Contents

Market Condition

Company Dynamics

E-commerce & Social Commerce News

Regulatory Compliance

Market Condition

Market Condition

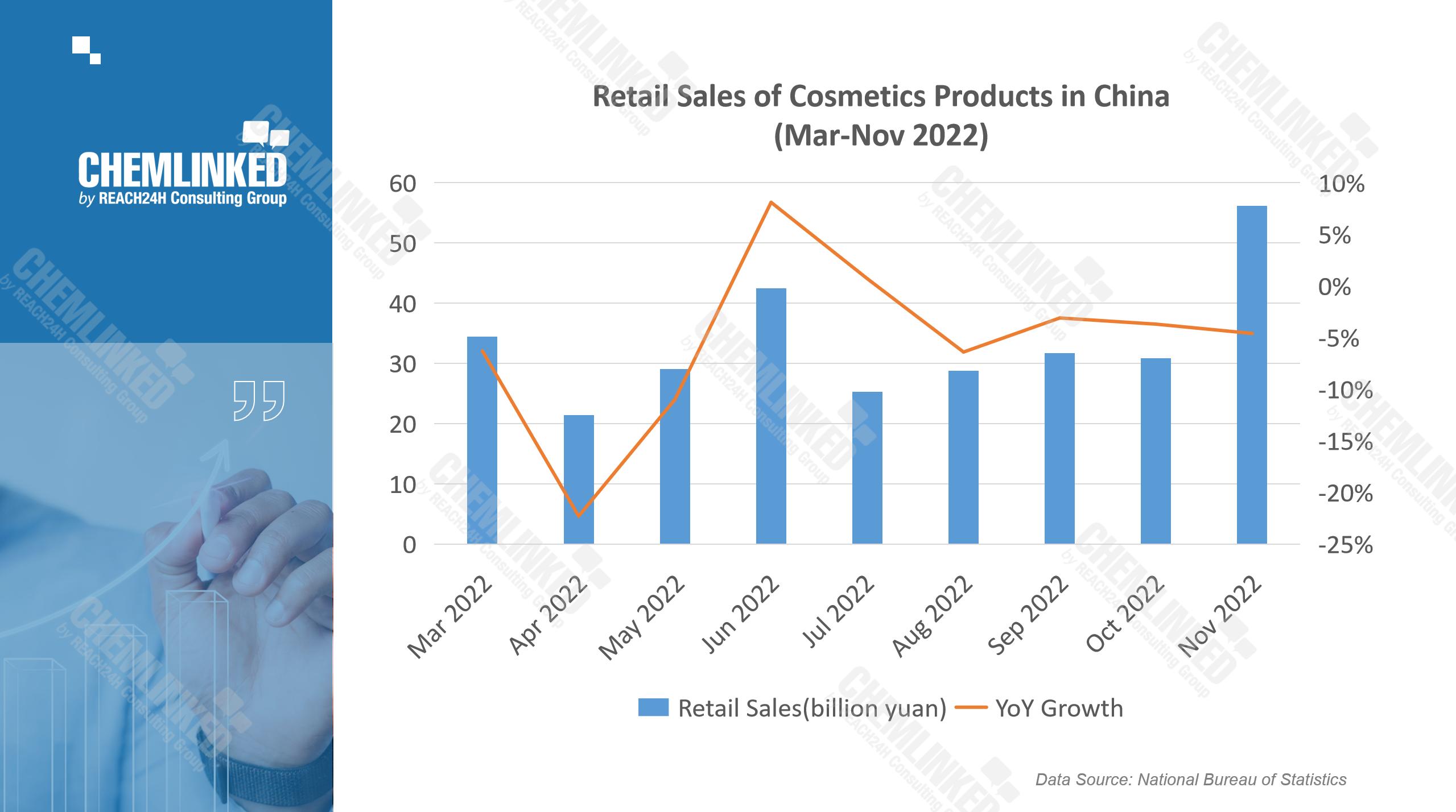

1. According to the National Bureau of Statistics, in November 2022, driven by the Double 11 Shopping Festival, China's retail sales of cosmetics increased significantly on a month-on-month (MoM) basis, reaching 56.2 billion yuan. But, comparing to the same period of 2021, the figure declined by 4.6%. The total retail sales of cosmetics from January to November 2022 dropped by 3.1% year-on-year (YoY) to 365.2 billion yuan.

2. According to the General Administration of Customs of China, in November 2022, China's import value of cosmetics and toiletries was 12.6 billion yuan, a YoY decrease of 11.5%. The total import value of cosmetics and toiletries from January to October 2022 was 138.6 billion yuan, down 5.8 % YoY.

3. According to Beauty Insight, from January to November 2022, there were 85 investments in China's beauty industry. Although the investment decreased by 32% YoY, popular tracks were given great attention. Fragrance, technological skincare, and pure beauty became the focus of investment, while makeup received less attention. In addition, catering to the functional skincare trend, upstream raw material enterprises with synthetic biotechnology were sought after by the capital.

4. After China relaxed the zero-COVID policy at the beginning of December 2022, infections rose sharply. As a result, the heavily impacted production and logistics brought the supply chain of most industries to a standstill. Beauty industry is not an exception. With the gradual recovery of the first-wave of the epidemic and consumer confidence, the beauty industry is expected to usher in a new era in 2023.

5. Eternal and Kantar jointly released the 2022 China Perfume Industry White Paper (hereafter referred to as the White Paper), pointing out that the retail sales of China's perfume market in 2021 was 14.09 billion yuan, a YoY increase of 38.7%. The compound annual growth rate (CAGR) from 2016 to 2021 was 21.4%, about ten times that of the world market. The estimated sales in the Chinese market would reach 37.13 billion yuan in 2026, with a CAGR of 22.3% from 2022 to 2026. In addition, data showed that high-end perfumes were the driving force of the perfume market growth in China.

According to the White Paper, perfume consumption in China showed six trends:

Perfumes have further penetrated daily life, with diversified demand in different scenarios.

Niche perfumes are sought after by consumers to express individuality.

Consumers seek emotional value through wearing perfumes, such as relaxation, comfort, and confidence.

Factors related to health, nature, and cleanness are highly concerned.

Consumers increasingly gain perfume information and buy products through omnichannel approaches.

Perfume has become the first choice for gift-giving.

Note: ChemLinked also analyzes the market size, latest trends, competitive landscape and consumer preferences in the Chinese perfume market. Please click to check ChemLinked's insight into this booming industry.

Company Dynamics

1. Snowberry, a high-end skincare brand under P&G, closed its official store on Tmall. Besides, this brand has deleted all contents on its Douyin account, and stopped updating on Weibo and Xiaohongshu. These signs implied Snowberry's withdrawal from the Chinese market. Snowberry was acquired by P&G in 2018 and entered the Chinese market in 2019 with its signature product—copper peptide serum. However, bumped by many strong competitors in the copper peptide track, Snowberry lost its advantages in the intense competition. Industry insiders indicated that P&G had cut losses in time to focus on its competitive brands.

2. According to F-Beauty's interview with Yu Jian, General Manager of External Affairs of Amorepacific China, the group would introduce its high-end brand AP to the Chinese market in 2023. Besides, Amorepacific would continue to deeply cultivate the Chinese market in three aspects: consumer-oriented product innovation, digital transformation, and sustainable development. As China has become one of the key markets in Amorepacific's global layout, the group is refreshing the brands positioning in China around "high-end", "functional" and "young generation".

3. CHA LING, an oriental skincare brand under the LVMH group, closed all offline stores in China as a result of operation adjustment. Sales through the Sephora channel remained. In addition, KENZO beauty, another high-end beauty brand under LVMH, closed its official store on Tmall and retained the Sephora channel for Chinese consumers. The Q3 2022 financial report of LVMH showed that the revenue of the perfumes & cosmetics sector in the first three quarters of 2022 rose by 12%, but was the slowest growth compared to other sectors under LVMH. Moreover, Asia (including China) saw a lower level of growth over the first nine months of 2022, though growth in Q3 accelerated due to the partial easing of COVID-19 control.

4. Estée Lauder unveiled its new China Innovation Lab in Shanghai to further accelerate growth in the local beauty market. Covering 12,000 square meters, the innovation lab is equipped with collaborative workspaces, interactive testing facilities, and packaging prototype labs as well as a pilot plant to speed up new product launches. There is also a center for consumer experience and live streaming, to engage consumers in the co-creation of new products. Fabrizio Freda, president and CEO of Estée Lauder, indicated that this innovation lab reinforced the group's strong commitment to local consumers by developing products tailored to the specific features of Asian skin, especially Chinese skin.

5. Prada Beauty launched its official flagship store on JD.com. Four perfume series including Les Infusions, Candy, Luna Rossa, and Paradoxe, covering more than 20 perfumes, were put on sale. Early in October 2022, Prada Beauty settled in Tmall and opened the official flagship store.

6. L'Oréal China celebrated its 25th anniversary and opened "Beauty Moves—L'Oréal China 25th Anniversary Exhibition" at Shanghai Exhibition Center. Lasting for a week, L'Oréal China's 25th anniversary exhibition consisted of five sessions: "Beauty Is Diverse and Inclusive," "Beauty Is Innovative," "Beauty Empowers Women," "Beauty Is Sustainable," and "Beauty is Evolving". Over the past 25 years, L'Oréal has developed into China's largest beauty group, and China has become L'Oréal's second-largest market in the world. This exhibition is a new start for L'Oréal's future journey in China.

7. TAKAMI, a Japanese high-end skincare brand under L'Oréal, opened three offline stores in Chengdu SKP, Hangzhou Wulin Intime, and Hangzhou Hubin Intime. The newly opened offline stores provide Chinese consumers with brand-new experience of skin peel care, including skin detection and customized clinic-level skin peel care. Early in July 2022, TAKAMI launched its official flagship store on Tmall. TAKAMI's penetration into the Chinese market unveils L'Oréal's layout in China's high-end skincare market.

8. Armani Beauty opened a new global flagship store—Armonia (a synonym for harmony), in Shenzhen, combining high-tech and high-touch elements. Covering 300 square meters, Armonia is a beauty retail and experience space inspired by art, technology, modernity, and nature. There are five areas in the store, including Ceremony Road, Red River, Experience Lab, Fragrance Wearing, and Light Lab, to provide consumers with high-end skincare service, fragrance customization, and facial makeup analysis. In addition, Armani Beauty is expected to open a flagship store with the same concept in Hainan in 2023.

9. The Face Shop (Shanghai) Cosmetics Sales Co., Ltd., the operating company of well-known Korean beauty brand THE FACE SHOP, was deregistered. Currently, The Face Shop's online channel is operated by Lily & Beauty, an online cosmetics marketing and retail service provider in China. As the share of China's mass beauty market has been increasingly snatched by local brands, LG Household & Health Care Co., Ltd.—the parent company of THE FACE SHOP shifts its focus to the North American market, and mainly exploits high-end market in China through social media like Douyin. During the 2022 Double 11 Shopping Festival, Whoo—the high-end skincare product under LG, ranked first in the beauty category on Douyin and Kuaishou.

10. Florasis located its first offline flagship store—Hidden Garden Next to West Lake, in Hangzhou close to West Lake, becoming the largest offline beauty retail store in China covering 1,000 square meters. By applying Chinese gardening concepts and techniques, the Hidden Garden is constructed as an art-museum-style beauty experience space. To provide customers with more pleasant, artistic, and immersive experience, Hidden Garden consists of five areas, including beauty retail, customized service, social interaction, art exhibition, and cultural immersion. According to the store manager, the Hidden Garden is dedicated to presenting the unique brand image of Florasis, conveying oriental beauty concepts and culture, so as to create more significant and long-term value.

11. UNTAGGED, a digital fragrance base brand featured with the rising genderless concept, was jointly developed by Tmall New Product Innovation Center (TMIC) and international raw material giant Symrise. By leveraging TMIC's powerful consumer data and Symrise's professional resources, UNTAGGED aims to empower fragrance brands throughout the new product creation process, from identifying trends, research and development, and product co-creation, to brand positioning. Brands such as JasBaby, Aroma Naturals, and KONGBAI are using UNTAGGED to customize gender-neutral scents for Chinese consumers.

12. Chicmax, the parent company of Kans, One Leaf, and Baby Elephant, was listed on the main board of the Hong Kong Exchanges under the ticker symbol 02145. HK. This successful listing was secured after two failed attempts in 2018 and 2021. From 2019 to 2021, the revenue of Chicmax was 2.87, 3.38, and 3.62 billion yuan, and the net profit was 59.4, 203, and 339 million yuan respectively. The growth was attributed to the strong performance of Kans and Baby Elephant, whose brand recognition and online sales rose significantly during those years. However, due to the impact of COVID-19 in Q2 2022, Chicmax' s revenue in the first three quarters of 2022 was 1.80 billion yuan, a YoY decrease of 30.7%. As Chicmax used to be criticized for its overemphasis on marketing, it is necessary for Chicmax to strengthen product power to achieve long-term brand development.

13. Baixinglong Enterprise, one of the leading creative packaging suppliers in China, made its debut on the Beijing Stock Exchange under the ticker symbol 833075. Data showed that Baixinglong achieved 282, 426, and 246 million yuan in 2020, 2021, and the first half of 2022, with net profits reaching 22.38, 42.21, and 23.72 million yuan respectively. Specializing in the design and production of creative packagings, Baixinglong has established cooperation with internationally renowned brands such as L'Oréal, BVLGARI, Gucci, Louis Vuitton, Elizabeth Arden, etc.

Baixinglong’s Packaging Projects

Baixinglong’s Packaging Projects

E-commerce News

Top live streamers have been guiding consumers from the public domain (live streaming platforms) into the private domain (Wechat platform). For example, MeiOne, the company of Austin Li, launched the "All Girls" membership service center based on WeChat mini program. With the function of offering membership reward points for live streaming orders, using reward points to redeem prizes, applying for trial use, informing live streaming arrangements, and collecting user needs, the "All Girls" membership service center retained Austin Li's followers as private traffic. Once the public traffic is transformed into private traffic, live streamers not only better guarantee their sales but also have more opportunities to realize cross-platform live streaming.

WeChat Mini-program Based "All Girls" Membership Service Center

WeChat Mini-program Based "All Girls" Membership Service Center

Regulatory Compliance

1. On December 8, 2022, China National Medical Products Administration(NMPA) added a new function to the cosmetic notification information system, which would allow companies that meet specified conditions to update and maintain their notified ingredient safety information on their own, such as ingredient manufacturers and ingredient submission codes. More details on ChemLinked.

2. On December 23, 2022, China NMPA released a new cosmetics supplementary testing method, BJH 202204 Determination of Five Components Including Tetrahydrozoline in Cosmetics, which specifies the qualitative and quantitative determination methods of five prohibited ingredients. More details on ChemLinked.

3. On December 29, 2022, China NMPA released the finalized Regulations on Supervision and Administration of Enterprises in Implementing Entity Responsibility for Cosmetic Quality and Safety. The Regulations will come into effect on March 1, 2023. Consisting of 5 chapters and 33 articles, the Regulations specifies the responsibility entities of cosmetic's quality and safety, emphasizes the responsibilities of key positions related to cosmetic quality and safety, as well as clarifies the scope of personnel subject to penalties when certain misconduct happens, and the situations where penalties can be mitigated or exempted. More details on ChemLinked.