Contents

Market Condition

Company Dynamics

Financial Results

Regulatory Compliance

Market Condition

1. During Jan-Feb 2023, China's total imports of various dairy products amounted to 504.60 million kgs, reflecting a 32% year-on-year (YoY) decrease, with an import value of 15.86 billion yuan, showing a decline of 12% YoY. Notably, the import of infant formula increased by 33% YoY, reaching 47.25 million kgs, with a corresponding import value of 5.63 billion yuan, marking a substantial 53% YoY growth. The top five countries of origin by import value of infant formula were the Netherlands, New Zealand, France, Ireland, and Germany, accounting for 51.55%, 26.19%, 5.87%, 5.46%, and 4.89% respectively.

2. In March 2023, the new consumption sector witnessed a total of 74 investment and financing events, with the catering, food, and beverage industry accounting for nearly half of them, totaling 37. This notable surge can be attributed to the gradual recovery of offline consumption. Among these events, the coffee segment was exceptionally vibrant, with 9 investment and financing deals taking place. "TASOGARE," a boutique instant coffee brand (C round financing), and "Coffee Z," a coffee chain specializing in African coffee (A round financing), both secured funding in the billion-yuan level.

3. As temperatures gradually warm up, China's ice cream industry is coming alive with renewed vigor. This year, ice cream companies not only focus on product trends, flavors, and pricing, but also actively engage in the fierce competition of supply chain upgrades. For instance, Mengniu has invested 1.5 billion yuan to build 8 new ice cream production lines in Sichuan. Mars has commenced production at its ice cream factory in China to respond to the local demand through flexible production. Nestlé China is also expanding its investment in the ice cream business and plans to increase its offline ice cream freezers this year.

4. Tmall Health unveiled the "Blue Hat Plan" to support the health food industry. This comprehensive plan encompasses the following measures:

(1) Dolphin Plan: A customized tool designed to generate millions of exposures for brands.

(2) New Product Incubation: Tmall Health plans to incubate 1,000 new "blue hat" products within a year, catering to evolving consumer demand and facilitating the growth of emerging brands.

(3) Member Growth: Tmall Health aims to help brands achieve a YoY increase of 100%+ in member transaction.

(4) Marketing Mindset: Tmall Health will collaborate with brands to enhance consumers’ recognition of "blue hat" products when purchasing health products.

(5) Vertical Audience: Tmall Health will dive deeper into the profile of target consumers, gaining insights to assist brands in precise growth.

Note: "Blue Hat" is the authoritative certification mark for health food granted by State Administration for Market Regulation or local competent authorities.

5. According to the "2023 China Children's Anti-allergy Market Insights", the anti-allergy sector has become one of the fastest-growing niches in China's maternal and child market. The sector is projected to maintain double-digit growth in the next five years, with an estimated market size of 109.5 billion yuan by 2025. In terms of competition, international brands are more favored by consumers due to their earlier entry into the anti-allergy field, stronger research and development, branding, and market accumulation. For instance, Nestlé's NAN (imported through cross-border e-commerce) and NUTRICIA special formula in low-allergen infant formula segment, and i-Health's Culturelle in low-allergen nutrition segment, as well as AVEENO, Mustela in the low-allergen infant and child care segment. In terms of distribution channels, offline maternal and child stores remain the main distribution channel, but the market is swiftly transitioning to online channels, particularly cross-border e-commerce platforms.

6. Emerging snack specialty stores are driving a channel revolution in offline snack retailing. This kind of specialty stores features shortened distribution process compared to traditional supermarkets and grocery stores, and more flexibility in lower-tier markets compared to brands’ exclusive stores. Through direct collaboration with upstream manufacturers and streamlined supply chain management, snack specialty stores are able to improve efficiency and reduce costs, which leave more room for price advantage. Moreover, with diverse products, convenient locations, and fancy in-store displays, these stores have gained popularity among consumers for their convenience and affordability.

Company Dynamics

1. After one month since the implementation of China's new national standards for infant formula, Danone announced the launch of two goat milk infant formulas—Aptamil Zhuowang and Nutrilon Younuoyang. With a strategic focus on distribution channels, Aptamil Zhuowang will prioritize e-commerce and large-scale supermarkets, while Nutrilon Younuoyang will target local chain supermarkets, as well as maternity and baby specialty stores in key regions. This strategic move further establishes Danone's presence in the Chinese infant formula goat milk powder market, boosting the growth through a diverse range of high-quality products.

2. Nestlé China has formed a new plant-based food team, responsible for brands Nestlé Harvest Gourmet and Nestlé Ranhun Tofu. Harvest Gourmet was introduced into the Chinese market in 2020, while Ranhun Tofu was a local tofu-based snack brand targeting health-conscious post-90s consumers. Plant-based foods align with Nestlé's core categories, appealing to younger, educated, affluent consumers. Despite small market share, high growth implies great opportunities that Nestlé can't overlook.

2. Nestlé China has formed a new plant-based food team, responsible for brands Nestlé Harvest Gourmet and Nestlé Ranhun Tofu. Harvest Gourmet was introduced into the Chinese market in 2020, while Ranhun Tofu was a local tofu-based snack brand targeting health-conscious post-90s consumers. Plant-based foods align with Nestlé's core categories, appealing to younger, educated, affluent consumers. Despite small market share, high growth implies great opportunities that Nestlé can't overlook.

3. The Unilever Tianjin Food Factory held a lighting ceremony to celebrate its "Lighthouse Factory" award. This factory is Unilever's third "Lighthouse Factory" in China where Knorr and Hellmann's products are produced, following Hefei factory for personal care products and Taicang factory for ice cream products. These sites deploy advanced technologies to maximize production efficiency and competitiveness, and drive sustainable and responsible business growth.

3. The Unilever Tianjin Food Factory held a lighting ceremony to celebrate its "Lighthouse Factory" award. This factory is Unilever's third "Lighthouse Factory" in China where Knorr and Hellmann's products are produced, following Hefei factory for personal care products and Taicang factory for ice cream products. These sites deploy advanced technologies to maximize production efficiency and competitiveness, and drive sustainable and responsible business growth.

4. Starbucks has partnered with Amap, a Chinese digital map solution provider, to launch a brand-new retail channel in China—Starbucks Curbside, a drive-thru channel. Starbucks Curbside uses Amap's real-time route planning and position tracking technologies to estimate customers' arrival times at pick-up points. The service is an extension of third place, which means social environment outside home and workplace, from "in-store" to "on the road". The service is currently available in 150 stores in Beijing and Shanghai, and will be rolled out to more than 1,000 stores across China over next year.

5. DPC Dash Ltd, the exclusive master franchisee of Domino's Pizza in Chinese mainland, Chinese Hong Kong, and Chinese Macau (also called Domino China), made its debut on Hong Kong Stock Exchange (01405.HK), becoming the first restaurant company to go public in Hong Kong in 2023. However, despite its successful listing, Domino China faces significant challenges. It lags behind Pizza Hut and Champion Pizza in terms of market share, holding only 4.4% of the Chinese pizza market according to the latest Frost & Sullivan report. Moreover, the rise of food delivery platforms like Meituan and Ele.me has weakened Domino's Pizza's "30-minute delivery" advantage which has high operating costs. Domino China’s recent financial report showed consistent net losses, with total revenue increasing but profitability stagnant.

6. Costco's Shanghai Pudong store opened in March, becoming the second store in Shanghai and the third store in Chinese mainland. In recent years, Costco's expansion pace in China is accelerating. In 2023, in addition to the already opened Shanghai Pudong store, Costco will open three more stores in Hangzhou, Ningbo, and Shenzhen. Driven by high quality, high cost-effectiveness, diverse product categories, innovative warehousing displays, and effective social media marketing, the "warehouse club retail" represented by Costco and Sam's Club is reaping dividends in China.

7. Chinese dairy giant Mengniu has made strides into the sports nutrition market with the launch of a new product —M-ACTION, a protein drink designed to replenish body's protein needs during the golden window of 30 minutes after exercise. The product comes in two variants, medium intensity and high intensity, with protein contents of 15g and 25g respectively. Enriched with 14 essential vitamins and minerals, and formulated with low sugar, low fat, and low lactose, M-ACTION caters to health-conscious consumers. In recent years, impacted by COVID-19, popular international sports events and fitness influencers, the public health awareness has been significantly heightened, indicating great business opportunities in the sports nutrition market.

8. Yashili announced acquisition of 25% equity stake from Danone and sales of its stake in the Dumex China to Danone. As such, the prerequisites for Yashili's privatization and delisting from the Hong Kong Stock Exchange are about to be met. Industry insiders believe that the continued poor performance in business and stock market may be the main reasons for Yashili's privatization and delisting, which may in turn allow Yashili to make necessary adjustment for healthier development.

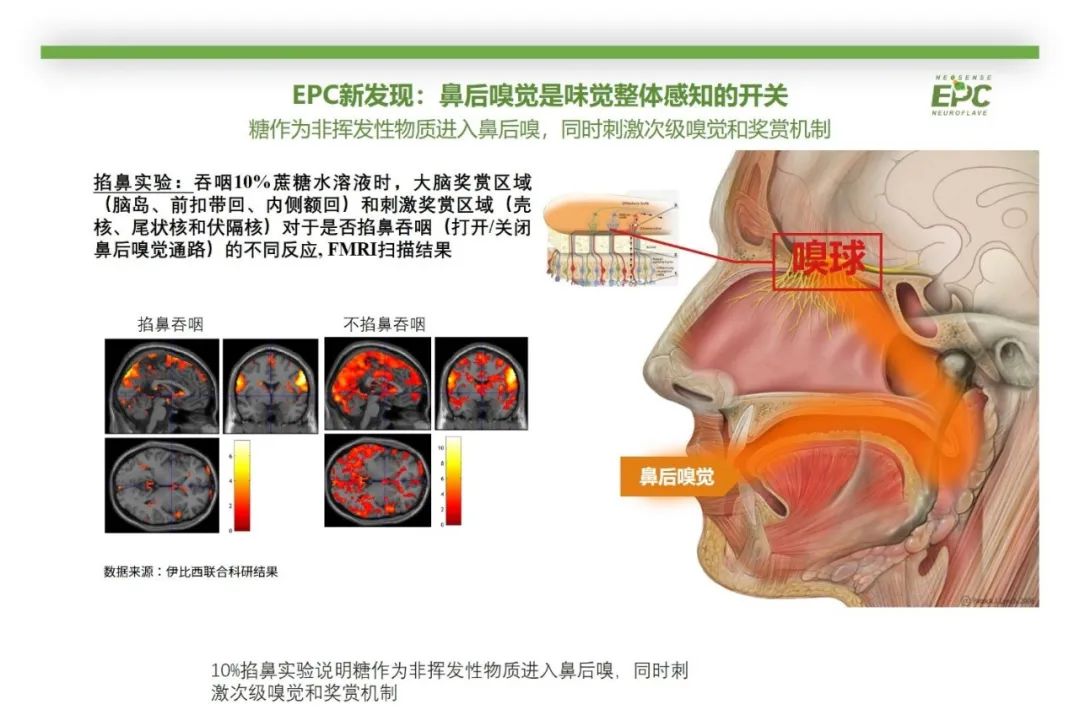

9. EPC Flavor has pioneered a groundbreaking reduced-sugar solution based on cutting-edge food science. Unlike traditional sweeteners and flavorings, EPC Flavor's innovative neuro-sweet flavoring employs novel pathways, including saliva, non-sweet receptors, and postnasal olfaction, to holistically modify high-intensity sweeteners and replicate the authentic taste of sucrose. This new ingredient enhances the overall mouthfeel of reduced-sugar beverages and dairy products.

EPC's research on the function of postnasal olfaction in sweet taste perception

EPC's research on the function of postnasal olfaction in sweet taste perception

10. Jinmailang launched its premium mineral water product—Jin Kuang, with a high-altitude flight press conference to highlight its exclusivity. Priced at 3 yuan, Jin Kuang boasts the ingredient orthosilicic acid which is called "soft gold for the human body", catering to consumers' demand for high-quality mineral water. In China, the mineral water market has seen a robust growth of 16.0% over the past 5 five years. The 3-6 yuan price range is a key battleground for high-end water competition, with brands like Nongfu Spring, Coca Cola, and Genki Forest vying for the market share.

11. Free Now, a leading brand of coconut-based plant milk, unveiled its largest factory in Hainan, with an annual production capacity of 100,000 tons and a total investment of 160 million yuan. With the support of this new factory, Free Now is embarking on a new strategic phase of "from dairy to beverage". Driven by this flagship product—thick coconut milk, Free Now's business doubled in 2021 and further doubled in 2022. In the future, while maintaining B2B business in the food service sector, the company will also accelerate developing new products and scenarios for the retail market.

12. Chicecream unveiled its new product series—"Sa'Saa" and "Dansheng". Sa'Saa is AI-driven in terms of flavor and design, conveying the concept of "Satisfy And Surprise Any Adventure". Targeting the mass market, this series features four flavors: red bean, mung bean, milk, and cocoa. The high-end Dansheng series has a strong implication of Chinese culture. As the word "Dansheng" has the same pronunciation of Chinese characters "诞生", an expression of birth/come into being, this series conveys the meaning of "good things will always come". Besides, as the pronunciation of "Dan" is the same to that of "蛋(egg)" in Chinese, the Dansheng series replicates the size of a real egg, and offers flavors of milk and chocolate and egg. Distributors have high expectations for the "Dansheng" series, believing that it has the potential to become a hit.

Financial Results

Financial Results of Chinese Dairy Enterprises

Enterprise | Revenue | YoY growth | Infant formula |

Yili (Q1-Q3) | 93.5 | 10.42% | Milk powder and dairy products:18.7 billion yuan, 60.50% YoY |

Mengniu | 92.6 | 5.10% | 3.9 billion yuan, -22% YoY |

Brightdairy Dairy | 28.2 | -3.39% | / |

Feihe | 21.3 | -6.40% | 19.9 billion yuan, -7.4% YoY |

Youran Dairy | 18.1 | 17.60% | / |

Modern Farming | 12.3 | 73.70% | / |

Ausnutria | 7.8 | -9.10% | Goat milk powder: 3.3 billion yuan, +5.5% YoY |

Milkground | 4.8 | 7.84% | / |

Regulation Compliance

1. State Administration for Market Regulation introduced new regulations for Internet advertising, involving health food and food for special medical purposes. More information on ChemLinked

2. China National Health Commission proposed the consultation draft of national food safety standard legislation plan for 2023. A total of 39 food standards are listed in the proposed plan, involving food additives, food testing methods, microbial testing methods, foods for special dietary use, contaminant limits and food-related products. More information on ChemLinked

3. ChemLinked examines the regulatory requirements for probiotics, prebiotics and postbiotics products in China and explore their development in the Chinese market. More information on ChemLinked

4. ChemLinked analyzes the future direction of regulation in the Chinese children food industry. More information on ChemLinked