The following paragraphs are just a glimpse of the formal report. Please contact us at contact@chemlinked.com to learn more about the complete report.

Market size

The health functional food market in China is undergoing steady expansion, driven by the continuous growth of the aging population and the increasing health consciousness among people. In 2021, the market size was 328.9 billion yuan. It is projected to reach 436.6 billion yuan by 2026, with a compound annual growth rate (CAGR) of 5.8% from 2022 to 2026. This upward trajectory reflects a shifting mindset among Chinese consumers who are increasingly prioritizing their health and well-being.

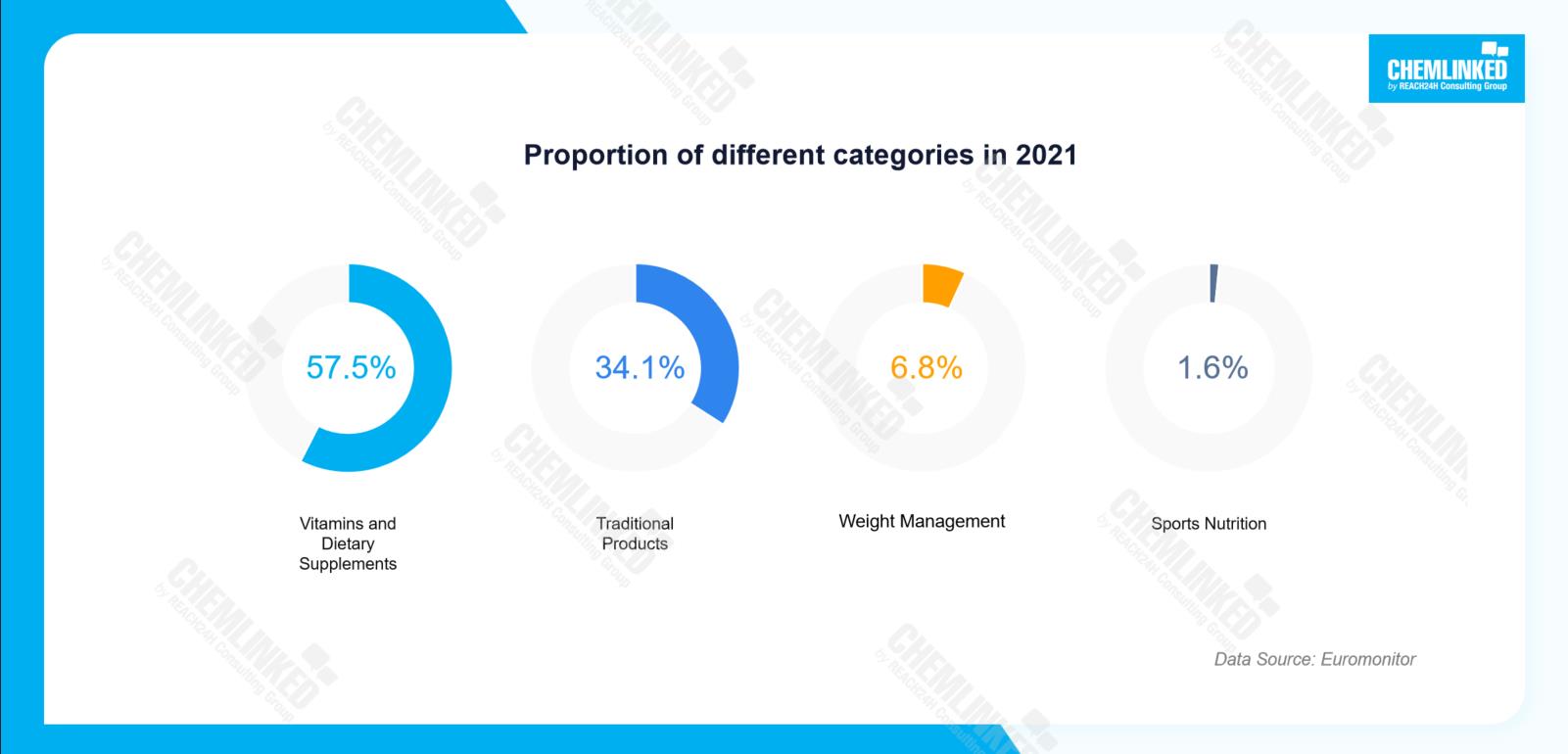

In terms of product categories, health functional food can be divided into Vitamins and Dietary Supplements (VDS), Traditional Products, Weight Management products, and Sports Nutrition products. VDS dominate China’s health functional food market, with a market share about 57.5% in 2021.

Penetration rate

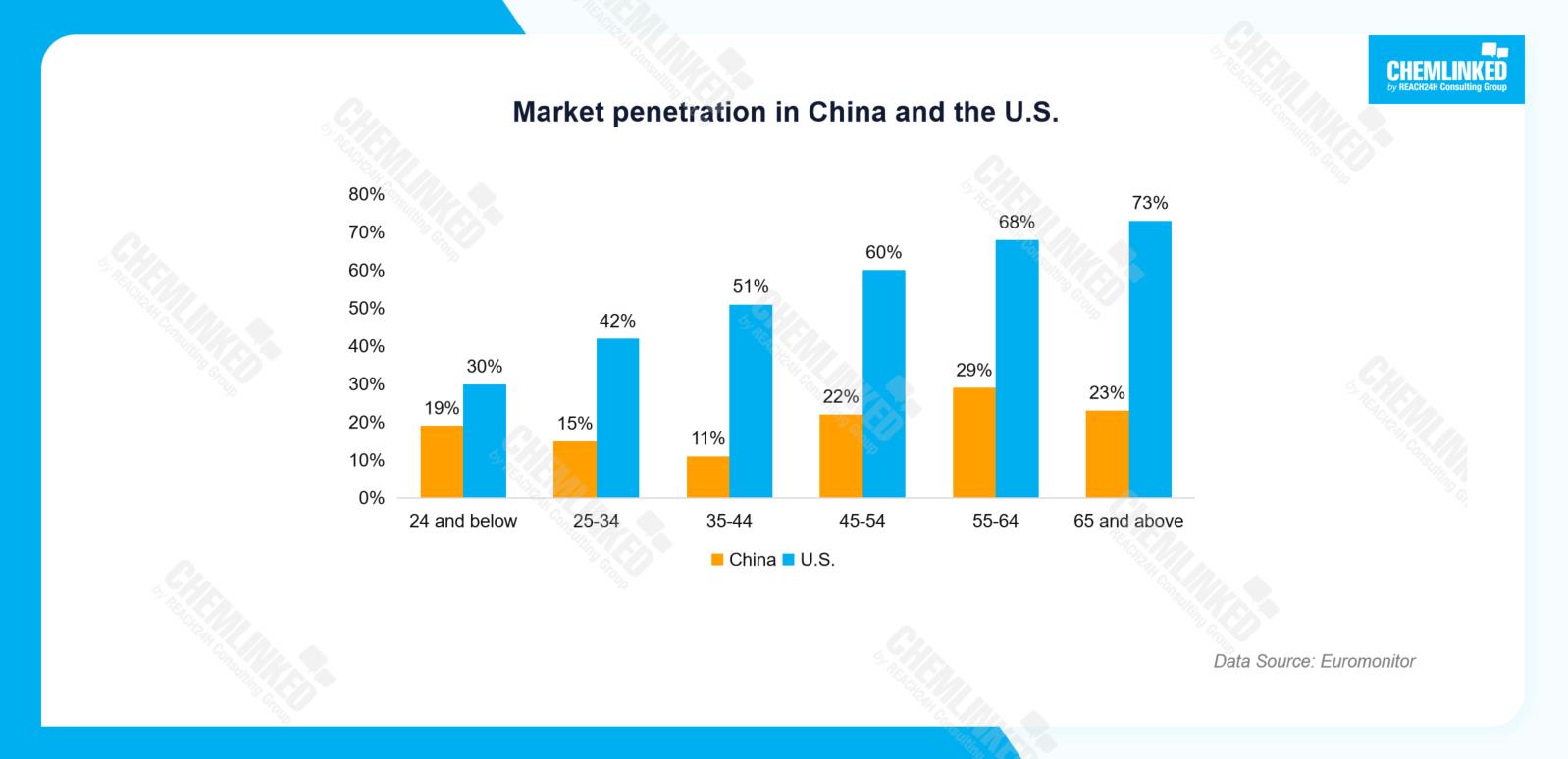

The penetration rate of health functional food in China stands at approximately 20%, which is relatively lower compared to mature markets such as the US, Australia, and Japan. This indicates substantial potential for growth. Moreover, while the mid-aged and elderly populations are traditionally the primary consumers, there is a noticeable shift as more and more young people are realizing the importance of maintaining good health. This changing consumer mindset is expected to contribute to higher penetration rates across all age groups, presenting new opportunities for market expansion.

Import data

China has emerged as a significant consumer of health functional food, attracting numerous international brands to enter the market. The total import value of health functional food in China reached 40.2 billion yuan in 2022, with a notable YoY growth of 14.6%. From 2016 to 2022, the CAGR of the import value of health functional food in China was an impressive 25.3%. This data highlights the sustained interest and demand for overseas health functional food. Concerning the importation sources, the United states is the largest import source, accounting for about 20% of the total import value. The following are Australia, Germany, Indonesia and Japan.

Competitive landscape

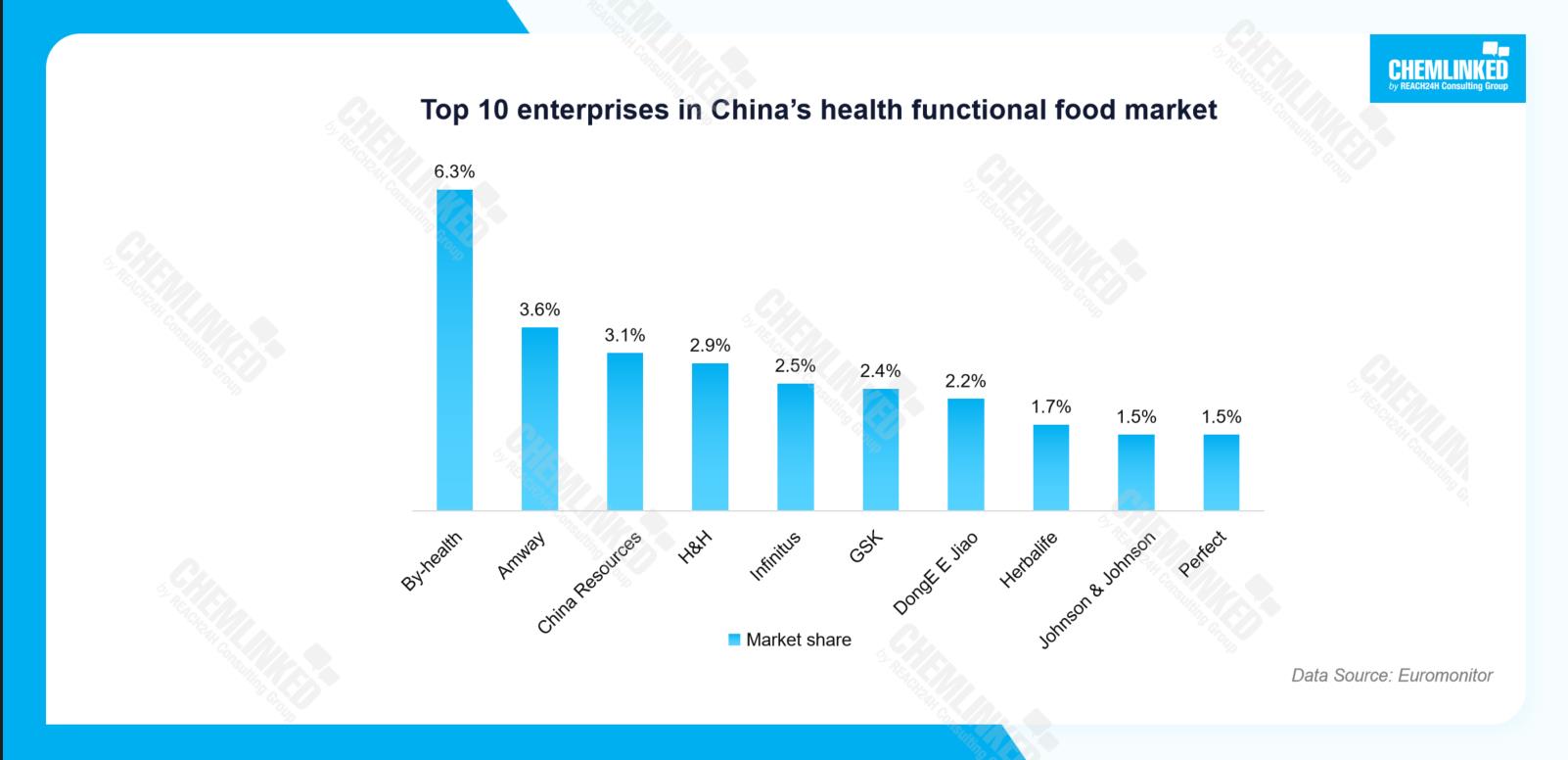

China's health functional food market exhibits relatively low concentration, with no dominant monopoly. In 2021, the top 10 players collectively held a market share of approximately 27.7%, and none of them individually commanded a share exceeding 10%. This creates a promising environment for new entrants seeking to enter China's health functional food market. Importantly, it is worth noting that half of the top 10 players are international companies, indicating the significant presence and competitiveness of global players in this industry.

Sales channels

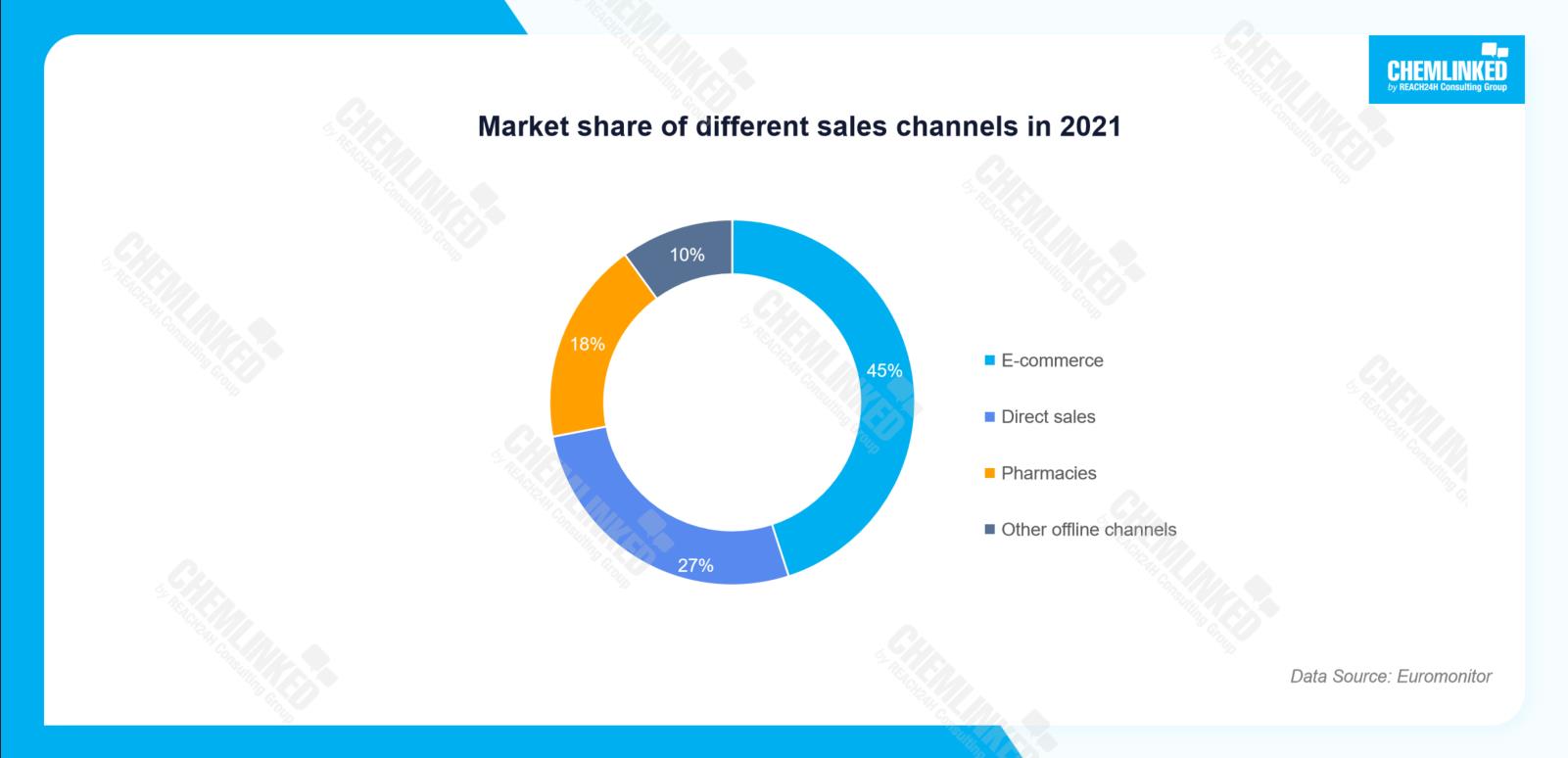

In China, health functional foods are sold through various channels, including e-commerce platforms, direct sales, pharmacies, and offline retail channels such as supermarkets and mother-and-baby stores. Historically, direct sales was the primary sales channel in China, but its prominence has declined since 2016, particularly after the notable Quanjian scandal of vicious false advertising and pyramid scheme. The Chinese government cracked down on non-compliance issues within the direct sales model, leading to a loss of consumer trust in products sold through this channel. Similarly, the pharmacy channel has experienced a slowdown in recent years due to factors such as higher prices, reduced foot traffic caused by the impact of COVID-19, and adjustments in medical insurance policies.

In contrast, e-commerce channels have witnessed rapid growth and have become the dominant channel for health functional food sales. This can be attributed to their convenience, competitive pricing, and wide product selection.

Among all e-commerce performances, a notable trend is that livestreaming e-commerce has emerged as the driver of new business growth. Therefore, it is essential for ambitious brands to adeptly harness livestreaming to captivate attention, drive traffic, and catapult sales to new heights.

REACH24H, the creator of ChemLinked, has extensive expertise in managing Douyin, the most prominent livestreaming ecommerce platform in China. The comprehensive services of REACH24H, such as flagship store management, short video promotion, self-livestreaming of stores, and KOL-invited livestreaming, assist brands in gaining wider recognition and boosting sales simultaneously. We are delighted to share one of our successful cases, where we effectively utilized Douyin to lead a UK health brand to achieve remarkable success in the Chinese market.

Regulatory Requirements

As mentioned above, health functional food includes several subcategories. If it is just sold as common food and not indicated with any healthcare function claims on the package, then such product just needs to follow the corresponding national food safety standards. However, if it has some function claims, or the ingredients used are included in the Health Food Raw Material Catalogue (example for this product is VDS), then it belongs to health food and is subject to more stringent supervision. Only health food products that meet corresponding national standards and have obtained the health food certificate (the "blue hat") from State Administration for Market Regulation (SAMR) are allowed to be placed in the Chinese market.

Health food that has specific health functions, such as immunity enhancement and memory improvement, is required to be registered with SAMR when first imported to China. Besides, health food that contains raw materials beyond the scope of permitted raw material catalogue for health food is also required to be registered.

Health food that supplements vitamins or minerals, such as vitamin C and calcium, is required to be filed with SAMR when first imported to China. Besides, health food that contains raw materials from the permitted raw material catalogue for health food is also required to be filed.

If these products are imported to China, their overseas manufacturers shall register with the General Administration of Customs of China (GACC). The registration of health food manufacturers should be recommended by competent authorities in exporting countries.

Want to check the detailed compliance procedures? Please contact us contact@chemlinked.com.