The following paragraphs are just a glimpse of the formal report. Please contact us at contact@chemlinked.com to learn more about the complete report.

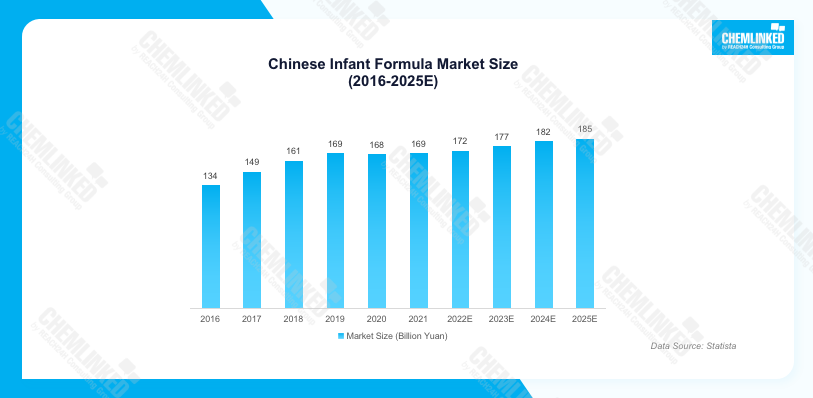

Market Size

According to Statista, China’s infant formula market came up to 169 billion yuan in 2021 and was estimated to reach 172 billion yuan in 2022. The market size increased significantly from 2016 to 2019, driven by both volume and price. However, the increment was basically stagnant during 2019-2021, mainly affected by the increasingly declining birth population and birth rate. But due to the third-child policy in 2021 and the rising product unit price, etc., the market size was anticipated to grow steadily since 2021.

Infant formula products in China can be divided into three categories: infant formula for babies of 0-6 months, 6-12 months and 12-36 months. In 2022, the market size of infant formula for babies of 12-36 months accounted for the biggest market share, arriving at nearly 73 billion yuan, achieving 42.40% of the total.

Imported VS Chinese

China’s domestic yield of infant formula has been significantly higher than the imported volume during 2017-2021. The volume difference greatly varied among different years. In 2017 and 2018, the difference was approximately 600 thousand tons, while in 2019 and 2020, it decreased to nearly 400 thousand tons, mainly due to the decrease of Chinese domestic output. Whereas in 2021, the difference rose to approximately 600 thousand tons again, because of the rose domestic output and sharply declined import volume.

The imported price was constantly higher than the Chinese domestic price from 2016 to 2021. However, the price gap between imported and domestic infant formula milk powder is narrowing, from 48.75 RMB/kg in 2016 to 47.08 RMB/kg in 2021.

Market Share of Different Brands

The market share of domestic infant formula brands has been increasing in recent years, from 42% in 2016 to 54% in 2020. Additionally, the market share of domestic infant formula brands first exceeded international infant formula brands in 2020. The rising of domestic brands was mainly attributed to their improving qualities, which was jointly made by the policy support and brands’ efforts on R&D.

According to Euromonitor, the Top 5 infant formula brands in China were Firmus, Aptamil, Jun Le Bao, Illuma and Yili in 2021, accounting for 19%, 7%, 6%, 6% and 5% of the total market, respectively. Since 2020, the market share of the domestic brand Firmus has surpassed that of Nestlé and become the Top 1 in China.

Market Share of Different Channels

The major sales channels of infant formula products in China includes mother and baby stores (MBS), supermarkets, and online platforms. The sales of MBS channels accounted for more than half of the overall infant formula market, while the supermarket channels solely took up a small part. Additionally, challenged by MBS and online channels, the proportion of supermarket channels is continuously decreasing. In contrast, the online channels were developing, taking up 21% of the total market during May 2019-May 2020.

Summary

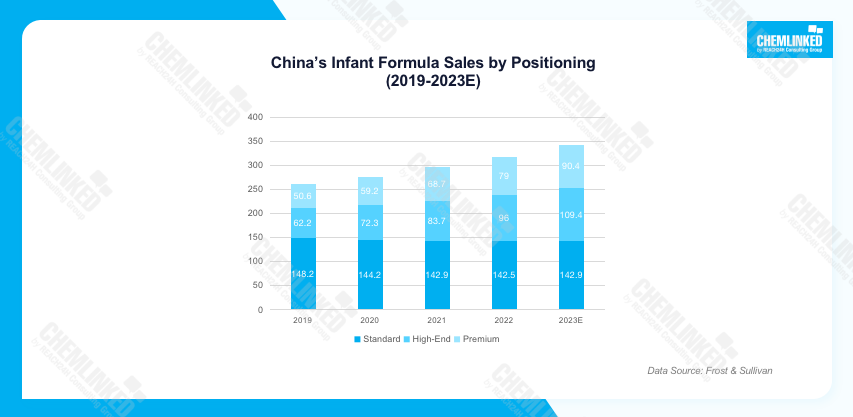

Although the Chinese infant formula market has suffered from the instantly decreasing birth population and birth rate, it is still one of the largest consumer markets worldwide, with its 1.4 billion population. It’s possible for market players to find opportunities in subdivided sectors, such as the high-end market, low-tier cities, etc. For instance, the high-end and premium infant formula market has been increasing in previous years. The high quality and scientific formulas of infant milk powder are consumers’ main concerns while purchasing, because of consumers’ increasing disposable income and educational level.

Regulatory Requirements

Different from most regular prepackaged foods, infant formula products sold to China shall get their recipe registered with China's State Administration for Market Regulation (SAMR) according to Administrative Measures for Registration of Infant and Young Children Milk Powder Formula Recipes. In July 2023, the authority issued the 2023 version of Administrative Measures for Registration of Infant and Young Children Milk Powder Formula Recipes, which will come into effect on October 1, 2023.

If these products are imported to China, their overseas manufacturers shall register with the General Administration of Customs of China (GACC) prior to recipe registration. The registration of infant formula manufacturers should be recommended by competent authorities in exporting countries.

Want to learn more about the detailed compliance procedures? Please contact us contact@chemlinked.com.