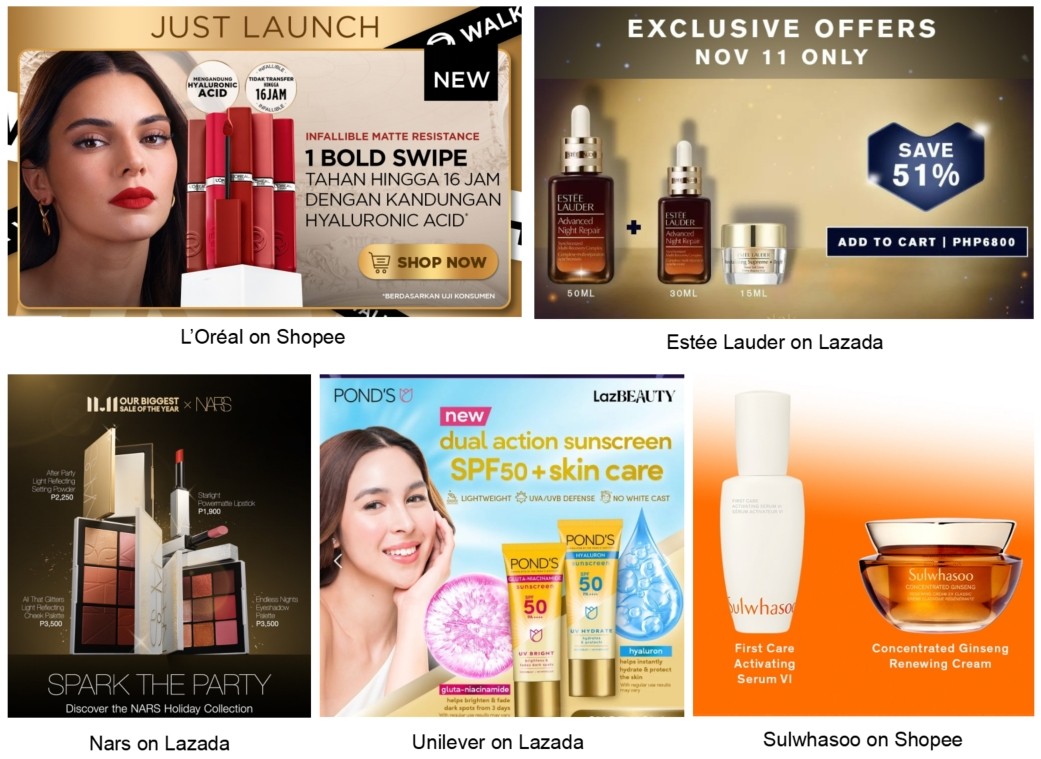

Within Southeast Asia's expansive beauty and personal care market, a competitive landscape unfolds, where European, American, Japanese, South Korean, Chinese brands, as well as local Southeast Asian brands vie for prominence. For instance, Shiseido established a research and development center in Singapore in 2019 to gain deeper insights into local consumer preferences. In recent years, Shiseido has frequently mentioned Southeast Asia as a noteworthy area of growth in their corporate reports. Amorepacific Group signed a cooperation agreement with the eCommerce platform Shopee in 2021 to extend its footprint in Southeast Asia. The group has also introduced products tailored to Southeast Asian women, considering the local climate and culture. Furthermore, in November 2022, Unilever Ventures, the venture capital arm of Unilever, led an investment in an Indonesian vegan beauty brand ESQA, marking their first investment in the beauty sector within Southeast Asia.

Chinese beauty brands have unique advantages when expanding into Southeast Asia. Firstly, their pricing strategies are well-suited to the purchasing power of Southeast Asian consumers. Secondly, the shared Asian regional context fosters significant cultural and skin tone affinities, enhancing their appeal. Of notable importance, China's "Belt and Road" initiative has established a favorable business environment, further facilitating the entry of Chinese beauty brands into the Southeast Asian market. This has led to the rise of brands such as Perfect Diary, CHANDO, Florasis, ZEESEA, Judydoll, and Colorkey, which have gained significant popularity in Southeast Asia.

Furthermore, many local beauty brands in Southeast Asia are on the rise and have performed well in the market. Notable local brands include Mistine and Cathy Doll from Thailand, Wardah, ESQA and Base from Indonesia. It's also noteworthy that Southeast Asian local brands created by Chinese teams, such as Y.O.U, Skintific, and BIOAQUA, have gained recognition in the Southeast Asian market by leveraging localized product positioning and marketing strategies, as well as maintaining strong and reliable supply chains.

Notable Trends to Embrace

Varied Aesthetic Preferences

There are diverse aesthetic preferences across Southeast Asia. Filipino consumers strive for "fair and beautiful" skin, with the highest usage of whitening products in Asia. They also favor a Western-style makeup look, often using products like eyeliners, eyebrow pencils, and contouring. Vietnamese consumers are influenced by Japanese and South Korean cultures, preferring a fresh and radiant base, natural eyeshadow shades, and bright lip makeup. They prioritize sun protection and products with natural ingredients for skincare. "Thai-style makeup" emphasizes a creamy and dewy complexion, along with bold eyebrows and European-style long eyelashes. In Malaysia, influenced by religious and cultural factors, consumers prefer alcohol-free and animal-friendly cosmetics. Singaporeans exhibit a greater willingness to invest in products that offer unique narratives and novelty. Given these unique characteristics, brands venturing into the Southeast Asian market should tailor their product selections and marketing strategies to align with the distinct preferences of each locale.

Growing Emphasis on Ingredient Efficacy and Long-Lasting Products

Due to the influence of the COVID-19 pandemic and a growing focus on sustainability and environmental protection, more Southeast Asian consumers are becoming ingredient-conscious. For example, Global Data shows that in the Malaysian market, consumers become increasingly aware of the potential harm caused by long-term use of chemical ingredients on their skin. Consequently, the demand for natural and organic skincare products has significantly increased. Furthermore, given that Southeast Asian countries are situated in tropical regions close to the equator, where individuals tend to sweat more,consumers have a strong demand for makeup products that offer enduring performance and resist smudging caused by sweat. As such, essential setting products like waterproof and sweat-resistant mascara, long-lasting cushion foundations, smudge-proof eyeliners, and setting sprays are highly popular on e-commerce platforms like Lazada.

Significant Influence of Pop Culture

Pop culture exerts a profound influence on the preferences of young consumers in Southeast Asia, especially concerning their choices in beauty and personal care products. Prominent celebrities, renowned actors, pop stars, and social media influencers hold significant influence among Southeast Asian youth. The endorsements and recommendations from these individuals have the power to elevate a product or brand to prominence. Therefore, brands entering the Southeast Asian market must harness the power of pop culture and social media for effective marketing communication.

In conclusion, the beauty and personal care market in Southeast Asia remains a "blue ocean" with diverse and enthusiastic consumer demands waiting to be met. It has evolved into a competitive arena where numerous beauty brands are vying to secure their share in this dynamic market.

Disclaimer: All images used in the article are from the Internet.