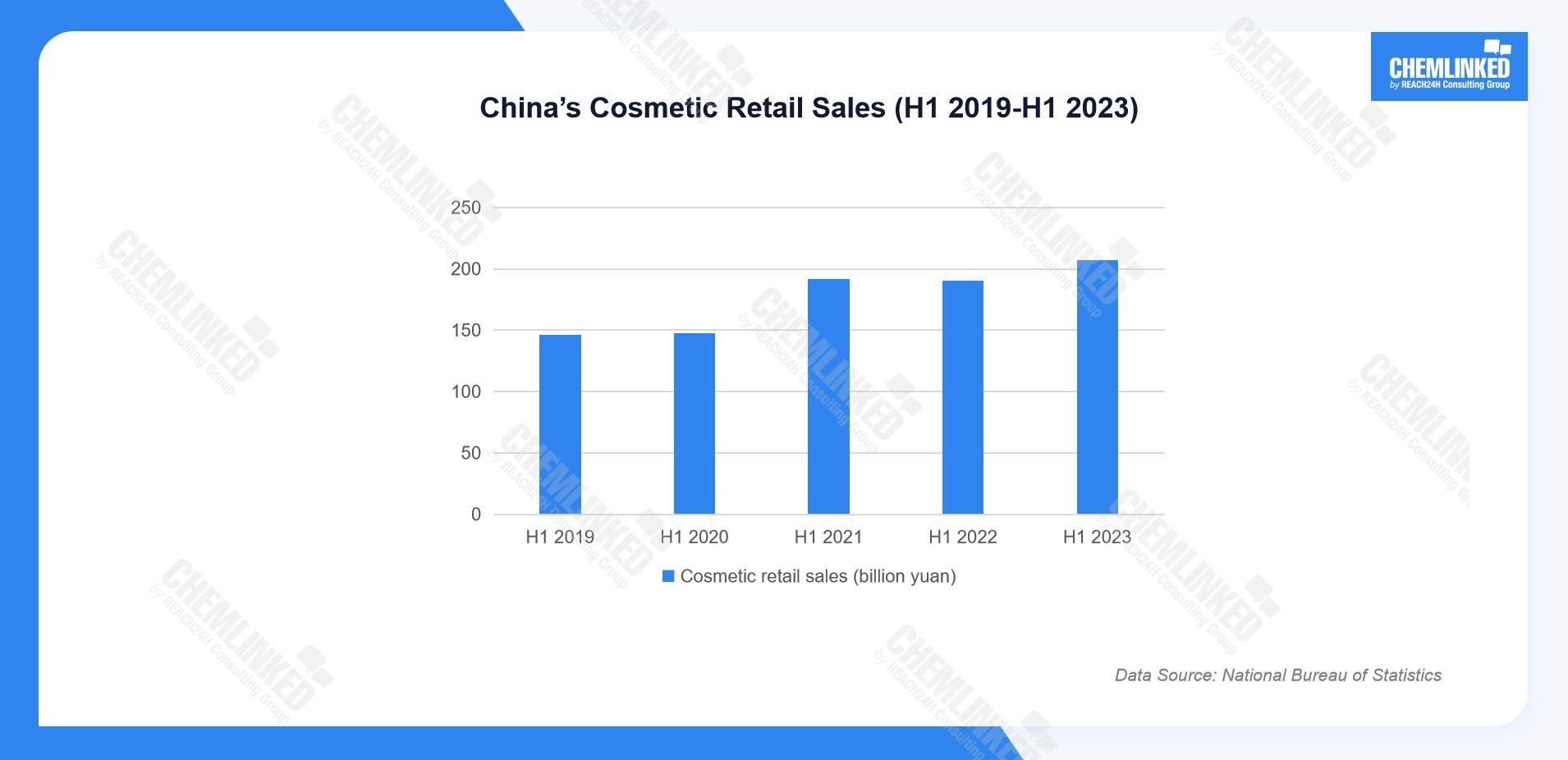

In H1 2023, China's cosmetic retail sales reached a record high of 207.1 billion yuan, marking impressive growth compared to the same periods in the preceding years. Specifically, it witnessed a substantial increase of 41.70% compared to H1 2019, 40.20% compared to H1 2020, 8.05% compared to H1 2021, and 8.74% compared to H1 2022.

With consumer confidence rebounding in the Chinese market, Douyin beauty has sustained its momentum of rapid growth. Unlike the overall stabilization observed on Ali platforms, Douyin beauty is experiencing an ongoing and robust surge, moving closer to the scale of Ali platforms. According to Sinolink Securities, in H1 2023, the total gross merchandise volume (GMV) of beauty products on Douyin exceeded 76.6 billion yuan, reflecting an impressive year-on-year (YoY) growth of 54.8%. Among these figures, the GMV of skincare products surpassed 50 billion yuan, securing a market share of over 65% in Douyin beauty. The GMV of makeup products on Douyin reached over 15 billion yuan.

Skincare

In the skincare category, four distinct subcategories—emulsions/creams, facial skincare sets, facial masks, and liquid essences—dominate the market share. Subcategories showing the most impressive growth are essence ampoules, essential oils, and emulsions/creams, each experiencing a YoY growth of 145%, 127%, and 113% respectively.

Regarding the competitive landscape, international brands have strengthened their presence. In H1 2023, international brands secured over half of the spots in the monthly Top 10 rankings, with L'Oréal claiming the top position for four months. Remarkably, L'Oréal has already surpassed 1 billion GMV within the first half of the year, setting a new record. Additionally, international brands have showcased remarkable performance during significant promotional occasions. For instance, driven by the June 18th E-commerce Shopping Festival, the top five brands in June were all international brands. Among local brands, Proya and Kans have firmly established themselves at the forefront. Particularly striking is Kans' performance in the first half of the year, significantly driven by Kans' strategies such as brand-hosted livestreaming and a compelling series of short videos created in collaboration with influencers. This exceptional performance has positioned Kans as a dark horse in Douyin beauty.

It's noteworthy that local and international brands employ different marketing strategies during major promotional months and regular sales months. Chinese domestic brands consistently prioritize regular and long duration brand-hosted livestreaming, with influencer collaborations as supplementary tactics, regardless of the sales period. For instance, Kans' brand-hosted livestreaming accounted for over 70% of their marketing efforts from January to June, and even reached 80% in April and May. Kans has established a matrix of brand-hosted livestreaming accounts on Douyin, with its "Kans official flagship store" account leading the beauty sector's brand-hosted livestreaming rankings in H1 2023.

On the other hand, international brands adopt different approaches for major promotional and regular sales months. Brands like Helena Rubinstein, La Mer, and Lancôme primarily focus on brand-hosted livestreaming during regular sales months, whereas during major promotional months, they shift their focus to influencer livestreaming for maximum impact.

Makeup

In the makeup category, facial makeup accounts for nearly half of the share, with liquid foundation, cushion products, and prime as the three most popular subcategories. Beyond facial makeup, the demand for lip makeup gradually recover, contributing to 15% of the overall share.

Chinese brands hold a favorable position in the makeup category. Specifically, while Florasis has consistently held either the Top 1 or Top 2 position, more Chinese brands have secured spots in the Top 10 rankings during the first half of 2023. It's also noteworthy that second brands of Chinese beauty enterprises are making significant strides. For example, Timage under Proya, and Passional Lover under Marubi have maintained a consistent presence in the Top 20 rankings in H1 2023, with Timage even making an impressive presence among the Top 10 in May.

Beauty Device

The beauty device category sustained the impressive growth momentum observed in the previous year, with a growth rate exceeding 100% in H1 2023. The market share of facial beauty devices is highly concentrated among the top brands, with the Top 5 list of January to June being dominated by the same brands—Jmoon, AMIRO, YA-MAN, NOWMI, and JOVS.Chinese brand Jmoon has witnessed remarkable performance. It achieved sales exceeding 900 million yuan and captured over 10% of the market share within just six months, firmly securing its top spot in this category, and outperforming longstanding frontrunners like YA-MAN and AMIRO.

The high growth of Israel's brand NOWMI and the Swiss brand GEMO is also worth highlighting. NOWMI's sales on Douyin surged from less than 10 million yuan last year to over 400 million yuan in H1 2023, maintaining a presence in the Top 5 rankings. In addition, GEMO, which officially entered the Chinese market in 2022, strategically began its Douyin campaign earlier this year. With a strong push in May and June, it broke into the Top 10 list, achieving over one hundred million GMV in less than six months after entering Douyin.

REACH24H, the creator of ChemLinked, has extensive expertise in managing Douyin (TikTok) and has formed strong collaborations with more than a thousand KOLs. The comprehensive services of REACH24H, such as flagship store management, short video promotion, self-livestreaming of stores, and KOL-invited livestreaming, assist brands in gaining wider recognition and boosting sales simultaneously.

We are delighted to share with you one of our successful cases, where we effectively utilized Douyin to lead a UK health brand to achieve remarkable success in the Chinese market. For further information, please email contact@chemlinked.com