On September 3rd, the first Chinese Beverage Healthy Consumption Forum released the Healthy China Beverage and Food Sugar Reduction Action White Paper (2021)1. The white paper indicated that 1 in 10 people in first-tier cities such as Beijing, Shanghai, and Guangzhou have diabetes, implying the urgency of sugar control in China.

China is already the world's third-largest sugar consumer.

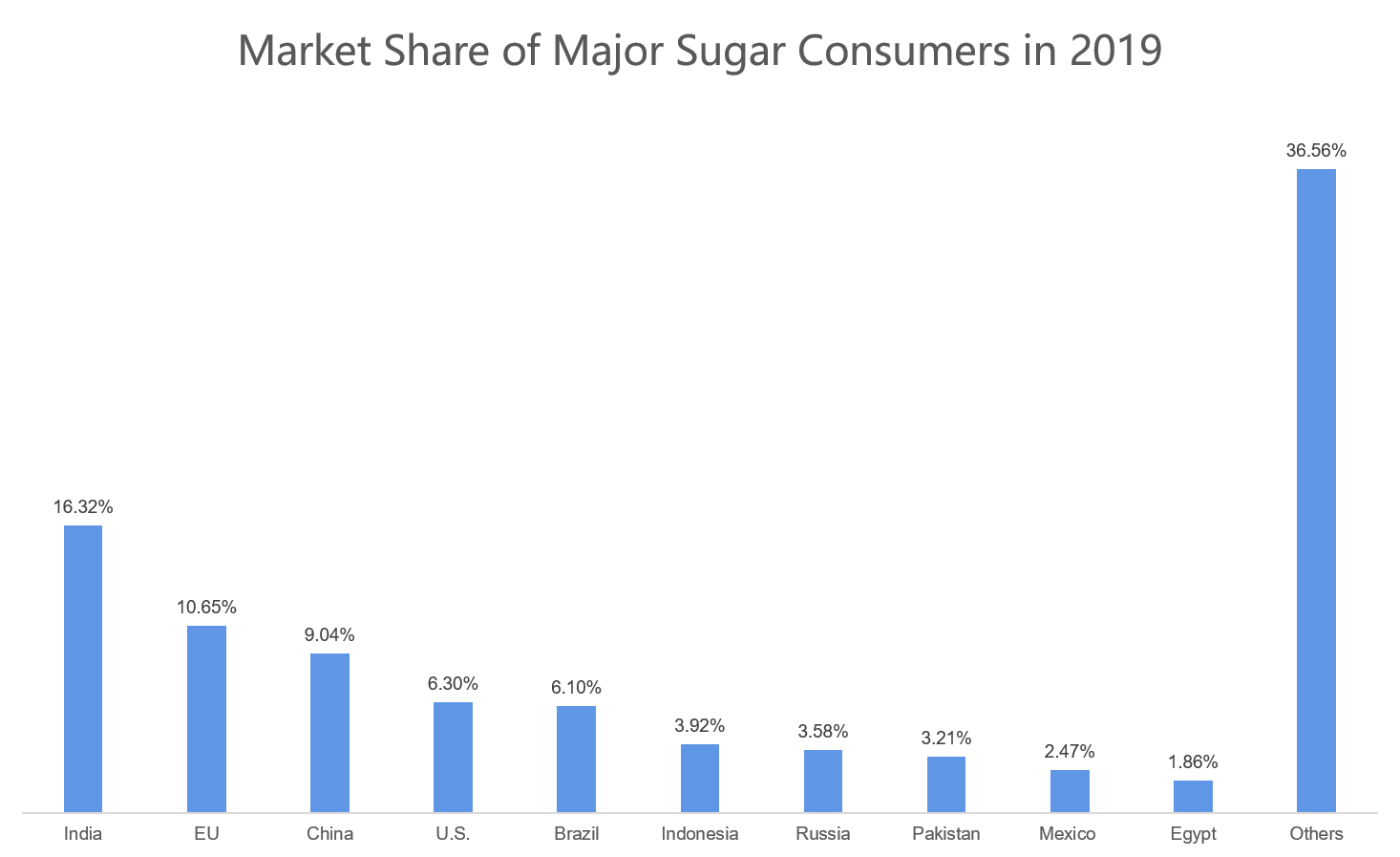

Data shows that China is the world's third-largest sugar consumer after India and the European Union. China consumed 15.8 million tons of sugar in 2019, with a proportion of 9.04%.

Source: Chinese Beverage Healthy Consumption Forum

Source: Chinese Beverage Healthy Consumption Forum

According to the white paper, the number of diabetics worldwide hit a record high of 463 million in 2019 and is expected to climb to 700 million in 2045. 60% of the world's diabetics live in Asia.

High sugar intake has become a major precipitating factor for obesity and diabetes. Daily intake of 400ml sugary drinks will double the risk of diabetes. Drinking 1,000 ml sugary drinks a day will increase the risk by nearly ten times. Data show a significant increase in diabetes among people who regularly consume sugary drinks.

China has the largest number of diabetics in the world.

In 2019, the number of Chinese people with diabetes reached 116 million1, accounting for 8.2% of the total population, making China the country with the largest number of diabetics globally. It is predicted the number will reach 151 million in 20401.

First-tier cities have become the hardest hit areas for diabetes in China. The prevalence rate is 18.5% in Beijing, and nearly 10% in other first-tier cities such as Shanghai, Guangzhou, Shenzhen and Chengdu, which means 1 in 10 people in first-tier cities has diabetes.

Besides, the preference for sugary drinks among young people, coupled with the irregular daily bedtime, has led to a high diabetes incidence rate. The disease, which usually occurs in middle-aged and elderly people, has outstretched to younger people.

In 2020, the prevalence rate of diabetes among people aged 18-29 in China reached 2%, and that among people aged 30-39 was 6.3%. While in 1996, the figures were 0.56% and 1.36%, respectively. The prevalence of diabetes among young Chinese has increased fourfold in the past two decades.

Urgent sugar control demand catalyzes market opportunities.

Given the snowballed diabetics number, the white paper citing opinions that China should speed up nutrition legislation, restrict advertising and promotion of sugary drinks, and tax sugary drinks.

In addition to regulations, the market should also develop foods and drinks with low sugar or sugar substitutes to reverse obesity and high incidence of diabetes in China.

In recent years, as consumers' health demands rise, they are becoming more cautious about sugar intake. Many of them have shifted from traditional high-sugar carbonated drinks and fruit juice drinks to "0 sugar" drinks.

According to the white paper, market share of "0 sugar" drinks is expected to rise from 2.85% in 2019 to 4.07% in 2021. China's sugar-free beverage market will maintain a double-digit growth rate in the next few years and reach 27.66 billion yuan in 2027.

The most striking example of the "0 sugar" beverage trend is the rapid rise of Chinese beverage brand Genki Forest. Following the success of Genki Forest, many beverage brands, including international giants Coca-Cola and Nestle, also rolled out “0 sugar” beverages, especially sugar free sparkling water. These “0 sugar” drinks use sweeteners such as erythritol, sucralose, and stevioside to replace cane sugar.

Besides, leading international snack brands have taken timely action, joining the trend to sell less-sugar and sugar-free products in the Chinese market. For example, Oreo launched the zero-sugar series, and Glico launched the low-sugar Pocky series.

Oreo and Glico launched sugar-free and less-sugar and products.

Oreo and Glico launched sugar-free and less-sugar and products.

There are also several new consumer brands on e-commerce platforms featuring sugar-free food and beverage, such as Ruomi, Chuji, and Tangyou Baobao.

Tangyou Baobao was founded in 2020 and completed 10-million-yuan angel round financing early this year. Its product family includes sugar-free, flour-free and starch-free noodles, bread, and cookies. It sold more than 1 million bags of sugar control bread within two months after its launch on Tmall.

Tangyou Baobao's sugar control bread.

Tangyou Baobao's sugar control bread.

ChemLinked believes that sugar control will continue to be a dominant trend in the Chinese food and beverage market. It is expected to see more imported brands bringing advanced sugar-control food and beverage products to Chinese consumers.