Contents

Market Condition

Company Dynamics

E-commerce & Social Commerce News

Financial Results

Regulatory Compliance

Market Condition

1. By the end of February 2023, 448 infant formula recipes of 37 dairy enterprises had been registered as per China’s new GB standards. Among the 448 recipes, 88% are from local manufacturers in China, including manufacturers established by overseas players. In terms of milk species, 376 recipes are from cow milk and 72 are from goat milk. The top 10 dairy enterprises with the most recipes were Feihe, Junlebao, Nestlé, Yili, Beingmate, Wondersun, Danone, Mengniu, Mead Johnson, and Liaoyuan.

2. China's freshly ground coffee market reached about 87.6 billion yuan in 2021 with a year-on-year (YoY) growth of 38.9%. It is projected that the market size will continue an upward trajectory and reach 190 billion yuan by 2024. To leverage this enormous potential, chain coffee brands are aggressively expanding nationwide through offline stores, with a particular focus on lower-tier cities. By the end of 2022, the top three coffee brands with the most stores were Luckin Coffee (8,171 stores), Starbucks (6,882 stores), and McCafé (2,530 stores).

3. In January 2023, the National Bureau of Statistics reported a 2.1% YoY increase in the consumer price index (CPI), with food prices rising by 6.2%.The majority of the Chinese food and beverage market has joined this nationwide price increase, involving well-known enterprises such as Wahaha, Nongfu Spring and C'estbon. Furthermore, international brands represented by Coca-Cola, Nestlé, and Unilever have also announced a new round of price increases.

4. The China Biotech Fermentation Industry Association (CBFIA) and leading enterprises in the industry jointly released a group standard named "Probiotic Products Postbiotics from Lactic Acid Bacteria". This standard applies mainly to the production, testing, and sales of postbiotics products from lactic acid bacteria. As the first group standard in China's postbiotics field, it marks an epoch-making significance for the high-quality development of the industry. According to Mr. Weichen Shi, honorary chairman of CBFIA, the market size of probiotics-related products in China has reached 22.7 billion yuan. As research into probiotics and postbiotics continues to deepen, it is expected that greater application potential and market value will be uncovered.

5. The "2022 Top 30 Beverage Enterprises in China" list was released, with Wahaha, Master Kong, and Nongfu Spring occupying the top three spots, forming a "tri-polar" situation. Emerging brand Genki Forest had a strong momentum and ranked 14th. By category, in the plant-based beverage category, traditional plant protein beverage enterprises need to innovate and upgrade under the drive of the new plant-based trend to maintain the vitality in the market. In the packaged drinking water category, the concept of "boiled water" has emerged as a new growth opportunity. The sugar-free tea beverage market is experiencing significant growth due to the increased health awareness among consumers. The functional beverage category is seeing a new opportunity emerge in electrolyte water with a remarkable growth.

Company Dynamics

1. Singaporean oat milk brand OATSIDE has officially entered the mainland Chinese market through partnering with coffee brand %ARABICA. Since February 14th, customers can enjoy OATSIDE's oat milk latte at over 60 offline %ARABICA stores across mainland China.

2. Mars Wrigley China announced to upgrade the bowl packaging’s lid of its crispy chocolate to 100% recycled polyethylene terephthalate (rPET), making crispy chocolate the first Mars Wrigley product in China to feature such packaging. The company plans to use rPET in more of its product packaging, including products under Snickers and M&M's, with a goal of reducing the use of virgin plastic by 300 tons per year.

3. Meiji announced to ramp up its investment in milk and yogurt production in China with a total investment of approximately 40 billion Japanese yen. The investment will be used to increase production capacity by 30% at its Suzhou factory, and to build new plants in Tianjin (started operation in January 2023) and Guangzhou (expected to start operation in October 2023). According to Matsui Tamotsu, the general manager of Meiji China, the company aims to enhance the production capacity and brand presence, as well as improve the revenue of products containing R-1 probiotics to six times by 2023, comparing to 2021’s level in China.

4. Feihe, in collaboration with other research institutions, led the development of the group standard named "High Performance Liquid Chromatography Method for the Determination of Osteopontin in Infant Food and Dairy Products". This group standard will provide significant technical support for innovation in Chinese infant formula. Corresponding research results are continuously being applied into products, such as the Feihe AstroBaby Zhuorui and Zhuoyao series, which contain the milk-derived active protein OPN. These products can help babies build their own natural defenses and are favored by new-generation parents.

5. Oatly has completed the establishment of a joint venture company with Xiangpiaopiao, named Super Plant Food and Beverage (Shanghai) Co., Ltd., aiming to jointly develop, produce and sell oat-based plant beverage products and other related products in the Chinese market. According to the cooperation scheme, Oatly will coordinate the use of its registered trademark "OATLY INSIDE" in China, and Xiangpiaopiao will allow the use of its "Lanfangyuan" trademark for the newly established company, with a license period of 10 years.

6. Tong Ren Tang and Mengniu Group have signed a strategic cooperation framework agreement. As per the agreement, the two parties will focus on innovation in the big health industry and aim to jointly create new and trendy health products to meet consumers' diversified needs in health care.

7. Nestlé Esper launched a new ultra-high-end student milk powder product—Youxue Ruixuan student milk powder. The product aims at the 6-15 age group, featuring A2 cow milk protein and comprehensive nutrition throughout the entire school period. Public data shows that China’s child milk powder market size was about 11 billion yuan, with a YoY growth of 23.4%. The penetration rate of student milk powder is only 6.2%, indicating significant growth potential.

E-commerce

1. JD released pet food data of the past year, which indicated a booming pet food market in China. In the baked pet food segment, both supply and demand saw significant growth, with GMV skyrocketing by 96 times and search volume 13.7 times. Baked cat food was the mainstay of this category, with a share of over 70%. GMV of freeze-dried pet food increased by 195% YoY, among which freeze-dried cat food accounted for 75%. Raw pet food also witnessed an upsurge, whose GMV soared with a 685% YoY growth. More information about China’s pet food market on ChemLinked.

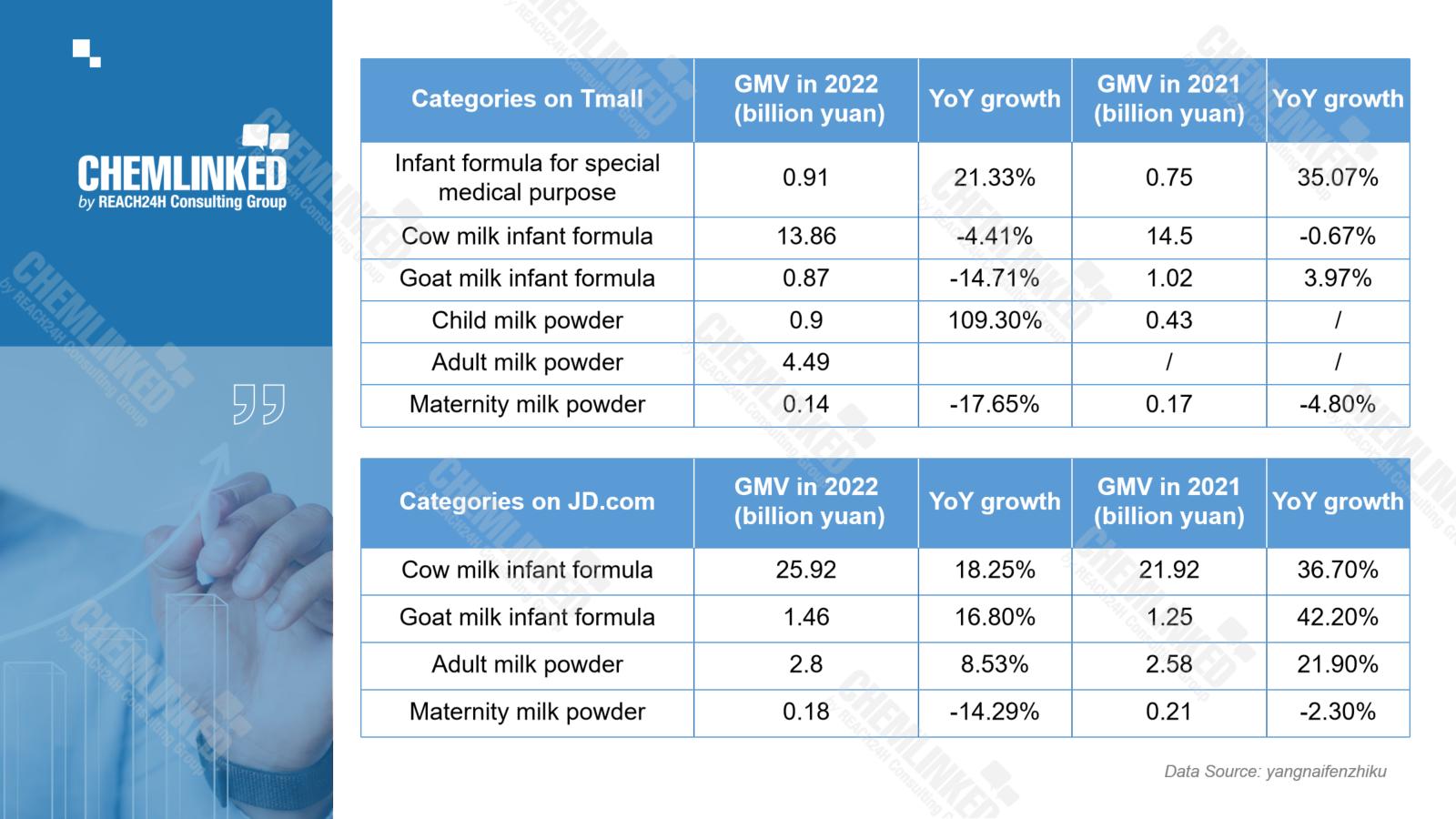

2. In 2022, the GMV of milk powder on Tmall and JD.com totalled 51.53 billion yuan. Tmall contributed 21.17 billion yuan, accounting for 41% of the total, and JD.com contributed 30.36 billion yuan, accounting for 59%. On Tmall, child milk powder and infant formula for special medical purpose achieved remarkable growth in 2022, while sales of cow milk infant formula, goat milk infant formula, and maternity milk powder showed a downward trend. Meanwhile, on JD.com, milk powder segments maintained growth at a slower pace except the maternity milk powder.

Financial Results

Financial Results of International Infant Formula Enterprises

Enterprise | Revenue (FY 2022) | Performance in China |

Nestlé | 706.6 billion yuan, +8.4% YoY |

|

Danone | 203.1 billion yuan, +7.8% YoY |

|

FrieslandCampina | 103.5 billion yuan, +22.4% YoY |

|

a2 | 3.38 billion yuan (H1 2023), +18.6% YoY |

|

More information on ChemLinked.

Financial Results of International Food and Beverage Enterprises

Enterprise | Revenue (FY 2022) | Performance in China |

Coca Cola | 293.6 billion yuan,+11% YoY | Sales in the Chinese market had a slight decline as a result of COVID-19. Sugar-free Coke performed noticeably well. Moreover, Coca Cola has entered the herbal tea and mid-range packaged drinking water sectors. |

Pepsi | 592.4billion yuan,+8.7% YoY | PepsiCo saw double-digit organic growth in China. It also gained more market share in China's salty snacks and beverage sectors. |

Unilever | 438.1 billion yuan, +14.5% YoY | The sales in the Chinese market experienced a slight decline, which was attributed to COVID-19, especially its impact on Unilever's food solutions and home care businesses in the second and fourth quarters. |

Kraft Heinz | 181.8 billion yuan, +1.7% YoY | The revenue of the International Zone including China was 39.19 billion yuan, a YoY growth of 8%. |

Mondelēz International | 216.9 billion USD, +9.7% YoY | Sales in the Chinese market achieved high single-digit rise, with growth exceeding 10% in the fourth quarter. The growth was due to the continuous increasing momentum of the biscuit sector and the recovery of the chewing gum business. |

Fonterra | 2.4 billion yuan(Profit of H1 2023),+50% YoY | Profit in Greater China decreased by 1% to 927 million yuan, with the Foodservice and Raw material channels showing resilience to market disruption from COVID-19. However, this was partially offset by the Consumer channel. |

Regulatory Compliance

1. On February 13, 2023, the Department of Food Safety Standards, Risk Surveillance and Assessment under China National Health Commission (NHC) released the exposure drafts of 38 national food safety standards, which include 12 newly established standards, 21 newly revised standards, and 5 amendment sheets. These drafts mainly cover standards for contaminant limits, food products, nutritional fortification substance, foods for special dietary use, food additives and food-related products. Please refer to ChemLinked for important GB standard drafts.

2. To help stakeholders catch up with the updates of the fruits that newly got the market access approvals from China’s Customs (GACC), ChemLinked summarizes and updates relevant information constantly in this article. The import performance of the corresponding fruit categories is analyzed as well. More details on ChemLinked.

3. The National Institute for Nutrition and Health of Chinese Center for Disease Control and Prevention (CDC), et al, released two papers in the Journal of Hygiene Research last month. Supported by Science & Technology Basic Resources Investigation Program, the two papers analyze the breast milk intake of Chinese infants aged 0-5 months and energy & nutrients intake from complementary foods of children aged 6-23 months, respectively, in 2019-2021. More details on ChemLinked.