Contents

Market Conditon

Company Dynamics

Financial Results

E-commerce & Social Commerce

Regulatory Compliance

Market Condition

1. According to the National Bureau of Statistics, the cosmetic retail sales in China from January to July 2023 totalled CNY 231.5 billion, with a year-on-year (YoY) increase of 7.2%. However, the retail sales in July decreased by 4.1% YoY to CNY 24.7 billion, which was the first decline this year.

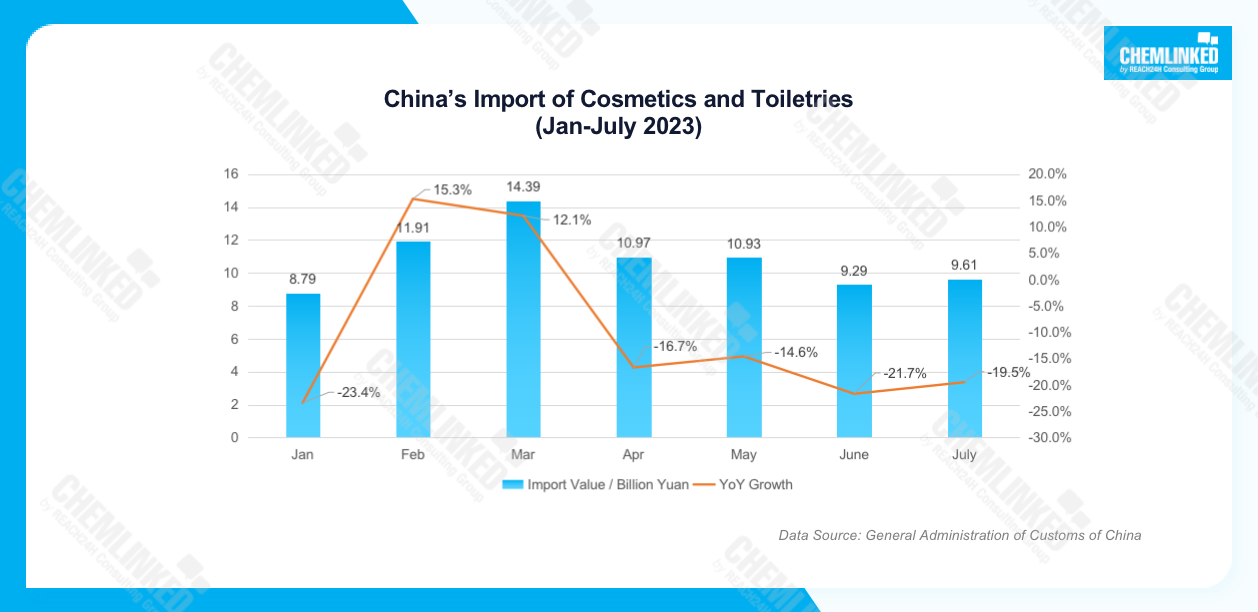

2. According to the General Administration of Customs of China (GACC), the total import value of cosmetics and toiletries from January to July 2023 was CNY 75.28 billion, declining 10.1% YoY. In July, the import value was CNY 9.61 billion, with a 19.5% YoY decrease.

3. The discharge of nuclear contaminated wastewater from Fukushima raised significant concerns among Chinese consumers regarding the safety of Japanese cosmetics. Many netizens in China have sorted out the lists of cosmetic products that can potentially be impacted by the wastewater, and expressed their decision to refrain from using Japanese cosmetics. Some consumers have discarded the Japanese cosmetic products purchased previously.

Company Dynamics

1. Luxury brand Prada unveiled its make-up and skincare lines under the cooperation with L'Oréal in August, which includes products like eyeshadow, lipstick and liquid foundation priced from CNY 315 to 800, and cleanser, mask and serum with the price between CNY 880 and 3,370, respectively. In particular, the lipsticks developed under Prada and L'Oréal's cooperation achieved remarkable sales on China’s e-commerce platforms with many colours sold out. Whereas, the skincare products controversial due to their similarity in formulas to L’ Oréal’s popular products, but with higher prices.

Prada's Cosmetic and Skincare Products

2. Helena Rubinstein rolled out a brand-new eye cream product featuring 30% pro-xylane concentration rate, panthenol and hyaluronic acid. This intensive formula is sufficient in repairing external irritation to the eyes and preventing early eye aging. Despite its price of CNY 2,180 for 15ml, the product was the top 1 of Tmall’s Eye Cream New Product List with monthly sales of 3,000 units in the brand’s Tmall flagship store.

HR’s Replastry Age Recovery Eye Cream

3. Le Labo, the niche perfume brand of Estée Lauder, introduced a personalised service at its offline store in Pudong, Shanghai. This initiative marked the second pilot project of customised cosmetic service in Shanghai, following SkinCeuticals’s (More detailed information on ChemLinked.). At the Le Labo store, consumers can select their preferred perfume type before perfumers prepare the product in a transparent and sealed laboratory. After the product is prepared, consumers can customise a label with their name to attach to the bottle.

Le Labo’s Perfume

4. Yatsen Global announced the official opening of the company’s first factory—Yatsen Biotechnology. The factory, built with over CNY 600 million investment in collaboration with Cosmax, integrates research and development, manufacturing, and quality control. According to Yatsen Global’s founder, the factory is to meet the growth of the company’s brands and users’ enhanced demand. In the future, it aims to manufacture cosmetics more sophisticatedly and environmental-friendly as well as with better quality, promoting both user health and beauty and the sustainable development of the Earth.

Yatsen Biotechnology’s Picture from Yatsen Global’s Official Website

Financial Results

International Enterprises | Revenue | YoY | Notes |

Estée Lauder (Full Year Ended on June 30, 2023) | CNY 115.5 bn | -6% | Estée Lauder’s net sales in the fourth quarter of the 2023 fiscal year was CNY 26.16 billion, with an organic rise of 4%, due to the robust growth in Asia/Pacific and double-digit growth in every product category. |

Shiseido (Six Months Ended on June 30, 2023) | CNY 24.67 bn | 0.2% | 1. In H1 2023, Shiseido’s net sales in China reached CNY 6.51 billion, with a like-for-like increase of 9.9% YoY. 2. Benefiting from the growth of both online and offline channels, China accounted for 26.4% of the total sales, becoming the company’s largest market in H1 2023. 3. In China, the company’s business shifted from a growth model driven primarily by large-scale promotions to a more sustainable growth model focusing on value-based brand and product communication tailored to consumer needs. |

Amore Pacific (Three Months Ended on June 30, 2023) | CNY 5.19 bn | -0.04% | 1. Asia’s revenue grew by 14% to CNY 1.57 billion in Q2 2023, with China’s sales taking up more than 50% of the total. 2. China’s revenue increased more than 20% in Q2 2023 on account of Sulwhasoo’s enhanced competitiveness gained by reinforcing online and offline marketing events, growth of key products involving Laneige and Innisfree and optimised channel portfolio. |

Chinese Domestic Enterprises | Revenue | YoY | Notes |

Yatsen Global (Three Months Ended on June 30, 2023) | CNY 859 m | -9.8% | As the key sector, the skincare business achieved a revenue of CNY 325 million yuan in Q2 2023, accounting for 37.9% of the total. |

Bloomage Biotech (Six Months Ended on June 30, 2023) | CNY 3.08 bn | 4.77% | The revenue of the company’s functional skincare product, ingredient, medical terminal and other business in H1 2023 was CNY 1,966, 567, 489 and 53 million, taking up 63.92%, 18.45%, 15.9% and 1.74% of the total, respectively. |

Giant Biogene (Six Months Ended on June 30, 2023) | CNY 1.61 bn | 63% | The revenue of the company’s brands Comfy and Collgene in H1 2023 was CNY 1,228 and 320 million, accounting for 76.4% and 20% of the total, respectively. |

E-commerce & Social Commerce News

1. On August 28th, Xiaohongshu announced to launch a live streaming promotion function to meet the enhanced demand of live streaming merchants and streamers, and help the growth of the live streaming rooms. The current promotion function can reach potential users of live streaming and help maintain stable views of the live streaming rooms. Additionally, the live streaming’s pre-heat views and the optimization goals for transactions in live streaming rooms are about to be launched.

Regulatory Compliance

1. To ensure that toothpaste efficacy claims are based on scientific evidence, China National Institutes for Food and Drug Control (NIFDC) issued an announcement on August 8, 2023, seeking project undertaking units to formulate five toothpaste efficacy evaluation standards. More detailed information on ChemLinked.

2. On August 28, 2023, China National Medical Products Administration (NMPA) announced significant amendments to the Safety and Technical Standards for Cosmetics (2015 Edition) (STSC), involving changes to prohibited ingredients and testing methods for cosmetics. Notably, except that the revised methods are scheduled to come into force on March 1, 2024, all other new contents will take immediate effect upon release. More detailed information on ChemLinked.