Contents

Market Condition

Company Dynamics

Financial Results

Regulatory Compliance

Market Condition

1. According to the MKTIndex, the elderly goat milk powder market is experiencing a significant growth. From July 2022 to June 2023, the sales of elderly goat milk powder on Taobao and JD.com platforms reached 728 million yuan, with a year-on-year (YoY) increase of 21.8%. Among these products, low GI goat milk powder is particularly favored by the elderly due to its capacity to help maintain stable blood sugar levels. Currently, the market of low GI elderly goat milk powder has yet to form representative brands and products. This also implies that the competitive landscape is relatively friendly for new brands.

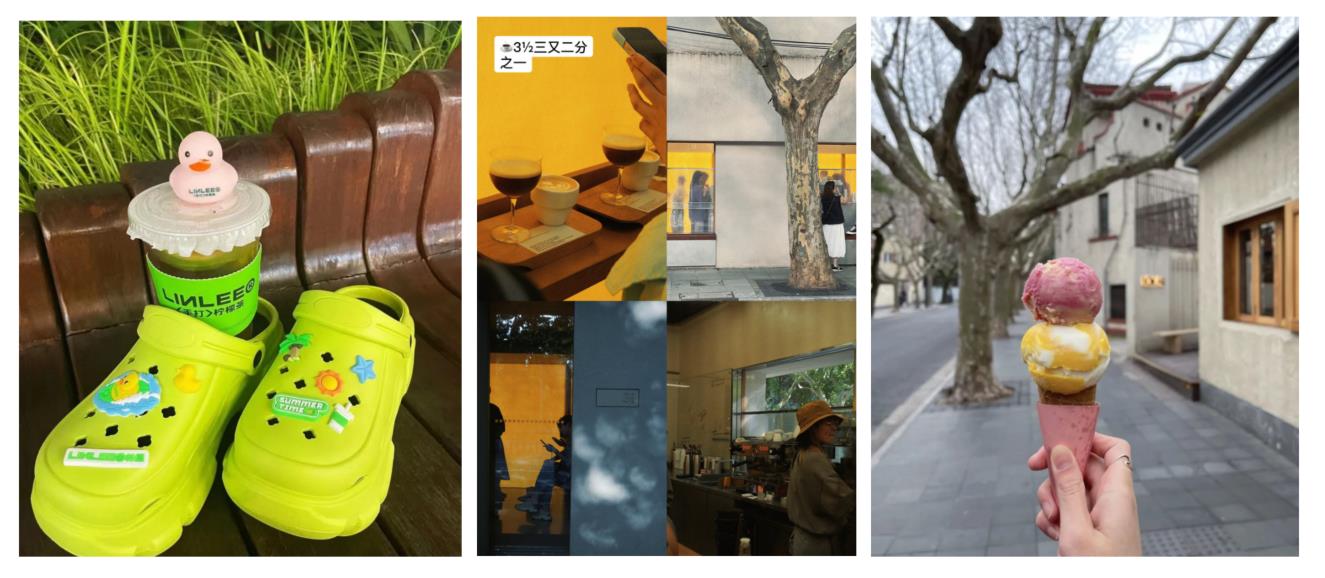

2. City Walk, a slow-paced travel style that combines natural exploration and social interaction has become the top lifestyle choice for the summer of 2023. Alongside the rise of City Walk, a wide array of products and offerings have also gained momentum. Places like tea houses, and coffee shops, ice cream booths have seized the opportunity, leading to increased exposure and sales.

3. Large-sized bottled beverages have gained popularity on social media due to their high cost-effectiveness, offering double volume for just one more yuan. Traditional beverage companies such as MASTER KONG and Uni-President have made a comeback in consumer preference with their large-sized bottled beverage offerings. Nongfu Spring, Yuanqi Forest, and Eastroc Beverage have also launched their large-sized products. The popularity of these products reflects the growing consumer demand for cost-effective options, a trend particularly noticeable among the younger generation as their consumption preferences evolve.

Recommended Reading: Unveiling the Surge in Demand for Large-Sized Prepackaged Beverages in China

4. Some supermarkets and convenience stores in Shanghai have introduced "red, orange, green" labels to encourage consumers to make informed decisions when buying sugary beverages. To be specific, the red label serves as a warning that excessive sugar consumption can lead to tooth decay and obesity. The orange label reminds consumers that the recommended daily sugar intake should not exceed 25 grams. Meanwhile, the green label encourages consumers to evaluate the sugar content by referring to the nutritional information on displayed product labels.

5. Coconut water is considered a natural electrolyte beverage with health benefits. With the soaring demand for coconut water, there is a notable shortage of its main raw material, young coconuts. This has led to a staggering 4000% price increase in mature coconuts, which were previously mainly used for coconut flesh processing, with coconut water as a byproduct. According to Tmall Mart, the sales of bottled coconut water has shown a robust growth trend over the past year. Notably, in the last three months, coconut water sales have seen a 65% increase compared to the same period last year. Additionally, the popularity of coconut water in the freshly made beverage segment has further fueled its hot sales.

Market Dynamics

1. Mar's Wrigley, in collaboration with the globally leading gaming equipment brand Razer, has officially launched the esports snack brand RESPAWN in China. This brand has two series, featuring a total of five new products, including three sugar-free chewing gums and two sugar-free mints. This launch signifies Mar's Wrigley's endeavor to target a younger demographic within the chewing gum and mint product category.

2. Aptamil has launched two new series of infant formula—ProfuturaNeo and EssensisBiotics, in line with China’s new national standards. The ProfuturaNeo series is the upgraded version of Profutura and features exclusive patented innovations, along with a prebiotic design optimized at a 9:1 ratio. The EssensisBiotics series is positioned as brand-new ultra-high-end infant formula, featuring the exclusive patented SYNEO® formula. According to Danone Nutricia, the company will continue its research projects on infant and toddler nutrition in China to provide more precise nutrition solutions for local infants and toddlers.

3. Arla Foods Ingredients has signed a distribution agreement with Zhongbai Xingye, with a specific focus on three key areas: infant nutrition, functional nutrition (including sports nutrition, elderly nutrition, and dietary supplements) as well as food and beverages.

4. According to unidentified sources cited by Reuters, Tyson Foods, the U.S. meat giant, plans to sell its China poultry business. The company has hired investment bank Goldman Sachs to advise on the sale and sent preliminary information to potential buyers including a number of private equity firms. The sale process is currently in its early stages, and the valuation remains undisclosed.

Recommended reading: Tyson Foods Plans to Sell Its China Poultry Business

5. Beyond Meat, a global plant-based meat brand, has launched its plant-based crab cakes in the Chinese market, marking the company's entry into the plant-based seafood category. The product is made from a variety of plant-based ingredients and provides 14.7 grams of plant-based protein and 2.7 grams of fat per 100 grams.

6. Brand Finance, the globally recognized brand valuation agency, has unveiled the "Top 10 Most Valuable Dairy Brands Worldwide of 2023" rankings. Yili claims the top spot with a brand value of USD 12.4 billion, marking a 17% increase from the previous year. Mengniu secures the third position, with a brand value of 6.1 billion USD, reflecting a 10% YoY growth .

7. Eastroc Beverage, China's leading functional beverage enterprise, has launched a sugar-free oolong tea priced at 4 yuan. According to Eastroc Beverage, the company will continue to develop energy drinks while also expanding into the sugar-free tea category, which has been gaining significant traction. In recent years. Traditional giants like Nongfu Spring, Master Kong, and Uni-President, as well as emerging brands like Yuanqi Forest, Tasan Tee, are all vying for a share of the sugar-free tea market.

Recommended reading: Uncovering the Flourishing Sugar-Free Tea Market in China

8. AMBROSIAL, the leading Chinese yogurt brand under the Yili Group, announced NBA superstar Stephen Curry as their brand ambassador, sparking significant attention across Chinese social media platforms. In recent years, dairy brands have been progressively turning to sports marketing to harness the vast audience reach and enhance their brand communication.

9. Junlebao, China's leading dairy enterprise, plans to invest 3 billion yuan to establish a liquid milk production facility in South China, covering markets in Guangdong, Guangxi, Hunan, Fujian, Jiangxi, and Hainan. The new facility is scheduled to be put into production by the end of 2024 and will primarily manufacture fresh milk, low-temperature yogurt, low-temperature dairy beverages, and student milk.

Financial results

Interim financial results of Chinese enterprises in the milk powder segment | ||||

Enterprise | Total revenue (billion yuan) | YoY growth | Milk powder revenue (billion yuan) | YoY growth |

Feihe | 9.74 | 0.60% | 9.71 | 2% |

Yili | 66.20 | 4.31% | 13.52 | 12.10% |

Ausnutria | 3.51 | -3.70% | 3.36 | -5.29% |

H&H | 6.98 | 17.20% | 2.21 | -10.07% |

Mengniu | 51.12 | 7.10% | 1.89 | stable |

Beingmate | 1.38 | -1.72% | 1.18 | -0.76% |

Interim financial results of Chinese enterprises in the liquid milk segment | ||||

Enterprise | Total revenue (billion yuan) | YoY growth | Liquid milk revenue (billion yuan) | YoY growth |

Yili | 66.20 | 4.31% | 42.42 | -1.09% |

Mengniu | 51.12 | 7.10% | 41.64 | 4.98% |

Bright Dairy | 14.14 | -1.88% | 8.01 | 3.11% |

New Hope Dairy | 5.3 | 10.84% | 5.3 | 10.84% |

Interim financial results of Chinese milk source enterprises | ||||

Enterprise | Total revenue (billion yuan) | YoY growth | Net profit | YoY growth |

Youran Dairy | 9.08 | 4.20% | -0.99 | -552.34% |

Modern Farming | 6.63 | 17.80% | 0.22 | -59.00% |

Austasia Dairy | 1.85 | 1.90% | -0.31 | -259.90% |

China Shengmu | 1.64 | 2.70% | 0.02 | -89.80% |

Regulatory Compliance

1. On August 24, 2023, General Administration of Customs of China (GACC) published a notification, announcing to immediately suspend the imports of all aquatic products (including edible aquatic animals) originating from Japan, in order to comprehensively prevent the radioactive contamination risk on food caused by the discharge of nuclear contaminated water from Fukushima into the sea. More information on ChemLinked

2. On August 28, 2023, the State Administration for Market Regulation (SAMR) published Detailed Rules on the Implementation of Technical Evaluation on New Functions and Health Food with New Functions (Trial), with immediate effect. This Regulation introduces new management model of new function for health food in China, aiming to encourage industries to engage in functional innovation and product R&D. More information on ChemLinked

Recommended reading:BYHEALTH Pioneers in Applying for New Function of Health Food

3. On August 31, 2023, the State Administration for Market Regulation (SAMR) published five regulations concerning health food with immediate effect. These regulations signify the resumption of the health food registration mechanism's normal operations, which will have a significant impact on the registration process for new health food products going forward. More information on ChemLinked

**Disclaimer: All images used in the article are from the Internet.