Contents

Market Condition

Company Dynamics

Financial Results

Regulatory Compliance

Market Condition

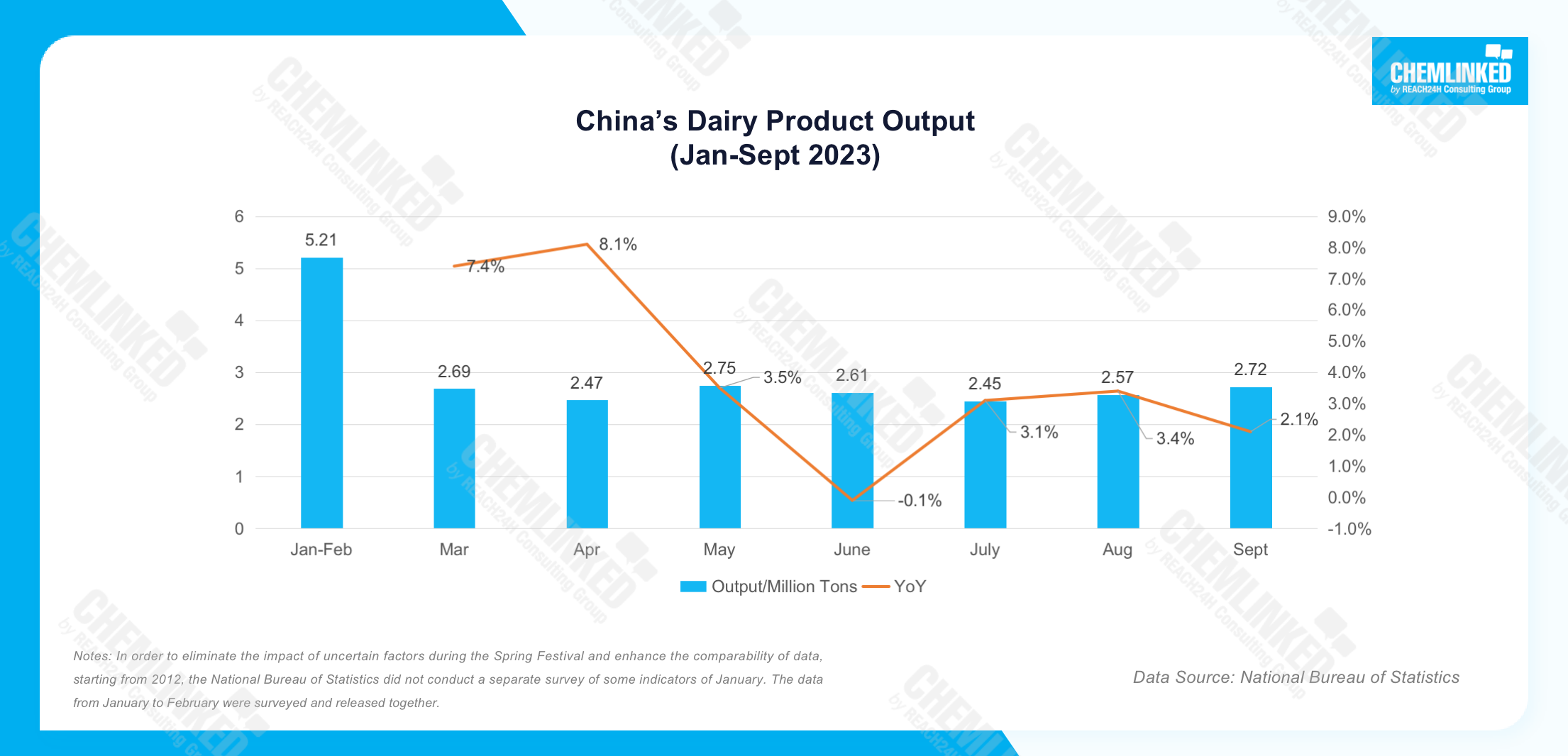

1. According to the National Bureau of Statistics, China’s dairy production from January to September 2023 totaled 22.86 million tons, with a year-on-year (YoY) increase of 3.8%. The dairy output in September 2023 was 2.72 million tons, up 2.1% YoY.

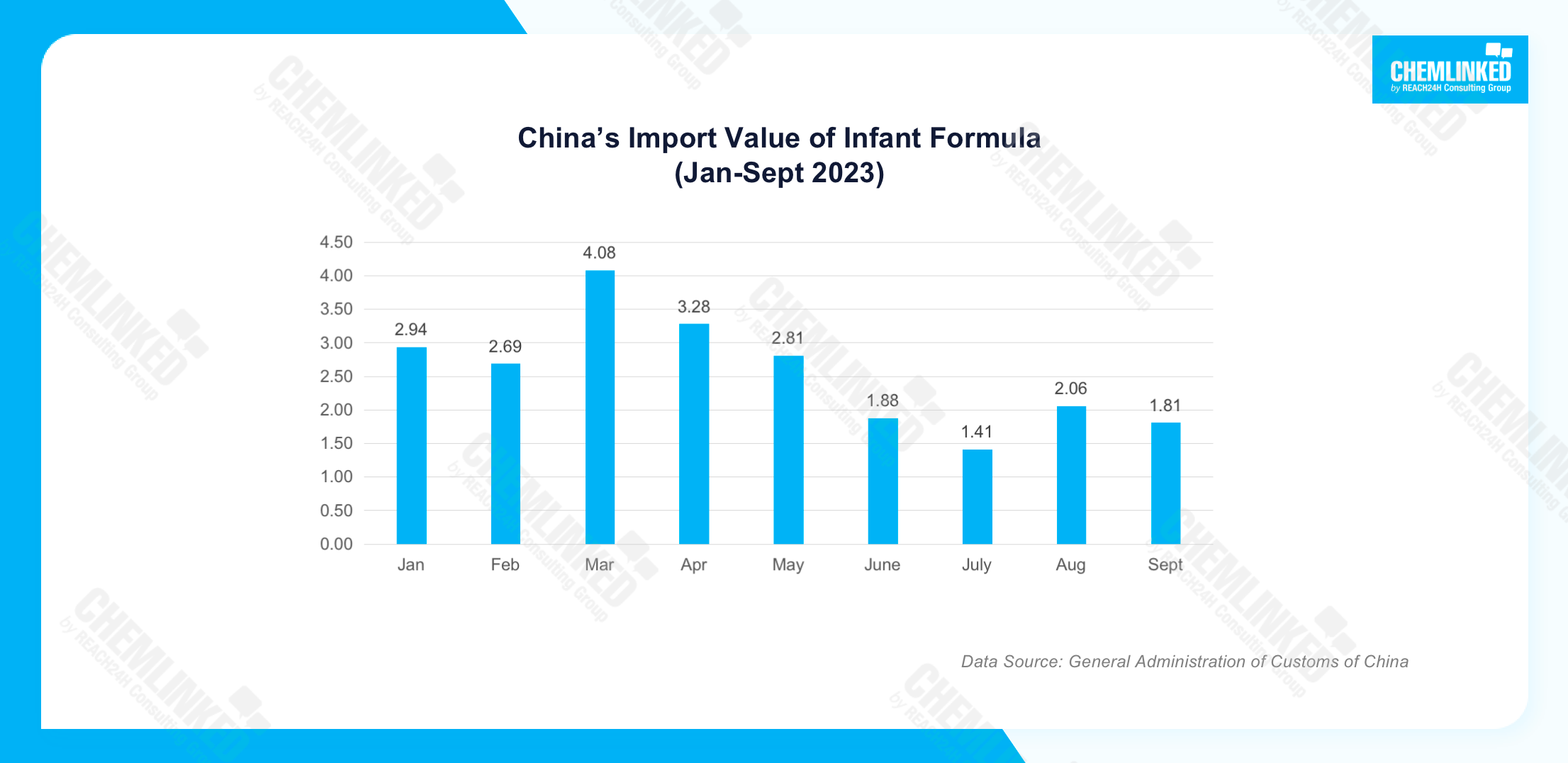

2. According to the General Administration of Customs of China (GACC), China’s import volume of infant formula from January to September 2023 was 178,500 tons, with CNY 22.96 billion import value. Netherlands, New Zealand, Ireland, France and Germany were the top 5 countries of origin by import values. In September 2023, the import volume and value were 12,788 tons and CNY 1.81 billion, respectively.

3. In September 2023, China’s food and beverage sector witnessed 18 investment and financing events, amounting a total of CNY 876 million. Compared to August 2023, the number of investment and financing events and the monthly total amount increased by 28.6% and 26.3%, respectively. [1]

4. Kantar Worldpanel indicated that the sales of China’s fast-moving consumer goods (FMCG) saw a YoY decline of 2.0% for the 12 weeks ending on September 8, 2023, impacted by factors such as the rather late happening of Mid-Autumn Festival, a Chinese lunar holiday, in the solar calendar compared to the previous year and the recovery of out-of-home consumption. In particular, the beverage category continued to experience sales growth in Q3 2023, up 2.9% YoY, while the food category decreased by 1.0% this year. [2]

Company Dynamics

1. Recently, Lay’s officially announced that its core products in China had achieved a 50% reduction in saturated fat by introducing low erucic acid rapeseed oil. As a result, the brand now provides Chinese consumers with more healthy snack products. In recent years, Chinese consumers are increasingly concerned about the health of snacks. Mintel’s statistics suggests that 70% of consumers in China are willing to pay higher prices for healthier raw materials and processing methods.

Lay’s Indicates 50% Reduction in Saturated Fat on Its New Packaging

2. Following the approval of HMOs, namely, 2'-fucosyllactose (2'-FL) and Lacto-N-neotetraose (LNnT) (more details on ChemLinked), prominent Chinese dairy enterprises, including Firmuse, Junlebao, Yili, Yeeper, and Wondersun, rushed to announce the launch of their first HMO-containing milk powder products. For instance, Junlebao unveiled another children milk powder added with 2’-FL, lactoferrin, FOS, GOS, DHA, etc., providing essential support for children’s brain, immunity and vision development. Notably, these products are primarily targeted at the children's milk powder market, with Yili being the only enterprise to officially announce the inclusion of HMOs in their infant formula.

3. Starbucks rolled out a new “Intenso Collection” with the exclusive “apron green” cup in China on October 17, 2023, which involves four products, Cortado, Ruby Velvet Cortado, Cocoaccino and Coconut Flat White. Priced at CNY 33, the newly introduced collection with 259ml is the brand’s first small cup products, aiming to provide a niche of heavy coffee drinkers with more intenser flavour products.

Starbucks’ Intenso Collection

4. Uni-president unveiled four cocktail-flavoured sparkling wine products under its brand Uni-Wonder this October. Based on spirits like whisky, vodka, etc., the new products have mojito, Moscow mule, sangria and whisky sour tastes with 8% alcohol volume. Currently, these products are available in Tmall’s Uni-Wonder flagship store at a unit price of approximately CNY15.

Uni-Wonder’s Cocktail-flavoured Sparkling Wine in Four Flavours

5. Master Kong introduced a new braised beef instant noodle product with iced black tea flavour on October 12, 2023. Since the braised beef instant noodle and iced black tea are both Master Kong’s hero products, the new product blending these two flavours greatly aroused consumers’ curiosity. The bucket, which consists of 6 boxes of the new product, 6 boxes of classic braised beef instant noodle and 6 bottles of iced black tea, was sold 1,000 units in 5 minutes and sold out in less than half an hour.

Master Kong’s Braised Beef Instant Noodle Product with Iced Black Tea Flavour

6. Holiland co-branded with Coca-Cola Creations, launching a type of dandelion air chocolate with popping candy and coke flavour. The inner layer of the chocolate ball is Coca-Cola flavoured air chocolate, which is light as dandelion. The middle layer contains popping candy, offering consumers an extrasensory bubble experience, and the outer layer is wrapped in cocoa powder. Moreover, the product is packaged in silver laser boxes, each containing 9 chocolate balls with a diameter of approximately 3 cm, sold in Holiland’s official WeChat mini-program at CNY 59.

Holiland and Coca-Cola Creations’ Co-branded Dandelion Air Chocolate

7. Mr. Bond Coffee, a Want Want’s coffee brand, rolled out a mint coffee beverage this October. The new product blends mint, New Zealand sourced milk, coffee and cocoa powder together, bringing consumers a combined sense of mint’s coolness and coffee’s rich aroma. Additionally, it adopts a low-fat formula. As a result, every 100ml drink contains only 1.1g fat.

Mr. Bond Coffee’s Mint Coffee Beverage

8. Starfield, a Chinese plant-based food brand, introduced a pocket salad bar with roasted vegetable and seaweed cheese flavours. The product features in high protein, multiple vegetables and zero trans fatty acid. Notably, every 100g of this salad bar contains more than 12g protein, but only with 186 kcal. Currently, it is available in 45 offline stores of Sam’s Club in China as well as Sam’s app, priced at CNY 59.9 per bag. Each bag involves 24 pieces of salad bars with half & half flavours.

Starfield’s Pocket Salad Bar with Half & Half Flavours

9. During the Halloween season, Chinese domestic food and beverage brands rushed to release Halloween limited edition products to captivate consumers. For instance, Wangzai launched an exclusive QQ candy including grape-, orange- and strawberry-flavoured gummies with skull, pumpkin and ghost shapes in one bag, respectively. Chinese coconut water brand, All Coconut, also unveiled an exclusive drink, black sesame coconut milk, just in time for Halloween. More Hallween exclusive products launched by Chinese domestic brands on ChemLinked.

Financial Results:

International Enterprises | Revenue (Q1-Q3) | YoY | Notes |

Danone | CNY 164.15 bn | 7.6% |

|

Nestlé | CNY 555.95 bn | 7.8% |

|

PepsiCo | CNY 465.34 bn | 11.8% | PepsiCo’s net revenue in Q3 2023 totaled CNY 171.52 billion, with an organic growth of 8.8%. |

Coca-Cola | CNY 255.34 bn | 6.16% | The net revenue of Coca-Cola grew 8% to CNY 87.41 billion in Q3 2023. |

Chinese Domestic Dairy Firms | |||

Yili Group | CNY 97.09 bn | 3.84% | Yili’s revenue in Q3 2023 reached CNY 31.11 billion, up 2.71% YoY |

Brightdairy | CNY 20.66 bn | -3.37% | Brightdairy’s revenue in Q3 2023 was CNY 6.53 billion, with a YoY decrease of 6.44%. |

New Hope Dairy | CNY 8.19 bn | 9.55% | New Hope Dairy’s revenue in Q3 2023 totaled CNY 2.90 billion, with a YoY increase of 7.25%. |

Sanyuan | CNY 6.15 bn | -2.41% | Sanyuan’s revenue in Q3 2023 decreased by 7.13% to CNY 1.89 billion. |

Milkground | CNY 3.08 bn | -19.69% | Milkground’s revenue in Q3 2023 was CNY 1 billion, declining 18.30% YoY. |

Regulatory Compliance:

1. On October 7, 2023, China National Health Commission (NHC) authorized the use of four new food raw materials. More details on ChemLinked.

2. On October 7, 2023, NHC approves five new food related products, including two new food contact materials (FCM) resins and three FCM additives with expanded usage scope. More details on ChemLinked.

3. Papaya, alfalfa, soy protein, soy pulp, corn bran, cornmeal, cottonseed oil, and cottonseed meal are newly added into the catalogue of agricultural genetically modified organism (GMO) subject to mandatory genetically modified (GM) labeling. More details on ChemLinked.

4. On October 17, 2023, China Food Additives and Ingredients Association (CFAA) released 13 food safety national standard exposure drafts for public comments. The drafts include 9 emulsifier GB standards and 4 sweetener standards. Additionally, On October 18, 2023, NHC announced to seek public comments on 11 national food safety standards, involving dairy products, FCM, food for special medical purposes (FSMP), canned food, and food additives. More details on ChemLinked.

5. On October 22, 2023, GACC published the list of non-compliant food products in September 2023. A total of 294 batches of imported food from 38 countries/regions were rejected. Most rejected imported food in September came from Indonesia, followed by the U.S. and Hong Kong, China. More details on ChemLinked.

6. On October 26, 2023, China National Center for Food Safety Risk Assessment (CFSA) opened eight new food additives for public feedback, including a new food additive, a new nutritional fortifier, two new enzyme preparations, as well as four food additives with expanded usage scope. More details on ChemLinked.

7. As of November 7, 2023, China greatly simplifies the authentication on foreign documents. Foreign public documents can be used in China after the obtain of a “Apostille” certificate issued by the competent authority in overseas countries, instead of the application for the consular legalization service in overseas countries. More details on ChemLinked.