According to Euromonitor, from 2010 to 2021, the proportion of E-commerce in China's beauty market increased from 2.6% to 38.7%, making E-commerce the largest sales channel. Following Ali platform's largest share of 68%, Douyin holds the second largest share of 21%. In 2022, Douyin beauty maintained double-digit growth, with a GMV exceeding 75 billion yuan.

Skincare Sector

Skincare was the dominant sector in the Douyin beauty market, accounting for 72% of the total GMV of the beauty market. Makeup accounted for approximately 18%, about one-fourth of the skincare sector.

The GMV of skincare products on Douyin increased by 74% YoY. More brands have joined Douyin, with the number of brands increasing by 42% YoY and the number of products increasing by 27% YoY. As China's consumption continues to recover in the post-pandemic era, the skincare sector is expected to maintain its growth momentum in 2023, although amidst intensified competition.

By category, facial skincare contributed over 80% of GMV, followed by eye care and sunscreen. The facial skincare category is mainly composed of facial care sets, face masks, serums and emulsions, with each subcategory generating over 10 billion yuan. All segments showed a growing trend, with emulsions seeing the highest GMV growth of 143%, followed by serums at 126%. Specifically, the fiercely competitive anti-aging serum segment was carved up by both international and Chinese brands, such as Estée Lauder, Proya, BIOHYALUX, Olay, Galenic, etc.

The GMV of the eye care category increased by 58% YoY, with eye cream and eye mask segments occupying the main market share. Renowned brands like Estée Lauder and Lancôme have successfully seized the high-end market. In 2022, Estée Lauder ranked first in the eye cream segment with a share of 17.58%, followed by Lancôme of 6.48%. In terms of price, eye care products in the 100-299 yuan range had the highest sales; products in the 300-499 yuan and 500-999 yuan range showed significant growth, which indicated an increasing consumer willingness to spend on high-end brands.

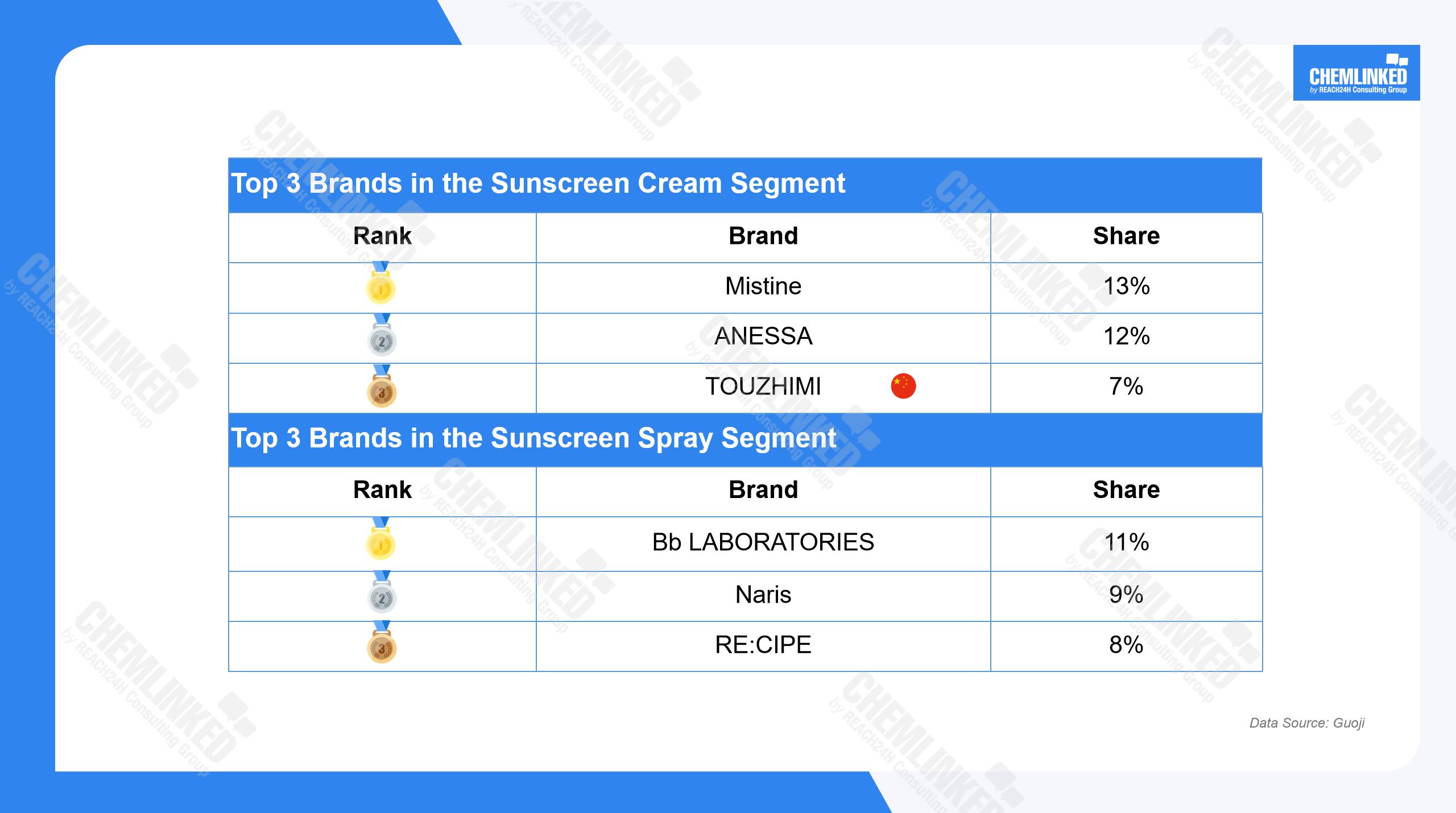

In 2022, despite the pandemic-prevention restrictions on outdoor activities, the sunscreen category witnessed a remarkable growth. GMV of sunscreen category increased by 126% YoY, with sunscreen cream segment accounting for a share of around 70%. Competition in the sunscreen cream segment was relatively concentrated, with the top 3 brands (CR3) accounting for about 32% of the market share. The Thai brand Mistine saw a remarkable 350-fold increase in its GMV and held the largest share of 13% in the sunscreen cream segment.

Mistine's achievement can be attributed to not only the brand's exceptional product features but also its well-crafted marketing strategy which involved collaboration with influencers for comprehensive promotion through live streaming, video promotion, and product seeding. In the past six months, the brand conducted more than 100,000 live streaming sales, resulting in 4.44 billion exposure. In addition, they released 16,000 product promotion short videos that reached 170 million viewers and 18,000 product seeding videos that garnered 2.02 billion impressions. In the live streaming and promotional videos, the brand's self-owned accounts contributed approximately 40% to the GMV, with KOLs contributing nearly 60%. Specifically, in the influencer layout, almost 80% of the influencers were long-tail (micro) influencers with fewer than 100,000 followers. Although they may not have generated high sales, they maintained consistent exposure and fostered overall traffic conversion. Seeding videos were soft marketing videos, including influencers' product reviews and recommendations, which functioned to raise consumers' interest in Mistine's products through subtle persuasion and casual language.

Makeup Sector

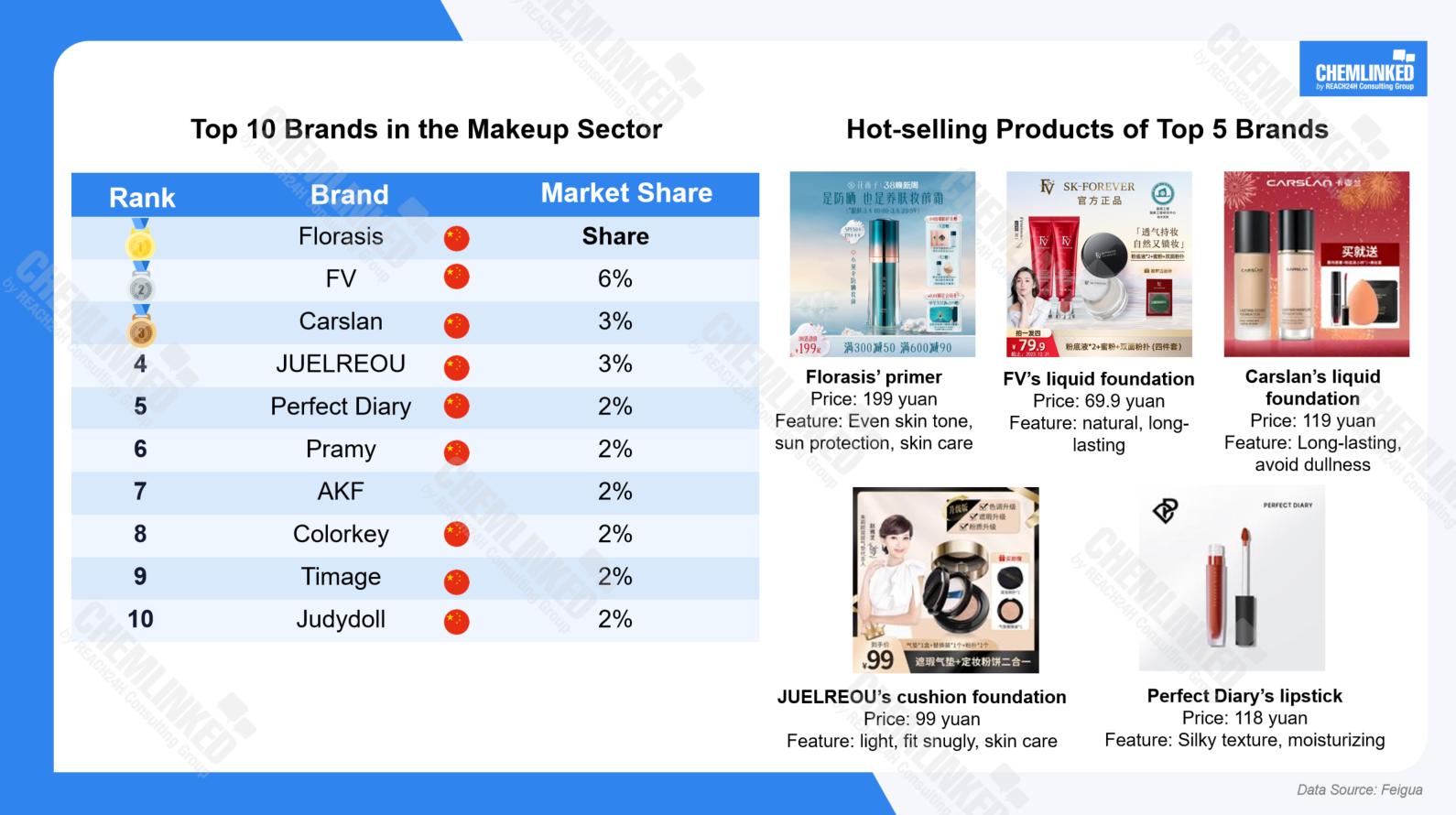

In 2022, the makeup sector on Douyin continued its rapid growth, with a YoY increase of 66% in GMV, 38% in monthly product promotion, and 119% in monthly active KOLs. In terms of brand landscape, the makeup sector was dominated by Chinese brands in 2022. Besides, competition in this sector was not highly concentrated, with the top 3 brands (CR3) accounting for a share of about 12%, and top 10 brands (CR 10) of about 26%. But as international makeup giants such as 3CE, YSL, Mac, and Lancôme have settled in Douyin and established live-streaming matrix, they are likely to snatch market share from Chinese brands aggressively.

By category, facial makeup held the leading position with a share of about 53% and a high growth of nearly 70% YoY in GMV. Within the facial makeup category, all segments showed a growth trend. In particular, cushion foundation saw a 101% YoY increase, with a share of 18.5% second only to liquid/cream foundation. Makeup sets category, despite a relatively small scale, had the highest growth driven by demand for gift-giving during holidays such as Valentine's Day, Mother's Day, Christmas, etc. Therefore, there is potential to tap into this category.

Take Florasis, the top-ranking Chinese brand in the makeup sector, as an instance. Despite a smaller product line compared to other makeup brands, Florasis has achieved over one billion yuan in GMV through a matrix of signature products as part of their product strategy. The brand has developed a range of explosive products with a strong focus on facial makeup, contributing to 70% of its total GMV. Furthermore, Florasis continually improves its signature products to cater to the ever-evolving needs of consumers.

In terms of marketing, Florasis positions itself as a high-end Chinese makeup brand with the oriental aesthetics. Moreover, by establishing a refined brand-owned account matrix and leveraging a multi-tiered influencer marketing strategy for live streaming and product seeding, Florasis has successfully engaged with consumers from various perspectives and effectively converted traffic into sales.

Sales Channel

On Douyin, live streaming remains the primary sales channel of beauty products, contributing to about 75% of the GMV, followed by shelf E-commerce and promotional short videos with purchase links. Specifically, live streaming includes influencer live streaming and brands' self-hosted live streaming.

Influencer live streaming involves brands entrusting live streamers to hawk the brands' products in their live streaming channels where products can get sufficient exposure in a short period of time, and audiences' purchasing desire are heightened. This approach is especially effective for promoting new products and driving explosive sales growth. Notably, in the increasingly competitive online market, vertical influencers with insights into the beauty market trends and targeted consumers tend to achieve higher conversion rates.

Brands' self-hosted live streaming allows brands to proactively and flexibly promote and sell their own products, accumulating private traffic and achieving long-term brand exposure. Therefore, brands have placed great emphasis on self-hosted live streaming, and built account matrix for continuous live streaming. Top Chinese beauty brands have performed noticeably well in self-hosted live streaming with an average proportion of over 50% in the total GMV of live streaming. Many international brands have also adopted this strategy, such as Olay, whose self-hosted live streaming during the 618 Shopping Festival in 2022 reached 29.9 million yuan, contributing 50.9% of the brand's total GMV during the event.

Shelf E-commerce has emerged as a new growth channel on Douyin. In 2022, the GMV of beauty products sold through Douyin Mall skyrocketed by 491% YoY, accounting for 16% of total GMV. This suggests that Douyin has expanded its E-commerce strategy beyond the traditional interest-based logic of "products seeking buyers" to include a new shelf-based logic of "buyers seeking products". Through an extensive selection of products on the "shelf" and comprehensive E-commerce services, Douyin has been able to enhance customer retention and capture their loyalty.

REACH24H, the creator of ChemLinked, has extensive expertise in managing Douyin (TikTok) and has formed strong collaborations with more than a thousand KOLs. The comprehensive services of REACH24H, such as flagship store management, short video promotion, self-livestreaming of stores, and KOL-invited livestreaming, assist brands in gaining wider recognition and boosting sales simultaneously.

We are delighted to share with you one of our successful cases, where we effectively utilized Douyin to lead a UK health brand to achieve remarkable success in the Chinese market. For further information, please email contact@chemlinked.com.