The following paragraphs are just a glimpse of the formal report. Please contact us at contact@chemlinked.com to learn more about the complete report.

Market Size

The Chinese coffee market is entering a stage of rapid development, driven by the consumption of the young generation and office workers in first and second-tier cities. As reported by Daxue Consulting, the market value of the coffee industry nearly doubled from 2015 to 2020, going from RMB 47 billion to RMB 82 billion. Additionally, it is expected that China’s coffee market will rise to RMB 219 billion by 2025, with a compound annual growth rate (CAGR) of 22%.

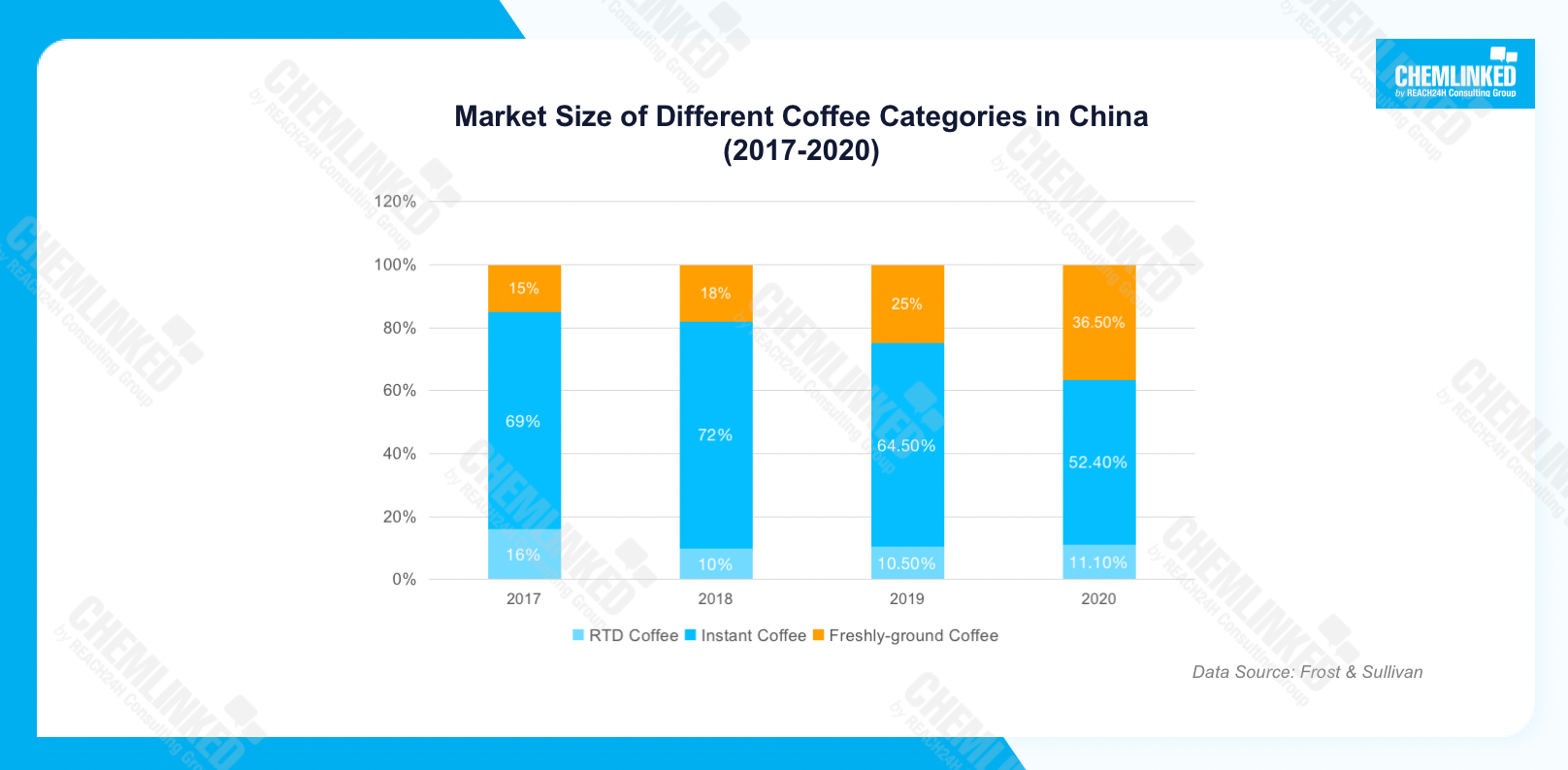

Currently, instant coffee still dominates the Chinese coffee market due to its low price and portability, accounting for more than half of the total market size. However, as the coffee industry in China develops, consumers are increasingly choosing coffee products with higher quality. The market share of instant coffee has been decreasing since 2018, while that of freshly-ground coffee has been continuously rising. From 2017 to 2020, the market share of freshly-ground coffee increased 21.5 percentage points to 36.5% and is promising to have a long-term growth trend in the following years.

Import Data

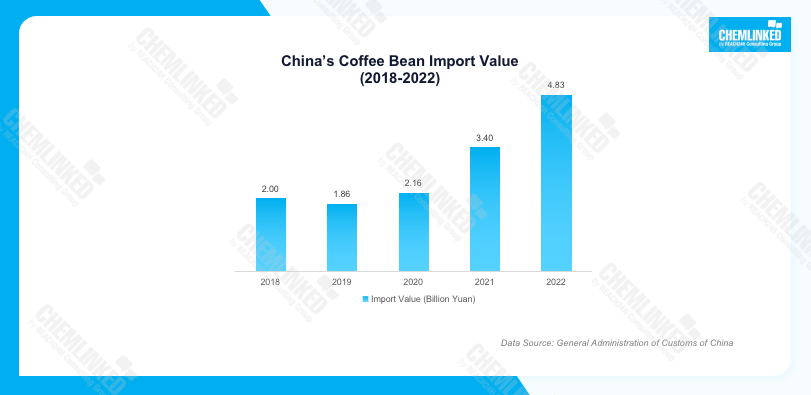

The Chinese import value of coffee beans was in stable growth from 2019 to 2022. In 2022, the import value reached 4.83 billion yuan. The top 5 import suppliers by import value were Ethiopia, Columbia, Brazil, Malaysia and Italy, accounting for 26.4%, 12.3%, 10.9%, 8.7% and 7.3% of the total, respectively.

Per Capita Coffee Consumption

China’s per capita coffee consumption in China was nine cups per year in 2021, solely 3.21%, 2.74% and 2.45% of that in Japan, the United States and South Korea, respectively, which indicated huge untapped potential of Chinese coffee market. But the average coffee consumption per capita was diverse in China’s different regions due to the income range. In the first and second tier cities, it reached around 300 cups per year in 2020, approaching the coffee consumption level of the United States.

Consumer Analysis

According to the survey by iiMedia Research in 2022, nearly 60% of Chinese coffee consumers purchase coffee every week and 21.5% of consumers drink coffee every day. Only 1.6% of the interviewees have little coffee. As the coffee industry develops and the variety of coffee continues to diversify, the frequency of consumer consumption might gradually increase. In addition, nearly 40% of coffee consumers in China spend 51-100 yuan per month in average on purchasing coffee. In the future, with the increase of consumers’ average disposable income and coffee affection, they will probably accept spending higher cost on coffee.

Currently, the coffee consumers in China are mainly white collars in first-tier cities aged between 20 and 40, mostly with a bachelor's degree or above and a comparatively high-income level. As the educational status and disposable income improve in the future, potential coffee consumers will continue to expand.

Regulatory Requirements

For pre-packaged foods including coffee, as long as the products meet corresponding national standards in China, they are allowed to be placed in the Chinese market.

If these products are imported to China, their overseas manufacturers shall register with the General Administration of Customs of China (GACC) prior to importation.

Want to learn more about the national standards or detailed compliance procedure? Please contact us contact@chemlinked.com.