Contents

Market Condition

Company Dynamics

Interesting & Noteworthy Products

Financial Data

Regulatory Compliance

Market Condition

1. According to the National Bureau of Statistics, the total production of dairy products was 23.7 million tons in China from March to November 2022, with a year-on-year increase of 2.8%. The dairy products production in last November was 2.72 million tons, with a year-on-year increase of 4.5%.

2. According to the General Administration of Customs of China, the import volume of infant formula milk powder was 243,400 tons in China from January to November 2022, with a year-on-year increase of 4.5%. The import value of infant formula milk powder was USD 4.07 billion in the same period, with a year-on-year increase of 5%. The import volume of infant formula milk powder in November 2022 was 24,400 tons, with a year-on-year decrease of 2.5%. The import value was USD 396 million, with a year-on-year decrease of 3.9%.

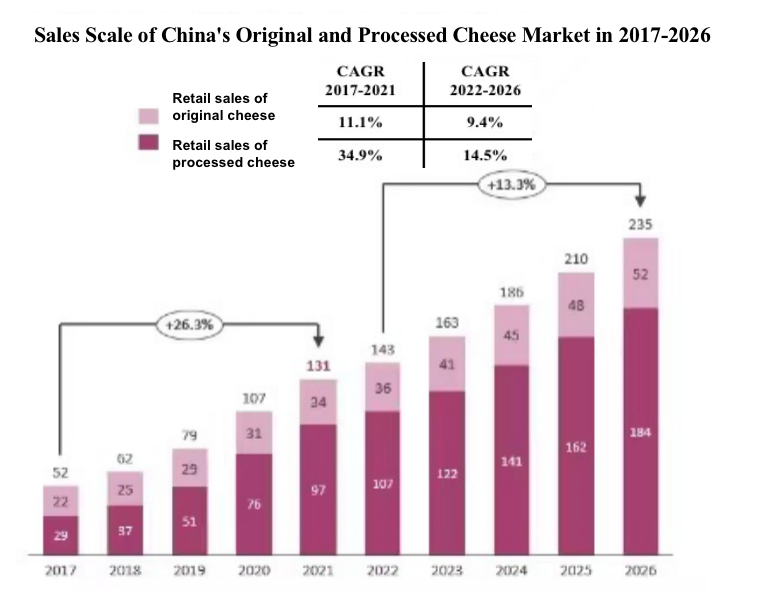

3. Euromonitor’s Global and Chinese Cheese Industry Development Report indicated that in 2021, the shipment volume of cheese in China reached 250,000 tons, with RMB 13.1 billion retail sales. Euromonitor estimated that in 2022, the shipment volume of Chinese cheese would reach 270,000 tons, and the retail sales would arrive at RMB 14.3 billion. In 2026, the shipment volume of cheese in China will come up to 460,000 tons, with retail scale hitting RMB 23.5 billion.

4. A report released by Bain & Company and Kantar Worldpanel indicated that the overall sales figure of China's FMCG market increased by 3.6% in the first three quarters of 2022 compared with the same period last year, with the overall sales volume growing by 5.9%. In Q1-Q3 2022, the sales volume of packaged food increased by 4.6%, and the average sales price also had a 2.6% increase. The sales volume of the beverage category rose by 7.2% in the same period, though the average sales price decreased by 3%.

4. A report released by Bain & Company and Kantar Worldpanel indicated that the overall sales figure of China's FMCG market increased by 3.6% in the first three quarters of 2022 compared with the same period last year, with the overall sales volume growing by 5.9%. In Q1-Q3 2022, the sales volume of packaged food increased by 4.6%, and the average sales price also had a 2.6% increase. The sales volume of the beverage category rose by 7.2% in the same period, though the average sales price decreased by 3%.

5. IiMedia Research unveiled the Top 15 Chinese New Coffee Brands in 2022, including Tasogare, Saturnbird, Yongpu, Catfour, Sinloy, S.engine, Secre, Blackdeer, Zhongka, T97, Summer Forever, Memot, UmeCme, Bulletproof and Xiong Kun Kun. The ranking criteria is based on the evaluation of company’s comprehensive strength, online platform sales figure network popularity, etc.

Company Dynamics

1. On December 14, Abbott China announced adjustments to its nutrition business, planning to gradually quit the operation and sales of infant and child nutritional products from the Chinese mainland market. Instead, it will mainly focus on developing the medical nutrition business. For more detailed information, please see https://market.chemlinked.com/insight/abbott-china-announced-to-gradually-quit-infant-and-child-nutrition-business-in-the-chinese-mainland-market

2. Mars stated to stop the sales of Be-kind’s nuts sticks in the Chinese mainland market. Be-kind is a brand under Mars’ wholly-owned subsidiary Wrigley, which currently has closed its flagship store on Tmall and its WeChat official account.

3. Milkground and Modern Farming will jointly set up a new company named Haoduoniu Animal Husbandry Technology Development Co., Ltd. Milkground will hold 40% equity of the joint venture by investing RMB 204 million, and Modern Farming will acquire 60% equity by financing RMB 306 million. The joint venture will take steps in the construction and acquisition of low-carbon ecological pastures. During this process, Milkground’s demand for milk sources will be prioritised.

4. AustAsia Group, a leading dairy farm operator in China, launched its initial public offering on the main board of Hong Kong Stock Exchange. Owning 10 large-scale pastures in China, AustAsia Group is among the Top 5 pastures operators in China. The enterprise submitted the prospectus in the middle of October 2022 and was successfully listed on the stock market in less than two months.

5. Meadjohnson China announced to launch its first adult nutrition brand Agijoy, as the firm’s latest scientific solution of precise nutrition for people aged 50+ in China. The roll-out of the new brand also implied that the firm’s nutrition product has expanded from the mother-infant field to the whole-life cycle.

6. Tim Hortons China officially released the brand’s Chinese name Tim Tianhao on January 9, 2023. It’s the first time that the brand has announced its Chinese name after its entering in the Chinese market for four years. According to the Tim Hortons official, the use of the brand’s Chinese name is a step of its localisation strategy. It aims to further deepen the Chinese market through localised innovation and consumer experience improvement.

7. Chi Forest (previously known as Genki Forest) announced on December 21,2022 that all of the company’s products in the future would be free of chemical preservatives. It will completely abandon the use of chemical preservatives such as sodium benzoate in all products sold in the mainland of China, and calls on the whole industry to gradually stop using sodium benzoate.

8. Nestlé declared to make a strategic investment in New Ruipeng Pet Healthcare Group. Nestlé’s pet food brand, Purina, will strategically cooperate with New Ruipeng to jointly develop the Chinese pet market.

9. Zesty Paws, a high-end pet nutrition brand under H&H group, joined mainstream cross-border e-commerce platforms in China, such as Jingdong International, Tmall Global and Tiktok Mall. The brand has launched over 100 products covering three series, namely, symptom alleviation, disease prevention, and daily supplement.

Interesting & Noteworthy Products

1. Lay’s launched a high-protein snack, air-popped chicken breast crisp. As a health-oriented product, the new snack contains 30% chicken breast and tastes crispy and joyful.

2. UNIF, a brand under Uni-President, rolled out a new type coconut drink, containing purified water, 30% coconut water, 20% coconut milk, 5% coconut fruit, and white granulated sugar. Compared with coconut drinks based on 100% coconut water, the new coconut drink has richer taste.

3. Chi Forest unveiled a new range of ice tea with two flavours, ice tea with zero sugar and ice tea with 25% less sugar. The product is planned to be fully placed on the market in 2023.

4. Nutrilite launched a new health product named low-sugar lecithin VE powder, featured in effectively emulsifying oil and promoting fat metabolism.

5. Xianlife, a Chinese domestic brand specialising in meat products, rolled out a new kind of sausage that combined with western sausage as the raw material and the Chinese cooking method.

Financial Data

Dairy Enterprises (Q3) | Revenue (RMB) | YoY (%) | Net Profit (Q3) (RMB) | YoY (%) |

Yili | 30.4 bn | 6.7% | 1.93 bn | -26.5% |

Brightdairy | 6.97 bn | -10.5% | 88 m | -52.18% |

Sanyuan | 2.04 bn | -7.18% | 14.85 m | -82.15% |

Beingmate | 2.42 bn | 45.78% | 44.25 m | 14.19% |

Beverage Enterprises (Q3) | Revenue (USD) | YoY (%) | Net Profit (Q3) (USD) | YoY (%) |

Pepsico | 21.97 bn | 8.8% | 2.7 bn | 21.5% |

Coca-Cola | 11.1 bn | 10% | 2.83 bn | 14% |

Suntory | 8.13 bn | 14.8% | 507.4 m | 14.5% |

Snack Enterprises (Q3) | Revenue (USD) | YoY (%) | Net Profit (Q3) (USD) | YoY (%) |

Kellogg's | 3.95 bn | 9% | 310 m | 0.9% |

Hershey | 2.73 bn | 15.6% | 399.5m | -10.2% |

Others | Revenue | YoY | Net Profit | YoY |

Kraft Heinz | USD 6.5 bn | 2.9% | USD 432 m | -41% |

By-health (Q3) | RMB 6.16 bn | 2.18% | RMB 1.48 bn | -10.88% |

Nestle (Q1-3) | USD 74.8 bn | 9.2% | / | / |

Danone (Q3) | USD 7.78 bn | 19.1% | / | / |

Regulatory Compliance

1. On December 7, 2022, China’s State Administration for Market Regulation (SAMR) opened Enforcement Guidance on Absolute Terms in Advertising for consultation. The Guidance specifies the situations that current provisions on absolute terms do not apply to. Direction is given in the Guidance to help market supervision authorities understand how to issue punishment. More details on ChemLinked.

2. China consults on the national food safety standard of General Rules for Foods for Special Medical Purposes. Compared to the 2013 version, the draft mainly revises the FSMP types, labels and technical requirements. More details on ChemLinked.

3. On December 18, 2022, General Administration of Customs of China (GACC) published the list of non-compliant food products in November of 2022. A total of 230 batches of imported food from 36 countries/regions were rejected. More details on ChemLinked.

4. As revealed by a notice released on December 23, 2022, China National Center for Food Safety Risk Assessment (CFSA) is soliciting public opinions on GB 13432 National Food Safety Standard Labeling of Prepackaged Foods for Special Dietary Uses. More details on ChemLinked.

5. According to a notice released by GACC on December 28, 2022, China is to cancel the COVID-19 testing on imported cold-chain foods and non-cold-chain goods from January 8, 2023. More details on ChemLinked.

6. On December 29, 2022, the Certification and Accreditation Administration of China (CNCA) announced an amendment to the Catalogue of Organic Product Certification in China (Catalogue). Since the promulgation of this announcement, certification agencies are allowed to accept the application for organic product certification for products newly included in the Catalogue. More details on ChemLinked.