On September 29, 2022, Tim Hortons China (Nasdaq: THCH), the Chinese business division of Canadian coffee chain Tim Hortons, made its US market debut on Nasdaq after merger with SPAC Silver Crest Acquisition Corp.

Founded in Canada in 1964 by the legendary Canadian ice hockey defenseman under his name, Tim Hortons has become one of the worldwide largest coffee, doughnut and tea chains. In 2018, its China division—Tim Hortons China (hereafter referred to as Tims China), was established as a joint venture between Restaurant Brands International (Tim Hortons' parent company) and Cartesian Capital Group. The first coffee shop of Tims China was opened in February 2019, with coffee priced at 15 to 30 yuan. In addition, Tims China won four rounds of investment from well-known organizations such as Tencent (twice), Sequoia China, Eastern Bell Capital, etc1., which also fueled its rapid growth.

Data source: Qichacha

Data source: Qichacha

First Store in China

First Store in China

Seizing the Opportunity in China’s Coffee Market

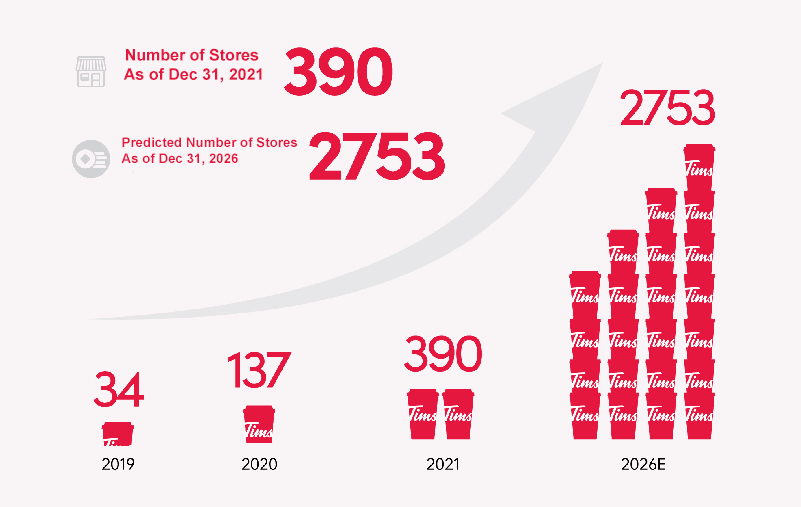

According to the iimedia research data, China's coffee market size was about 381.7 billion yuan in 2021 and was expected to reach 1,000 billion in 20252. With insight into the vast market potential, Tims China has been expanding its store network at full speed over the past three years since it entered the Chinese market. As of December 31, 2021, its stores increased by more than ten times, reaching 390 (including 373 self-operated stores) in 21 cities3. To cover more coffee-drinking scenarios, Tims China positioned its stores in diversified types, including Gold Maple (flagship store), Maple (classic store), Tims Go (mainly for takeaway service) and Tims Express (latest cooperation with Sinopec's Easy Joy convenience store). Equipped with kitchen facilities, Gold Maple and Maple stores provide freshly made food besides coffee drinks.

Data Source: Tims China

Data Source: Tims China

Tims China has seen an upsurge in revenue along with its rapidly expanded store network. From 2019 to 2021, the revenue was 57.26, 212, and 643 million yuan, respectively, with a year-on-year growth of 271.9% and 203.4%. Tims China's remarkable result is backed up by its strategic operation in China.

High Quality "Coffee plus Warm Food" Set at Competitive Price

Compared with other coffee chain brands, Tims China's differentiated advantage lies in the characteristic "coffee and warm food" concept, which is a continuation of Tim Horton’s operation philosophy in Canada. As the Gold Maple and Maple stores are equipped with a complete set of kitchen equipment, they can provide high-quality warm food and bakery products. Its coffee & breakfast set is well received by customers. Tims China has launched 40 food SKUs and plans to make full use of the existing equipment to offer more food choices.

Tims China also continues the cost-effectiveness strategy of Tim Hortons in Canada. The price of Tims China’s products ranges from 15 to 30 yuan, slightly higher than that of Luckin but lower than Starbucks and boutique coffee brands. The competitive price is supported by Tims China’s strong supply chain management and the enhanced bargaining ability as a result of the expansion4.

Localization Strategy

Tims China has been committed to its localization strategy in every aspect. In terms of product creation, except for the most basic brewed coffee series, all other coffee series are developed locally to cater to Chinese consumers, such as Fresh Coconut Cold Brew Coffee, Lemon Cold Brew Coffee, and Litchi Soda Cold Brew Coffee. In the past, more than 30 new products were launched yearly, and the figure is expected to reach 70 in 2022.

Meanwhile, Tims China fully integrated local elements into the store design and operation. For example, the first store in Wuhan adopted the Yellow Crane Tower elements (the landmark building of Wuhan) into the store design. The first store in Beijing launched a unique coffee and food set featured with Beijing culture—Osmanthus Flavored Flat White (inspired from Beijing Opera Facial Makeup) and City Exclusive Haws Timbits (inspired from Beijing traditional sugarcoated haws). The ingenious combination of local elements with product innovation and store design has conduced to Tims China's brand recognition.

Tims China also emphasizes community operation to improve user viscosity. With insight into coffee consumer groups with diversified personal interests, Tims China attracted wider consumer groups through co-branding. For example, after Tencent became a shareholder, Tims China cooperated with Tencent E-Sports, opening three stores with the theme of electronic games that provided Gen-Z with an immersive experience of "coffee plus electronic games". As of December 31, 2021, Tims China had about 6 million registered members, up 154.7% YoY.

Digital Operation

Tims China's business intelligence system covers the entire operation flow. From store location selection to inventory management and order management, a massive amount of data was gathered and analyzed to optimize the operation flow with enhanced efficiency. Taking Tims China's location selection as an example, multi-dimensional data of residents' type, passenger flow, competitor information, and take-away service coverage are considered to optimize the location selection.

Furthermore, Tims China expands its digital ecosystem from vertical-field service platforms such as Ele.me, Meituan, Dianping (a major platform for food consumption experience sharing and communication in China) and Tmall to social media such as Weibo, Xiaohongshu and Douyin. The comprehensive digital ecosystem not only brings rapid growth in revenue but also further enhances brand recognition and user viscosity. In July 2022, Tims China and Douyin jointly launched an integrated marketing campaign, which generated more than 20 million yuan GMV and 720 million views of Tims-related topics.

Experienced Management Team

Tims China’s successful expansion is credited to its experienced management team led by CEO Yongchen Lu—former CFO of Burger King. With successful experience in Burger King's development in China, this management team profoundly understands the challenges of and solutions for chain catering enterprises at different stages of development.

Challenges

Notwithstanding the rapid expansion of store network and growth in revenue, Tims China is faced with a severe problem—how to balance the expansion and profitability, a problem shared by almost all offline coffee brands. Due to COVID-19 as well as rising rents and raw materials costs, Tims China has not yet realized profitability. From 2019 to 2021, its net loss was 87.828, 143 and 383 million yuan, respectively5. For Tims China, narrowing losses and achieving single-store profitability are top priorities.

Moreover, the huge potential of China's coffee market has attracted numerous enterprises into the competition. In addition to Starbucks and Luckin, new brands such as M Stand, Manner, %Arabica, and illy coffee, as well as new consumption tea beverage brands have been snatching market share. Therefore, faced with fierce competition, Tims China still has a long way to realize long-term sustainable growth.