Contents

Market Condition

Company Dynamics

E-commerce & Social Commerce News

Financial Results

Regulatory Compliance

Market Condition

1. According to the National Bureau of Statistics, the retail sales of consumer goods from January to July 2022 totaled 24,630.2 billion yuan, a YoY decrease of 0.2%. The retail sales of cosmetics in July reached 25.3 billion yuan, a YoY increase of 0.7%, while the total retail sales of cosmetics from January to July dropped by 2.1% YoY to 216.1 billion yuan.

2. According to the national import and export data released by the China General Administration of Customs in July, China's total import and export value was 3.81 trillion yuan, up 16.6% YoY. Specifically, the import value of cosmetics and toiletries was 11.97 billion yuan, a YoY increase of 5.18%, which marked the first positive increase in the import value of beauty cosmetics and toiletries this year.

3. The 2022 New and Upgraded Personal Care White Paper reveals that online personal care consumption in 2021 reached nearly 100 billion, up 5% YoY. Consumers paid the most attention to hair care, body care, oral care, and feminine care under the personal care category, contributing to the growth in respective market segments from 2020 to 2021. In particular, the hair care market has seen the most prominent growth, with a YoY increase of 20%. From the perspective of brand landscape, big brands still dominate the Chinese market; meanwhile, niche brands such as Kimtrue, Spes, and Forvil also emerge.

Company Dynamics

1. Johnson & Johnson decided to transit to an all-cornstarch-based baby powder portfolio. As a result of this transition, the sales of talc-based Johnson's Baby Powder will be ended globally in 2023.

2. Edgewell Personal Care, the parent company of Banana Boat, voluntarily recalled three batches of Banana Boat Hair and Scalp Sunscreen Spray (SPF 30) across the United States. Edgewell stated that an internal review found that some product samples contained trace amounts of benzene from canned propellants.

3. Elemis, a luxury skincare brand under L'OCCITANE, entered TMALL and opened an official flagship store. Meanwhile, it invited Chinese idol Liu Yu as its brand spokesman in China. In L'OCCITANE's FY 2022 financial results, Elemis saw a strong net sales growth of 43.4%, and the net sales value accounted for 12.5% of the total net sales, making it the second essential brand for L'OCCITANE's record-high operating profitability. L'OCCITANE indicated that Elemis would be the next strategic brand in the Chinese market.

4. In August, premium fragrance brands, including Le Labo under Estée Lauder and Maison Francis kurkdjian under LVMH, announced their entry into the Chinese perfume market and planned to penetrate through all channels in general trade. Beauty giants' accelerated pace in the Chinese perfume market uncovers the broad market prospects.

5. L'Oreal disclosed the results of its scientific research and innovation on PRO-XYLANE over the past 20 years and announced the upgraded raw material- PRO-XYLANE PRO. According to L'Oreal, PRO-XYLANE PRO can improve skin bioavailability, efficacy, and skin feeling, which provides more possibilities for product formulations. L'Oreal also released a new formulation technology—double osmosis micro-pump technology. The new technology can effectively enhance the formulation stability of raw materials containing high-concentration PRO-XYLANE PRO, resulting in a skin feeling that could better cater to the needs of consumers.

6. Shiseido Beauty Innovation Fund announced an investment of nearly 100 million yuan in Trautec as a lead investor. Trautec is a leading Chinese company dedicated to recombinant collagen-based biomaterials. By combining both parties' product development advantages, raw material supply, and channel resources, Shiseido aims to penetrate the area of new biomaterials for cosmetics and plans to explore the potential for functional skincare products in China.

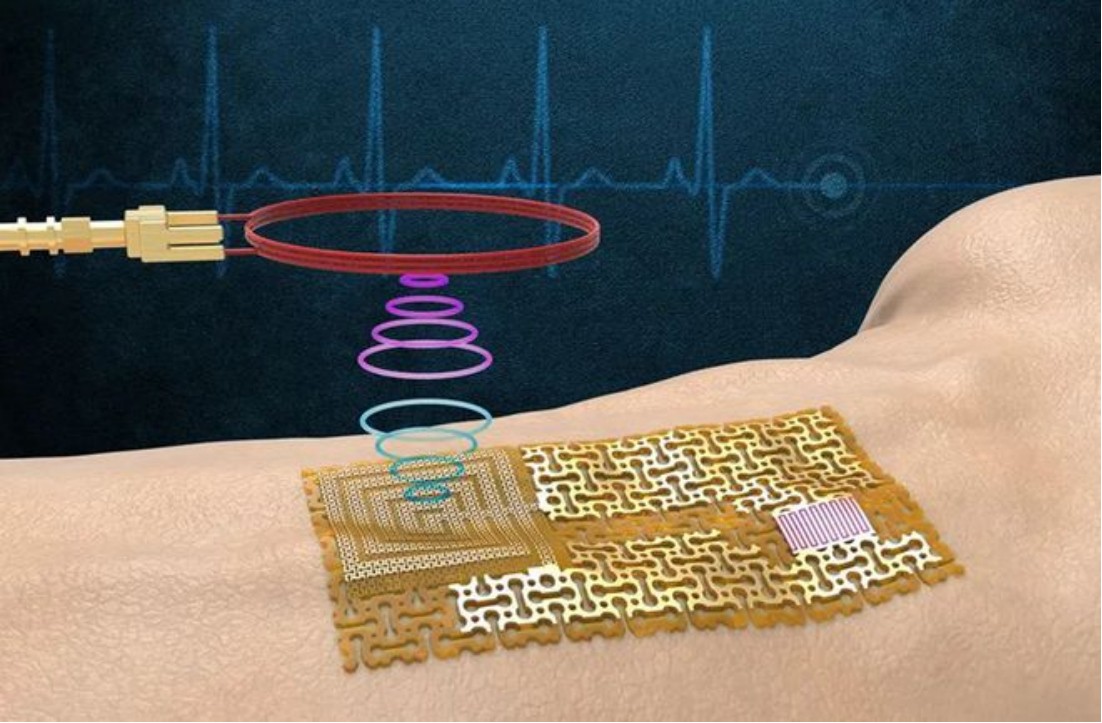

7. Amorepacific announced the development of the world's first "chipless wireless electronic skin" that could be applied to measure and analyze skin conditions anytime anywhere. Utilizing chipless single-crystal semiconductors with excellent sensitivity, the electronic skin can be attached to curved skin to wirelessly measure personal skin conditions anytime anywhere, without heavy equipment. Amorepacific plans to apply the research result to its major brands, such as Sulwhasoo.

8. RUOYUCHEN announced a strategic investment of tens of millions in YOUGMAY, a Chinese biotechnology company specializing in transdermal beauty. This investment also attests to RUOYUCHEN's blueprint for new beauty tracks.

8. RUOYUCHEN announced a strategic investment of tens of millions in YOUGMAY, a Chinese biotechnology company specializing in transdermal beauty. This investment also attests to RUOYUCHEN's blueprint for new beauty tracks.

9. Proya officially released the 2022-2025 Sustainable Development Strategic Plan, and reaffirmed its commitment to realize sustainable development through sustainable business, sustainable value chain, sustainable social ecology, and corresponding ESG management goals.

10. S'YOUNG International officially announced the launch of "Shuiyangtang," a new digital retail collection store for high-end cosmetics. Shuiyangtang pioneers the new retail model of "one exhibition for one store" and is committed to selecting various global high-end cosmetics brands for high-end Chinese consumers. It integrates art, culture, and technology to bring unique digital interactive experiences that allow consumers to gain enjoyment from advanced skin aesthetics.

E-commerce & Social Commerce News

The 2022 TMALL Beauty Awards, known as the "Oscars of Beauty Brands," announced 24 awards based on consumers' purchase data, search data, and use feedback. The awards included Annual TOP Brand, Annual Super Emerging Brand, Annual Most Searched Brand, Annual Men's Care Brand, Annual Hot Single Product, etc.

In addition, TMALL Beauty released a "three-new" strategy: serving merchants to innovate new products, investing in new brand incubation, and exploring new trendy tracks. To secure the success of new products, TMALL Beauty will launch the "Super New Product Plan" utilizing new product incubation tools, word-of-mouth communication inside and outside the platform, and strengthened partnerships with upstream and downstream service providers. Through this systematic plan, TMALL Beauty aims to launch 500 super new products in a year and help brands achieve innovation-driven growth.

Part of the Awards in the List

Financial Results

1. Shiseido (2022 H1)

Net sales in H1 were about 493.399 billion yen, a YoY decrease of about 0.4%. Core operating profit was down 23.9% to 17.539 billion yen.

In regional markets, the net sales of China business totaled 115.739 billion yen, down 19.7% YoY. The net sales of Japan business also dropped by 17.4% YoY to 115.667 billion yen. Despite the COVID-19 impact on China, the sales of the Chinese market outperformed the Japanese market and became Shiseido's No. 1 market globally. For the rest of the markets, net sales of Asia-Pacific business, US business, EMEA (Europe, Middle East, and Africa) business, and travel retail business rose by 2.8%, 9.5%, 8.4%, and 35.1% YoY, respectively.

2. Estée Lauder (FY2022)

Estée Lauder reported net sales of US$17.74 billion for its fiscal year ending on June 30, 2022, a YoY increase of 9%. Meanwhile, the net earnings were down 16% YoY to US$2.408 billion.

Regarding the results by geographic region, Estée Lauder achieved net sales of US$4.623 billion and US$7.681 billion in the Americas and EMEA, up 22% and 11% YoY, respectively. In the Asia-Pacific, net sales fell slightly to US$5.437 billion.

Regarding the results by product category, the skin care segment accounted for the largest share of the company's business, generating US$ 9.886 billion in net sales, up 4% YoY. The makeup and hair care segments achieved US$ 4.667 billion and US$ 631 million, respectively, both an increase of 11% YoY. The fragrance segment grew the fastest, with a YoY growth of 30%, reaching $2.508 billion.

3. Coty (FY2022)

According to Coty's financial results for the fiscal year 2022, the net revenue amounted to US$ 5.304 billion, a YoY increase of 14.57%. Net income attributable to common shareholders increased substantially by 120.16% to US$ 61.2 million. The prestige segment led the growth of 20%, totaling US$ 3.268 billion. The consumer beauty segment rose by 7%, reaching US$2.036 billion.

4. Kose (2022 H1)

Net sales were 130.6 billion yen, up 4.4% YoY. The operating profit was 7.2 billion yen, 81.5% higher than that in 2021. Among them, the net sales of the cosmetics segment achieved 105.5 billion yen with an operating profit of 9.9 billion yen. In 2022 H1, Kose’s performance was affected by the increased costs of crude oil, raw materials and China's epidemic control policy.

5. Kao (2022 H1)

Kao's net sales grew by 8.7% YoY, reaching 733.9 billion yen. The operating income was 53.6 billion yen, down 23.9% YoY. The cosmetics business showed the highest growth rate of 4.9%, totaling 116 billion yen in net sales. The operating profit rose from -0.5 billion yen in 2021 H1 to 2.2 billion yen in 2022 H1. Kao stated that the decline in profits owed to the soaring raw material prices, rising logistics costs, and China's COVID epidemic control policy.

6. Proya (2022 H1, Chinese Domestic Company)

Proya reported a YoY increase of 36.93% to 2.626 billion yuan in revenue. The net profits attributable to shareholders of the listed company were 297 million yuan, up 31.33% YoY. Both the revenue and net profit hit a record high. In particular, the revenue of the online channel achieved 2.309 billion yuan, up 49.49% YoY, accounting for 88.26% of the total revenue.

7. Yatsen Holding Limited (2022Q2, Chinese Domestic Company)

In the Q2 financial result of Yatsen Holding Limited, Perfect Diary's parent company, the total net revenue decreased by 37.6% to 951.8 million yuan. While the topline declined by 37.6% YoY, its net revenue from skincare brands grew by 49.2%, making up one-third of Yatsen's total net revenue. In particular, net revenue from newly acquired clinical and premium skincare brands DR.WU (Chinese mainland business), Eve Lom, and Galénic increased by 112.0% YoY in aggregate.

8. Botanee Group (2022 H1, Chinese Domestic Company)

The net revenue rose by 45.19% YoY to 2.05 billion yuan. The net profits attributable to shareholders of the listed company were 395 million yuan, with a YoY growth of 49.06%. The financial report revealed that the net revenue of Winona accounted for 98% of the total net revenue. If the growth momentum continues in the year's second half, Winona's annual revenue is expected to exceed 4 billion yuan.

9. Bloomage Biotech (2022H1, Chinese Domestic Company)

Bloomage Biotech's net revenue in 2022 H1 totaled 2.935 billion yuan with a 51.58% YoY growth rate. The net profits attributable to shareholders of the listed company were 473 million yuan, up 31.25% YoY. There was an upsurge in the functional skincare business, reaching 2.127 billion yuan, a YoY increase of 77.17%, accounting for 72.46% of the primary business revenue. One of its major brands, Bio-MESO, soared to 485 million yuan in revenue with a YoY increase of 445.75%, and is expected to be the third 1-billion-yuan brand under Bloomage Biotech.

Regulatory Compliance

1. On August 1, 2022, National Institutes for Food and Drug Control (NIFDC) released the draft Technical Guidelines for Special Cosmetics with Freckle-removing and Whitening Efficacy (hereafter Guidelines) for public consultation. This draft Guidelines integrates the regulatory requirements for "freckle-removing and whitening cosmetics" in Cosmetic Supervision and Administration Regulation (CSAR) and its subsidiary regulations, as well as provides the basis for registrants to prepare registration documents and for the technical review department to review registration documents. More details on ChemLinked.

2. On August 17, China National Medical Products Administration (NMPA) drafted the first regulation specifically for the online operation of cosmetics, Supervision and Administration Measures on Online Operation of Cosmetics (Draft for Comments), and released it for public comments. The draft comprehensively and systematically stipulates the management requirements on cosmetics e-commerce platforms (except for cross-border e-commerce), cosmetics operators on the platforms, and supervision and administration departments. More details on ChemLinked.

3. On August 19, China China National Medical Products Administration (NMPA) announced that the electronic registration certificate system for cosmetics would be officially implemented from October 1, 2022. From then on, electronic registration certificates will be issued for special cosmetics and new cosmetic ingredients approved for registration, as well as special cosmetics approved for registration certificate change and renewal. More details on ChemLinked.

4. In August, China China National Medical Products Administration (NMPA) updated six new cosmetic ingredients (NCIs) notification information. The basic information about these new NCIs is as follows:

1) TMP Lauryl Dimethicone (CAS: 1961223-88-0), notified on August 2, 2022

2) Cyclohexylglycerin, notified on August 18, 2022

3) Polyurethane-34, notified on August 19, 2022

4) Polyurethane-48, notified on August 19, 2022

5) Acetylneuraminic Acid (CAS: 131-48-6), notified on August 19, 2022

6) Bakuchiol (CAS: 10309-37-2), notified on August 26, 2022