July 8th to 10th, Food and Beverage Innovation Forum (hereinafter FBIF) held the annual food industrial conference in Hangzhou, China. On July 10th, Mr. Zheng Zhi from Data 100 Insight was invited to talk about the consumption capability of lower-tier cities in China. Mr. Zheng points out the market opportunities in lower-tier cities, and he reckons the great potential in those cities.

According to the National Bureau of Statistics and Yicai News [1], about 1bn people, or 71.4% of China's total population, live in third-tier and lower-tier cities.

***Low-tier city definition and classification: Six Terms about Lower-tier Cities in China

Consumer Portrait

27% of first- and second-tier city residents live with their parents, compared with 43% in lower-tier cities [1]. Therefore, the housing purchase demand and pressure of residents in lower-tier cities are far lower than those in first-tier and second-tier cities [2]. Consequently, after excluding the mortgage, their disposable income is higher than those in higher-tier cities.

Residents of lower-tier cities also have more freedom in time allocation. Compared with first-tier and second-tier cities, people in lower-tier cities have more spare time for shopping, parent-child activities, and entertainment.

***Click to enlarge image.

***Click to enlarge image.

Purchase Channel Preferences

Consumers in lower-tier cities prefer to use comprehensive e-commerce platforms instead of buying specific categories on different e-commerce platforms when purchasing food and beverage products. The discount offered by group buying is very attractive to them. Unlike higher-tier cities possess plenty of shopping malls, lower-tier towns rarely have supermarkets. Therefore, offline shopping channels are mainly roadside and small groceries.

Different e-commerce shopping platforms have different user groups. The utilization rates of Taobao and Little Red Book in different cities show no significant disparities. People in higher-tier cities prefer Hema and WeStore. In contrast, consumers in lower-tier cities are more addicted to e-commerce platforms that combine social interaction with shopping, such as Kuaishou and Douyin. Pinduoduo is more popular among consumers in lower-tier cities due to its group-buying service.

Different e-commerce shopping platforms have different user groups. The utilization rates of Taobao and Little Red Book in different cities show no significant disparities. People in higher-tier cities prefer Hema and WeStore. In contrast, consumers in lower-tier cities are more addicted to e-commerce platforms that combine social interaction with shopping, such as Kuaishou and Douyin. Pinduoduo is more popular among consumers in lower-tier cities due to its group-buying service.

Category Growth

Category Growth

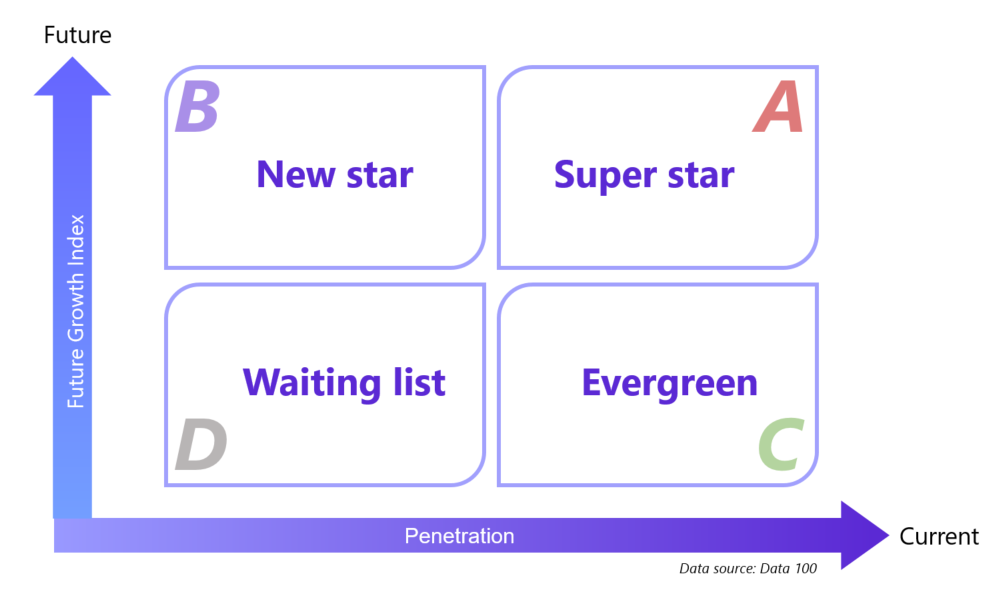

According to the current market penetration rate and predicted growth index of the products, here, 49 categories from the food and beverage sector are selected and divided into four different groups. Products with a high penetration rate and future growth potential can be regarded as the most steady and prevalent categories. On the contrary, categories showing lower market share and growth rates are more likely to perform less competitively.

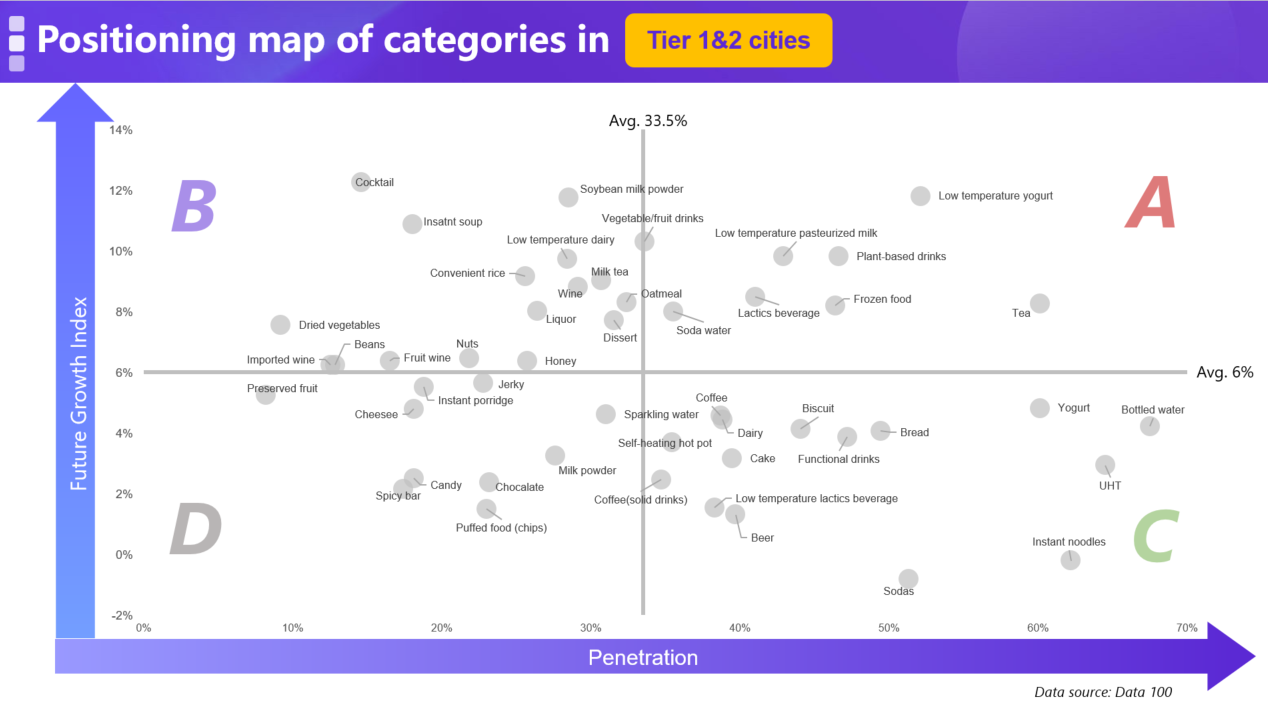

According to Data100, in tier1&2 cities, the growth rate of most categories is around the average value, and the market penetration is as well. As consumers in these cities are more in pursuit of high quality, for industry players, the key to shaping their future competitiveness lies in the upgrading of product quality.

According to Data100, in tier1&2 cities, the growth rate of most categories is around the average value, and the market penetration is as well. As consumers in these cities are more in pursuit of high quality, for industry players, the key to shaping their future competitiveness lies in the upgrading of product quality.

For lower-tier cities, the lower the city's level, the lower the product's average market penetration. Moreover, the gap between products gets wider. In the above tier1 &2 cities, the average market penetration rate of 49 categories is 33.5%, while in tier3&4 cities, the average penetration rate drops to 24.7%, and in tier5&6, this figure even declines to 20%.

However, the future growth rate of third-tier and fourth-tier cities is two percentage points higher than that of second-tier cities.

Compared with tier3&4 cities, tier5&6 cities have fewer competitive products in Group A and fewer categories above the average market penetration rate. Consumers in lower-tier cities have less choice, thus, many categories are limited to form a particular market scale and stay at Group B(new star) and D(waiting list). Therefore, for those who aim to expand business in the lower-tier cities, the focus of the future should be to broaden the category and increase consumer choices.

Compared with tier3&4 cities, tier5&6 cities have fewer competitive products in Group A and fewer categories above the average market penetration rate. Consumers in lower-tier cities have less choice, thus, many categories are limited to form a particular market scale and stay at Group B(new star) and D(waiting list). Therefore, for those who aim to expand business in the lower-tier cities, the focus of the future should be to broaden the category and increase consumer choices.

The categories' distribution in tier1&2 cities is relatively uniform and dispersed, while in lower-tier cities, it is relatively concentrated and asymmetrical. The market penetration of most products in lower-tiers is not high, which is more evident in tier5&6 cities. However, it has to be admitted that the category of lower-tier cities has more significant potential in the future, and many sectors are predicted to have a rapid growth rate.

The categories' distribution in tier1&2 cities is relatively uniform and dispersed, while in lower-tier cities, it is relatively concentrated and asymmetrical. The market penetration of most products in lower-tiers is not high, which is more evident in tier5&6 cities. However, it has to be admitted that the category of lower-tier cities has more significant potential in the future, and many sectors are predicted to have a rapid growth rate.

Overall, to cater to the preferences of consumers in first- and second-tier cities, in-depth market exploration seems necessary. In contrast, those focusing on the business development of lower-tier cities should expand the categories and grab market share with more types.

Beverages

In terms of drinks, plant-based protein beverages show an outstanding growth rate in China, and this emerging beverage category is considered to have great potential for future development. Besides, sodas are likely to be popular in lower-tier cities.

Related article:

Related article:

China's Plant-Based Milk Market

Dairy

Normal temperature dairy products have better prospects in lower-tier cities, while in tier1&2 cities, people pursue fresher and more nutritious low-temperature dairy products.

Related articles:

Related articles:

China Encourages the Consumption of Dairy Products

Convenience Food

Convenience food is prevalent in the domestic market in recent years. Instant noodles, frozen food, and self-heating hot pots are similarly welcomed in both higher and lower tiers. Instant soup seems like more attractive to consumers in tier1&2.

Related article:

Related article:

China Convenience Food Market Situation and Opportunities

Wine

In the wine market, the cocktail is the fastest growing sector, followed by fruit wine, and beer is the most penetrated in any city. It is worth mentioning that, for overseas wine brand, tier1&2 cities are more suitable to become the first choice for the first entry.

Related articles:

Related articles:

A Comparison of Beer, Wine, and Spirits Import Data in China: 2017 to 2019

***Acknowledgement: this report is supported by FBIF 2020 Conference, and the market data used in this article offered by Data 100 Insight.