Contents

Market Condition

Company Dynamics

Interesting & Noteworthy Products

E-commerce & Social Commerce News

Regulatory Compliance

Market Condition

Market Condition

1. According to the National Bureau of Statistics, China’s dairy production in Dec 2022 was 2.67 million tons, down 6.1% year-on-year (YoY). Total dairy production in 2022 was 31.18 million tons with a YoY increase of 2.0%.

2. According to the General Administration of Customs of PRC (GACC), in Dec 2022, China imported 252.1 thousand tons of dairy products, with a YoY decrease of 6.4%. The import value in Dec grew by 12.7% YoY to 7.86 billion yuan. The total import volume of dairy products in 2022 declined by 17.1% to 3.27 million tons, with total import value of 92.73 billion yuan, an YoY increase of 3.6%. Among the overall imported dairy products, the volume of imported milk powder was 1.3 million tons, down by 15.4% YoY. The value of imported milk powder was 58.84 billion yuan, a slight growth of 2% YoY.

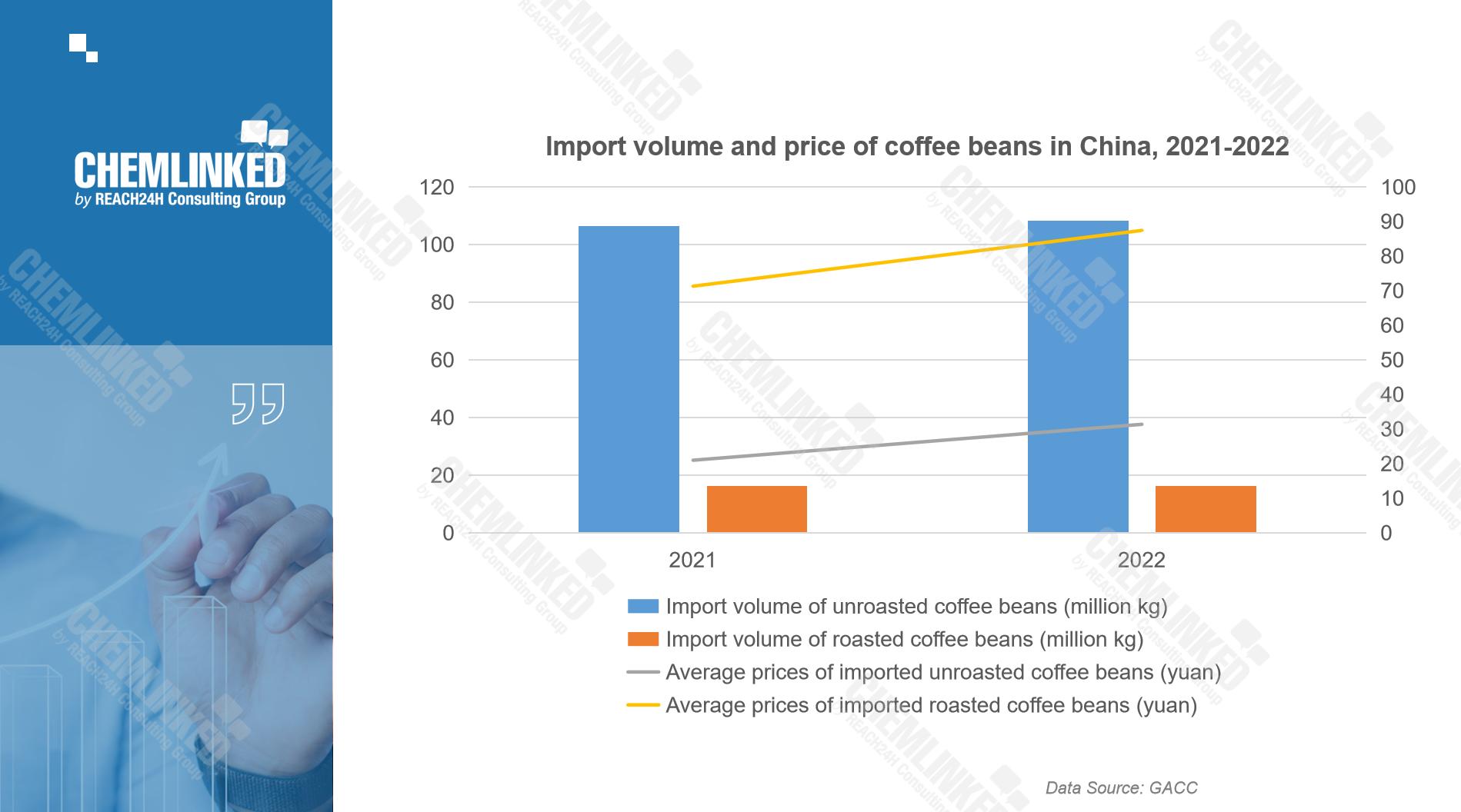

3. According to GACC, in 2022, the volume of imported coffee beans remained relatively stable over 2021, but the average price rose significantly. Specifically, the import volumes of roasted and unroasted coffee beans were 16.36 and 108.26 million kg, respectively, almost the same as those of 2021. Regarding prices, the average prices of imported roasted and unroasted coffee beans were 87.45 and 31.39 yuan per kg, up 22.61% and 49.42% YoY respectively.

In terms of origins of unroasted coffee beans, imports from Ethiopia and Indonesia grew prominently by 127.84% and 97.95% YoY, reaching 29.97 and 9.65 million kg. Imports from Brazil was 19.85 million kg, a moderate increase. However, imports from Vietnam dropped by 28.47% YoY to 23.15 million kg.

4. As of January 31, 2023, 22 dairy groups have registered 244 recipes that comply with the new national standards for infant formula. Feihe is in the leading role with 45 recipes, followed by Junlebao and Nestle with 36 and 28 recipes respectively. Yili, Beingmate, and Wondersun each has 18 recipes. Danone has 12 recipes. Among all the recipes, 30 are goat milk recipes.

5. According to JD's 2023 CNY Consumer Trends, sales of pre-made dishes increased more than six folds compared to the previous year. In addition, the overall sales of gift boxes increased by more than 50% YoY . Sales of Chinese liquor and dried fruit gift boxes grew by more than 10 times, while sales of fruit, baking, and seafood gift boxes rose by more than three times. Cherry gift boxes remained the top-selling in the fruit category with a YoY growth of 102%.

6. After the Chinese government terminated zero-COVID policy and lifted most COVID restrictions in early December 2022, COVID quickly swept across the whole country. In Jan 2023, the keyword "coenzyme Q10" gained more than 100 million views and 10,000+ discussions on Chinese social media Weibo. On China’s leading online shopping platform Taobao, the search volume of this keyword has soared by more than 2,500%. In offline shopping channels, the sales of CoQ10 supplements also rose sharply. Some brands even ran out of stock for a time. More details on ChemLinked.

Company Dynamics

1. AustAsia, a leading Chinese cow farm operator, completed its IPO and was listed on the main board of the Hong Kong Stock Exchange. From 2019 to H1 2022, AustAsia produced 565,400 tons, 582,800 tons, 638,800 tons and 359,200 tons of raw milk, respectively. In 2021, AustAsia ranked third, fourth, and fifth in terms of raw milk sales volume, sales revenue, and output among all cow farm operators in China, with a market share of 1.6%, 1.8%, and 1.7%, respectively. Its customers are diversified downstream dairy manufacturers, including Mengniu, Yili, Meiji, Junlebao, Xinjiang Dairy, etc. According to its prospectus, from 2019 to H1 2022, AustAsia achieved revenues of approximately USD 352 million, USD 405 million, USD 522 million, and USD 278 million, respectively.

2. Coca-Cola's bottling partners in China, COFCO Coca-Cola and Swire Coca-Cola, have completed the acquisition of Coca-Cola China's non-carbonated beverage business in January 2023. Coca-Cola China stated that this equity transfer would enable regional production of non-carbonated beverages, optimize production management efficiency, and enhance supply chain collaboration. The transaction involves the business of functional water, juice, tea, dairy beverage, and coffee, with major brands such as Minute Maid, Aquarius, Purejoy, Chunchashe, and bottled beverage of Costa Coffee.

3. Be-Kind, an energy bar brand under Mars, discontinued its business in the Chinese mainland market. The production line located in Jiaxing are retained for export purpose. The brand stated it had not have a sustainable development model despite great efforts made. According to Euromonitor, the total retail sales of the Chinese energy bar market was 1.16 billion yuan, with the top six players (including Xiwang Food, ffit8, OTSUKA, CPT, By-Health, Herbalife) accounting for 67% of the market share. Other players are challenged in such a highly-concentrated energy bar market. Even so, Mars expressed its confidence in the Chinese market and planned to provide more high-quality products catering to consumer demands.

4. Dolce Gusto, a high-end capsule coffee machine brand owned by Nestle, has authorized UBOX as the first self-service capsule coffee machine distributor in China. Their strategic cooperation project will be piloted in first-tier cities in Q1 2023. The two sides integrate their advantages and resources to achieve rapid growth. Specifically, UBOX will be responsible for developing outdoor self-service capsule coffee machines and distribution landscape. Dolce Gusto will supply coffee capsules and provide suggestions on machine development, product selection, and brand communication. UBOX has ranked first in the recent three years in China’s self-service retail industry. Through partnering with UBOX, Dolce Gusto aims to expand its customer base and boost capsule coffee sales.

5. According to information from the official website of the State Intellectual Property Office, Chi Forest was granted a new patent for a bottle label design. The label indicates a natural, weak alkaline water beverage with white peach flavor, aptly named "Forest Water" which highlights the exceptional quality of the water source. The product is still in its incubation phase. If "Forest Water" is commercialized successfully, it will become Chi Forest's first natural drinking water brand in the competitive bottled water market, bringing new growth for this beverage unicorn enterprise.

6. Yili launched the "Online Tour: Networking Yili’s Global Value Chain" activity for consumers worldwide. It was the first time Yili opened its global industry chain which spanned multiple continents to consumers. Through live streaming, short videos, virtual scenes, and other forms of media, Yili showcased its high-quality pastures, production bases, as well as research and innovation centers worldwide in a more open and transparent way.

7. Tims China, a world-famous coffee chain in China, announced its official Chinese name as "天好咖啡". It is an important market strategy of Tims China, aiming at further deepening its presence in the Chinese market through localized innovation and improved consumer experience. The brand has opened over 500 stores as of Oct 2022, and is accelerating towards its goal of 2,750 stores before 2026 through speeding up the expansion in lower-tier cities.

8. Mondelēz Suzhou has officially joined the World Economic Forum's global "Lighthouse Factory" network, becoming the first "end-to-end" lighthouse factory in the global snack and biscuit industry. Lighthouse factories are hailed as the "most advanced factories in the world", representing the highest level of intelligent manufacturing and digitalization in today’s manufacturing industry. By utilizing the fourth industrial revolution technologies such as artificial intelligence, 3D printing, and big data analysis, Mondelēz has digitized and transformed their linear supply chain into an integrated intelligent supply ecosystem, resulting in 18% increase in on-time delivery and 32% reduction in delivery time.

9. Japanese probiotic brand Yakult raised the prices of its two probiotic drinks, "Yakult" and "Yakult Light", in China to pass on the increased cost of raw materials to consumers. The price increase ranges from 8.7% to 14.3% in different regions of China. As consumers are particularly concerned about boosting immunity since the lifting of COVID-19 restrictions, the demand for probiotic products in China has resulted in the shortage of both probiotic products and raw materials. This may have been a significant factor in Yakult China's decision to raise prices.

10. PepsiCo Global Business Services Center (Chengdu) was launched in the Chengdu Hi-tech Zone. It is PepsiCo's first global business service center in the Asia-Pacific region and the sixth globally, expecting to promote digital strategies and improve innovation in local market. As a significant part of PepsiCo's Greater China operations, the Chengdu Center performs six functions: sales, supply chain, human resources, integrated consumer management, financial planning, and global procurement. The Center will provide efficient and adaptable solutions to accelerate the development of PepsiCo's Greater China.

11. The Chinese cola brand Tianfu Cola surged in popularity due to misleading information of bankruptcy. Driven by a passion for national brands, many consumers rushed to Tianfu Cola’s Tmall store to show their support. Data shows that on January 4th, the daily revenue of Tianfu Cola's Tmall store skyrocketed by 17 times. Similar incidents, including the surging sales of Baixiang food in 2022 for its entrepreneurship and national righteousness, reveal that Chinese consumers have increasing recognition of cultural identity and renewed interest in national brands.

12. After announcing that their products would be labeled with suggested retail prices on the packaging, Zhongxuegao planned to launch a subsidiary ice cream brand called “Zhongxuebugao” in March 2023, priced at 3.5 yuan, with flavors including red bean, mung bean, milk, and cocoa. In recent years, Zhongxuegao has been on the rise in China’s ice cream industry with its high-end positioning and strong brand marketing. Despite public relations crises due to high prices, Zhongxuegao's online sales has remained in a leading position in the past two years. Industry insiders believe that the emergence of "Zhongxuebugao" may indicate that Zhongxuegao is further deepening its layout in traditional offline channels and sinking markets.

13. Top e-commerce operation company Ruoyuchen exclusively invested millions of yuan in a high-end pet functional main food brand called "BRIGHT brand." The brand provides high quality pet food with focuses on pet’s gastrointestinal health, fur beauty, and body management. Their star products, the full-priced canned cat food and dry food, respectively won the first place in 2022's overall sales and Tmall's "Double 11" sales. This is Ruoyuchen's third foray into the pet market, following its investment in "Best Care"—a pet health food brand and "More Care”—a pet diagnosis and treatment brand. Ruoyuchen stated that with the continuous upgrading of pet-raising concepts and the growing lonely economy, the pet market would see continuous growth in the future.

Interesting & Noteworthy Products

1. Chi Forest launched a new series of super carbonated drinks called MAXXTM, with emphases on "super-stimulation," "super-refreshing," and "super-icy." Being added with concentrated green plum juice, the new product features a refreshing and ice-cold taste. MAXXTM contains sucrose rather than zero-sucrose as Chi Forest’s sparkling water. The new products are currently available online, with a promotional price of 75 yuan for a pack of 15 bottles (480ml). It mainly aims at consumption scenarios of electronic games and sports scenes.

2. China's leading functional beverage company, Dongpeng Beverage, launched a new electrolyte water product, "Dongpeng Water Replenishment." The product is available in two sizes, 555ml and 1L, with retail prices of 4 yuan and 6 yuan, respectively, to meet the different consumption and sports scenarios. Since the lifting of pandemic restrictions, electrolyte water brands such as Alienergy, Pocari Sweat, and Scream have become popular due to their perceived ability to replenish trace elements and boost immunity. Although panic buying has subsided, people's habit of drinking electrolyte water has been strengthened, leading to a positive development for the industry. More details about market and regulatory compliance of electrolyte drink industry in China

3. DANONE launched "YouBai", a new high-end protein milk drink brand, on DANONE China Beverages' JD flagship store (the official JD store for DANONE’s product Mizone). This milk drink, which blends animal and plant-based proteins from sources like milk, soy and oat, is positioned to health-conscious consumers aged 18 to 40 for breakfast, post-workout snacks, and light meals scenarios. The new product is part of DANONE's strategic push into the protein drink market in 2023, which aims to diversify its business in China and tap into the trendy "plant-based" concept to further expand its market share.

4. Following the launch of the Budweiser Master Legend Tiger Limited Edition last year, in Jan 2023, Budweiser launched the Leaping Rabbit Limited Edition of the Budweiser Master Reserve Beer, with only 5,000 sets available worldwide, priced at 1,588 yuan. In terms of craftsmanship, the innovative "double-barrel" techniques endow the Limited Edition with better flavor and aroma. In terms of packaging design, by combining Chinese traditional culture with trendy elements, the Limited Edition enable consumers to feel a sense of ceremony, dignity, and profound cultural heritage at the first sight. The bottle cap was decorated with a delicate leaping rabbit made of real gold, which can be collected as an exquisite art collection.

5. Nestle launched its first low-temperature fresh milk in China—Nestle A2 β-casein fresh milk, targeting the high-end market. At present, the milk is available in two bottle sizes, 236ml and 650ml priced at RMB17 and RMB48 per unit respectively. After entering the low-temperature fresh milk market, Nestle will compete with Yili, Mengniu, Guangming and other enterprises.

E-commerce & Social Commerce News

1. Douyin launched "Douyin Supermarket". Users need to search for "Douyin Supermarket" in the search bar or shopping entrance to enter the online supermarket. The supermarket features a wide range of products, including dairy drinks, instant coffee, paper products, laundry, alcoholic beverages, health care, home cleaning, personal care, beauty, snacks, sweets, maternal and child supplies, grains, oils, and household appliances. As those product categories have a high level of immediate demand, Douyin Supermarket has promised same-day delivery for customers who make a payment before 4:00 pm. This launch is an important addition to Douyin's e-commerce ecosystem, which aims to expand its reach to shelf-based e-commerce while remaining its leading position in the interest-based e-commerce. With deeper attention to the mature shelf-based e-commerce, Douyin is expected to become a more powerful rival of Tmall, JD and Pinduoduo.

Regulatory Compliance

1. On January 19, 2023, China National Center for Food Safety Risk Assessment (CFSA) announced to solicit public opinions on an amendment to GB 14880-2012 National Food Safety Standard—Standard for the Use of Nutritional Fortification Substances in Foods. The biggest change is the introduction of "mass food fortification" and "voluntary food fortification". Along with the introduction of the two concepts, the amendment stipulates and revises the types and usage amounts of nutritional fortification substances that are permitted to be used in the two cases. More details on ChemLinked.

2. ChemLinked reviewed the regulatory updates of food additives in 2022, from the three major links in the new food additive application process: the acceptance, proposal and approval of the application. More details on ChemLinked.

3. ChemLinked reviewed the regulatory updates of new food raw materials in 2022, primarily divided into three types: the approved new food raw materials, new food raw materials under public consultation, and new food raw materials whose applications have been accepted. More details on ChemLinked.