The bakery industry is primarily categorized into four types of products: make-ahead baked goods, pre-packaged baked goods, fresh baked goods, and small artisanal bakeries. Make-ahead baked goods refer to fully or partially baked products that are stored in the refrigerator or freezer until needed.

Compared with traditional baked goods, make-ahead baked goods is a new type of bakery product that have the dual advantage of offering fresh-tasting products and convenience for consumers. The process of freezing helps to preserve the flavor and texture of food products, while also reducing the need for preservatives and extending the shelf life. Additionally, make-ahead baked goods are also a convenient option for consumers who expect to enjoy homemade fresh baked goods but may not have the time or resources to bake from scratch.

Make-ahead baked goods can be further divided into make-ahead pastries and make-ahead bread. The make-ahead pastry market holds a larger share, accounting for approximately 70%, while make-ahead bread occupies roughly 30%.

Market size

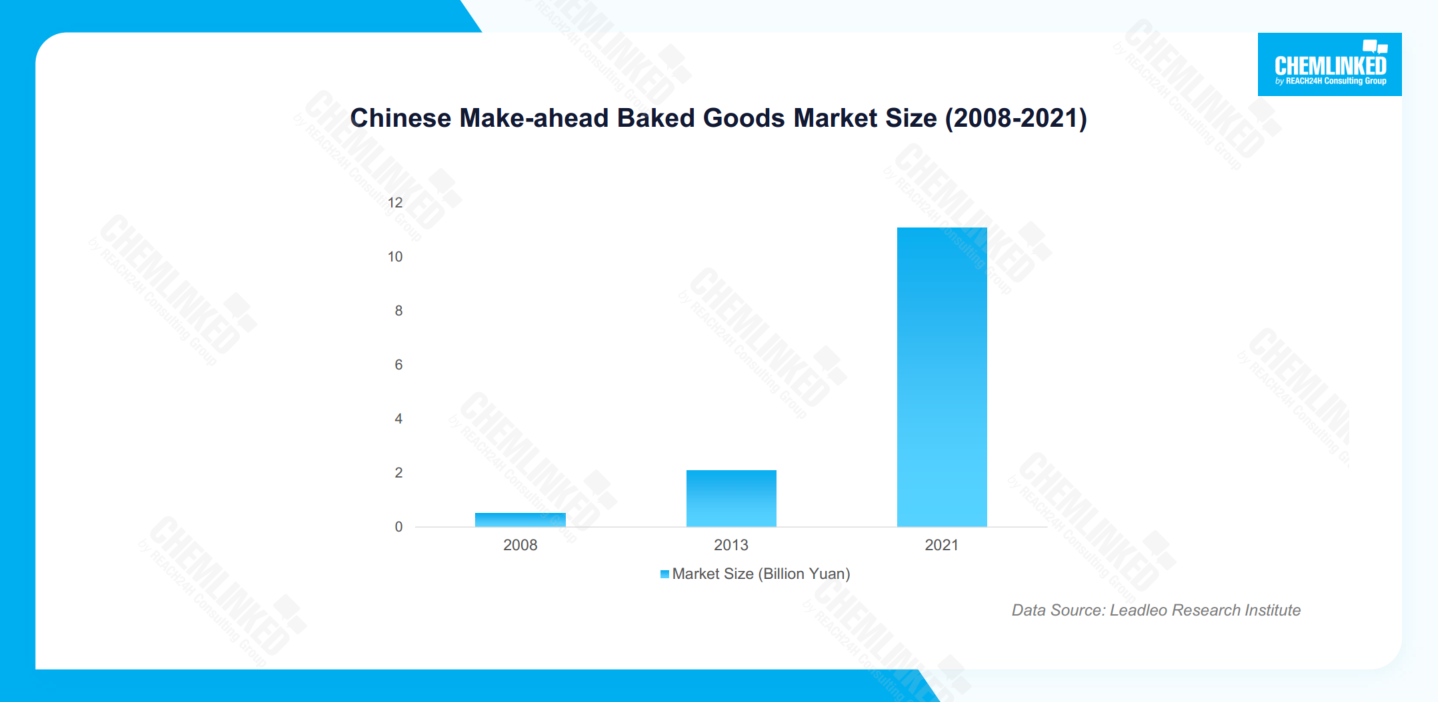

Over the past few years, the bakery industry in China has been on a steady growth trajectory. According to data from the Leadleo Research Institute, the market size rose from 170 billion yuan to 265.2 billion yuan between 2016 and 2021, with a compound annual growth rate of 9.30%. The make-ahead baked goods sector, in particular, performed outstandingly with its market size expanding from 500 million yuan in 2008 to 11.1 billion yuan in 2021, at a compound annual growth rate of 26.93%, making it a rapidly growing niche in China's bakery industry.

Despite rapid growth, the penetration rate of the make-ahead baked goods market remains relatively low. In 2020, the penetration rate of make-ahead baked goods in China was only 10%, while Japan and North America achieved 31% and 83% in 2018, respectively. However, with the growth of economy, the increase in consumer spending, the diversification of dietary preferences, etc., it is expected that there will be significant growth potential in the penetration rate of make-ahead baked goods in China.

Competitive landscape

Due to high financial and technological barriers, there are limited companies capable of large-scale production and sales of make-ahead baked goods. Currently, the major market players include Ligao Foods, Evirth, Xin Wanlai, Newland Foods, Delifrance, etc. In 2021, the industry was not highly concentrated, as evidenced by a four-firm concentration ratio (CR4) of 36.27%. Among all the companies in this sector, Ligao Foods holds the highest market share at 15.51%, which means it has established a significant brand influence in the market and possesses a competitive edge over other players.

In terms of sales revenue, Ligao Foods and Evirth are among the top-performing companies, belonging to the prestigious first tier and generating over 1 billion yuan. The second tier of companies, which includes Gobei, Xin Wanlai, Newland Foods, and Delifrance, achieve sales revenue ranging between 300 million to 1 billion yuan.

Sales channel

In China, manufacturers of make-ahead baked goods usually depend on B2B distribution and direct sales channels to reach their customers, thereby reaching consumers indirectly. Currently, bakeries are the largest sales channel, accounting for approximately 70% of the industry's sales, while supermarkets and catering account for 20% and 10%. But leading supermarkets such as Sam's Club, Vanguard and Freshippo (which is also unofficially called Hema Fresh) have seen substantial growth in make-ahead baked goods revenue in recent years. Catering channels have also benefited from the growing trend of tying tea drinks with baked goods as well as accelerated penetration, resulting in an increase in their market share of make-ahead baked goods.

Regulatory Requirements

For pre-packaged foods including make-ahead baked goods, as long as the products meet corresponding national standards in China, they are allowed to be placed in the Chinese market.

If these products are imported to China, their overseas manufacturers shall register with the General Administration of Customs of China (GACC) prior to importation.

Want to learn more about the national standards or detailed compliance procedures? Please contact us contact@chemlinked.com.