Contents

Market Condition

Company Dynamics

E-commerce & Social Commerce News

Financial Results

Regulatory Compliance

Market Condition:

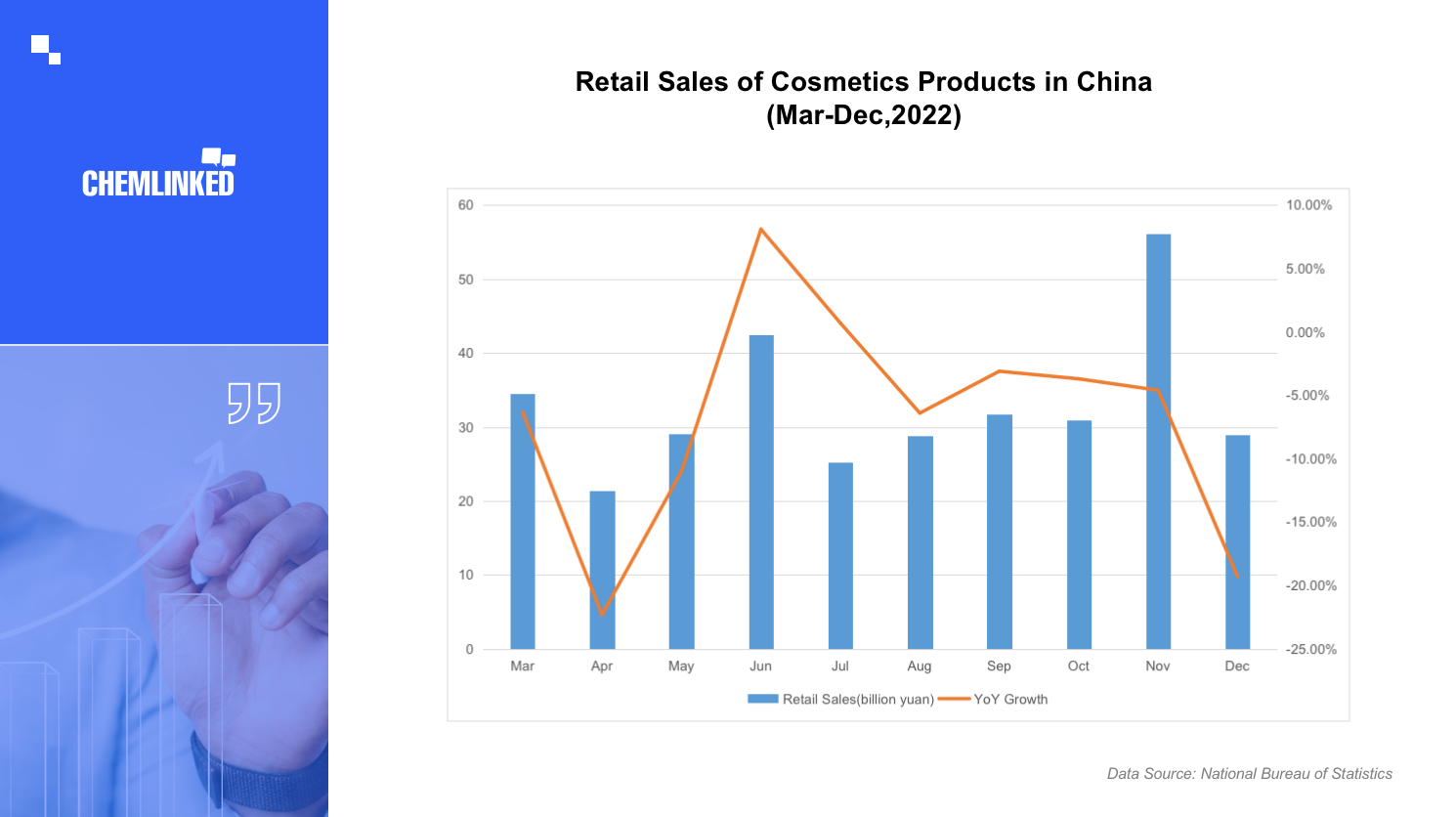

According to the National Bureau of Statistics, the total retail sales of cosmetics in 2022 was RMB 393.6 billion, with a year-on-year decrease of 4.5%. The retail sales of cosmetics in December 2022 were RMB 29 billion, with a YoY decline of 19.3%. The statistics of online shopping platforms, including Tmall, JD, TikTok, Kuaishou, etc., collected by e-commerce data analysis platform Shanzhizhen indicated that the retail sales of personal care products, facial care products, perfume and make-ups in 2022 decreased on a YoY basis. Instead, shampoo, hair care products and cosmetic instruments had a YoY increase.

2. According to the General Administration of Customs of China, the total import value of cosmetics and toiletries from January to December 2022 was RMB 149.35 billion, down 7.3% YoY. In December 2022, China's import value of cosmetics and toiletries was RMB 10.72 billion, a YoY decrease of 23.2%.

3. In 2022, 179 enterprises in cosmetic fields announced the completion of different rounds and types of financing. The total investment for these financing events reached about RMB 29.88 billion, a YoY increase of 98.56% compared with RMB 15 billion of the previous year. While perfume and functional skincare are still attractive tracks for financing, beauty collection stores have also received several rounds of investments within a few months.

4. Brands under two cosmetic giants, L'Oréal and Estée Lauder, such as Kiehl's, HR, La Mer, etc., planned to raise prices of various products among categories including perfumes, make-ups, skin care products, etc. The price growth rate of perfumes was approximately 10%, make-ups was about 7% and skin care products was around 5%. Estée Lauder explained that the reasons were mainly the increasing cost of raw materials, transportation, storage and frequent changes in international exchange rates.

Company Dynamics:

1. Guangzhou Uniasia Cosmetic Technology Co., Ltd., a Chinese cosmetic enterprise with brands in skin care, body care and hair care fields, submitted a prospectus to be listed on the GEM of Shenzhen Stock Exchange on December 31, 2022. It plans to raise RMB 607 million, among which RMB 405 million will be used for brand construction and promotion projects, RMB 107 million for intelligent manufacturing and information system upgrading projects, RMB 55.46 million for R&D centre upgrading projects, and RMB 40 million used to supplement working capital. The basic financial data of Uniasia Technology in recent years was as follows:

2. P&G will migrate the international trade supply chain control centre from Europe to Guangdong this year. The centre then will take over the duty of regulating import and export businesses from the countries in RCEP and in the One Belt and One Road. This movement will set up P&G’s strategic layout in which Great Bay Area in China as the core and further radiate the Eurasian market.

3. Aoxmed, a high-end skin care brand of Botanee, founded its initial offline shop in Beijing Hanguang Department Store. The brand has also set up its online flagship store on Tmall previously and launched different product categories like essence, cream, mask, cleanser, etc. With focus on the 3R skin care concept, namely repair, rejuve and retain, Aoxmed aims to integrate functional skin care products with professional beauty projects. Through the development of Aoxmed, Botanee hopes to broaden the firm’s product range and open up the high-end market.

4. Uraige, a French brand for sensitive skin, stopped operating its Tmall stores on December 31, 2022. The brand’s official stores on Xiaohongshu and TikTok have also been shut down. The probable reason of the close was brand’s transformation to self-operation. But as one of the initiators in the Chinese sensitive skin market, Uraige’s fame has indeed faded in recent years amid this competitive market due to lack of promotion and new products.

5. Sisley has updated the formula of its ecological compound for the first time in 42 years. After the update, more active substances like glycine soja seed extract, arctium majus root extract and spiraea ulmaria extract were added and the proportion of active plant substances became higher. The matrix was updated to the combination of plant oil represented by avocado fruit fat and synthetic fat instead of mineral oil and emulsifier, which more catered to the purity concept advocated by the current market.

6. Mac, a well-known cosmetic brand of Estée Lauder, rolled out a new range of skin care products named Hyper Real, which includes three products: serum, cream and cleaning oil. The prices are between 340 and 480 yuan. As Mac’s first professional skin care products, the new range is designed to both improve skin and enhance make-up results, and is probably a trial for Mac to enter the skin care market. Currently, Chinese domestic channels to buy the products are official website and online shopping platforms like Taobao, JD, etc.

E-commerce & Social Commerce News:

Xiaohongshu announced that business posts on the platform would not necessarily have the cooperation signal from January 5, 2023. The Xiaohongshu platform is well-known for its function to recommend useful products for users. Many authors on Xiaohonshu will cooperate with brands and release recommendation posts. In the past, authors had to display cooperation sign in the post if it contains promotional content. But currently, authors can choose to cancel the sign after in agreement with brands, which is regarded as a step to weaken users’ perception of advertising and increase their willingness to comment and interact.

Financial Results:

1. The total revenue and profit from recurring operations of LVMH in 2022 were 79.2 billion euros and 21 billion euros respectively, both up 23%. All business groups of LVMH achieved significant organic revenue growth over the prior year. The Perfumes & Cosmetics business group recorded 17% revenue growth in the first quarter of 2022 and had a year-on-year increase of 10% to 7.72 billion euros.

2. The sales volume of Johnson & Johnson in Q4 2022 was USD 23.7 billion, with a YoY decrease of 4.4. The net earnings were USD 3.52 billion, decreasing 25.7%. The decrease was mainly caused by unfavourable foreign exchange and reduced COVID-19 vaccine sales compared with the previous year. The full-year sales grew 1.3% to USD 94.9 billion, primarily driven by strong commercial executive ability, but partially offset by unfavourable foreign exchange.

3. The net sales of P&G from October to December 2022 were USD 20.8 billion, a drop of 1% versus the prior year. Organic sales increased 5%, excluding the impacts of foreign exchange, acquisitions and divestitures. The net profit was USD 4.0 billion for the quarter, with a YoY decrease of 7%.

4. The sales of LG H&H (The Company), Ltd. decreased 10.6% YoY to 1.8 trillion won in Q4 2022. The operating profit plunged 46.5% YoY to 129 billion won. The full-year sales were 7.2 trillion won with a YoY decrease of 11.2%, and the operating profit was 711 billion won with a YoY plunge of 44.9%. It has been the first decline of LG H&H in full-year sales in the recent 18 years. The beauty department suffered the most severe decline. The total sales of beauty business in 2022 decreased 27.7% YoY to 3.2tr won, and the operating profit fell 64.7% YoY to 309bn won. The overall decline was because of the sluggish in both domestic and global markets impacted by worldwide economic recession. The plunge in beauty business was mainly influenced by macroeconomic pressures in China due to prolonged COVID-19 related issues and consequent weak demand.

Regulatory Compliance:

1. On January 18, 2023, China’s National Medical Products Administration (NMPA) issued a notice, further optimizing the management measures for the notification testing of general cosmetics. Under certain conditions, notifiers or entrusted manufacturers of Chinese domestic low-risk cosmetics are allowed to conduct self-testing and submit the product self-testing reports as part of notification dossiers. More details on ChemLinked.

2. On January 12, 2023, NMPA released the finalized Measures for the Management of Cosmetic Sampling Testing, which will be implemented on March 1, 2023. The Measures is divided into 8 chapters and 61 articles, providing detailed requirements on the formulation of sampling testing work plan, sampling, testing and result submission, objection and re-testing, verification and disposal of unqualified products, as well as information disclosure. More details on ChemLinked.

3. On Jan. 19, 2023, China National Institutes for Food and Drug Control (NIFDC) released the draft of Technical Guidelines for Determination of New Cosmetic Ingredients for public consultation. The draft regulates the principles for the determination, classification and naming of new cosmetic ingredients. All notifiers and registrants of new cosmetic ingredients shall conduct research and safety assessment in accordance with the requirements prescribed. More details on ChemLinked.