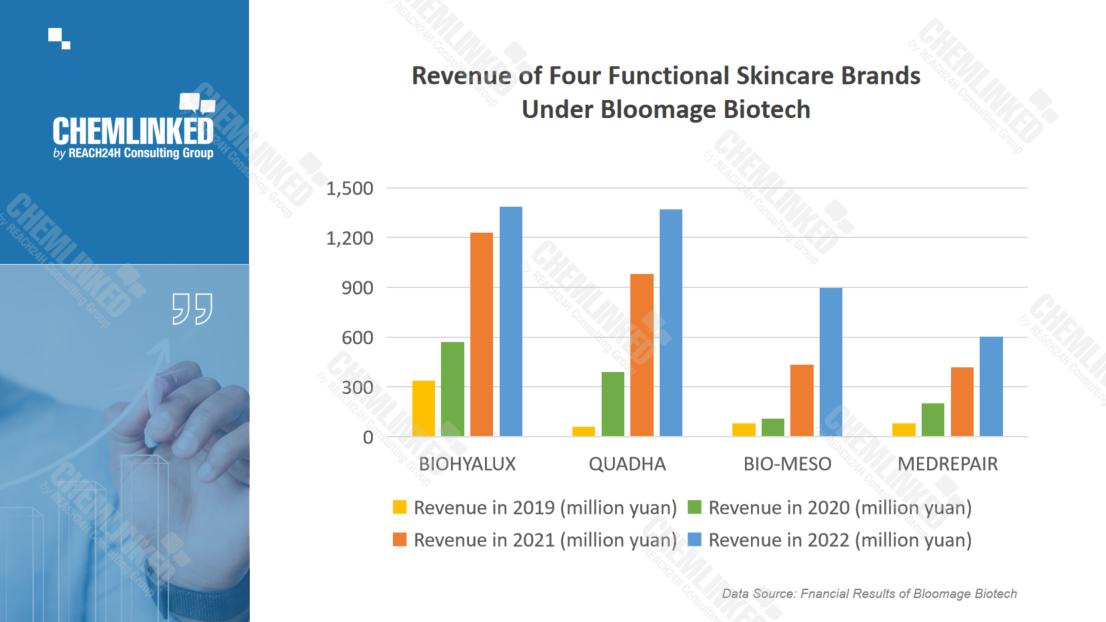

According to Bloomage Biotech's financial report of 2022, the company achieved a revenue of 6,359 million yuan, representing a substantial year-on-year (YoY) increase of 28.53%. Over the past 5 years, the company has witnessed an increase of five folds in revenue and two folds in net profit. The success of Bloomage Biotech can be subdivided to the concerted efforts of the company's four major business segments, namely, functional skincare products, raw materials, medical terminal products, and functional foods. Among them, the functional skincare business has skyrocketed over the past few years and emerged as the most crucial segment under Bloomage Biotech. From 2019 to 2022, it respectively achieved revenue of 634, 1,346, 3,319 and 4,607 million yuan, accounting for 33.6%, 51.15%, 67.10%, and 72.45% of the total revenue.

In the following, ChemLinked digs into the fast development of Bloomage Biotech's functional skincare business from the perspectives of brand matrix, marketing, online sales channel, as well as research and development.

Brand Matrix that Aligns with Current Skincare Trends

Bloomage Biotech has built a differentiated brand matrix in the functional skincare market with its four ace brands: BIOHYALUX, QUADHA, BIO-MESO, and MEDREPAIR, each featuring different functions, target consumers and prices. Precisely, BIOHYALUX and QUADHA brands are positioned in the mid-to-high-end market, emphasizing moisturizing, barrier repairing, and anti-aging effects. Meanwhile, BIO-MESO and MEDREPAIR are targeted at the mass market, catering to the skincare needs of Generation Z with oily or sensitive skin. Together, these four brands address the diverse demands of different consumer groups, forming a comprehensive matrix of efficacy-focused skincare brands.

Moreover, Bloomage Biotech has been diligently executing a "signature product strategy" to elevate brand awareness. The approach enables the company to strategically allocate resources of product research and development, advertising, supply chain, and sales channels towards the most promising products under each brand. This results in the creation of distinct competitive advantages and reinforces consumers' recognition of the brand. In the past two years, the best-selling products under each brand include BIOHYALUX's HA Barrier Conditioning Series (that focuses on barrier conditioning), QUADHA's 5D Single-use Radiant Concentrated Essence (that goes beyond traditional hyaluronic acid products with multiple effects such as deep hydration, strong absorption, and anti-aging), BIO-MESO's Saccharomyces Rice Moisture-oil Balancing Series (that is tailored for oily skin to balance water and oil), MEDREPAIR's Rejuvenating Repairing Mask (that specializes in repairing sensitive skin). Take BIOHYALUX's HA Barrier Conditioning Series as an example. This series addresses the concerns of the thinning skin barrier and recurring skin sensitivity with its four-fold barrier repairing concept. By leveraging the exclusive INFIHA technology that synergizes hyaluronic acid with other bioactive ingredients, this series effectively reaches the skin base to boost the skin's defence mechanism. The HA Barrier Conditioning series is a big hit, with GMV reaching 42.85 million yuan on the day of launch, among which HA Barrier Conditioning Single-use Essence contributed 23.52 million yuan. In 2022, the GMV of the HA Barrier Conditioning series accounted for about 36% of BIOHYALUX's total GMV.

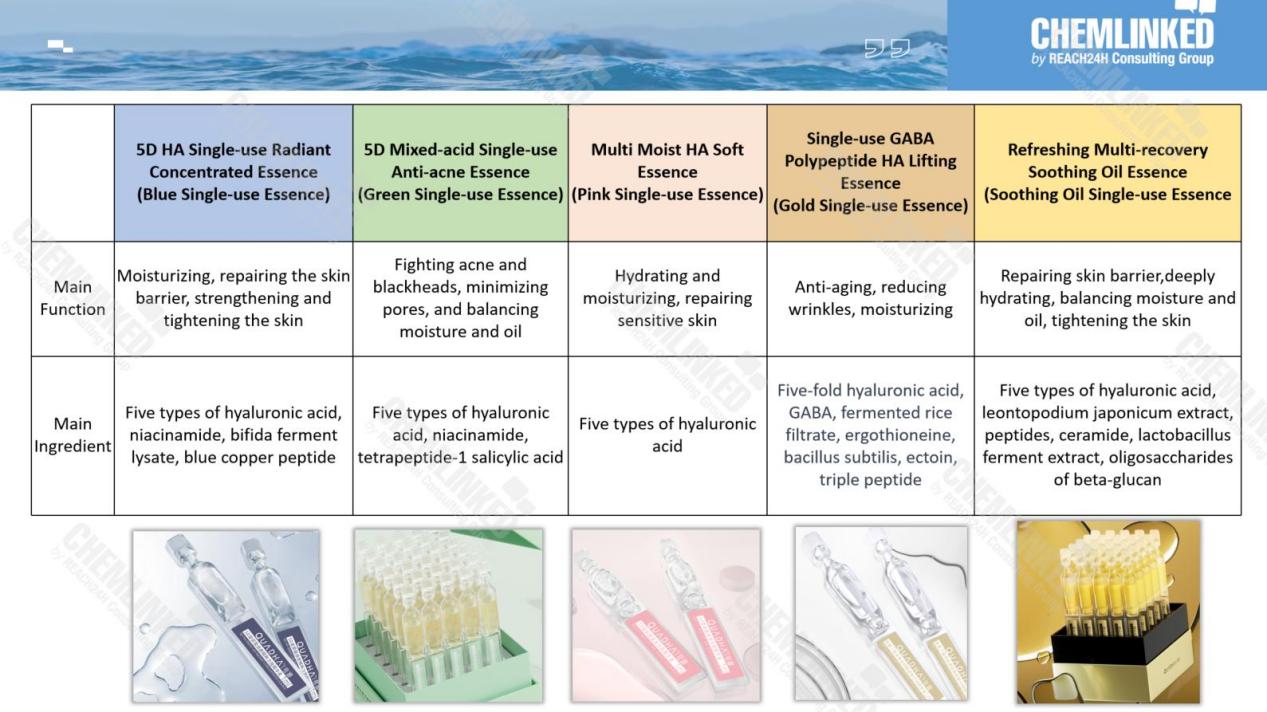

While maintaining the "signature product strategy", each brand has been vertically upgrading products and horizontally expanding categories in response to evolving consumer preferences and emerging usage scenarios. For example, after the success of the 5D Single-use Radiant Concentrated Essence, QUADHA continued to expand the single-use essence series formulations, catering to different skin types. Among them, the 5D Mix-acid Single-use Anti-acne Essence has become one of the brand's core products. Additionally, when "oil-based skincare" emerged as a popular concept, QUADHA swiftly seized the market opportunity by launching its Refreshing Multi-recovery Soothing Oil Essence, which also became one of QUADHA's best-selling products.

Integrated Marketing for Effective Lead Generation and Brand Image Building

In addition to product enhancements, the four brands have adeptly employed sophisticated marketing strategies to attract traffic and enhance brand image which is crucial for traffic conversion. BIOHYALUX's marketing strategy revolves around event marketing and deep collaboration with top influencers. For example, the brand once partnered with Tmall Little Black Box to hold a new product launch event at the Beijing Times Art Museum, inviting beauty KOLs, medical experts, artists, and other expertise to promote their products. In addition, it also cooperated with beauty and skincare influencers on social media platforms to generate soft marketing copywriting and videos for extensive exposure. Moreover, BIOHYALUX has further elevated the brand marketing strategy to covey emotional care for the female audience. One notable campaign was themed "Female Resilience", which garnered over 590 million exposures across various channels and resulted in an impressive 800% surge in GMV of search-driven transactions.

Promotion of BIOHYALUX's "Female Resilience" Marketing Campaign on Social Media

QUADHA, on the other hand, has focused on influencer live streaming, particularly collaborating with top-tier influencer Austin Li. Through these strategic collaborations, QUADHA gained massive exposure, leading to heightened brand recognition and the steady growth of loyal consumers. Since QUADHA first appeared on Li's live streaming channel in March 2020, sales have skyrocketed. In 2020, QUADHA's hyaluronic acid series sold 24.42 million units on Li's live streaming channel. On the first day of 2022's 618 shopping festival, QUADHA's GMV in Li's live streaming channel achieved RMB 100 million. To establish a distinctive communication approach between the brand and consumers, QUADHA has nurtured its own influencer—Zhi Fanfan, the brand's product manager. Despite a relatively small fan base, Zhi Fanfan has captured traffic and converted it into highly loyal brand followers through her expertise and professional approach to skincare. In the 618 shopping festival of 2022, the GMV of Zhi Fanfan's live streaming channel exceeded 50 million yuan in one day. This demonstrates the power of creating and nurturing a unique brand IP that resonates with the target audience and builds brand loyalty.

BIO-MESO actively conveys a brand image of "professionalism, youthfulness, and vitality", which appeals to its GEN-Z audience. For example, during the launch of the Saccharomyces Rice Cream, the brand created a drama-style marketing campaign around the topic of "Who is the culprit behind oily skin." Using a personification approach with suspenseful storytelling, they produced a series of high-quality short films and placed them on various social media platforms such as Douyin, WeChat Video, and Weibo to reach broader young consumer groups.

BIO-MESO’s Drama-style Marketing Campaign

As for MEDREPAIR, this brand is dedicated to enhancing its brand image as a sensitive skincare expert. It collaborates with dermatologists and skincare influencers to explore the scientific theory of micro-ecological barrier skincare, educate consumers about skin knowledge, and help them have a correct understanding of their own skin. At the same time, MEDREPAIR effectively communicates its product concept of "precise sensitive skincare" to consumers, reinforcing their awareness of the brand that is "developed specifically for sensitive skin".

Online Sales Channels as A Key Growth Driver

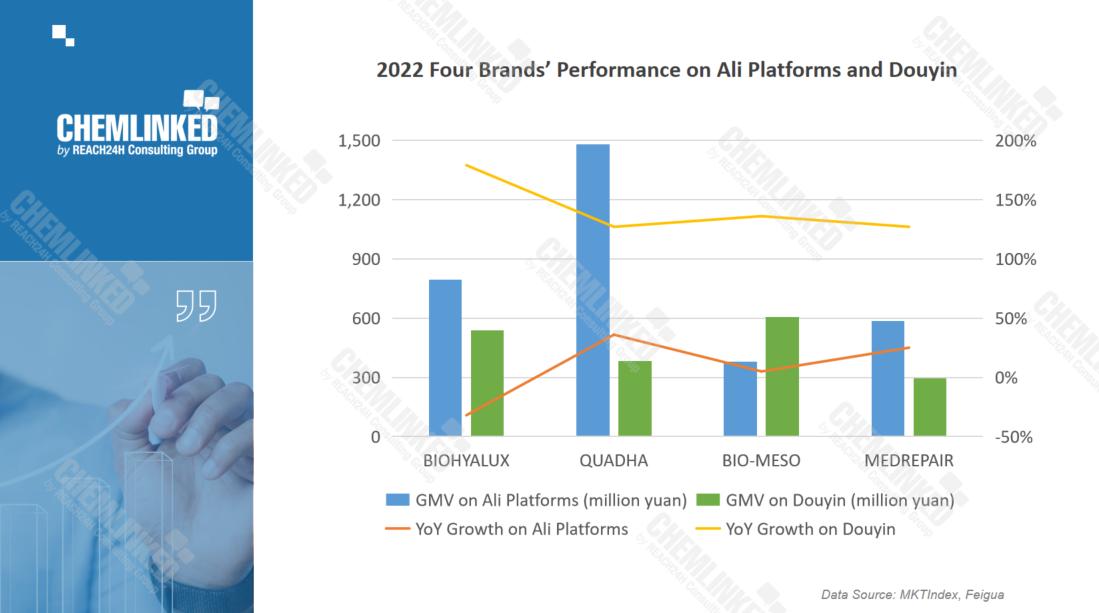

Bloomage Biotech's functional skincare business initially focuses on Ali platforms, which generate the highest traffic. Through collaboration with top-tier live streamers, its flagship products have gained substantial exposure, which has led to an upsurge in GMV. According to MKTIndex, the GMV of BIOHYALUX, QUADHA, BIO-MESO, and MEDREPAIR on Ali platforms was 794, 1478, 378, and 585 million yuan respectively, totaling 3,235 million yuan, accounting for 61% of brands' total online GMV.

More importantly, Bloomage Biotech flexibly capitalizes on the benefits of Douyin, a thriving social media e-commerce platform. According to Feigua, the company's functional skincare products sold on Douyin rose to about 1,820 million yuan in 2022, accounting for about 34% of the total online sales. Specifically, the GMV of BIOHYALUX, QUADHA, BIO-MESO, and MEDREPAIR on Douyin were 538, 382, 605, and 295 million yuan, respectively, up 208%, 154%, 155%, and 161%. It is also worth mentioning that self-hosted live streaming has become the brands' main sales channel on Douyin, which is more proactive and flexible in the form and length of live streaming and beneficial for accumulating loyal consumers.

The two mature channels allow Bloomage Biotech to flexibly leverage platform advantages and allocate resources with a refined focus. This is why the company's functional skincare business on Douyin has significantly outpaced that on Ali platforms regarding GMV growth in recent years. Furthermore, the four brands are concurrently exploring new opportunities for growth by expanding their presence on platforms such as WeChat, JD.com, Kuaishou, Little Red Book, etc., indicating a multi-channel approach to online sales for continued growth.

Heavily Invested Research and Development for Product Innovation

Bloomage Biotech's functional skincare business is strongly backed by its heavy investment in research and development. As a global leader in hyaluronic acid raw materials, Bloomage Biotech has built an integrated platform for R&D, production, and sales of hyaluronic acid. Moreover, the company has beenupgrading from a single active ingredient to a diversified active ingredient platform in recent years. With synthetic biology technology as the driving force, the company has developed six categories of bioactive ingredients, including ectoin, ergothioneine, recombinant collagen, etc. Its "HA + collagen + other bioactive ingredients" framework fully supports consumers' skincare demand, including moisturizing, soothing, repairing, anti-aging, whitening, etc.

Built upon Bloomage Biotech's research and development strength, each brand boasts exclusive technologies that enable them to create barriers from competitors. BIOHYALUX's skincare solutions are built around the "Hyaluronic Acid + Biocosmetics" concept, with the R&D team synergizing hyaluronic acid with other bioactive ingredients using their exclusive INFIHA technology. QUADHA is built around 5D hyaluronic acid technology, utilizing hyaluronic acid with different molecular weights to create a comprehensive three-dimensional hydration network. One of their exclusive ingredients, microHA®, the smallest molecule weight hyaluronic acid in the market, penetrates deeply into the skin, alleviates sensitivity, and reshapes a healthy skin barrier. BIO-MESO adopts the exclusive fermentation technology to develop the saccharomyces rice essence ingredient with high efficiency and concentration without sacrificing safety or mildness. MEDREPAIR has built its exclusive matrix of ingredients—Xibeiwen and Xibeishu®, and distinguishes itself from competitors through its precise sensitive skincare concept, offering different levels of repair solutions for different degrees of skin sensitivity.

The sustained growth of Bloomage Biotech's functional skincare business provides valuable insights for other beauty enterprises. Firstly, the meticulous construction and positioning of brand matrix have proven to be pivotal, catering to diverse consumer segments and creating distinct competitive edges. Secondly, diversified and refined marketing strategies can elevated brand awareness and influence. Additionally, effective channel operations and collaborations have played a crucial role, requiring constant optimization of layout and expansion of sales networks. Lastly, unwavering investment in research and development, coupled with product innovation, has been essential in maintaining market competitiveness and keeping pace with the evolving consumer demand.